Articles of Association

of

Chapter 1: General Provisions

Article 1: Purpose of the Articles of Association

In accordance with the provisions of the Company Law of the (hereinafter “Company Law”) and other relevant laws and regulations, , , , and commonly invest to establish , especially in formulating these Articles of Association.

Article 2: Supremacy of Law

If any of the provisions in this Articles of Association are inconsistent with laws, regulations, and rules, the provisions of laws, regulations, and rules shall prevail.

Chapter 2: Company Name and Address

Article 3: Company Name

Company Name:

Article 4: Company Address

Company Address:

Chapter 3: Company Business Scope

Article 5: Business Scope

General: [Business Activities as Defined by Law] (Projects that require approval according to law can only be carried out on business activities after approval by relevant departments).

Chapter 4: The Registered Capital of the Company, the Name of the Shareholder, the Method of Investment, the Amount of Investment, and the Time of Investment

Article 6: Registered Capital

The registered capital of the Company (subscribed): Contributed by .

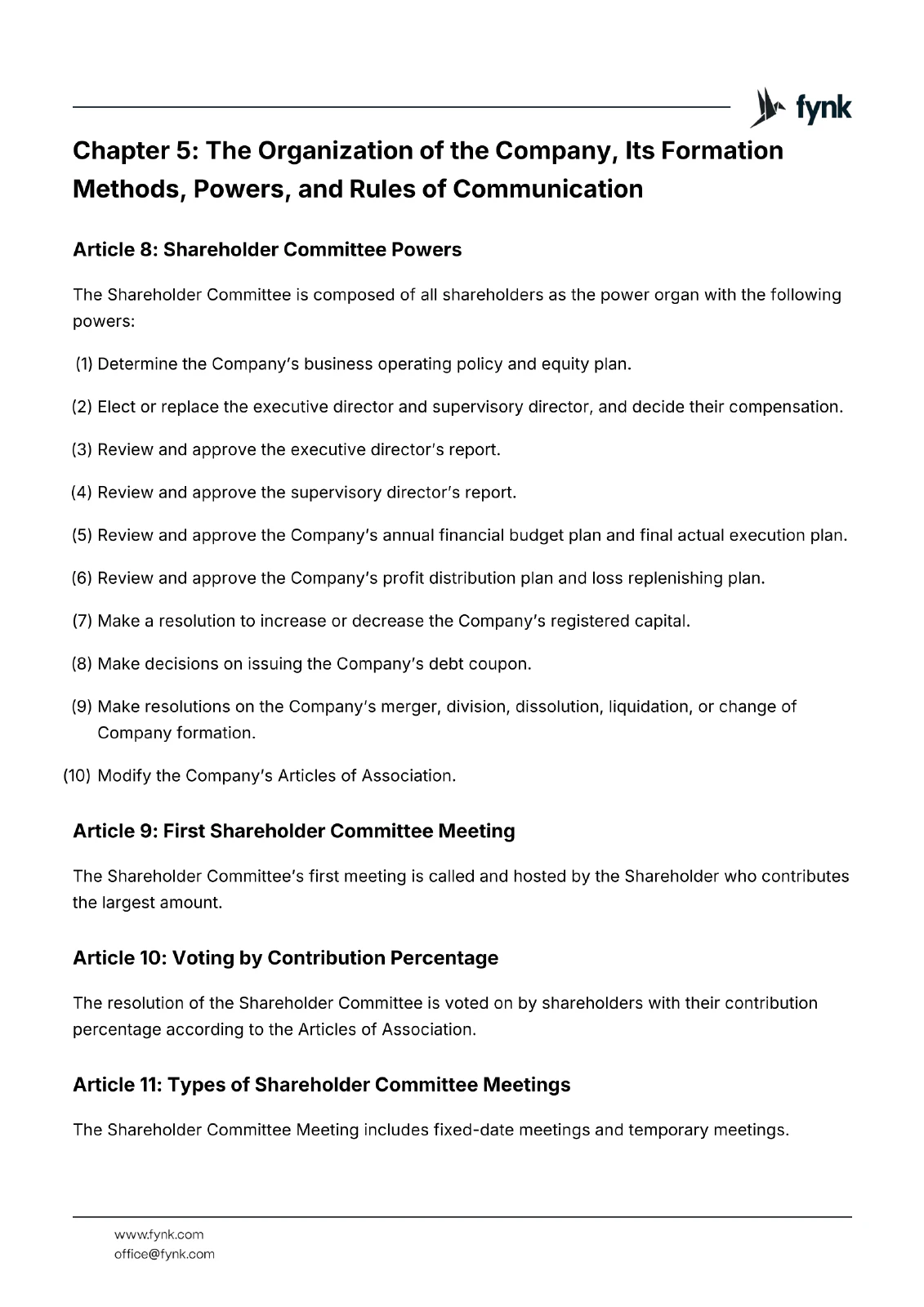

Article 7: Shareholders and Capital Contributions

The name of the shareholder, the amount of capital contribution subscribed and the amount actually paid after the subscription, the capital contribution time, and investment methods are as follows:

Name of shareholder | Amount contributed | Date contributed | Method of Contribution |

|---|---|---|---|

Article 7.1: Shareholder Responsibilities

Shareholder is responsible to the Company with the amount contributed as a limitation.

Shareholder shall pay in full and on time the amount of capital contributions stipulated in the Company’s Articles of Association. If the Shareholder does not pay according to the Articles of Association, it shall, in addition to paying in full, assume breach liability to any other Shareholder who has paid according to the Articles of Association.

A Shareholder who abuses the Company’s independent status as a legal person and the limited liability of shareholders to evade debts, seriously damaging the interests of the Company’s creditors, shall bear joint and several liability for the Company’s debts.

The Company shall disclose the amount of capital contribution subscribed by Shareholders, the method of capital contribution, the period of capital contribution, and the payment status on the corporate credit information disclosure system in accordance with the law and within the prescribed time limit.

Chapter 5: The Organization of the Company, Its Formation Methods, Powers, and Rules of Communication

Article 8: Shareholder Committee Powers

The Shareholder Committee is composed of all shareholders as the power organ with the following powers:

Determine the Company’s business operating policy and equity plan.

Elect or replace the executive director and supervisory director, and decide their compensation.

Review and approve the executive director’s report.

Review and approve the supervisory director’s report.

Review and approve the Company’s annual financial budget plan and final actual execution plan.

Review and approve the Company’s profit distribution plan and loss replenishing plan.

Make a resolution to increase or decrease the Company’s registered capital.

Make decisions on issuing the Company’s debt coupon.

Make resolutions on the Company’s merger, division, dissolution, liquidation, or change of Company formation.

Modify the Company’s Articles of Association.

Article 9: First Shareholder Committee Meeting

The Shareholder Committee’s first meeting is called and hosted by the Shareholder who contributes the largest amount.

Article 10: Voting by Contribution Percentage

The resolution of the Shareholder Committee is voted on by shareholders with their contribution percentage according to the Articles of Association.

Article 11: Types of Shareholder Committee Meetings

The Shareholder Committee Meeting includes fixed-date meetings and temporary meetings.

To call a Shareholder Committee Meeting, notice should be given to all shareholders at least 15 days ahead. Fixed-date meetings should be called annually. If shareholders with one-tenth of voting power, the executive director, or the supervisory director propose a temporary meeting, it should be called.

Article 12: Convening Shareholder Meetings

The Shareholder Committee Meeting is called and hosted by the Executive Director. If the Executive Director cannot perform or does not perform the responsibility of calling the Shareholder Committee Meeting, the Supervisory Director will call and host it. If the Supervisory Director does not call or host it, shareholders representing more than one-tenth of the voting rights may call and host it.

Article 13: Special Resolutions

For the resolution of amending the Articles of Association, increasing or decreasing registered capital, merging, splitting, or dissolving the Company, or changing the Company’s formation, it must be voted on by shareholders with more than two-thirds of voting rights.

Article 14: Executive Director Role

The Company does not set up a Board of Directors and only appoints an Executive Director. The Executive Director is the Company’s legal representative and is responsible to the Shareholder Committee after being elected for a three-year term that may be renewed by re-election. The Shareholder Committee may not fire the Executive Director without reason.

Article 15: Executive Director Powers

The Executive Director shall exercise the following powers:

To call the Shareholder Committee Meeting and report to the Shareholder Committee.

To execute the resolution of the Shareholder Committee.

To review and decide the Company’s operation plan and investment proposal.

To decide the annual financial budget plan and final actual execution plan.

To decide the Company’s profit distribution plan and loss replenishing plan.

To decide the proposal to increase or decrease the Company’s registered capital and issue the Company’s debt coupon.

To decide the proposal of the Company merger, division, dissolution, liquidation, or change of the Company's formation.

To decide on the setup of the internal management organization.

To name the appointment or dismissal of the Company’s manager and determine compensation. Additionally, to decide the appointment or dismissal of the deputy manager, accounting manager, and their compensation after the manager’s nomination.

To decide the Company’s basic management policy.

Article 16: The Manager

The Company shall have a Manager, whose appointment or dismissal shall be decided by the Executive Director. The Manager reports to the Executive Director and exercises the following powers:

Preside over the Company’s production, operation, and management work, and organize the implementation of the Shareholder Committee’s decisions.

Organize and implement the Company’s annual business plan and investment plan.

Formulate a plan for the establishment of the Company’s internal management organization.

Formulate the Company’s basic management system.

Formulate the Company’s specific regulations.

Propose the appointment or dismissal of the Company’s deputy manager and financial director.

Decide to appoint or dismiss responsible management personnel, except those who are appointed or dismissed by the Executive Director.

Exercise other powers granted by the Executive Director.

Article 17: The Supervisory Director

The Company shall have one Supervisory Director. The term of the Supervisory Director shall be three years. Upon the expiration of the term, the Supervisory Director may be re-elected.

Article 18: Supervisory Director’s Powers

The Supervisory Director shall exercise the following powers:

Check the Company’s finances.

Supervise the corporate behavior of Executive Directors and senior managers, and advise on their dismissal for breach of law, administrative regulations, the Articles of Association, or resolutions of the Shareholder Committee.

Require the Executive Directors and senior managers to make corrections when their actions damage the interests of the Company.

Propose to call a temporary Shareholder Committee Meeting. If the Executive Director fails to perform the responsibility of calling and hosting the meeting, the Supervisory Director may call and host the meeting.

Make proposals to the Shareholder Committee Meeting.

Initiate lawsuits against Executive Directors and senior managers in accordance with .

Chapter 6: Legal Representative of the Company

Article 19: Legal Representative

The Executive Director is the legal representative of the Company. The term is three years. The Executive Director is elected by the Shareholder Committee and may be re-elected after the expiration of the term.

Chapter 7: Other Matters Deemed Necessary by Shareholder Committee Meeting

Article 20: Internal Equity Transfers

Shareholders may transfer their part or all of the equity to each other. When the percentage of shareholder equity changes, the Company should file the Articles of Association or an amendment with the registration authority.

Article 21: External Equity Transfers

A Shareholder may transfer equity to a person who is not a shareholder only after approval by shareholders holding more than % of equity. The transferring shareholder should notify other shareholders in writing to obtain their opinions on the transfer. Other shareholders must respond within after receiving the notice; otherwise, it is regarded as agreement.

If shareholders holding more than % of equity disagree with the transfer, the shareholders who disagree must purchase the equity to be transferred. Otherwise, it will be regarded as an agreement.

For transferred equity agreed upon by shareholders, other shareholders have the right of first refusal to purchase it under the same conditions. If two or more shareholders claim this right, they should negotiate the percentage to be purchased by each. If no agreement is reached, the division will follow each shareholder’s percentage of contributed capital.

Article 22: Business Period

The Company’s business period is , calculated from the date the Company’s Enterprise Legal Person Business License is issued.

Article 23: Dissolution and Liquidation

If any of the following circumstances occur, the Company’s liquidation team shall apply to the original registration authority for dissolution within from the completion of the Company’s liquidation:

The Company is declared bankrupt according to the law.

The business period stipulated in the Company’s Articles of Association expires, or other reasons for dissolution stipulated in the Articles of Association occur, except where the Company continues to exist by amending the Articles of Association.

Shareholders decide to dissolve the Company.

The business license has been revoked, the Company is ordered to close, or it is revoked in accordance with the law.

The People’s Court orders dissolution in accordance with the law.

Other dissolution situations are stipulated by laws and administrative regulations.

Chapter 8: Supplementary Provisions

Article 24: Registration Authority Approval

Company registration matters shall be subject to the approval of the Company Registration Authority.

Article 25: Document Copies

This Articles of Association shall be made in triplicate, with one copy submitted to the Company Registration Authority.