Aleatory contracts, rolling the dice on risk and reward

If you’ve ever dealt with insurance, gambling, or certain investment agreements, you’ve come across something called an aleatory contract. Sounds fancy, right? But it’s basically a contract where the outcome depends on chance. Some people gain, some people lose, and it all depends on an uncertain future event. In this blog post, we’re going to explore aleatory contracts, what the term means, what makes an agreement aleatory, and the risks and benefits of having one. Let’s get started.

What are aleatory contracts? 🎲

Aleatory contracts are a special type of agreements where the outcome, and sometimes even the value exchanged, depends on unpredictable events. Simply put, the terms in these contracts trigger only if a particular, uncertain event takes place.

The term “aleatory” itself comes from the Latin “alea,” meaning dice, which is fitting: chance is the name of the game. In practice, this means the parties are essentially betting on what might (or might not) happen, with their obligations triggered by the roll of fate.

Aleatory contracts sound complicated, but you probably deal with them more often than you think:

- Insurance policies: You pay premiums, but the insurer only pays out if a loss (like a car accident or house fire) occurs.

- Gambling agreements: You stake money, but your payout depends entirely on chance.

- Stock options or futures contracts: You agree to trade under certain conditions, but only if market prices reach specific levels.

Notice a pattern? The defining trait is uncertainty; both parties take on risk, but neither knows upfront whether they’ll have to deliver.

Why it matters?

If you’re in business, especially in finance, real estate, or insurance, understanding aleatory contracts can save you a ton of headaches. Misunderstanding them could mean unexpected costs or missed opportunities.

Aleatory contracts are important because:

- They help shift or spread risk (e.g., insurance).

- They can create win-win opportunities, but only if you understand the conditions.

- They require careful reading of the fine print, since obligations only “trigger” under certain events.

💡 Good to Know: According to Swiss Re’s 2023 Financial Report, global life insurance premiums added up to about USD 2.9 trillion in 2023, that is a mix of savings components and pure risk protection.

✨ Pro Tip: Whenever you’re dealing with an aleatory contract, don’t just skim the terms. Write down the exact “trigger events” that activate each party’s obligations. If you can’t explain it in one sentence (“The insurer pays if my house burns down”), you probably need clarification before signing.

3 famous examples of aleatory contract

1. Life insurance

The classic example. You pay regular premiums, but the payout only happens if an uncertain event—your death (god forbids!)—occurs during the coverage period. If that happens sooner, your family could receive far more than you ever paid in. If it doesn’t happen within the term, the insurer keeps the premiums. Unequal, unpredictable, but that’s exactly the point: it’s about shifting risk.

2. Royalty agreements in publishing or music

Authors, musicians, and creators often sign contracts where payment depends on future sales. If a book becomes the next global bestseller or a song tops the charts, the royalties can be enormous. But if sales flop, the royalties may barely cover a coffee. The risk is baked into the deal, success brings huge upside, failure brings almost nothing.

3. Mineral or oil exploration agreements

Think drilling rights or mining concessions. Companies sink millions into exploration, but whether they actually find oil, gas, or valuable minerals is a giant question mark. If they strike gold (literally or figuratively), the rewards are massive. If not, the investment is lost. This is uncertainty on an industrial scale, and one of the clearest examples of aleatory risk in business.

💡 Good to Know: In 1901, William Knox D’Arcy obtained a concession from the Shah of Persia to search for oil across a vast region. For years, the venture drained huge sums of money with almost nothing to show for it, and many believed it would collapse. Then, in 1908, just as funds were running out, his team struck oil in southern lands of Persia. That single discovery gave birth to the Anglo-Persian Oil Company, the forerunner of today’s BP.

The D’Arcy Concession is a perfect example of an aleatory contract: massive uncertainty at the start, enormous costs shouldered by one party, and life-changing profits only if the gamble paid off.

Benefits and drawbacks of aleatory contracts

On paper, aleatory contracts look like clever little tools to juggle risk. But once you zoom out, there are a few bonus perks and sneaky traps worth calling out that don’t always make the highlight reel.

Upsides:

- ✅ Cash-flow freedom: Instead of hoarding rainy-day funds, you pay smaller amounts upfront and keep the rest of your capital working for you.

- ✅ Courage to take bigger swings: With risk parked safely elsewhere, you can chase opportunities you would normally avoid.

- ✅ Built-in diversification: These deals often hinge on events outside your core business, spreading your exposure in clever ways.

- ✅ Quick rebounds (sometimes): Parametric contracts tied to objective triggers can pay out lightning fast, helping you bounce back before the dust settles.

- ✅ Custom-fit protection: You are not stuck with cookie-cutter terms. Contracts can be tailored to your very own “what if” scenarios.

Downsides:

- ❌ The “wrong payout” problem: Basis risk means the contract might pay (or not pay) in ways that do not line up with your actual loss.

- ❌ Slow-motion safety nets: Traditional claims can drag on forever, leaving you hanging when you need cash most.

- ❌ Counterparty roulette: If the other side collapses or refuses to honor the deal, your safety net vanishes.

- ❌ Behavioral quirks: People covered by protection sometimes take bigger risks, or worse, withhold information to game the system.

- ❌ Hidden red tape: Regulations, taxes, or accounting rules can quietly eat into the benefit you thought you were getting.

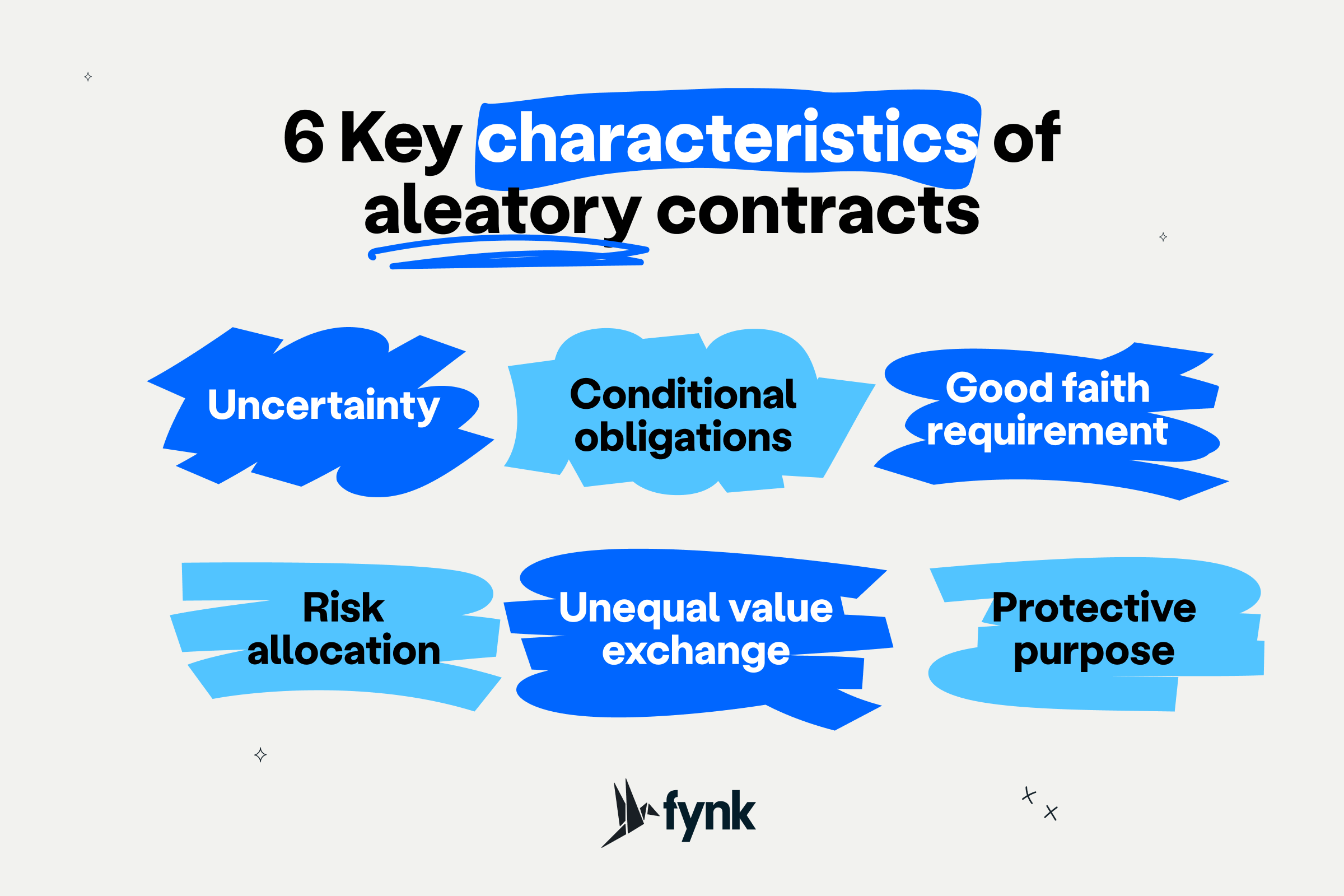

6 Key characteristics of aleatory contract

Just like rolling a dice, aleatory contracts has 6 sides:

1. Uncertainty

At the heart of every aleatory contract is uncertainty. Uncertainty isn’t just about if an event happens, it’s also about when and how big the outcome might be.

Think about car insurance. You pay premiums every month, but you only “win” the payout if you actually get into an accident. Sounds weird, but in this concept is true. No accident? No payout. (That’s the uncertain element.)

The uncertainly elements doesn’t have to be a negative event.

Look at stock options: you know a stock price will move, but you can’t predict how far or in which direction.

So uncertainty here comes in multiple flavors:

- Event uncertainty (will it happen at all?)

- Timing uncertainty (when will it happen?)

- Magnitude uncertainty (how big will the impact be?)

This multi-layered uncertainty is what separates aleatory contracts from simple “if/then” deals like service agreements, consulting contracts, or even sales contracts.

2. Conditional obligations

The beauty (and danger) of these contracts is that promises are triggered only if a specific event happens.

But the twist is, sometimes both parties are bound conditionally.

For example: In a derivatives contract, one side might have to buy at a set price if the market moves a certain way, while the other side is only obliged to sell under opposite conditions.

This means obligations can be:

- One-sided (like an insurance payout)

- Mutual (like two traders betting on opposite market outcomes)

Conditional obligations keep both sides “on the hook,” but only if the dice roll the right way.

⚖️ Legal Spotlight: Buffett’s Coca-Cola Puts

In 1993, Warren Buffett sold 50,000 put options on Coca-Cola stock with a strike price of $35. At the time, Coke was trading above $39.

- If the stock stayed above $35: the options would expire worthless, and Buffett would simply pocket the premiums.

- If the stock fell below $35: Buffett would have been legally obliged to buy millions of shares at the agreed strike, even if the market price was much lower.

This is a classic aleatory contract in action: the obligation was triggered only if a contingent event occurred (Coca-Cola’s share price dropping). The buyer of the options had a right, not an obligation, while Buffett’s duty to perform was conditional and potentially very costly.

3. Good faith requirement

If a contract is based on on uncertain events, what hold the parties actually accountable? the answer is trust. For an aleatory contract to work, both parties must be honest and share all important information.

Insurance companies, for example, have a duty to explain exclusions clearly. If they bury them in fine print, courts often side with the policyholder.

On the flip side, policyholders must disclose material facts (like health conditions or risky behaviors). If they don’t, the contract can collapse.

So good faith operates like a safeguard against the imbalance that uncertainty creates. Without it, aleatory contracts would be easy to exploit.

⚖️ Legal Spotlight: The Rolling Stones’ tour insurance

In 2014, the Rolling Stones postponed their tour after the sudden death of Mick Jagger’s partner, L’Wren Scott. Behind the scenes, the band had a multimillion-dollar insurance policy meant to cover losses from exactly this kind of event.

When they filed a claim, the insurers pushed back. Why? Because insurance contracts live and die on good faith. If a policyholder hides material facts like health conditions or risky behaviors the insurer can challenge the payout. In this case, Jagger’s personal medical details became part of the dispute, and questions were raised about whether the policy applied.

Eventually, the case was settled. But the fight underscored the safeguard of good faith: without honesty and full disclosure, aleatory contracts like insurance would collapse under mistrust. Even global rock icons have to play by that rule.

4. Risk allocation

In aleatory contracts risk isn’t eliminated, but It’s just shifted or shared.

In fact, most aleatory contracts are designed to:

- Move individual risk → collective risk (like an insurer spreading claims across thousands of customers).

- Transfer specialized risk → risk-taker (like a company hedging against fuel price hikes by shifting that risk to a futures trader).

This isn’t random, it’s actually a very strategic move. Risk allocation is the reason businesses and individuals enter into these contracts in the first place.

5. Unequal exchange of value

“unequal” doesn’t always mean unfair.

Aleatory contracts are structured so the perceived value at the start is roughly equal, even though the actual value exchanged later may swing wildly.

Example: You may pay $600 a year for renters insurance and never file a claim. That looks “unequal.” But the perceived value is the peace of mind and financial protection if something catastrophic happens.

So the unequal exchange (ironically) here isn’t a flaw. Both sides accept that the value will only balance out across many contracts or over long periods of time.

6. Speculative or protective purpose

Aleatory contracts don’t exist for their own sake, they serve one of two big purposes:

- Protective: shielding against losses (like insurance policies, disaster coverage, or warranty contracts).

- Speculative: seeking profit from uncertainty (like options trading, swaps, or gambling contracts).

The line between the two can blur. For example, buying a put option on a stock can be seen as protection (hedging against a price drop) or as speculation (betting the stock will fall).

This dual nature is what makes aleatory contracts so widespread: they aren’t limited to risk-averse people or risk-seekers. Instead, they’re tools that adapt depending on why you enter them.

In other words, the same dice roll can either be a safety net or a lottery ticket, depending on which side of the table you sit.

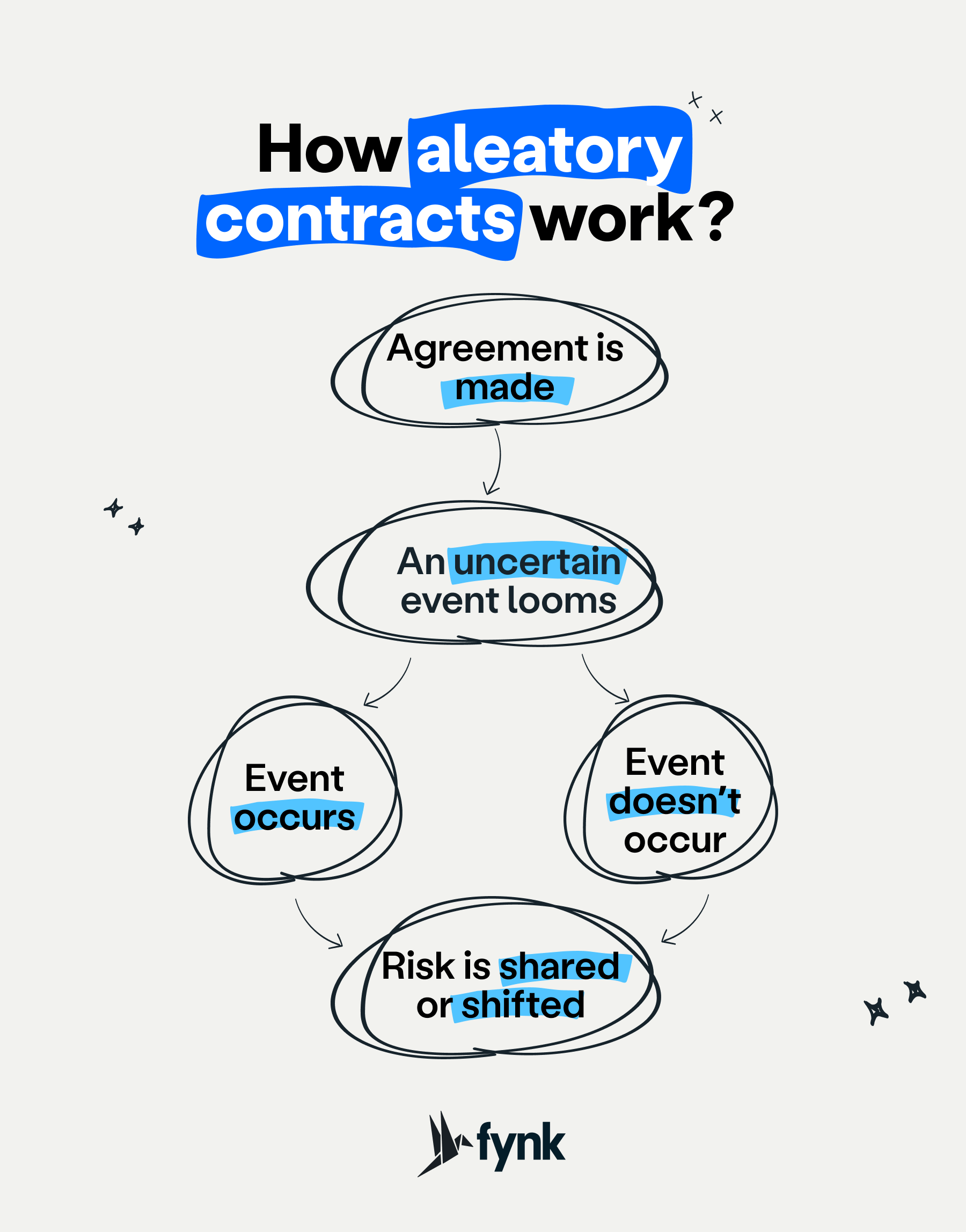

How aleatory contracts work?

Okay, so you get the idea; aleatory contracts hinge on uncertainty. But how do they actually work in practice? Let’s break it down step by step.

- Two parties agree: One promises to pay or perform if something happens. The other pays a premium, fee, or stake upfront.

- An uncertain event hovers in the background: Fire, accident, death, stock crash, jackpot—whatever the contract is built around. Nobody knows if or when it will occur.

- Trigger moment: If the event occurs, the contract “activates.” Obligations kick in—like an insurer paying a claim, or a trader delivering on a derivative.

- No trigger, no payout: If the event doesn’t occur, the other side still keeps the upfront payment (premiums, wagers, etc.).

- Risk is shared or shifted: Either way, the real purpose is risk management. One side gets peace of mind (protection), the other gets compensated for taking on that risk (profit).

How to turn aleatory contracts from risk magnets into opportunities

Aleatory contracts are built on uncertainty. You can’t predict when a trigger event will hit or how big the impact will be, but you can set yourself up to respond quickly and confidently. That’s exactly how a Contract Lifecycle Management (CLM) tool like fynk can help you; here’s how:

fynk tracks and reminds your “what ifs”

Aleatory contracts hinge on triggers such as an accident, a market swing, or a payout clause. Metadata turns those vague “what ifs” into structured data points you can actually track. Dates, thresholds, and values sit in one place, searchable and filterable. Tie that to reminders, and the system nudges you when deadlines or trigger moments approach.

Think about a health insurance policy. It might include a clause that says:

If a claim is not filed within 90 days of treatment, coverage will not apply.

In fynk, “Claim Filing Deadline” becomes a metadata field. You can then:

- Search for all contracts with upcoming deadlines: “Show me all policies with a claim deadline in the next 30 days.”

- Set reminders so the system automatically alerts the claims team and policyholder when the 90-day window is about to expire.

Instead of hidden risks buried in PDFs, you have a living map of conditions that tells you when to act.

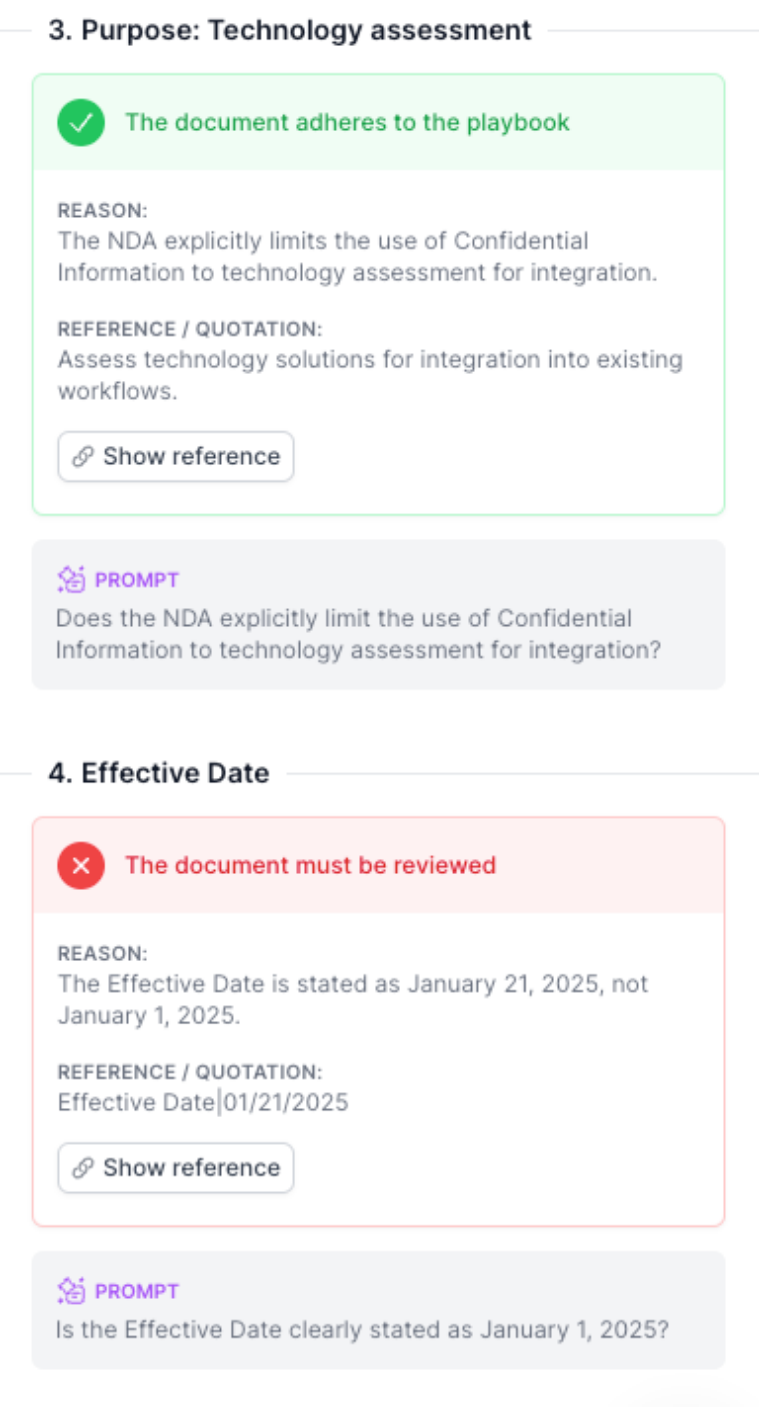

Build playbooks and checkpoints to create guardrails for uncertainty

Uncertainty loves loopholes. fynk closes them by creating clear, repeatable workflows with legal review here, finance approval there, and compliance sign-off before go-time. Checkpoints make sure nothing moves forward until the right eyes have seen it.

Think about a life insurance policy. Before it can be issued, it often needs approval from multiple teams: underwriting, compliance, and finance. In fynk, a playbook sets this sequence automatically, and checkpoints ensure each team signs off before the contract is finalized.

Use automation to respond the moment triggers happen

Through automation, fynk can connect to external systems such as claims databases or market feeds and update contract metadata the instant a trigger is detected.

Take car insurance. Policies are signed with fixed terms such as “Coverage Limit = €50,000” and “Deductible = €500.” Those values are stored in fynk as metadata.

When a claim is filed in the insurer’s system, you can set an automation workflow (Zapier for example) to:

- Trigger event: The external claims system registers a repair cost that exceeds the €500 deductible.

- The automation starts and searches fynk to find the policy for that customer.

- fynk instantly surfaces the key metadata, for example, “Coverage Limit = €50,000, Deductible = €500, Renewal Date = 01/01/2026.”

- An automatic task is created that assigns the case to the claims team, with a clear note that the payout condition is met.

Searching for a contract management solution?

Find out how fynk can help you close deals faster and simplify your eSigning process – request a demo to see it in action.

FAQs about aleatory contracts

- What’s an aleatory contract in insurance?

- In insurance, an aleatory contract is the deal you strike when you pay regular premiums but only get a payout if a specific event happens. Think of it like this: you keep sending money to your insurer, and in return, they promise to step in if your car crashes, your house burns, or your health takes a sudden turn. The catch is that you might never see a payout — and that’s exactly how the system is designed.

- How is an aleatory contract different from a commutative contract?

- A commutative contract is the straightforward, “I pay, you deliver” type of deal. For example, you pay a contractor $10,000 and they build you a deck. The value exchange is clear and roughly equal on both sides. Aleatory contracts, on the other hand, thrive on uncertainty. You might pay for years and get nothing back, or you might get a massive payout after one unlucky event. The balance isn’t obvious until the dice roll.

- What is moral hazard in aleatory contracts?

- Moral hazard happens when one party changes their behavior because they are protected by the contract. In insurance, that could look like a driver being less careful because they know their policy will cover the damage. It is one of the biggest headaches insurers face, which is why they sprinkle exclusions, deductibles, and careful underwriting into every policy.

- Are aleatory contracts legally enforceable?

- Yes, but with a caveat. Courts generally enforce aleatory contracts as long as the agreement is clear, entered into in good faith, and not tied to illegal activities. Insurance, futures trading, and royalty agreements all fall under enforceable categories. Gambling, however, might or might not be enforceable depending on the jurisdiction.

Please keep in mind that none of the content on our blog should be considered legal advice. We understand the complexities and nuances of legal matters, and as much as we strive to ensure our information is accurate and useful, it cannot replace the personalized advice of a qualified legal professional.

Table of contents

Want product news and updates? Sign up for our newsletter.

Other posts in Guides

What is a document audit trail and how it work

When you’re dealing with regulated processes, contracts, or any kind of business documentation, having a clear …

How to extract and manage contract metadata with AI

Contracts contain critical information, but finding it shouldn’t take hours. Instead of manually searching …

SaaS contract management explained for buyers and vendors

If you work in SaaS, you know how quickly contracts can pile up. Each one comes with its own terms, renewals, …

Contracts can be enjoyable. Get started with fynk today.

Companies using fynk's contract management software get work done faster than ever before. Ready to give valuable time back to your team?

Schedule demo