Learn everything there is about venture capital term sheets for startups—what they are, when to use them, and what they should contain.

What Is a Term Sheet?

A term sheet is a non-binding agreement outlining the key terms and conditions under which an investor (usually a VC) plans to fund your company. Much like the relationship status update between your startup and your investor; it’s “complicated” if you don’t get it right. Term sheets are not a legally binding commitment or an enforceable contract, but they get everyone on the same page before the real paperwork hits the table.

For VC-backed startups, getting a term sheet feels like leveling up; it’s validation, excitement, and a tiny bit of terror all rolled into one. A term sheet shows your valuation, the investor’s expectations, and the big-picture framework of your business. Important topics like ownership dilution, control rights, and exit conditions take center stage, shaping your company’s destiny.

When to Use a Term Sheet

A term sheet enters the chat when talks with investors heat up, when the “We love what you’re doing!” turns into “Let’s make it official.” For VC-backed startups, this moment typically follows pitch meetings, intense due diligence, and enough coffee to power a small country.

You’ll whip out a term sheet when:

- Securing Venture Capital Investment: Whether it’s your seed round or a Series A glow-up, a term sheet locks down who, how much, and what rights.

- Raising Angel Funding: Even with angel investors, a formal term sheet keeps relationships sunny and misunderstandings at bay.

- Negotiating Strategic Partnerships: When a partner wants a slice of your magic for cash, a term sheet sets expectations early.

- Preparing for Mergers and Acquisitions: Early-stage exits often start with a term sheet, easing the move toward a definitive agreement.

Who uses it?

- Founders and Co-Founders: To steer the ship and defend the vision.

- Venture Capitalists and Angel Investors: To secure protections and guide outcomes.

- Legal Counsel: To keep negotiations smooth without tossing in unnecessary drama.

What’s Included in the Term Sheet?

1. Company Overview

Meet the star of the show: your company. This section identifies exactly who’s raising the cash, usually a Delaware corporation for venture finance fame.

2. Securities Offered

Investors aren’t throwing money for hugs. They’re getting Series A Preferred Stock, complete with special perks. Convertible notes and SAFEs, if any, will also convert into preferred shares under shadow terms.

3. Investment Amounts

Who’s bringing the dough, and how much? This section spells it out, including any past promises from convertible securities.

4. Valuation

Post-money valuation takes the spotlight here: it’s the company’s worth immediately after the new investment, including the refreshed option pool reserved for future hires.

5. Liquidation Preference

Investors want their money back first (can you blame them?). The 1x non-participating liquidation preference ensures they get their investment back, but no double-dipping.

6. Dividends

Investors are entitled to 6% non-cumulative dividends, but only if and when declared by the Board. Investors love the option; startups love not having to fork over cash unnecessarily.

7. Conversion to Common Stock

Preferred shares automatically convert to common stock at the investor’s choice or upon specific trigger events like an IPO or majority investor approval, with an initial 1:1 ratio.

8. Voting Rights

Major moves, like new senior shares or a sale, require the nod from a majority of preferred shareholders, giving investors meaningful sway without a full takeover.

9. Drag-Along Rights

Major investor protections are baked using drag-along rights. Certain major decisions (like issuing new senior securities or selling the company) require approval from a majority of preferred shareholders, safeguarding their influence.

10. Anti-Dilution Protection and Other Investor Rights

A broad-based weighted average anti-dilution clause shields investors if future rounds get spicy (read: cheap). Plus, they get first dibs on new offerings, co-sale rights, and crystal-clear info access.

11. Board Composition

Board control matters! Here, the Lead Investor appoints one director, while the Common Stock Majority appoints two, balancing investor oversight with founder control.

12. Founder and Employee Vesting

A four-year vesting schedule with a one-year cliff ensures everyone’s earning their stripes, no instant equity bonanzas here.

13. No-Shop Agreement

To prevent last-minute shopping for better deals, the startup agrees not to solicit or accept other offers for a limited period (usually 30 days).

How to Write a Term Sheet

Here’s a quick 5-step guide to draft a great term sheet:

1. Start With the Basics

Spell out the Company, the Securities on offer, and the Investment Amount. These three pillars hold the whole thing up.

2. Nail the Valuation and Cap Table

Define the post-money valuation and sketch out the new ownership map, including a refreshed option pool for future rockstars.

3. Protect Both Sides

Layer in essential safeguards:

- Liquidation preferences (keep it at 1x non-participating)

- Anti-dilution provisions

- Voting rights for major changes

These protections make investors happy; without making founders look desperate.

4. Define Governance

Lay down Board Composition and drag-along rights. Founders want control, investors want assurance; you can make both happen.

5. Add Standard Provisions

Cap it off with vesting schedules, a no-shop clause, and a quick note on legal fees. Use plain language, no legal gobbledygook needed.

✨ Pro Tip: Startups typically draft a “friendly” version first, then negotiate details with the lead investor’s legal team. Staying flexible and fast can make all the difference in sealing the deal.

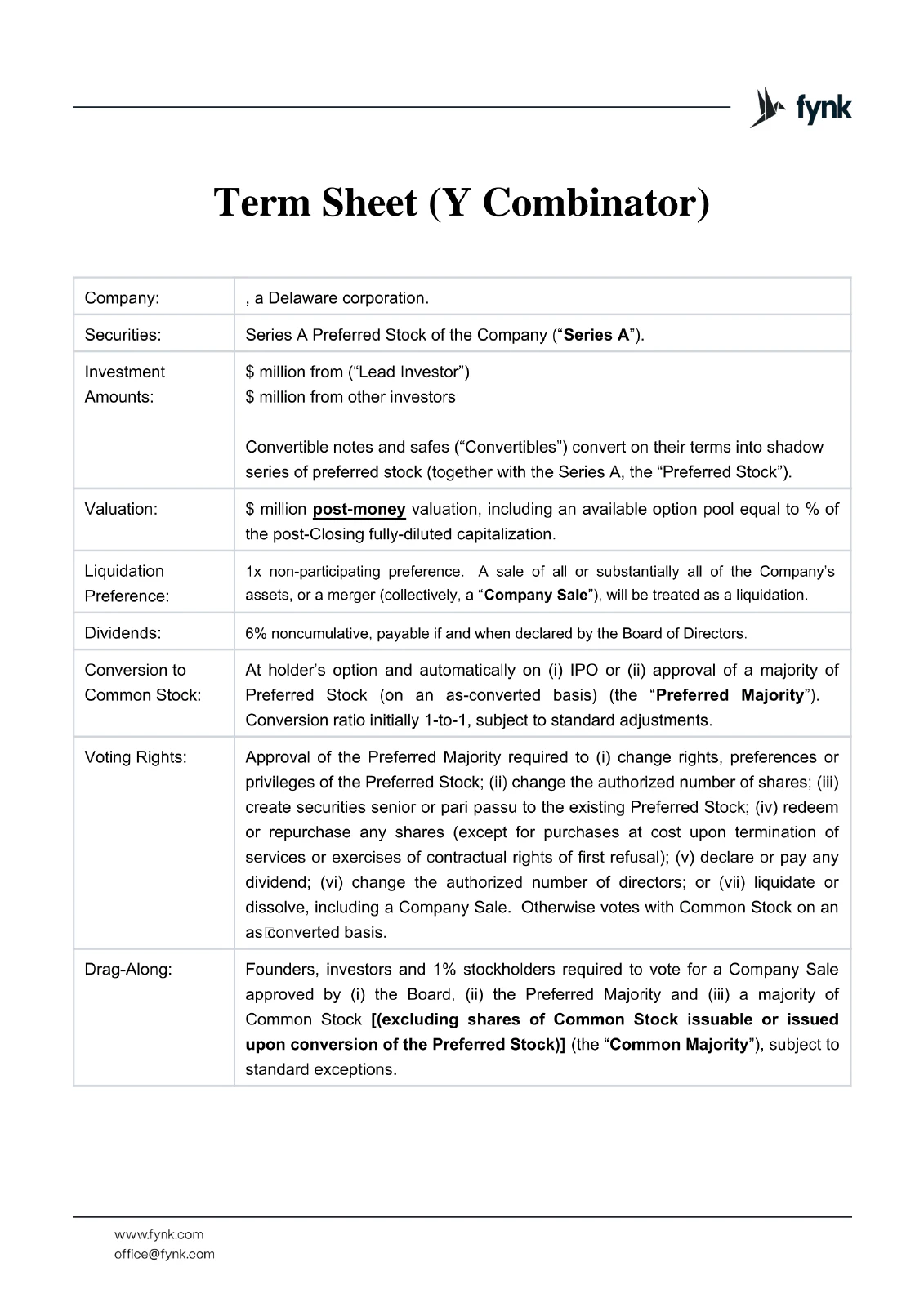

Term Sheet Template

Our term sheet template is modeled after industry gold standards like the Y Combinator Series A format, making it startup-tested and investor-approved. Whether you’re closing your first big funding round or negotiating a Series A raise, this template gives you a head start with the key terms investors expect.

Bonus points if you use this template using fynk, where you’ll unlock power features like:

- Electronic Signatures (SES, AES, QES; pick your flavor) for lightning-fast execution.

- Dynamic, customizable templates that grow with you.

- AI Playbooks to spot sketchy terms before you get blindsided.

Searching for a contract management solution?

Find out how fynk can help you close deals faster and simplify your eSigning process – request a demo to see it in action.

FAQs

- What is a Term Sheet in Business?

- It’s a non-binding document that outlines the key terms and conditions of a proposed business deal, typically used before you sign a final agreement.

- Is a Term Sheet Legally Binding?

- Most of a term sheet is non-binding, but some parts, like the no-shop clause or confidentiality terms, can be legally enforceable.

- What is the Term Sheet Newsletter?

- It’s also the name of a popular VC and startup newsletter from Fortune that covers deals, investors, and market trends.

- Can Founders Negotiate a Term Sheet?

- Yes, you can and should negotiate key terms such as valuation, board seats, liquidation preference, and anti-dilution rights.