Contract Management Mistakes that’ll Fail you in Audits

Finance teams are always under fire. Audits, compliance checks, and investor questions are just a few examples that show the pressure never stops. Regulators are ruthless. If you can’t deliver fast, expect red flags. In this blog post, we’ll cover five big mistakes finance teams make when it comes to contracts and explain how to fix them, so your next audit goes smoothly and even impresses your auditor. Let’s dive in.

TL;DR

Finance audits expose weak contract management fast. If your process is messy, you risk fines, lost revenue, wasted headcount, and reputational hits. The biggest mistakes (and fixes) are:

1. Relying on Excel and email → error-prone, no audit trail.

✅ Fix: Centralize contracts in a system with dashboards and logs.

2. Poor control over auto-renewals → surprise costs when deadlines slip.

✅ Fix: Use automated reminders and alerts to stay ahead of renewal dates.

3. Missing approval/signature trails → weak internal controls, compliance gaps.

✅ Fix: Enforce structured approval workflows and auditable e-signatures.

4. No audit-ready version control → outdated terms, disputes, and audit findings.

✅ Fix: Keep one source of truth with full version history and change logs.

5. Inefficient, manual workflows → slow audit responses, missing data, inconsistent reviews.

✅ Fix: Use AI to extract metadata, generate instant summaries, and run standardized playbooks that keep audits fast and consistent.

What happens in a finance audit?

Audits are stress tests. Auditors pick through your numbers and ask: prove it. The problem is, that proof almost always lives in contracts.

They’ll pull sample deals: customer agreements, vendor contracts, leases, loans. Then they’ll match terms to your books. If you recognized revenue before delivery, that’s a red flag. Deferred revenue under ASC 606/IFRS 15 is a favorite target.

They don’t stop at PDFs. They’ll demand approval and signature logs too. Who signed? Who approved that discount? If you rely on inboxes or handshakes, you’ll sweat. Auditors expect timestamps and audit trails.

It’s not just financial audits. Regulators check GDPR clauses in Data Processing Agreements. Investors want to see customer contracts before funding. If your contracts are scattered, you’ll lose days digging. And that, means risk.

The cost of getting it wrong

Messy contracts burn money. If you underestimate their power, here’s some data that convince you:

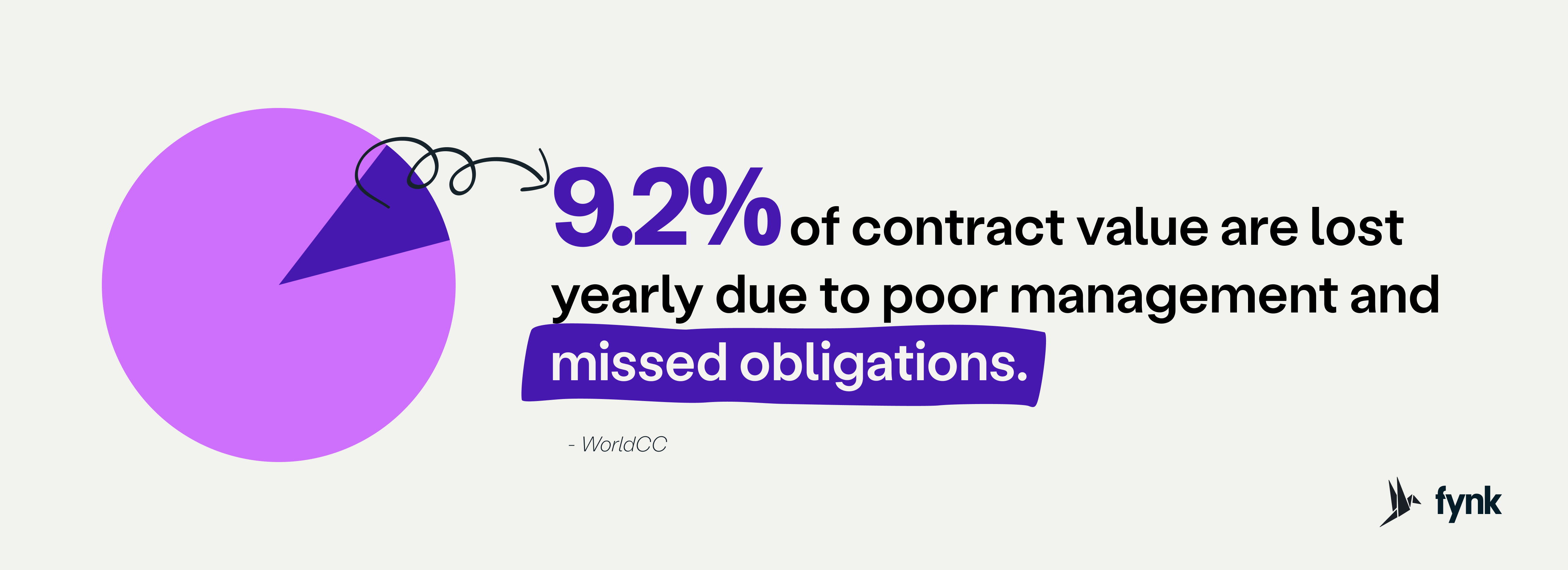

- Companies lose an average 9% of annual revenue to bad contract management. On €1M ARR, that’s €90k down the drain.

- Then there are compliance fines and value leakage. Research by World Commerce & Contracting (WorldCC) shows that organizations lose on average 9.2% of contract value** due to poor management and missed obligations.

- On average cost of processing and reviewing a standard contract is approximately $6,900.

As you can see, the real-world fallout is pretty ugly.

🔦 Legal spotlight: Morgan Stanley, a global bank, was hit with a $60 million fine by the OCC for failing to properly oversee a third-party data deletion contract. The bank had decommissioned some servers and assumed the vendor wiped them, but because they hadn’t tracked the vendor’s contract and performance closely, customer data was left on some devices. The result? Regulatory penalties and seven class-action lawsuits alleging negligence. All from a lapse in contract/vendor management.

And on a smaller scale, countless firms have lost revenue because a renewal was missed or a pricing term not enforced. These costs, deferred or lost revenue, fines, extra headcount, legal disputes, etc., are driven by the common mistakes we’ll explore next.

5 mistakes to avoid for your next audit

Mistake #1: relying on excel and email for contract tracking

Excel and email feel cheap and easy. But they’re traps. Spreadsheets are error factories. Emails bury docs. Neither gives you an audit trail.

In 2012, JP Morgan suffered losses of more than $6 billion in what became known as the “London Whale” incident. The culprit? An overly complex risk model built and managed in Excel.

The model relied on manual copy-paste operations and frequent formula changes, with little quality control or proper oversight. As a result, it significantly underestimated the bank’s exposure, and by the time errors came to light, the damage was done. Regulators later criticized the lack of testing, governance, and monitoring.

The lesson is clear: Excel may work for small tasks, but it’s dangerously unreliable for high-stakes processes like risk and contract management. Even the largest institutions have learned this the hard way.

Even the sharpest eyes are prone to skip a mistake in spreadsheets.

Fix: Dashboards, Not Spreadsheets

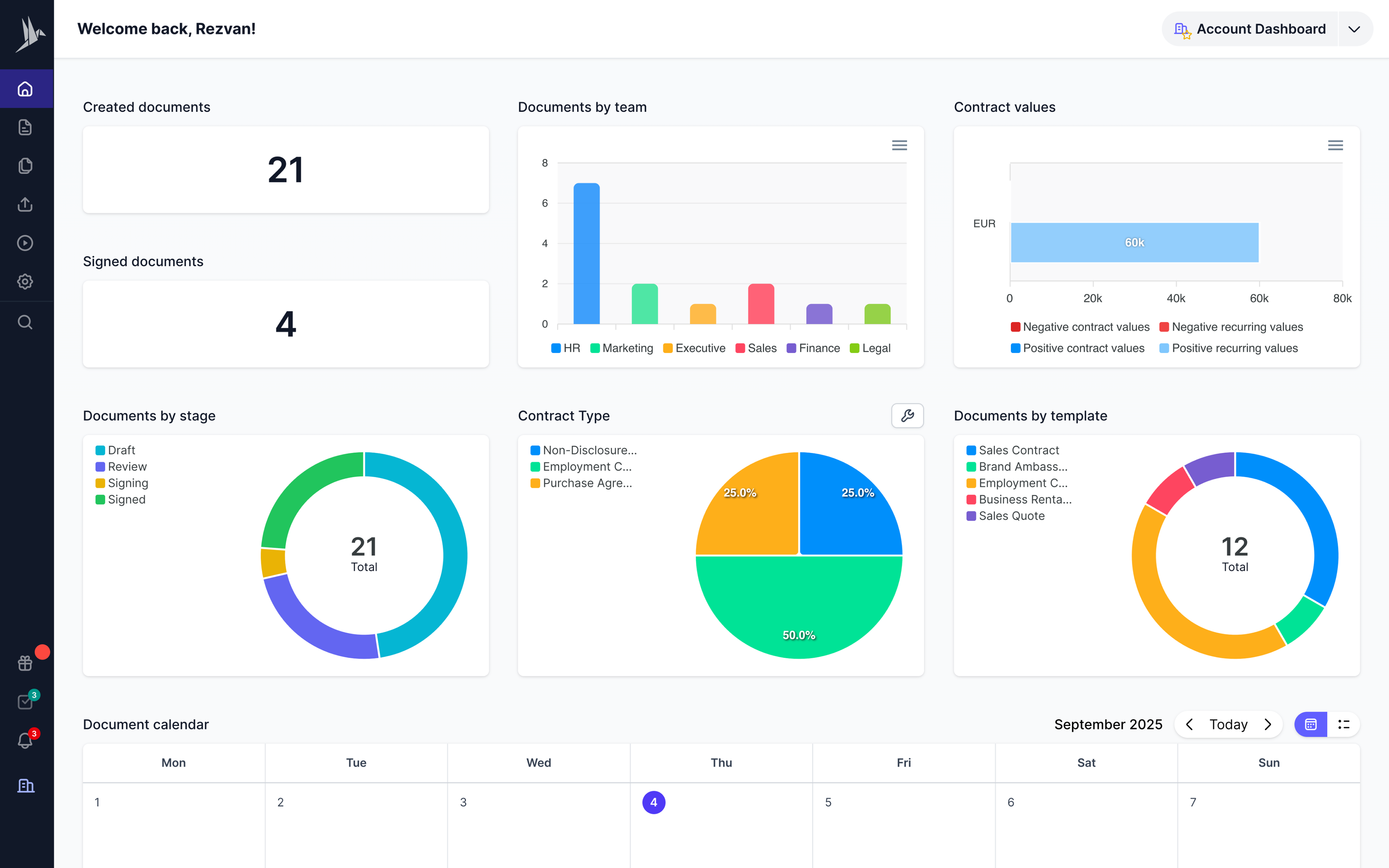

The way out of this first mess is to move into a proper, centralized contract hub. Forget siloed Excel files. A modern contract lifecycle management platform like fynk, gives you a single source of truth for every contract, backed by real-time dashboards and audit trails.

And the transparency is the best thing that you get. Every tweak to contract metadata is logged. Every action, edit, approval, signature, leaves a digital footprint. Contrast that with Excel or email, where you can’t tell who last touched a file or whether the attachment really was final.

In fynk, the dashboard a live window into your contract pipeline. Drill in to see five deals “awaiting signature” or three renewals looming next quarter without scouring your inbox.

fynk Dashboard

Mistake #2: poor control over auto-renewals and terminations

Auto-renewals are silent budget bombs. Miss a window, and you’re stuck. How dangerous and ugly a missed renewal can get?

ABC Capital, a mid-size investment firm, had a contract with a third-party data provider. The deal auto-renewed every June. That data powered their trading algorithms. But ABC had already switched to a cheaper vendor and planned to drop the pricey one. Problem: nobody clearly owned the cancellation. “Someone in IT” was supposed to handle it, but nothing was logged or tracked.

Come July, and Finance got the shock. Result?

- Financial: $200k wasted, since the vendor refused mid-term exits.

- Operational: they’d already migrated to the new system, leaving them paying double or scrambling back.

- Audit: the next audit flagged a 40% jump in “Data Services.” Finance had to admit it was a renewal slip.

And they’re not alone. Other firms have faced outages, delays, and lawsuits from missed renewals.

Treat renewal deadlines like tax deadlines, miss them, and the cost is brutal.

Fix: Smart Notifications

Stop relying on memory and scattered calendar notes.

Auto-renewals need structure. In fynk, notifications & reminders make surprise renewals almost impossible. You set a custom alerts for say, 90, 60, and 30 days before a renewal. They hit inboxes or dashboards for the right people.

The reminders are customizable. A high-value deal can ping a director 90 days out. A smaller one might only need a 30-day nudge. And beyond reminders, dashboards show a calendar that shows the whole upcoming renewal agreements.

The same goes to terminations, deadlines, or any other time-sensitive value that you have in your agreements.

Notifications and Reminders in fynk

The good thing about getting an auto reminder for Finance teams is that it gives you the freedom to ask questions like: Is there a cheaper option? Can we consolidate?

Mistake #3: missing approval and signature trails

Auditors love asking: “Who approved this?” and “Who signed that?”. If your process doesn’t leave a clear trail, you’re asking for trouble. No approval log means you can’t prove the right people signed off. In finance, that means being sloppy and no control over contracts.

This often comes from informal habits. Maybe Sales cut a side deal without Finance. Maybe someone signed off on paper or with a verbal “all good.” During an audit, that sticks out fast. Auditors might pull a contract with a pricing exception and ask: “Show us who approved this.” If all you’ve got is, “Bob said it was fine,” that does not sound good.

Signatures are no different. Under SOX, only authorized people can bind a company. If your system doesn’t track who actually signed, or worse, you’re still using wet signature with no audit trail, proving validity gets messy.

Email chains don’t save you either. If the CFO approved via email but it’s buried in an inbox, that’s not an audit-ready record. What if the email was deleted or someone wasn’t copied? Auditors won’t buy “trust us.” They’ll want proof. Without it, they’ll conclude your process is uncontrolled.

Fix: e-signatures and approval workflows

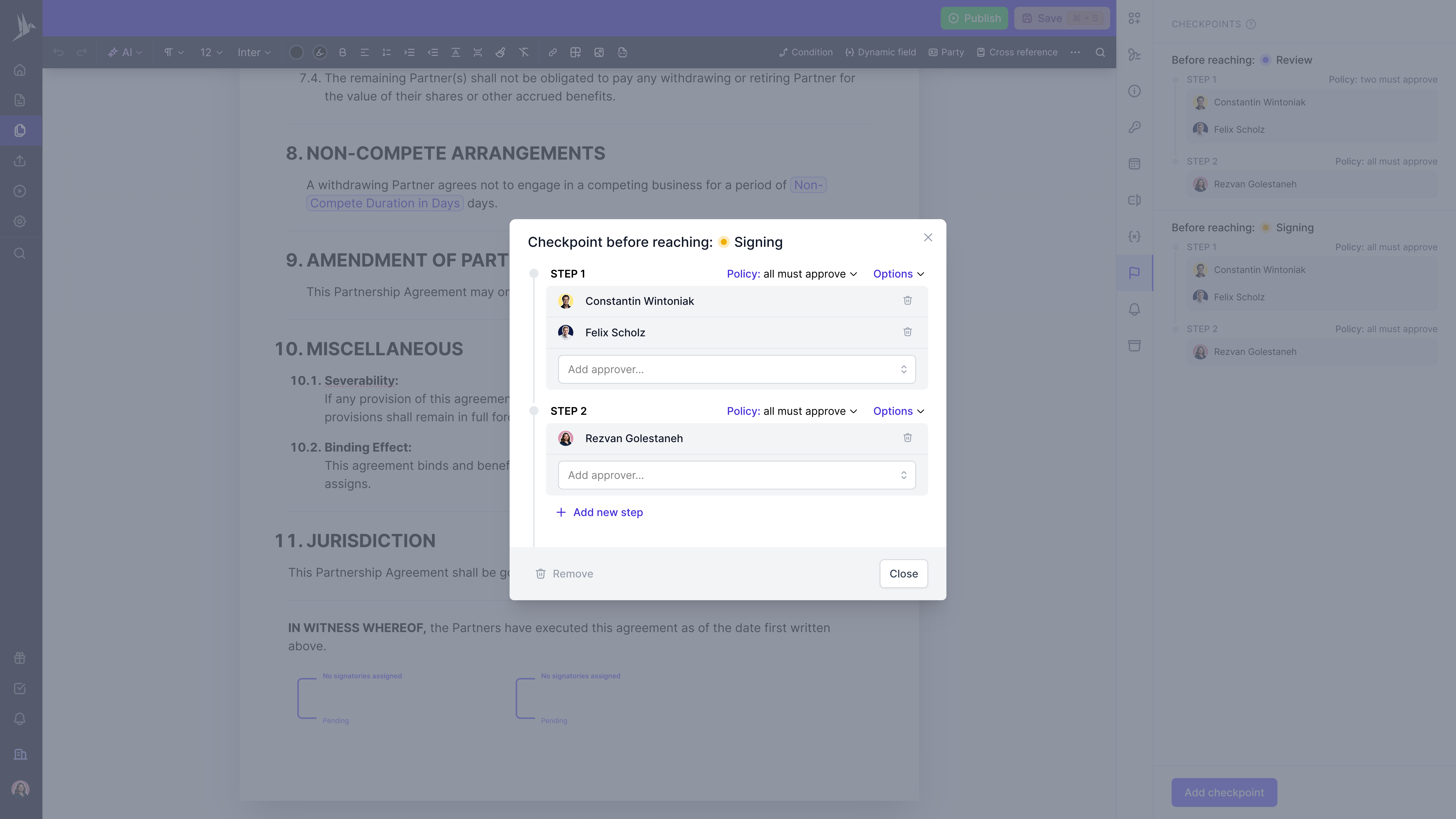

With fynk, every contract runs through Approval Workflows & Checkpoints. Each step is logged with names and timestamps. Signatures? fynk supports SES, AES, QES – eIDAS-compliant with full audit trails. You’ll know exactly who signed, when, and how. Rock solid for auditors and counterparties.

The fix? E-signatures and approval workflows, preferably integrated into your CLM. Thanks to technology, now systems let you select who must approve a contract and even automate the process. They log every decision with name, timestamp, and action.

For signatures, secure e-signatures (SES, AES, QES) create tamper-proof, auditable records that show exactly who signed, when, and how. That’s the kind of evidence auditors and regulators trust.

Approval workflows in fynk

Contracts in fynk could run through Approval Workflows & Checkpoints. Before a contract moves forward, whether for review or signature, you decide who has to approve it, and under what rules. ensuring no deal skips the right reviews. Every step is logged automatically.

Mistake #4: no audit-ready version control

How many “final” versions of a contract do you have? If the answer is “uh… a few,” that’s a version control problem.

Multiple unmanaged drafts cause confusion, compliance gaps, and audit headaches. Without proper versioning, teams may act on different terms or you might not know which version was actually executed. For auditors and lawyers, that’s a flashing red light.

Think about the lifecycle: draft → redline → revision → signature. If this happens over email with filenames like “Contract_v3_FINAL_FINAL.docx,” you’ve got duplicates everywhere and no real history. Then an auditor asks, “Show us how this contract evolved.” Without a system, you’ll scramble to compare Word docs and risk missing something important.

From an audit standpoint, poor version control makes you look unprepared. Questions like, “What changed between last year’s contract and this one?” or “Was this clause added before signature?” become nightmares if you don’t have a chronological record. In court, a missing version trail can even be spun as negligence. And during due diligence, presenting inconsistent contracts to investors or buyers can tank confidence and valuation.

Fix: version history that tells the story

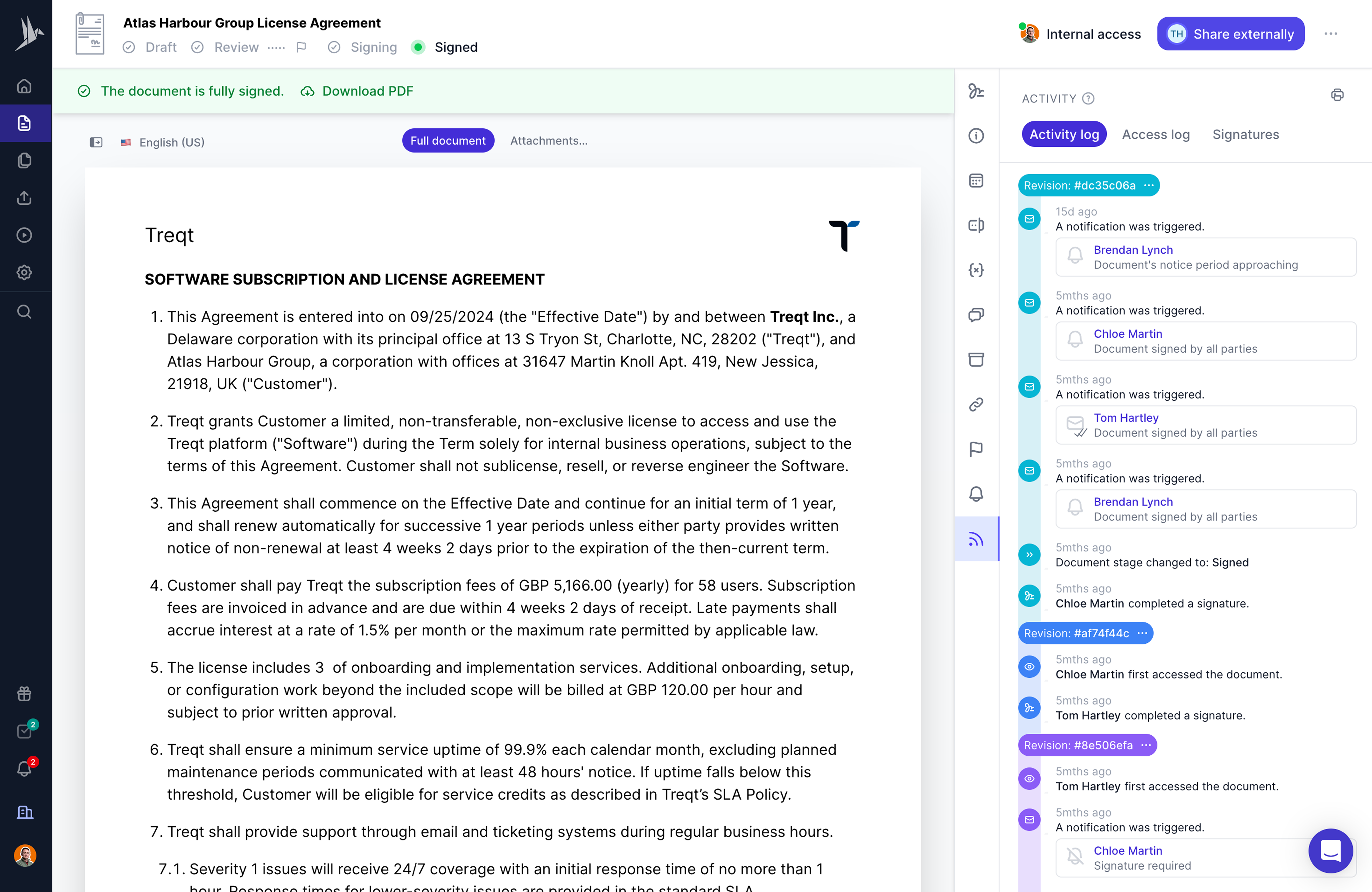

fynk keeps one canonical record per contract. Drafts, edits, and comments stack in one timeline. Every change is logged with user and timestamp. Comparing versions takes one click. Everyone sees the latest. No mix-ups, no disputes.

The fix is simple: every contract needs one source of truth with tracked versions. In a proper CLM, all drafts, edits, and redlines live in a single record.

Activity log in fynk

With fynk, version control is built in. Every change is logged with user, timestamp, and details. You can roll back, compare drafts side-by-side. Everyone always sees the latest version but can access older ones if needed. Comments and negotiations stay attached too, so the “why” behind changes isn’t lost in emails.

Sign

any

Document in Less than

a Minute.

Mistake #5: not making contract work efficient

Finance teams waste huge amounts of time on manual contract work, digging through PDFs, re-checking renewal dates, or manually drafting review notes. That’s bad enough for productivity. But during an audit, inefficiency becomes an actual risk.

Here’s why:

- Missed data: If key metadata (dates, values, clauses) isn’t captured properly, auditors won’t find what they need. That gets flagged as incomplete records.

- Slow responses: Audits run on tight timelines. If your team spends days searching inboxes and folders, auditors will see weak internal controls.

- Human error: Manual reviews mean higher odds of missing a clause or misclassifying a contract, gaps that pop up in audit findings.

- Inconsistency: Without standardized checks, every reviewer works differently. Auditors call that lack of control.

In other words, inefficiency undermines your audit readiness.

Fix: let AI do the heavy lifting

The fix? Use AI to handle the repetitive, error-prone tasks so your team stays fast and consistent when the auditors come calling.

Modern CLM systems life fynk use AI to:

- Auto-extract metadata from any contract, even messy old PDFs. This makes every agreement searchable and audit-ready.

- Generate instant summaries so finance and legal can pull key facts without combing through 30 pages.

- Run AI-powered playbooks that apply the same checks to every contract, ensuring consistency across the board.

fynk AI analysis

Turn contracts into an edge

Audits don’t have to be nightmares. Solid contract management flips the script. You’ll:

- Recognize revenue faster.

- Avoid surprise costs and fines.

- Keep cash flow tight.

- Free your team from contract chaos.

Want visibility, reminders, approvals, versioning – all-in-one, fast to set up, no hidden fees? With fynk, you’ll stay sharp and in control. That’s peace of mind for finance teams. The next audit? Just another day. Maybe even a flex.

Searching for a contract management solution?

Find out how fynk can help you close deals faster and simplify your eSigning process – request a demo to see it in action.

Please keep in mind that none of the content on our blog should be considered legal advice. We understand the complexities and nuances of legal matters, and as much as we strive to ensure our information is accurate and useful, it cannot replace the personalized advice of a qualified legal professional.

Table of contents

Want product news and updates? Sign up for our newsletter.

Other posts in Contracts

What is contract metadata and how it works

Contract metadata is the structured information that describes a contract, like dates, parties, values, …

How to extract and manage contract metadata with AI

Contracts contain critical information, but finding it shouldn’t take hours. Instead of manually searching …

How to create an automated document approval workflow?

An automated document approval workflow helps your team move faster, stay organized, and avoid the delays and …

Other posts in Guides

What is a document audit trail and how it work

When you’re dealing with regulated processes, contracts, or any kind of business documentation, having a clear …

How to extract and manage contract metadata with AI

Contracts contain critical information, but finding it shouldn’t take hours. Instead of manually searching …

SaaS contract management explained for buyers and vendors

If you work in SaaS, you know how quickly contracts can pile up. Each one comes with its own terms, renewals, …

Contracts can be enjoyable. Get started with fynk today.

Companies using fynk's contract management software get work done faster than ever before. Ready to give valuable time back to your team?

Schedule demo