Term Sheet Template (YCombinator)

A Series A term sheet defines the key economic and governance terms for a startup’s first VC funding round.

Drag-along rights are provisions in shareholder agreements that allow majority shareholders to compel minority shareholders to join in the sale of a company, ensuring that potential buyers can acquire 100% ownership. These rights help facilitate smoother transactions by aligning interests and reducing obstacles from minority shareholders who might otherwise block a sale.

Drag Along Rights. McEwen Mining and Rob McEwen to agree not to, directly or indirectly, trigger drag along rights under Shareholder Agreement. Right terminates if Nuton’s ownership % falls below 7.5%

Since we will no longer be a publically reporting company, the liquidity of these Units will be affected. Further, transfers of the Class B Units will be subject to a right of first refusal of the Company and drag along rights. The reclassification of the Common Units who own less than 50 of our Common Units will further change their rights and obligations. As noted above, those reclassified units, the Class C Units and the Class D Units, will have restricted voting rights, will be subject to transfer restrictions and drag along rights. However, the limited liability of all of the units will not change. The Board considers the impacts of the reclassification to be fair to each holder of our Units due to the potential increase in the value of their units from the savings the Company will generate from reduced reporting requirements.

Except as may be required to enforce Section 8.3(B) of ANS's Amended and Restated Operating Agreement effective March 26, 2014, by and among ANS and the ANS Members (the "Operating Agreement") including, without limitation, ANS' s drag along rights therein (the "Drag Along Rights " ): (i) the execution and delivery of this Agreement by ANS does not, and the consummation of the transactions contemplated by this Agreement in accordance with the terms hereof will not, violate any provision of ANS' s organizational documents; (ii) ANS has taken all action required by laws, its articles of organization, operating agreement, certificate of business registration , or otherwise to authorize the execution and delivery of this Agreement; and (iii) ANS has full power, authority, and legal right and has taken or will take all action required by law, its articles of organization, Operating Agreement , and otherwise to consummate the transactions herein contemplated.

Drag-Along Rights. (a) Participation. If at any time Members constituting a Supermajority Member Approval (the “Supermajority Members”) desire to transfer their interests hereunder to a third party (the “Transferee”), the Supermajority Members shall have the right to require each other Member party to this Agreement (“Drag-along Members”) to participate in such transfer to said Transferee in the manner set forth in this Section 3.4. (b) Notice. The Supermajority Members shall exercise their rights pursuant to this Section 3.4 by having a designee selected by them (the “Designee”) delivering a written notice to the Drag-along Members as soon as practicable following the decision to implement the drag-along rights set forth herein, setting forth (i) the consideration to be received by the Drag-along Member, (ii) the identity of the Transferee, (iii) any other items and conditions of the proposed transfer as reasonably determined by the Supermajority Members, and (iv) the date of the proposed transfer with respect to the Drag-along Members. (c) Conditions of Transfer. The consideration to be received by each Drag-along Member shall be the same form and pro-rata amount of consideration to be received by the Supermajority Members. The terms and conditions of the transfer by the Drag-along Members shall be the same as those agreed to by the Supermajority Members. (d) Cooperation. The Drag-along Members shall take all necessary and desirable actions, as requested by the Designee, to consummate the transfer of interests hereunder pursuant to the exercise of the drag-along right set forth in this Section 3.4, including, without limitation, entering into agreements and delivering certificates, assignments and instruments, in each case, consistent with the agreements and assignments being entered into and the certificates being delivered by the Supermajority Members.

Drag-Along Rights. If (i) the Board, (ii) an Investor Majority and (iii) the holders of a majority of the Common Stock (excluding shares of Common Stock issued upon conversion of Preferred Stock) held by the Voting Parties, each approve a Change of Control Transaction, each of the Voting Parties agrees (i) to vote all shares held by such Voting Party in favor of such Change of Control Transaction, and (ii) to sell or exchange all shares of Capital Stock then held by such Voting Party pursuant to the terms and conditions of such Change of Control Transaction, subject to the following conditions: (a) such Voting Party receives with respect to his, her or its Shares of a class or series of Capital Stock consideration per share that is no less than every other Voting Party participating in the transaction with respect to his, her or its Shares of the same class or series of Capital Stock; (b) the proceeds payable to such Voting Party in connection with such transaction are equal to or greater than the proceeds required to be paid to such Voting Party pursuant to Article V(3)(a) of the Restated Certificate; (c) the maximum liability of such Voting Party in connection with such transaction is several and not joint with any other person (except to the extent that funds may be paid out of an escrow established to cover breach of representations, warranties and covenants of the Company as well as breach by any stockholder of any of identical representations, warranties and covenants provided by all stockholders), and is pro rata in proportion to, and does not exceed the consideration payable to such Voting Party in such transaction (other than in the case of potential liability for such Voting Party for fraud or intentional misrepresentation for which liability need not be subject to such limitation); (d) the ratio of such Voting Party’s liability for breaches of representations, warranties, covenants or other obligations of the Company in connection with such Change of Control Transaction of the Company to the total consideration paid to such Voting Party in the Change of Control Transaction of the Company shall not exceed such ratio with respect to any other Voting Party; (e) if any holder of Capital Stock is given an option as to the form and amount of consideration to be received as a result of the Change of Control Transaction, such Voting Party shall have also been given such option; provided, that if the consideration to be paid in exchange for the Shares in such Change of Control Transaction includes any securities and due receipt thereof by any Voting Party would require under applicable law (x) the registration or qualification of such securities or of any person as a broker or dealer or agent with respect to such securities or (y) the provision to any Voting Party of any information other than such information as a prudent issuer would generally furnish in an offering made solely to “accredited investors” as defined in Regulation D promulgated under the Securities Act of 1933, as amended, the Company may cause to be paid to any such Voting Party in lieu thereof, against surrender of the Shares which would have otherwise been sold by such Voting Party, an amount in cash equal to the fair value (as determined in good faith by the Company) of the securities which such Voting Party would otherwise receive as of the date of the issuance of such securities in exchange for the Shares; and (f) the terms of such transaction applicable to such Voting Party are materially no less favorable than the terms applicable to each other Voting Party holding the same class or series of Shares as such Voting Party.

Where the shareholders holding a majority of 75% or more of the total share capital intend to sell the shares, such shareholder may compel the other shareholders to sell all of their shares (ie the remaining 25%) on the same terms as the shareholders exercising the drag along rights.

Drag Along Rights. Right to Sell Corporation. The holder or holders of at least a majority of the outstanding Class A Common Stock and at least a majority of the outstanding Class B Common Stock (together, the "Drag-Along Seller") have the right to seek and approve a Drag-Along Sale of the corporation. If at any time, the Drag-Along Seller receives a bona fide offer from an Independent Purchaser for a Drag-Along Sale, the Drag-Along Seller shall have the right to require that each other shareholder participate in the sale in the manner provided in Article XV, Section l; provided, however, that no shareholder is required to transfer or sell any of its shares if the consideration for the Drag-Along Sale is other than cash or registered securities listed on an established U.S. securities exchange or traded on the NASDAQ National Market. Every shareholder shall promptly deliver to the Board a written notice of any offeror indication of interest for a Drag-Along Sale that it receives from a third party, whether the offeror indication of interest is formal or informal, binding or non-binding, or submitted orally or in writing, and a copy of the offer or indication of interest, if it is in writing. The foregoing written notice must state the name and address of the prospective acquiring party and, if the offer or indication of interest is not in writing, describe the principal terms and conditions of the proposed Drag-Along Sale. Notwithstanding any provision of the Bylaws to the contrary, the provisions of Article XIV (Right of First Refusal) do not apply to any transfers made pursuant to Article XV, Section I.

The Agreement contains market terms on transfer of shares by a shareholder, pre-emptive rights and certain tag along and drag along rights upon a sale of the ADGM Entity.

Drag Along Rights. (a) In the event that the stockholders holding a majority of the outstanding shares of the Company’s Common Stock desire to consummate a “Sale of the Company” (as defined below), then prior to consummation of such Sale of the Company, the stockholder or group of stockholders initiating the Sale of the Company (each a “Drag-Along Seller”) shall deliver written notice (in accordance with Section 4.3(e)) to the other non-initiating stockholders (the “Non-Initiating Drag-Along Sellers”, and together with the Drag-Along Sellers, the “Sellers” and each a “Seller”) notifying such Non-Initiating Drag-Along Sellers that they will be required to participate in such Sale of the Company on the same terms and subject to the same conditions as the Drag-Along Sellers and otherwise comply with the terms of this Section 4.3 (a “Drag-Along Sale”), provided that the consideration received for the Drag-Along Sale (i) must be entirely for cash and/or marketable securities and (ii) must be for a price per share not less than the purchase price per share paid by the Investor under this Agreement (adjusted appropriately in the event of any forward or reverse stock split, stock dividend or recapitalization, reorganization, reclassification, combination, exchange of shares or other similar exchange with respect to the Common Stock, other than pursuant to the Amended and Restated Certificate of Incorporation of the Company) (the “Per Share Purchase Price”). Upon the consummation of the Sale of the Company, each Non-Initiating Drag-Along Seller shall be entitled to receive the same proportion of the aggregate consideration from such Sale of the Company that the Drag-Along Sellers are entitled to receive. (b) A “Sale of the Company” shall mean (i) the sale or transfer, in a single transaction or series of related transactions, of fifty percent (50%) of more of the outstanding Common Stock of the Company, (ii) the sale, lease, transfer, exclusive license or other disposition, in a single transaction or series of related transactions, by the Company of the Company of all or substantially all the assets of the Company taken as a whole, or (iii) the consolidation, merger or reorganization of the Company into any other entity, in which the Company is not the surviving entity or in which the stockholders of the Company existing prior to the transaction hold less than fifty percent (50%) of the outstanding Common Stock of the Company or the surviving corporation, as applicable, immediately following such transaction. (c) In connection with a Sale of the Company, the Non-Initiating Drag- Along Sellers shall cooperate in the execution and consummation of the Sale of the Company, as requested by the Drag-Along Seller(s), including by taking or causing to be taken all such actions as may be reasonably necessary or desirable to expeditiously consummate the Sale of the Company and any related transactions, including: executing, acknowledging and delivering consents, assignments, waivers and other documents or instruments; furnishing information and copies of documents reasonably requested of such Non-Initiating Drag-Along Seller; and otherwise reasonably cooperating with the Company, the Drag-Along Seller(s) and the prospective purchaser (the “Drag-Along Purchaser”). Without limiting the generality of the foregoing, with respect to a proposed Sale of the Company, the Non-Initiating Drag-Along Sellers agree to execute and deliver such agreements, certificates and other documents as may be reasonably requested by the Drag- Along Seller, the Company or the Drag-Along Purchaser, as the case may be, so long as all Sellers to such agreement will be subject to the same terms.

MM’s Drag Along Right. At any time following the earliest to occur of (x) prior to the two year anniversary of the initial closing date (the “Initial Two Year Period”) or a Material Governance Event, if MM and Orgenesis approve a sale of Morgenesis or (y) (i) after the Initial Two Year Period or (ii) after the occurrence of a Material Governance Event, if MM or the Morgenesis Board by Supermajority Vote approves a Sale of Morgenesis (an “Approved Sale”), then, subject to notice, MM or Morgenesis can require the members of Morgenesis to sell their units (the “Drag Along Rights”) to the purchaser in the Approved Sale. Notwithstanding the foregoing, Orgenesis is entitled to advise Morgenesis and the Morgenesis Board of Orgenesis’ election to be a potential acquiror of Morgenesis. Notwithstanding the foregoing, if MM falls below 50% of its initial holdings in Morgenesis as specified above, then it is no longer entitled to exercise the Drag Along Right. Notwithstanding the foregoing, prior to the three-year anniversary of the initial closing date (the “Initial Three Year Period”), MM and Morgenesis will not be entitled to exercise the Drag Along Right unless the valuation of Morgenesis reflected in the sale is equal to or greater than $300,000,000. If Orgenesis breaches its obligation to effectuate an Approved Sale or otherwise the failure of an Approved Sale to be consummated is primarily attributable to Orgenesis or its affiliates, then (i) the Morgenesis Board shall be appointed as follows: (a) one manager shall be appointed by Orgenesis, (b) the Industry Expert Manager shall be appointed by MM and (c) three Managers shall be appointed by MM and (ii) MM will have the option to convert all of its Preferred Units into such number of Common Units (as defined below) that represents (on a post-conversion basis) the Applicable Percentage (as defined in the LLC Agreement) of all of the outstanding Common Units (including any Common Units to be issued to MM pursuant to this provision).

TRANSFER RESTRICTION, RIGHT OF FIRST REFUSAL, COMPANY PURCHASE RIGHTS AND DRAG ALONG RIGHTS. In the event that you propose to sell, pledge or otherwise transfer to a third party any Shares acquired under this Agreement, or any interest in such Shares, such sale, pledge or other transfer as permitted, you shall be subject to the “Transfer Restriction” and the Company shall have a “Right of First Refusal” with respect to such Shares or interest therein, each in accordance with the provisions of the Exercise Notice. In accordance with the Exercise Notice, the Shares you receive on exercise will also be subject to the terms of the “Company Purchase Rights” in the event of your termination of Service and Drag Along Rights upon a sale of the Company.

Drag-along rights are a legal mechanism designed to protect majority shareholders in a company. They allow these shareholders to “drag” minority shareholders into the sale of the company. This ensures that if a majority owner finds a buyer for the company, minority owners cannot block the deal, promoting smoother exit opportunities and potentially higher valuations.

These rights are typically outlined in a company’s shareholder agreement, ensuring that minority shareholders must sell their stakes to a potential buyer if the majority owners wish to proceed with the sale.

Drag-along rights are particularly useful in several scenarios:

Exit Strategy: When planning a future exit strategy, especially in startups and private companies, these rights can facilitate smooth transitions and sales.

Attracting Investors: They are often necessary when seeking venture capital as investors want assurance of liquidity events.

Ensuring Strategic Deals: If a strategic sale is essential, drag-along rights can prevent minority shareholders from obstructing the process.

Simplifying Negotiations: Since buyers typically prefer acquiring 100% of a company to avoid dealing with additional shareholders, these rights simplify negotiations by guaranteeing full acquisition capability.

Writing drag-along rights involves careful legal drafting, usually overseen by legal professionals specializing in corporate law. However, the basic elements to include are:

Trigger Event: Define what constitutes a sale or exit event that activates the drag-along rights.

Threshold Requirement: Specify the percentage of majority shareholders needed to enforce these rights.

Notification Procedure: Detail how and when minority shareholders will be informed about the sale or merger.

Fair Terms: Ensure that minority shareholders are subject to the same financial terms and conditions as majority shareholders in the sale.

Effective Date: Include when these rights become enforceable.

Note: Always consult with an attorney to ensure compliance with relevant laws and regulations, which vary by jurisdiction.

Drag-along rights are generally found in several types of contracts, including:

Shareholders’ Agreements: Among private companies, especially those with multiple investors, to govern the rights and responsibilities of shareholders.

Investment Agreements: Often part of venture capital and angel investment deals, providing clarity on exit strategies.

Articles of Incorporation or Bylaws: Certain companies might include these rights in their foundational documents as a safeguard against future disputes.

Example: In a typical venture capital investment agreement, drag-along rights might state that if 75% of voting shareholders agree to a sale, dissenting shareholders must comply with the sale under the same terms and conditions.

These templates contain the clause you just read about.

A Series A term sheet defines the key economic and governance terms for a startup’s first VC funding round.

Dive deeper into the world of clauses and learn more about these other clauses that are used in real contracts.

A due diligence contingency clause in a contract allows a party, typically the buyer, to thoroughly investigate the property or asset in question before fully committing to the purchase. It provides the buyer with the option to terminate the agreement or renegotiate terms if the findings during the due diligence period are unsatisfactory.

The due diligence period in a contract is a designated timeframe during which the buyer is allowed to thoroughly inspect and evaluate the property or assets involved in the transaction. This period aims to ensure the buyer can identify any potential issues and make informed decisions before finalizing the agreement.

The "Duration of Confidentiality" clause specifies the time period during which parties involved are obligated to maintain the confidentiality of the disclosed information. This period may extend beyond the termination of the agreement, ensuring continued protection of proprietary information for a defined duration or indefinitely.

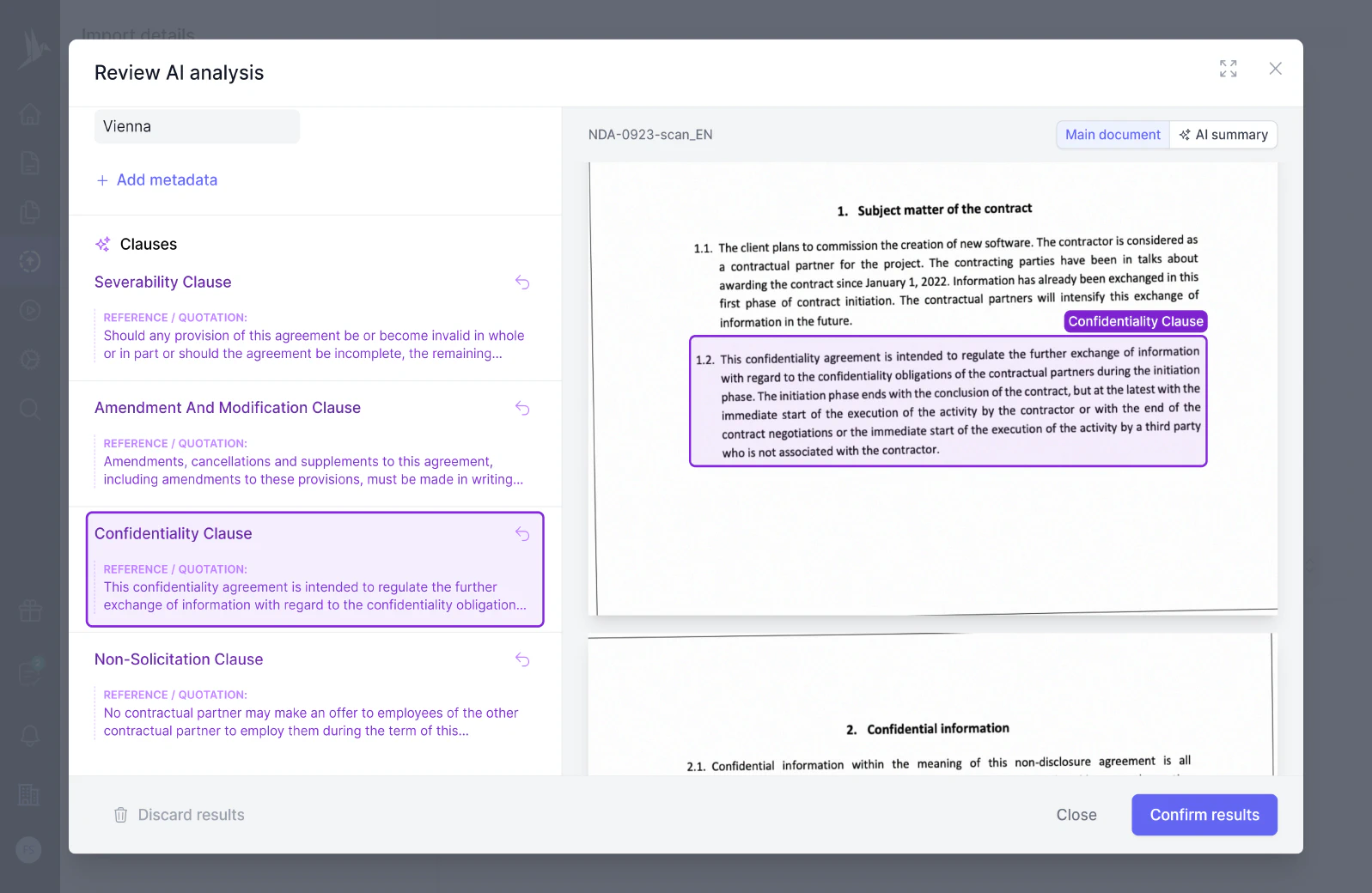

Try our AI contract analysis and extract important clauses and information from existing contracts.

< <

Fill out the form and we will get in touch with you to give you a personal, customized demo of fynk.

Greetings!

I'm Markus, co-founder of fynk. After you've submitted the form, I'll swiftly get in touch with you.

Also, right after you submit your details, you can pick a time that works best for you for our meeting.