Employee Retention Agreement

THIS AGREEMENT is entered into by and between (the “Company”) and (the “Employee”) (each, a “Party” and collectively, the “Parties”) as of (the “Effective Date”).

Recitals

To encourage Employee to remain employed with the Company through the closing of the transaction contemplated by the , dated as of (the “Transaction”) and beyond, the Company wishes to provide Employee with one or more Retention Bonuses, as specified by this Agreement.

Terms and Conditions.

Scope of Agreement; At Will Employment.

This Agreement deals solely with the attainment and payment of Retention Bonuses. All other terms and conditions of Employee’s employment are determined pursuant to the Company’s employment policies and practices, unless otherwise specifically modified by this Agreement.

Employee acknowledges that Employee’s employment by the Company is and remains “at-will” and that Employee or the Company may terminate the employment relationship at any time and for any reason, without prior notice. This Agreement only governs the terms of the payment of the Retention Bonuses.

Retention Bonuses.

Attainment.

Employee shall be entitled to one or more Retention Bonuses, as described by this Section, if (1) except as set forth in Section 3. (Termination of Employment), the Employee remains employed by the Company or an Affiliate through the applicable Retention Dates and (2) the Transaction closes. If the Transaction does not close, Employee will not be entitled to any Retention Bonuses provided under this Agreement.

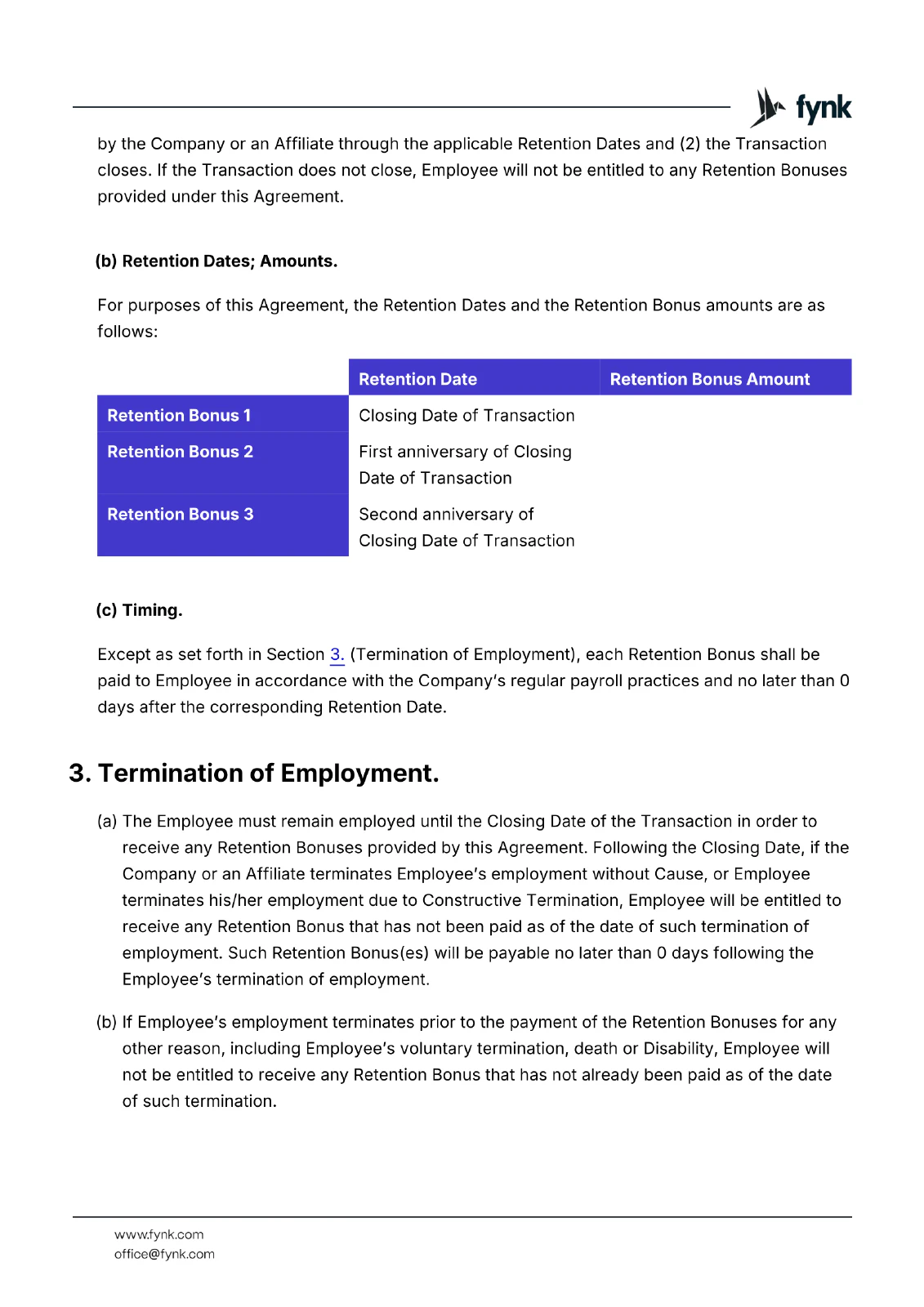

Retention Dates; Amounts.

For purposes of this Agreement, the Retention Dates and the Retention Bonus amounts are as follows:

Retention Date | Retention Bonus Amount | |||||||

Retention Bonus 1 | Closing Date of Transaction | |||||||

Retention Bonus 2 | First anniversary of Closing Date of Transaction | |||||||

Retention Bonus 3 | Second anniversary of Closing Date of Transaction |

Timing.

Except as set forth in Section 3. (Termination of Employment), each Retention Bonus shall be paid to Employee in accordance with the Company’s regular payroll practices and no later than 0 days after the corresponding Retention Date.

Termination of Employment.

The Employee must remain employed until the Closing Date of the Transaction in order to receive any Retention Bonuses provided by this Agreement. Following the Closing Date, if the Company or an Affiliate terminates Employee’s employment without Cause, or Employee terminates his/her employment due to Constructive Termination, Employee will be entitled to receive any Retention Bonus that has not been paid as of the date of such termination of employment. Such Retention Bonus(es) will be payable no later than 0 days following the Employee’s termination of employment.

If Employee’s employment terminates prior to the payment of the Retention Bonuses for any other reason, including Employee’s voluntary termination, death or Disability, Employee will not be entitled to receive any Retention Bonus that has not already been paid as of the date of such termination.

Clawback.

The payments described by this Agreement are subject to potential forfeiture or clawback to the fullest extent called for by applicable law or a policy adopted by the Company or its Affiliates. Employee hereby agrees to return the full amount required by applicable law or any policy adopted by the Company or its Affiliates.

Withholding.

Payments made pursuant to this Agreement shall be subject to withholding of applicable income and employment taxes.

Binding Nature of Agreement.

This Agreement will be binding upon and inure to the benefit of the Company and Employee, but neither this Agreement nor any rights arising hereunder may be assigned, pledged or otherwise alienated by Employee.

Severability.

If any provision of this Agreement as applied to either Party or to any circumstances is adjudged by a court of competent jurisdiction to be void or unenforceable for any reason, the same will in no way affect any other provision of this Agreement or the validity or enforceability of this Agreement.

Amendment or Waiver.

No provision of this Agreement may be modified, waived or discharged unless such modification, waiver or discharge is agreed to in a writing signed by Employee and an authorized officer of the Company. No waiver by either Party at any time of any breach by the other Party of any condition or provision of this Agreement to be performed by such other Party will be deemed a waiver of any other condition or provision at any time.

Governing Law.

This Agreement will be governed in all respects, whether as to validity, construction, capacity, performance or otherwise, by the laws of the State of .

Entire Agreement.

This Agreement embodies the entire agreement of the Parties respecting the payment of Retention Bonuses to Employee and with respect to the other terms expressly set forth in this Agreement.

Further Assurances.

Each Party agrees to cooperate fully with the other Party and to execute such further instruments, documents and agreements, and to give such further written assurances, as may be reasonably requested by the other Party to evidence and reflect the transactions described and contemplated by this Agreement and to carry into effect the intent and purposes of this Agreement.

Counterparts.

This Agreement may be executed in counterparts, each of which shall be deemed an original, but all of which together will constitute one and the same instrument.

Dispute Resolution.

Any dispute over this Agreement must first be submitted in writing to within 0 days of Employee becoming aware of the dispute. The will issue a written decision on the dispute within 0 days of receipt. If Employee disagrees with the decision of the , then Employee may appeal to the (the “Committee”) within 0 days of receipt of the decision. The Committee will issue its decision on the appeal within business days of receipt of the appeal. The decision of the Committee shall be final and binding on all Parties to this Agreement. If the Committee ceases to exist, any appeal shall be made to the person or committee responsible for deciding appeals under the retirement plan sponsored by the Company or its Affiliates.

Tax Compliance.

Ban on Acceleration or Deferral.

Under no circumstances may the time or schedule of any payment made or benefit provided pursuant to this Agreement be accelerated or subject to a further deferral except as otherwise permitted or required pursuant to regulations and other guidance issued pursuant to the relevant legal Code.

No Elections.

Employee does not have any right to make any election regarding the time or form of any payment due under this Agreement.

Compliant Operation and Interpretation.

This Agreement shall be administered in accordance with the relevant legal Code or an exception thereto, or similar provisions of applicable law, and each provision shall be interpreted, to the extent possible, to comply with such applicable tax laws or an exception thereto. Although this Agreement has been designed to comply with such tax laws or to fit within an exception to their requirements, the Company specifically does not warrant such compliance. Employee is fully responsible for any and all taxes or other amounts imposed by such tax laws, and the Company shall not be liable to the Employee if any payment or benefit hereunder fails to be exempt from, or to comply with, such applicable tax laws.

IN WITNESS WHEREOF, the Company and Employee have caused this Agreement to be executed as of the date set forth below.

Company:

Employee: