How to Review Business Contracts Like a Pro in 2026

When it comes to business contracts, what you don’t catch can hurt you. That’s why reviewing a business contract before signing is a must. Whether you’re sealing a partnership, onboarding a supplier, or finalizing a customer agreement, knowing exactly what you’re signing up for helps protect your company, avoid costly disputes, and keep your goals on track. In this guide, we break down what a business contract review really is, why it matters way more than people think, who should be involved, and how to do it step by step. You’ll learn how to review contracts like a pro.

- What’s a Business Contract Review and Why It Matters?

- Who Reviews Business Contracts?

- How to Review a Business Contract?

- Step 1: Get the Business Context

- Step 2: Read Through the Entire Contract Once

- Step 3: Review the Contract Clause-by-Clause

- Step 4: Red Flags and Redlining

- Step 5: Check Schedules, Annexes, and Referenced Documents

- Step 6: Cross-check for Consistency

- Step 7: Summarize the Key Points and Risks

- Step 8: Final Review Before Signature

- Business Contract Review Checklist

- How to Review a Business Contract Efficiently?

- Now Over to You

What’s a Business Contract Review and Why It Matters?

A business contract review is basically a deep dive into the fine print of a legal agreement before you go ahead and sign on the dotted line. Think of it as a sanity check, making sure everything’s in order, and nothing comes back to bite you later. It’s a crucial step in the contract lifecycle management process and usually happens pre-signature.

While the main aim is to make sure everything’s legally sound and compliant, there’s a lot more riding on it. A solid contract review helps companies:

- Catch red flags early, from financial slip-ups to operational headaches, before they turn into full-blown disasters.

- Get clear on roles and responsibilities, so everyone knows exactly what they’re signing up for (no room for “wait, what?” moments later)

- Align the deal with business goals because if it doesn’t move the company forward, what’s the point?

- Protect the crown jewels, like intellectual property and trade secrets. You don’t want that stuff leaking.

- Avoid future drama by making sure the contract reflects what was actually agreed on.

- Double-check that the money talk, pricing, payments, and financial terms need to be on point.

And that’s just the start. Skipping a contract review is like going skydiving without checking your parachute. Not exactly the most brilliant move.

Who Reviews Business Contracts?

Generally speaking, the legal team is the go-to for reviewing different types of business contract. But in smaller companies, that job often falls on whoever is closest to the action. It could be the operations lead, a contract-savvy manager, or someone juggling multiple roles.

Even if there is a full-time in-house counsel on board, they are not handling things alone. Others often jump into the mix or even take the lead entirely. This includes contract managers, the business units or teams directly involved with the deal, upper management, or any decision-makers with skin in the game. At the end of the day, contract review is rarely a one-person job.

How to Review a Business Contract?

Reviewing a business contract is not exactly a walk in the park. Even seasoned lawyers have to buckle up for it. But if you break it into bite-sized steps, it becomes way less intimidating and a whole lot more doable.

In this 8-step guide, we will walk you through the full review process so you know what to look out for and how to tackle each part like a pro, especially when it comes to business contracts.

Step 1: Get the Business Context

Before you even open the contract, pause for a second. The first and probably most important step is to understand the real business context behind the deal. This is not something you can grab from the summary alone or by throwing a few generic questions at your client, manager, or even yourself. You need to dig deep into why this contract is being signed, how it fits into the company game plan, and what the business hopes to get out of it.

Why is reading the summary not enough?

Because the summary usually reflects just one party’s take, and it often misses the subtle but essential stuff like strategic intent or past context. It gives you a still photo when you actually need the complete behind-the-scenes footage. The real story includes business goals, negotiation power, and background info that changes the way you read the contract.

You should not look at the contract only as a legal document. It is a powerful business tool. Skip the context, and you risk serious business or financial fallout.

How do you really get the business context?

Talk to the people who know. Stakeholders, execs, product owners, team leads. Get the clearest picture you can on these four points:

Expected Outcomes What is the company hoping to achieve with this contract? If the answer sounds like growth, cost efficiency, or better collaboration, push for more. The goal should look something like this:

- Cut operating costs by combining service providers and aim for five hundred thousand in yearly savings

- Launch new products into at least three European markets in the next two years with a five percent market share each

- Limit liability in supplier contracts with a hard cap of one million per incident

Company Position and Leverage

How much influence does your company have in this deal? Knowing if you are the stronger or weaker party helps shape your negotiation approach. If this is about a critical supplier, for example, the priority may shift toward security and continuity rather than pushing too hard on price.

Relevant History and Precedents

Has your company worked with this partner before? How did that go? Any past agreements, disputes, or standard practices can totally shape how you review the current contract. Ignoring that history can lead to friction, missed risks, or repeating old mistakes.

Internal Policies and Risk Appetite

Every company has a different comfort zone when it comes to risk. Some are fine taking big swings, others play it safe. You need to know how bold or cautious your business is, especially around things like warranties, indemnities, or payment terms. If you miss this, you might waste time redlining something the team is already cool with.

✨ Pro Tip: Before diving in too deep, take a minute to jot down the business context. Just a short paragraph, a few bullet points, or a quick internal note. It keeps your review sharp, focused, and way more effective in the long run.

Step 2: Read Through the Entire Contract Once

The temptation to dive directly into clauses is strong, but it’s important first to pause, zoom out, and read the entire contract straight through without interruption.

Why?

Because doing this provides a holistic overview and helps you grasp the rhythm, flow, and logic of the document. More importantly, it immediately highlights sections that could become contentious or significantly affect risk and compliance. We know that critical issues often emerge clearly only when the contract is understood as a cohesive whole, rather than fragmented clauses in isolation.

And by zooming out, we mean actually not getting bogged down in minor details too soon. Instead, use this initial read through to pinpoint key provisions, flag areas of confusion, and note any obvious gaps or inconsistencies. Resist making detailed notes or comments just yet. Save those for the detailed, clause by clause review that follows.

A great way to do this step is getting help from AI. AI can extract the gist of your document literally in a second, saving you tons of effort and time.

Let’s see it in practice, using the fynk’s AI contract analysis tool:

You just need to upload your draft (or even a signed document) and then give it a few second so that it shows you:

- A clear summary and abstract

- Important dates

- Critical clauses

- Party’s details

- Obligations

As you can see, with a glance now, you can have a pretty good view of what’s happening in your contract.

Step 3: Review the Contract Clause-by-Clause

This step is the heart of any thorough business contract review. It’s where your careful attention might prevent costly misunderstandings and disputes down the line.

💡 Good to Know: Having a good contract playbook, especially for frequent contracts, will help you greatly to save time and effort at this stage.

What clauses should you particularly pay attention to?

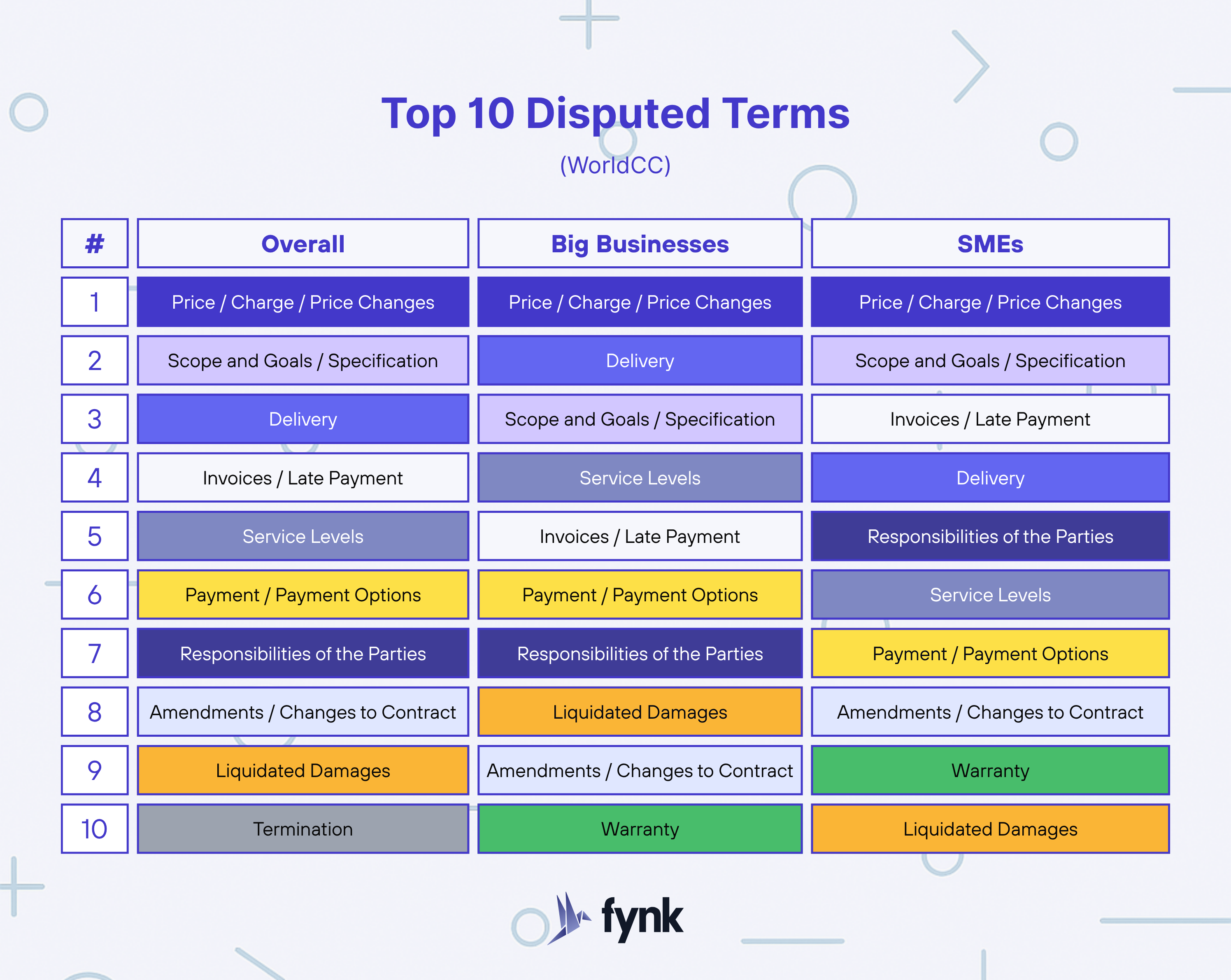

Well, ideally, You should pay special attention to all clauses. But, of course, some clauses are more important than others. According to Most Negotiated Terms 2024, published by WorldCC, the top 10 most negotiated terms in contracts are:

And not surprisingly, the most disputed terms are:

Putting it all together, we can see that when you run a clause-by-clause review, you can tailor your checklist and your red-lining playbook based on the insights you can get from these lists, including:

1. Elevate Price Clauses up Front.

Since Price/Charge/Price Changes is both the most negotiated and the most disputed term, your review should call out every pricing-related clause:

- Fees and expenses,

- Change-order mechanisms,

- Inflation adjustments,

- Currency-exchange formulas, etc.

Use a single Pricing section in your contract playbook that points reviewers to sample language, fallback positions, and triggers for finance or legal to weigh in.

2. Don’t Gloss Over Liability and Indemnity

Although these tend not to flare up as formal disputes, they’re the top items in negotiation. Your clause-by-clause review should flag every reference to caps, baskets, carve-outs, and indemnity scopes. Make sure you have your standard liability-cap thresholds at hand, along with any sector-specific carve-outs (e.g., data breaches).

3. Treat Scope and Delivery Like Red Flags

Scope and Goals/Specification and Delivery may not headline your term-sheet conversation, but they are dispute magnets. In your review, embed prompts under Scope, Acceptance, Milestones, and SLAs that ask:

- Is scope defined by objective deliverables?

- Are acceptance tests or sign-off criteria crystal clear?

- Are service-level metrics (uptime, response time, remedy for failures) spelled out?

4. Add a Billing and Invoicing Sanity Check

Invoices and Late Payment and Payment Options rarely get heavy pushback at signature, yet they show up high on the dispute list. Under Payment Terms, explicitly review:

- Invoice timing and content requirements

- Late-payment interest rates and cure periods

- Dispute processes for invoicing disagreements

5. Call out Party Responsibilities

SMEs, in particular, fight over the Responsibilities of the Parties later on. In the review, have a dedicated section that maps obligations to the team or role (Customer shall… Provider shall…), and double-check that every bullet under Responsibilities is matched by a corresponding milestone or deliverable elsewhere.

6. Keep Amendments and Termination in View

Amendments or Changes to Contract and Termination live in both lists. Your clause review should:

- Confirm that any change-control process is workable (e.g., written change orders only, hierarchy of approvals)

- Ensure termination rights and notice periods align with your business’s risk tolerance (e.g., for convenience vs. for cause)

- Highlight any financial or operational unwind obligations

✨ Pro Tip: Avoid over-engineering liability caps and indemnities by benchmarking your terms against industry standards. Quickly analyze market practices, checking liability caps, indemnity carve-outs, and insurance expectations across similar deals. Set clear, realistic bands (low, target, high) and create a simple “Caps & Carve-outs” cheat sheet for your deal teams.

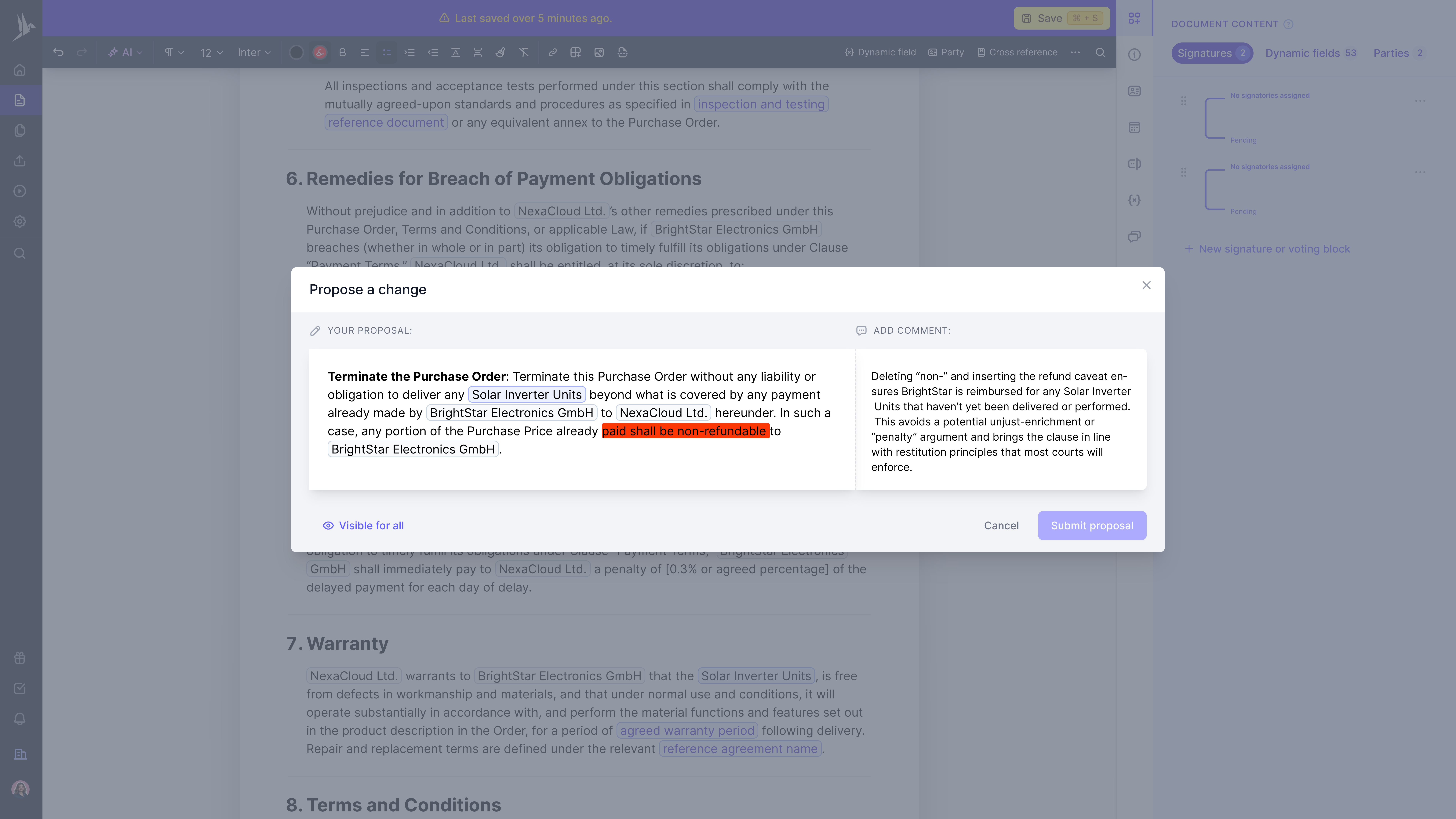

Step 4: Red Flags and Redlining

Now that you know your clauses inside and out, it’s time to zero in on anything that could blow up later and mark it up immediately.

First, find the red flags, then redline your contract for further edits and assign it to the person responsible for the edits.

Here’s how to make your review truly proactive:

- Run “What-If” Scenarios: Read each clause and ask yourself, “What if the other side acts in bad faith here?” For example, if a “force majeure” clause is too narrow, sketch out a real-world disruption (like a cyber-attack) and see if it’s covered. If it isn’t, flag it.

- Stress-Test Vague Language: Whenever you see terms like “reasonable efforts” or “promptly,” write down a worst-case timeline (“What if ‘promptly’ means 90 days?”). If that blows up your operational plan, demand specific deadlines or objective metrics.

- Map Out One-Sided Powers: Identify any clause that gives the counterparty unilateral control, price changes, termination rights, audit access, or IP use. For each, draft a one-sentence counterproposal that restores balance (e.g., “Price increases allowed only with 60-day notice and cap of 5% per year”).

- Check for “Sinkholes”: Unlimited liability or open-ended indemnities are contract sinkholes. Calculate your potential exposure under worst-case scenarios (e.g., a data breach or product recall) and insist on a cap tied to tangible metrics like a multiple of fees or available insurance limits.

- Verify Dispute Paths: Ambiguous dispute-resolution clauses cost six figures in legal fees. If the “arbitration venue is to be agreed later,” lock it down now with a specific institution, location, and ruleset (e.g., “ICC Rules, London seat”).

Spotting red flags is only half the battle. Once you’ve identified a problematic clause, the next natural step is to redline the contract itself.

When you flag a problem, mark it up right in the text with tracked changes or comments so everyone sees exactly where the issue lies, then immediately replace vague or one-sided phrasing with your precise fix (for example, swapping “reasonable efforts” for “commercially reasonable efforts within 30 days”), add a brief margin note tying the change back to business priorities (capping liability, securing notice periods, avoiding auto-renewals), and keep a running redline log as you go so every edit makes it into the final negotiation draft.

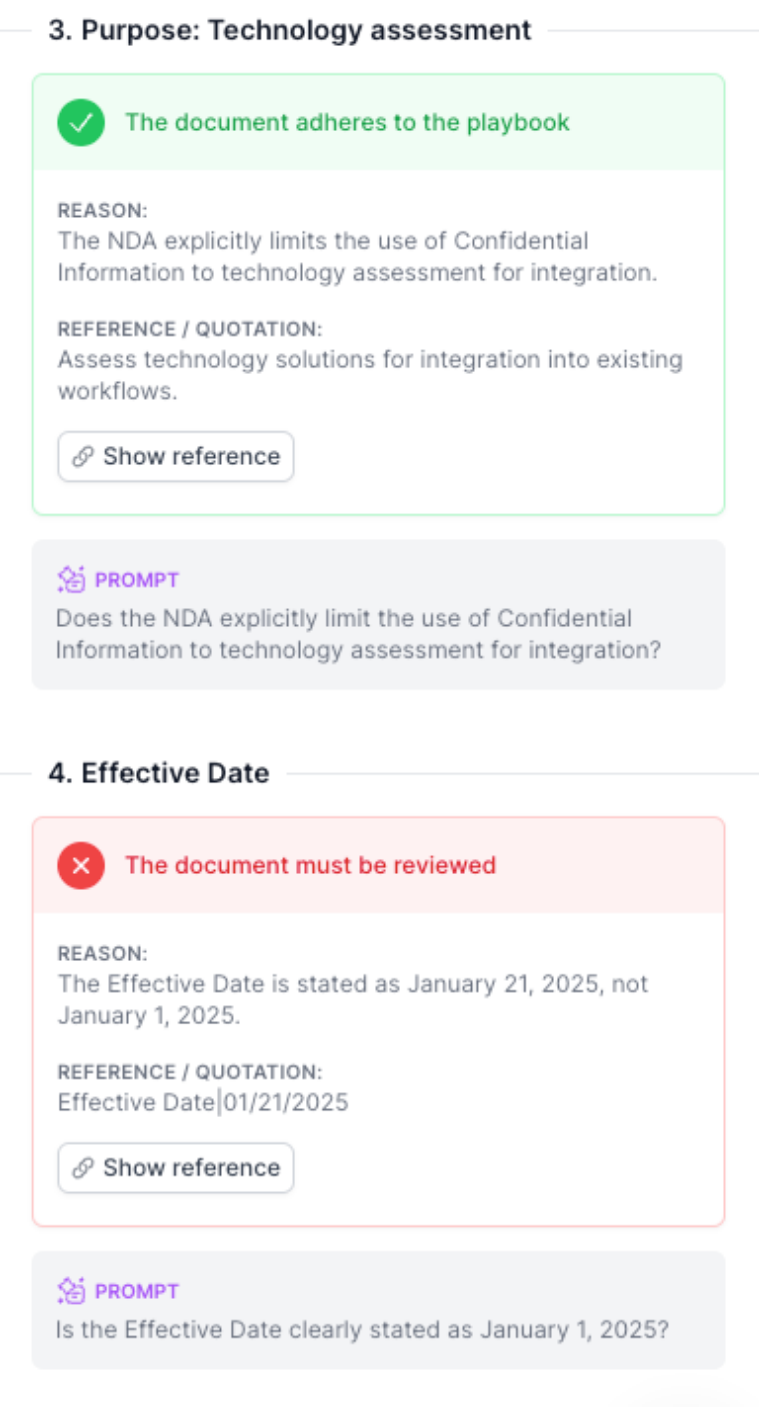

To supercharge this process, design your contract playbooks in fynk and apply it automatically to scan your drafts and highlight:

- 🔴 Red Flags for critical missing or dangerous terms

- 🟠 Orange Flags for warnings or mid-severity concerns

- 🟢 Green Flags where your language matches your standards

Once flagged, use suggestion and commenting features to add your edits, striking through risky wording and inserting clear replacements. Then, invite your colleagues or external parties to see the suggestions.

Step 5: Check Schedules, Annexes, and Referenced Documents

Don’t let critical details hide in the attachments; verify every schedule, annex, and referenced document is not only included but up to date and correctly cross-referenced. You’ve seen contracts where Exhibit B never arrives, or an annex cites a superseded service-level matrix; catching those gaps now saves costly disputes later.

Step 6: Cross-check for Consistency

Flip between sections to verify that defined terms, deadlines, party names, and numeric figures match everywhere. A “30-day notice” here and “45 days” there, or citing “XYZ Corp.” in one clause and “XYZ GmbH” in another, undermines enforceability and invites disagreement. Consistency is your safety net against internal contradictions that can be exploited later.

Step 7: Summarize the Key Points and Risks

Before you move on, distill the entire agreement into a one-page snapshot: what you’re buying or providing, the financial commitments, the critical deadlines, and the top three “watch-out” clauses. A tight executive summary ensures stakeholders immediately grasp the deal’s essentials, know where the landmines lie, and can prepare negotiation or implementation strategies without wading back through dense legal text.

Step 8: Final Review Before Signature

With negotiated edits incorporated, do one last pass in a fresh view: confirm every change is correctly applied, every exhibit is attached, and that signature blocks show the proper names and dates. A clean, error-free final version not only looks professional but prevents embarrassing last-minute hiccups and ensures the deal closes smoothly.

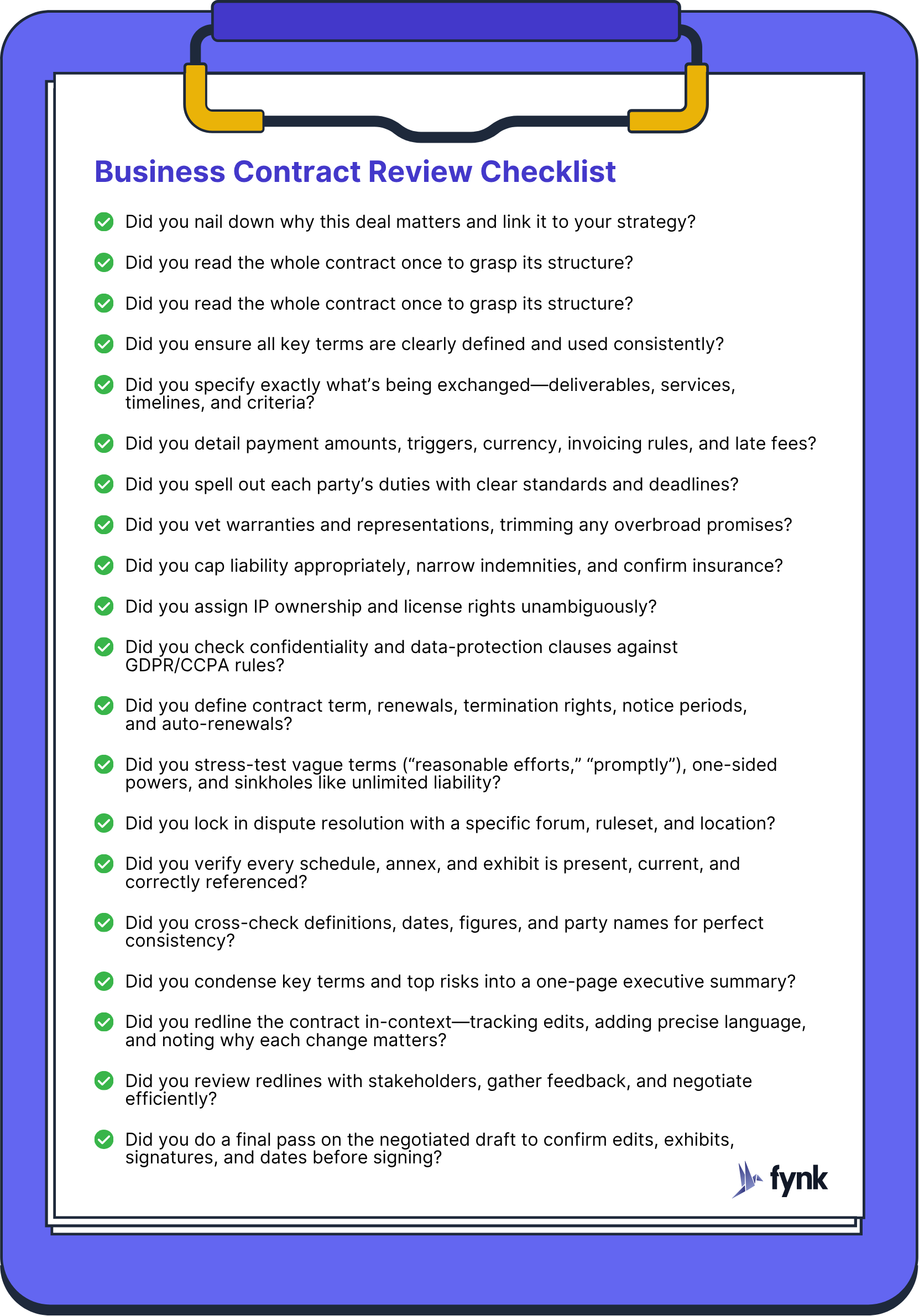

A fast way to do this is by automating the review approval process. In fynk, you can place review approvals before reaching the “review” and “signing” stages of the documents. Also, you can add policies to set whether a specific person needs to approve the contract or several people.

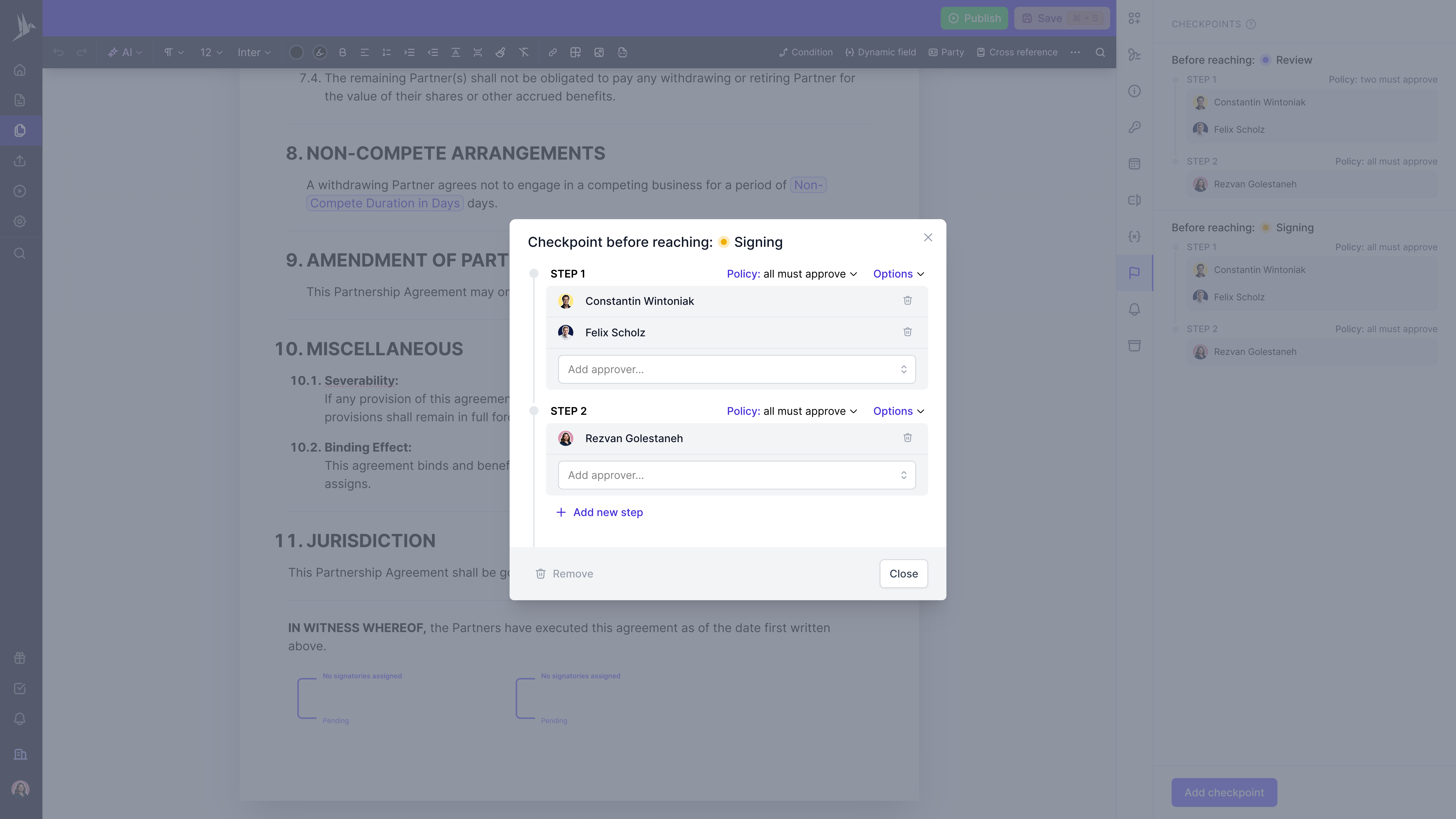

Business Contract Review Checklist

How to Review a Business Contract Efficiently?

Using good contract management helps you to pass the review stage easily and smoothly. Here are some of the CLM features that help you to make reviewing contracts even easier:

- Dynamic Review Queues: As soon as a draft is uploaded, the system knows exactly who needs to weigh in: legal, finance, sales, procurement, and executive sponsor, and sends each reviewer a task.

- Clause-Level Discussions: Reviewers can highlight specific language, leave threaded comments on individual sentences, and @-mention colleagues for clarification, all directly on the contract text.

- Real-Time Visibility: Every comment, suggestion, or question is visible to the whole team in real-time. No more “I didn’t see your email” or “Which redline are we reviewing?”

- Version Control: Each round of feedback automatically spawns a new, immutable version. You can see exactly which clauses changed between Version 3 and Version 4 and who made each edit.

- Rollback Safety Net: If a late review round goes off-rails or someone accidentally overwrites important language, you can instantly revert to any prior version, preserving months of careful negotiation.

- Focused Decisioning: Reviewers spend less time hunting for edits and more time evaluating whether a change is acceptable, speeding up sign-off.

- Who Said What, When: Every comment, approval, and edit is timestamped and attributed to a specific user. You can generate a “review audit” report in seconds—critical for highly regulated industries or internal audits.

- Risk Scoring & Tiering: Each clause can be assigned with a “flag” based on the preset and prompt that you defined. High-risk items get flagged in red, medium-risk in orange, and those that are safe in green.

Searching for a contract management solution?

Find out how fynk can help you close deals faster and simplify your eSigning process – request a demo to see it in action.

Now Over to You

Reviewing a business contract is an easy task, but it can be optimized by using a systematic approach, attention to detail, and professional tools that make it much easier, even if you are not a lawyer by profession.

The golden rules to remember are:

- If you don’t understand it, neither will a court, so rewrite it.

- If it isn’t in the contract, it doesn’t exist.

- Always review with fresh eyes and never rush.

- Document every discussion and rationale for changes.

- Never be afraid to say “no” or walk away from a bad deal.

Please keep in mind that none of the content on our blog should be considered legal advice. We understand the complexities and nuances of legal matters, and as much as we strive to ensure our information is accurate and useful, it cannot replace the personalized advice of a qualified legal professional.

Table of contents

- What’s a Business Contract Review and Why It Matters?

- Who Reviews Business Contracts?

- How to Review a Business Contract?

- Step 1: Get the Business Context

- Step 2: Read Through the Entire Contract Once

- Step 3: Review the Contract Clause-by-Clause

- Step 4: Red Flags and Redlining

- Step 5: Check Schedules, Annexes, and Referenced Documents

- Step 6: Cross-check for Consistency

- Step 7: Summarize the Key Points and Risks

- Step 8: Final Review Before Signature

- Business Contract Review Checklist

- How to Review a Business Contract Efficiently?

- Now Over to You

Want product news and updates? Sign up for our newsletter.

Other posts in Contract-Management

SaaS contract management explained for buyers and vendors

If you work in SaaS, you know how quickly contracts can pile up. Each one comes with its own terms, renewals, …

The Complete Guide to Effective Contract Repository Management

A contract repository is where every agreement your business depends on finally finds its place. No cluttered …

How to Review Business Contracts Like a Pro in 2026

When it comes to business contracts, what you don’t catch can hurt you. That’s why reviewing a business …

Other posts in Guides

What is a document audit trail and how it work

When you’re dealing with regulated processes, contracts, or any kind of business documentation, having a clear …

How to extract and manage contract metadata with AI

Contracts contain critical information, but finding it shouldn’t take hours. Instead of manually searching …

SaaS contract management explained for buyers and vendors

If you work in SaaS, you know how quickly contracts can pile up. Each one comes with its own terms, renewals, …

Contracts can be enjoyable. Get started with fynk today.

Companies using fynk's contract management software get work done faster than ever before. Ready to give valuable time back to your team?

Schedule demo