Authority Signatory - Who, Why, & How to Authorize?

An authority signatory is someone in a company who has the official and legal power to sign documents, approve spendings, and make important decisions. They are responsible for all financial and contract-related actions and should check and approve many things to keeping the company’s finances in order.

- Signatory Authority Definition, Roles and Permissions

- 4 Types of Signatory Authority

- Why Is Signing Authority Important?

- How to Grant Signing Authority?

- Step #1: Who Needs to Sign What

- Step #2: Define Approval Authorities

- How to Track Approvals?

- Step #3: Create Clear Permission Papers

- Types of Permission Papers

- Delegation of Authority (DoA) Document: Who Can Sign & Their Limits

- Signature Authorization Form: Gives the Power to Sign

- Signature Authority Matrix: Who Approves Different Contracts

- Compliance Checklist: Tracks All Steps Before Signing

- Step #4: Monitor the Process Closely

- What Is an Example of an Authority Signatory?

- What Happens if an Unauthorized Person Signs a Contract?

- Conclusion

- Frequently Asked Questions

Your company needs new office supplies, but you don’t have the time to handle it, so you delegate the task to your employees. What if anyone in the office could approve major contracts—like $10,000 worth of advanced software licenses that the company doesn’t even need?

Suddenly, you find yourself facing a financial mess. To avoid this, you can simply designate a “signing authority” responsible for ordering and managing these needs and signing on behalf of others.

Having an authority signatory means you can stop unapproved spending, make sure contracts are properly reviewed, and keep your finances in check. It’s not just about managing office supplies; having authority signatories is a common practice with lots of benefits.

In this blog post, we’re going to explain why it’s so important to authorize signing authorities correctly (and legally), the benefits that it brings to your organization, and how to do it properly.

Signatory Authority Definition, Roles and Permissions

Signatory Authority is the power and responsibility granted to specific individuals within an organization or company to sign documents and make legally binding decisions on its behalf. The individuals who take this role are called the “authorized signatory” or “authorized signers."

This permission is typically designated by the board of directors or based on an employee’s role, with the signatory’s name recorded in official company records. In some cases, multiple authorized signatories may be required to jointly sign documents to ensure compliance with legal obligations and proper oversight.

The role someone takes on when given this power is called a “signatory title” or “company signatory.” This can range from CEO and CFO to manager, depending on the company’s activities and needs. Clear signature authority titles help everyone know who’s in charge of certain transactions, cut down on confusion, and make the decision-making process easier and faster.

4 Types of Signatory Authority

Being an authority signatory is a big responsibility. You need to understand what each document means and ensure you’re signing within your allowed scope of signing authority.

That’s why for different levels of authority, there are different types of signing authorities:

- Full authority: allows someone to sign any document, giving them broad powers to handle various transactions and agreements. For example, a CEO with full authority can sign contracts, checks, and all types of agreements without needing further approval.

- Limited authority: Restricts the individual from signing only specific types of documents, such as contracts, purchase orders, or checks. A department manager might have limited authority to sign purchase orders and expense reports, but not contracts or legal agreements.

- Joint authority: Needs multiple signatories to sign a contract for it to be valid. A good example is a business loan, which might need signatures from both the CFO and the CEO.

- Conditional authority: This might require approval from another party before the authorized signatory can execute certain documents. For example, a purchasing agent might need to get approval from the finance department before signing off on large expenses.

Why Is Signing Authority Important?

1. Prevents Unauthorized Activities

Choosing the trusted and authority signatories in your company prevents and decreases unauthorized activities, whether it’s on purpose or just a result of an error. The reason is that you make it clear that only those people have the right to sign anything on behalf of the company. So, naturally, every time there’s a need for something to be signed, everyone will turn to authorized signatories and won’t just sign off anything.

Another reason that having a signing authority is great is that it ensures legal compliance. This is especially useful if you deal with many important contracts that might not need your direct attention but still are important enough to be thoroughly examined by an informed person.

2. Simplifies Management and Decision Making

Depending on the size and need of your organization, you can have several authorized signatories with different authorization levels. This creates a procedure within your company which in turn makes things much easier to manage.

For example, you can categorize contracts and agreements based on different criteria such as related departments or level of importance. Then, you can delegate the signing authority to the employee you think is the best for the job. You can even design an approval hierarchy if you’re dealing with highly sensitive deals.

When you establish who will sign what, it’ll be much easier to handle agreements, even if you have too much on your plate. This is the method that large organizations such as universities for example usually use to manage everyday business affairs and even important agreements.

3. Increases Organizational Trust

Giving employees signing authority can really help build trust in an organization. While 86% of executives say they highly trust their employees, only 60% of employees feel that trust. When you give employees the power to make decisions and sign off on important stuff, you’re showing that you genuinely value their judgment and abilities. This makes employees feel more trusted and respected, which can boost their confidence and engagement. In the end, it helps create a culture where trust flows more freely between everyone in the company.

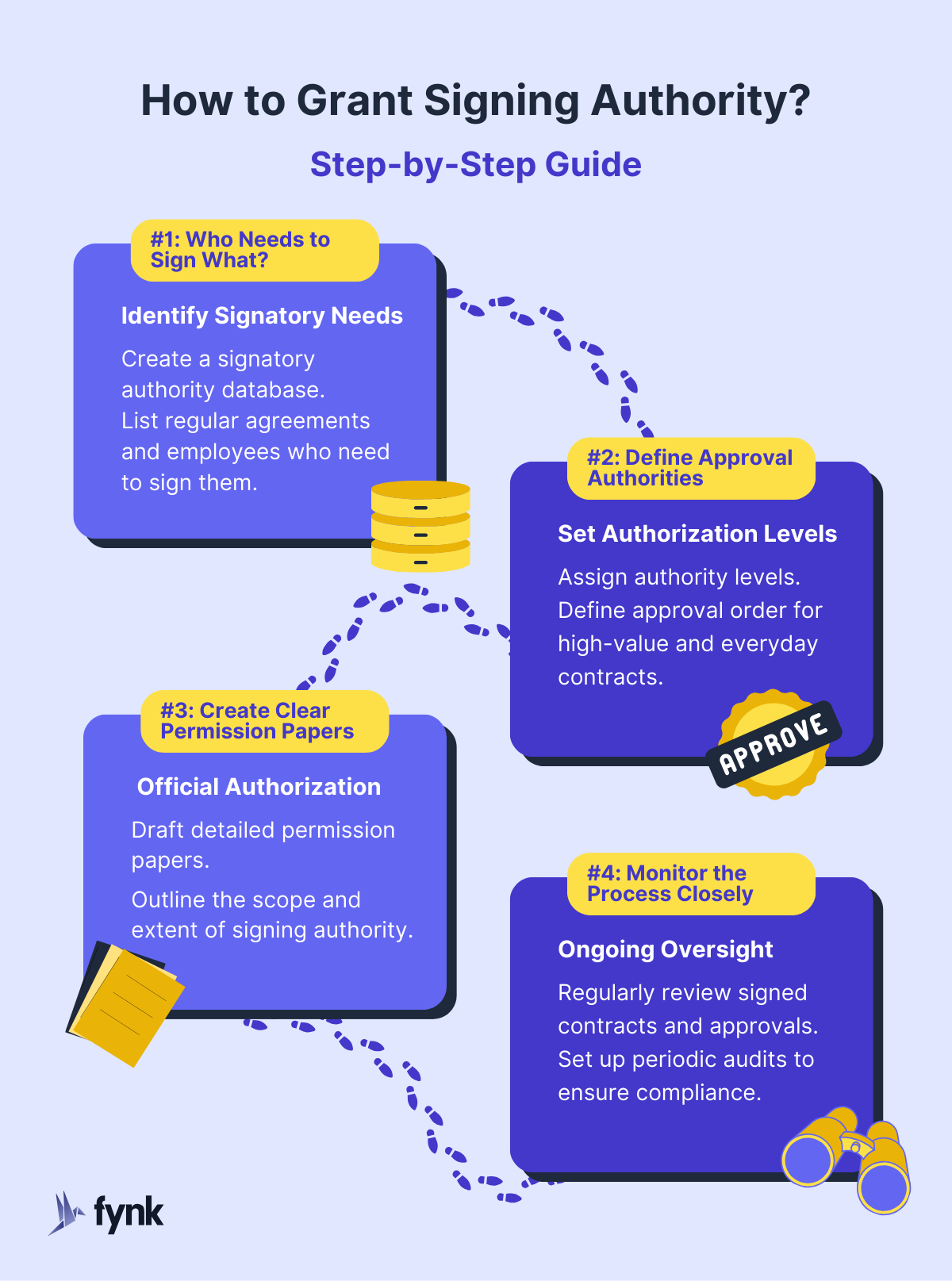

How to Grant Signing Authority?

Here’s a four-step process you can use to authorize your employee and define signatory titles.

Step #1: Who Needs to Sign What

First, you need to come up with your own signatory authority database. Make a thorough list of all regular agreements that your company deals with and also the employees whose signature is regularly needed.

In other words, you’ll be answering the question, who can be authorized signatory of a company and can sign what?

You can create a data sheet which can then be used as a source for other employees when they need to know who to turn to for a company signature.

Here are some hints about which employees should take over what responsibilities:

- Executive Team: Typically, CEOs, CFOs, and other top executives’ signatures are usually needed for high-value contracts, strategic partnerships, and agreements with significant financial commitments.

- Department Heads: Leaders of key departments like finance, sales, HR, and marketing often need to sign various documents on a daily basis. This can range from HR signing an employee contract to the finance department paying for departmental expenses.

- Project Managers: If your company runs projects that involve suppliers, purchase orders, or anything in between, you may want to delegate the signing authority to employees that are involved—say the project manager?

- Procurement Officers: It’s better if the employees dealing with purchasing goods and managing the supply chain have the right to sign contracts, otherwise the process of acquiring the goods may take too long and get complicated.

- Legal Team: Your legal department may need authorization to sign on behalf of the company to approve legal documents, non-disclosure agreements (NDAs), and compliance-related papers.

Step #2: Define Approval Authorities

The next step is to assign different authority levels to different authority signatories and decide whether some documents need approvals from multiple people.

For high-value contracts, you might want to grant signature authority to multiple people with high levels of authority and define the approval order. For example, the setup can look like this:

- Initial review and approval by the COO (3rd Level of Authority)

- Financial review and approval by the CFO (2nd Level of Authority)

- Final sign-off by the CEO (1st Level of Authority

So as you can see, the authorized signatory who has the highest level should be the last one who signs a contract.

However, not all the contracts need approvals from all C-levels. For example, for everyday items like office supplies, the process looks like something like this:

- Office Manager/Admin Manager approves the purchase request (1st Level of Authority).

- The Procurement Officer reviews and approves budget alignment (2nd Level of Authority).

How to Track Approvals?

Using Excel sheets is useful to keep a list of authorized signatories but it’s not very useful for collaborations and tracking approvals. This way, you need to regularly check and search for status updates on the contracts. Not to mention that the number of contracts might reach a point where it simply gets out of hand.

Instead, use contract management software like fynk that automates the approval tracking. You can create checkpoints and collect approvals from the signatory authority in reviewing or signing stages of contracts. Each person involved receives a notification through email and app when it’s their turn to sign. Finally, all signing authorities will be informed when a document is fully signed.

Want to try creating approvals for free? Then better try fynk, the all-in-one contract lifecycle management app powered by AI.

Sign

any

Document in Less than

a Minute.

Step #3: Create Clear Permission Papers

To officially and legally grant the authority to each signatory, you need to create a clear permission paper—also known as a letter of authorization—for each person.

When you’re issuing a power of attorney, you need to provide comprehensive information about the person you’re authorizing (the proxy) and their position in the company. Clearly outline the scope and extent of their signing authority to avoid any confusion or misunderstandings later on.

When drafting these documents, avoid using casual language or slang that could make the document seem less professional or vague. Remember, these papers have legal consequences, so you want to convey the seriousness of giving someone the power to sign documents.

✨ Pro Tip: A good practice is to think about the 5 Ws when drafting these documents.

- Who needs authorization to sign certain documents?

- Why do these individuals require this authority?

- What roles or responsibilities do these individuals have within their departments or teams?

- When do they need to exercise this signing authority?

- Where should a detailed explanation of their roles and responsibilities be included in the document?

Types of Permission Papers

There are different types of permission papers to choose from:

Delegation of Authority (DoA) Document: Who Can Sign & Their Limits

Use a Delegation of Authority to clearly explain who in your company has the right to sign different types of contracts. This document defines the levels of authority and specific roles so that everyone knows their limits and responsibilities.

Signature Authorization Form: Gives the Power to Sign

The Signature Authorization Form is what you fill out to officially grant someone the authority to sign documents. It includes details about the person, what they can sign, and the period of their authorization, along with necessary approvals from higher-ups.

Signature Authority Matrix: Who Approves Different Contracts

An approval signature authority matrix helps you quickly see who needs to approve what types of contracts. It lists the contract types, the required approval levels, and the specific people authorized to give those approvals.

Compliance Checklist: Tracks All Steps Before Signing

You use a Compliance Checklist to make sure all necessary steps are completed before a contract gets signed. This list includes budget checks, legal reviews, and strategic alignments. This authority signature letter helps you to reduce the risks associated with contracts.

🧠 Did You Know? You can create, automate, and manage all these forms using CLM software like fynk.

Step #4: Monitor the Process Closely

Delegating is not the last step of granting the signature authority power; you need to monitor the contractsafterward. So, regularly review signed contracts and approvals to make sure they align with your company’s policies. Keep an eye out for any red flags, like unauthorized signatures or if someone signs a document that they should not be supposed to.

You can also set up periodic audits to neatly keep track of things.

What Is an Example of an Authority Signatory?

Authority signatory is a common practice of all businesses of all sizes. Here’s an example of an authority signatory given in a bank and university.

In Banks

Branch Manager: Has the authority to approve a big loan for a small business looking to expand. They’ll check the business’s credit to see if everything complies with banking rules, and then sign off on the loan documents to get the funds moving.

Chief Financial Officer (CFO): At a big national bank, you’re the one who signs off on the annual financial statements that go to the regulators. You review the bank’s performance, ensure all the numbers are accurate, and approve major investments to grow the bank’s assets.

In Universities

Dean of a College: At a major university, the Dean of the College of Engineering signs off on new faculty contracts. They evaluate the candidate, approve the salary, and finalize the employment terms, making sure the new professor fits the college’s goals.

University Treasurer: At a state university, the Treasurer has the job of signing off on big purchases like new lab equipment. They review the purchase, make sure it fits the budget, and sign the contract, helping the university improve its research facilities.

What Happens if an Unauthorized Person Signs a Contract?

If an employee signs a contract without having the authority, it doesn’t automatically make it invalid for two main reasons:

a) Legality of Signatures: Whether wet signatures or electronic signatures, these are legally binding and the signatory is responsible for the documents they signed.

b) Apparent Authority: When a third party—like a supplier—reasonably believes that a person has the right to act on behalf of a company and enters a deal with that person.

Putting these two together, even if you didn’t have the proper permission to sign a contract, your company could still be held responsible for your actions.

Conclusion

Setting up authorized signatories in your company is a smart strategy to prevent unauthorized activities, make management simpler, and build trust within the organization. By clearly defining who can sign what and keeping a close eye on the process, you can speed up decision-making and keep a firm grip on your finances.

Frequently Asked Questions

- How Many People Should Have a Signature Authority?

- It depends on the size and structure of your company. As a rule of thumb and considering the signature authority policy of the company, it's recommended to have at least two or three authorized signatories to keep everything in order and also avoid delays if one responsible person is out of reach.

- Who Can be an Authority Signatory?

- Anyone in your company can be authorized to sign contracts, not just top executives. Usually, they are the CEO, CFO, and senior managers, but it can also extend to board members or other employees.

- What Do You Call a Signing Member of the Company?

- The person who signs legal documents or any other agreement is called authorized signatory or authorized signer as the official title.

Please keep in mind that none of the content on our blog should be considered legal advice. We understand the complexities and nuances of legal matters, and as much as we strive to ensure our information is accurate and useful, it cannot replace the personalized advice of a qualified legal professional.

Table of contents

- Signatory Authority Definition, Roles and Permissions

- 4 Types of Signatory Authority

- Why Is Signing Authority Important?

- How to Grant Signing Authority?

- Step #1: Who Needs to Sign What

- Step #2: Define Approval Authorities

- How to Track Approvals?

- Step #3: Create Clear Permission Papers

- Types of Permission Papers

- Delegation of Authority (DoA) Document: Who Can Sign & Their Limits

- Signature Authorization Form: Gives the Power to Sign

- Signature Authority Matrix: Who Approves Different Contracts

- Compliance Checklist: Tracks All Steps Before Signing

- Step #4: Monitor the Process Closely

- What Is an Example of an Authority Signatory?

- What Happens if an Unauthorized Person Signs a Contract?

- Conclusion

- Frequently Asked Questions

Want product news and updates? Sign up for our newsletter.

Other posts in Electronic-Signature

Signature Forgery Explained - Types, Risks, and Protection Tips

Signature forgery is the unauthorized imitation or duplication of a person’s signature to commit illegal …

Authority Signatory - Who, Why, & How to Authorize?

An authority signatory is someone in a company who has the official and legal power to sign documents, approve …

How to Add Signature to Email (Gmail, Outlook, and Mail)?

You can easily add a digital signature to your emails on platforms like Gmail, Outlook, and Apple Mail by …

Contracts can be enjoyable. Get started with fynk today.

Companies using fynk's contract management software get work done faster than ever before. Ready to give valuable time back to your team?

Schedule demo