Payment Agreement

(Working Capital Note Settlement Agreement)

This Payment Agreement (this “Agreement”) is made as of , by and among (the “Company”) and (“Sponsor”). Together, the parties to this Agreement will be referred to herein as the “Parties” and each a “Party.”

WHEREAS, on and , the Company issued unsecured promissory notes (the “Working Capital Notes”) in the aggregate principal amounts of and , respectively, to Sponsor in consideration for loans from the Sponsor to fund the Company’s working capital requirements until ;

WHEREAS, the Working Capital Notes bear no interest and are repayable in cash upon the consummation of the Company’s initial business combination (the “Business Combination”); and

WHEREAS, the Parties desire to amend the terms of the Working Capital Notes to set forth the amounts of the fees to be paid by the Company to Sponsor and the form of such payment on the terms set forth herein.

NOW, THEREFORE, in consideration of the promises and the covenants contained herein and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties agree as follows:

Payment Amount.

The Company agrees to pay and Sponsor agrees to accept the total sum of (the “Payment Amount”) as payment of the fees and reimbursable expenses incurred to the date hereof due and owing to Sponsor pursuant to the terms of the Working Capital Notes.

Payment Method.

The Parties agree that the Payment Amount will be paid at the closing of the Business Combination (the “Closing”) by the delivery of the Company to Sponsor or its assignee of shares of common stock of the Company (the “Payment Shares”).

Representations.

Each Party represents and warrants to the other Party that

the execution, delivery and performance by such Party of this Agreement is within the powers of such Party and have been duly authorized by all necessary action on the part of such Party,

this Agreement has been duly executed and delivered by such Party and constitutes a valid and binding obligation of such Party,

it is not relying upon any statements, understandings, representations, expectations or agreements other than those expressly set forth in this Agreement,

it has had the opportunity to be represented and advised by legal counsel in connection with this Agreement, which it enters into voluntarily and of its own choice and not under coercion or duress, and

it has made its own investigation of the facts and is relying upon its own knowledge and/or the advice of its counsel.

Payment Schedule.

The Company shall pay the Payment Amount to Sponsor in accordance with the schedule set forth in Exhibit A attached hereto. The Parties agree that the Payment Amount shall be paid in full at the Closing of the Business Combination by delivery of the Payment Shares. Upon such payment, all obligations of the Company to Sponsor under the Working Capital Notes shall be deemed fully satisfied and extinguished.

Additional Representations, Warranties and Covenants of Sponsor.

Sponsor hereby represents, warrants and covenants to the Company as follows:

Organization.

Sponsor is an entity duly organized, validly existing and in good standing under the laws of with the requisite corporate power and authority to enter into and to consummate the transactions contemplated herein and under the other agreements being entered into pursuant to this Agreement and otherwise to carry out its obligations hereunder and thereunder.

No Public Sale or Distribution.

Sponsor is (i) acquiring the Payment Shares for its own account and not with a view towards, or for resale in connection with, the public sale or distribution thereof, except pursuant to sales registered under the or under an exemption from such registration and in compliance with applicable federal and state securities laws, and Sponsor does not have a present arrangement to effect any distribution of the Payment Shares to or through any person or entity; provided, however, that by making the representations herein, Sponsor does not agree to hold any of the Payment Shares for any minimum or other specific term and reserves the right to dispose of the Payment Shares at any time in accordance with or pursuant to a registration statement or an exemption under the and pursuant to the applicable terms of this Agreement and the other agreements being entered into hereunder.

Accredited Investor Status.

Sponsor is an “accredited investor” as defined in Rule 501(a) under the .

Experience of Sponsor.

Sponsor, either alone or together with its representatives has such knowledge, sophistication and experience in business and financial matters so as to be capable of evaluating the merits and risks of the prospective issuance and acceptance of the Payment Shares as provided for under this Agreement, and has so evaluated the merits and risks of such issuance. Sponsor understands that it must bear the economic risk of this investment in the Payment Shares indefinitely, and Sponsor is able to bear such risk and is able to afford a complete loss of such investment.

Access to Information.

Sponsor acknowledges that it has reviewed the reports, schedules, forms, statements and other documents required to be filed by the Company under , as amended, and the , as amended, including pursuant to Section 4., (the “Disclosure Materials”) and has been afforded: (i) the opportunity to ask such questions as it has deemed necessary of, and to receive answers from, the Company and its representatives concerning the terms and conditions of the issuance of the Payment Shares and the merits and risks of accepting the Payment Shares as consideration for services rendered; (ii) access to information about the Company and its subsidiaries and its and their respective financial condition, results of operations, business, properties, management and prospects sufficient to enable it to evaluate its decision to receive the Payment Shares as consideration for services rendered; and (iii) the opportunity to obtain such additional information that the Company possesses or can acquire without unreasonable effort or expense that is necessary to make an informed investment decision with respect to the Payment Shares. Neither such inquiries nor any other investigation conducted by or on behalf of Sponsor or its representatives or counsel shall modify, amend or affect Sponsor’s right to rely on the truth, accuracy and completeness of the Disclosure Materials.

General Solicitation.

Sponsor is not acquiring the Payment Shares as a result of any advertisement, article, notice or other communication regarding the Payment Shares published in any newspaper, magazine or similar media, broadcast over television or radio, disseminated over the Internet or presented at any seminar or, to its knowledge, any other general solicitation or general advertisement.

No Governmental Review.

Sponsor understands that no United States federal or state agency or any other government or governmental agency has passed on or made any recommendation or endorsement of the Payment Shares or the fairness or suitability of the investment in the Payment Shares nor have such authorities passed upon or endorsed the merits of the offering of the Payment Shares.

Restricted Securities.

Sponsor understands that the Payment Shares are characterized as “restricted securities” under the U.S. federal securities laws inasmuch as they are being acquired from the Company in a transaction not involving a public offering and that under such laws and applicable regulations such securities may be resold without registration under the only in certain limited circumstances.

Legends.

Sponsor understands that, except as otherwise provided in Section (3.ii), certificates evidencing such Payment Shares shall bear the legends set forth in Section (3.ii).

No Legal, Tax or Investment Advice.

Sponsor understands that nothing in this Agreement or any other materials presented by or on behalf of the Company to Sponsor in connection with the issuance of the Payment Shares constitutes legal, tax or investment advice. Sponsor has consulted such legal, tax and investment advisors as it, in its sole discretion, has deemed necessary or appropriate in connection with its receipt of the Payment Shares.

Additional Representations, Warranties and Covenants of the Company.

The Company hereby represents, warrants and covenants to Sponsor as follows:

As of the Closing, the Payment Shares will be duly authorized and, when issued and delivered to Sponsor in accordance with the terms of this Agreement, the Payment Shares will be validly issued, fully paid and non-assessable and will not have been issued in violation of or subject to any preemptive or similar rights created under the Company’s certificate of incorporation (as amended to the date of the Closing) or under the .

The execution and delivery of this Agreement, the issuance of the Payment Shares and the compliance by the Company with all of the provisions of this Agreement and the consummation of the transactions contemplated herein will not conflict with or result in a breach or violation of any of the terms or provisions of, or constitute a default under, or result in the creation or imposition of any lien, charge or encumbrance upon any of the property or assets of the Company pursuant to the terms of (i) any indenture, mortgage, deed of trust, loan agreement, lease, license or other agreement or instrument to which the Company is a party or by which the Company is bound or to which any of the property or assets of the Company is subject, (ii) the organizational documents of the Company, or (iii) any statute or any judgment, order, rule or regulation of any court or governmental agency or body, domestic or foreign, having jurisdiction over the Company or any of its properties that, in each case of clauses (i) and (iii), would reasonably be expected to have a material adverse effect on the Company’s ability to consummate the transactions contemplated hereby, including the issuance and sale of the Payment Shares.

Assuming the accuracy of the representations and warranties of Sponsor set forth herein, the Company is not required to obtain any consent, waiver, authorization or order of, give any notice to, or make any filing or registration with, any court or other federal, state, local or other governmental authority, self-regulatory organization or other person in connection with the issuance of the Payment Shares pursuant to this Agreement, other than (i) filings with the and (ii) filings required by applicable state securities laws.

As of their respective dates, all reports required to be filed by the Company with the (the “ Reports”) complied in all material respects with the applicable requirements of the and the, as amended, and the rules and regulations of the promulgated thereunder, and none of the Reports, when filed, contained any untrue statement of a material fact or omitted to state a material fact required to be stated therein or necessary in order to make the statements therein, in the light of the circumstances under which they were made, not misleading. The financial statements of the Company included in the Reports comply in all material respects with applicable accounting requirements and the rules and regulations of the with respect thereto as in effect at the time of filing and fairly present in all material respects the financial position of the Company as of and for the dates thereof and the results of operations and cash flows for the periods then ended, subject, in the case of unaudited statements, to normal, year-end audit adjustments.

As of the date hereof, the issued and outstanding shares of the Company are registered pursuant to Section of the , and are listed for trading on under the symbol (it being understood that the trading symbol and the national securities exchange will be changed in connection with the Business Combination). There is no suit, action, proceeding or investigation pending or, to the knowledge of the Company, threatened against the Company by or the , respectively, to prohibit or terminate the listing of the Company’s Shares on the or to deregister the Shares under the . The Company has taken no action that is designed to terminate the registration of the Shares under the .

Assuming the accuracy of Sponsor’s representations and warranties set forth in Section 5. of this Agreement, no registration under the is required for the offer and sale of the Payment Shares by the Company to Sponsor.

Neither the Company nor any person acting on its behalf has engaged or will engage in any form of general solicitation or general advertising (within the meaning of Regulation D) in violation of the in connection with any offer or sale of the Payment Shares.

No broker or finder is entitled to any brokerage or finder’s fee or commission from the Company solely in connection with the issuance of the Payment Shares to Sponsor.

As of the date hereof, except for such matters as have not had a material adverse effect on the Company, the Company is in compliance with all state and federal laws applicable to the conduct of its business. The Company has not received any written, or to its knowledge, other communication from a governmental entity that alleges that the Company is not in compliance with or is in default or violation of any applicable law, except where such non-compliance, default or violation would not be reasonably likely to have, individually or in the aggregate, a material adverse effect on the Company. Except for such matters as have not had and would not be reasonably likely to have, individually or in the aggregate, a material adverse effect on the Company, as of the date hereof there is no (i) action, lawsuit, claim or other proceeding, in each case by or before any governmental authority pending, or, to the knowledge of the Company, threatened against the Company or (ii) judgment, decree, injunction, ruling or order of any governmental entity or arbitrator outstanding against the Company.

Governing Law.

This Agreement shall be governed by and construed in accordance with the laws of the , exclusive of the choice-of-law principles thereof.

Exclusive Jurisdiction.

The Parties agree that any dispute, claim or controversy directly or indirectly relating to or arising out of this Agreement shall be commenced in the located in the or in the , which courts shall have exclusive jurisdiction over the adjudication of such matters and shall decide the merits of each claim on the basis of the internal laws of the without regard to principles of conflicts of law. The Parties agree and consent to personal jurisdiction, service of process and venue of such courts, waive all right to trial by jury for any claim and agree not to assert the defense of forum non conveniens. The Parties also agree that service of process may be effected through next-day delivery using a nationally-recognized overnight courier or personally delivered to the Parties. The Parties further agree that a final non-appealable judgment in respect of any claim brought in any such court shall be binding and may be enforced in any other court having jurisdiction over the party against whom the judgment is sought to be enforced.

Waiver of Jury Trial.

Each party to this payment agreement hereby irrevocably waives all rights to a trial by jury in any action brought to resolve any dispute between or among the parties, whether arising in contract, tort, or otherwise, that arises out of, relates to, is connected with, or is incidental to this payment agreement, the transactions contemplated by this payment agreement, and/or the relationships established among the parties under this payment agreement.

The parties further represent and warrant that each has reviewed this waiver with its legal counsel and that each knowingly and voluntarily waives its right to a jury trial following consultation with legal counsel.

Entire Agreement.

This Agreement reflects the complete understanding of the Parties and may not be amended orally.

Interpretation.

The Parties acknowledge that this Agreement represents the combined efforts of negotiation and drafting of the Parties and their attorneys and that any ambiguity shall not be construed against any Party.

Counterparts.

.This Agreement may be executed in two or more counterparts, including by email or facsimile, each of which shall be deemed an original, but all of which together shall constitute one and the same agreement.

No Modification.

This Agreement shall not be modified or amended in any way except by a writing signed by all Parties hereto.

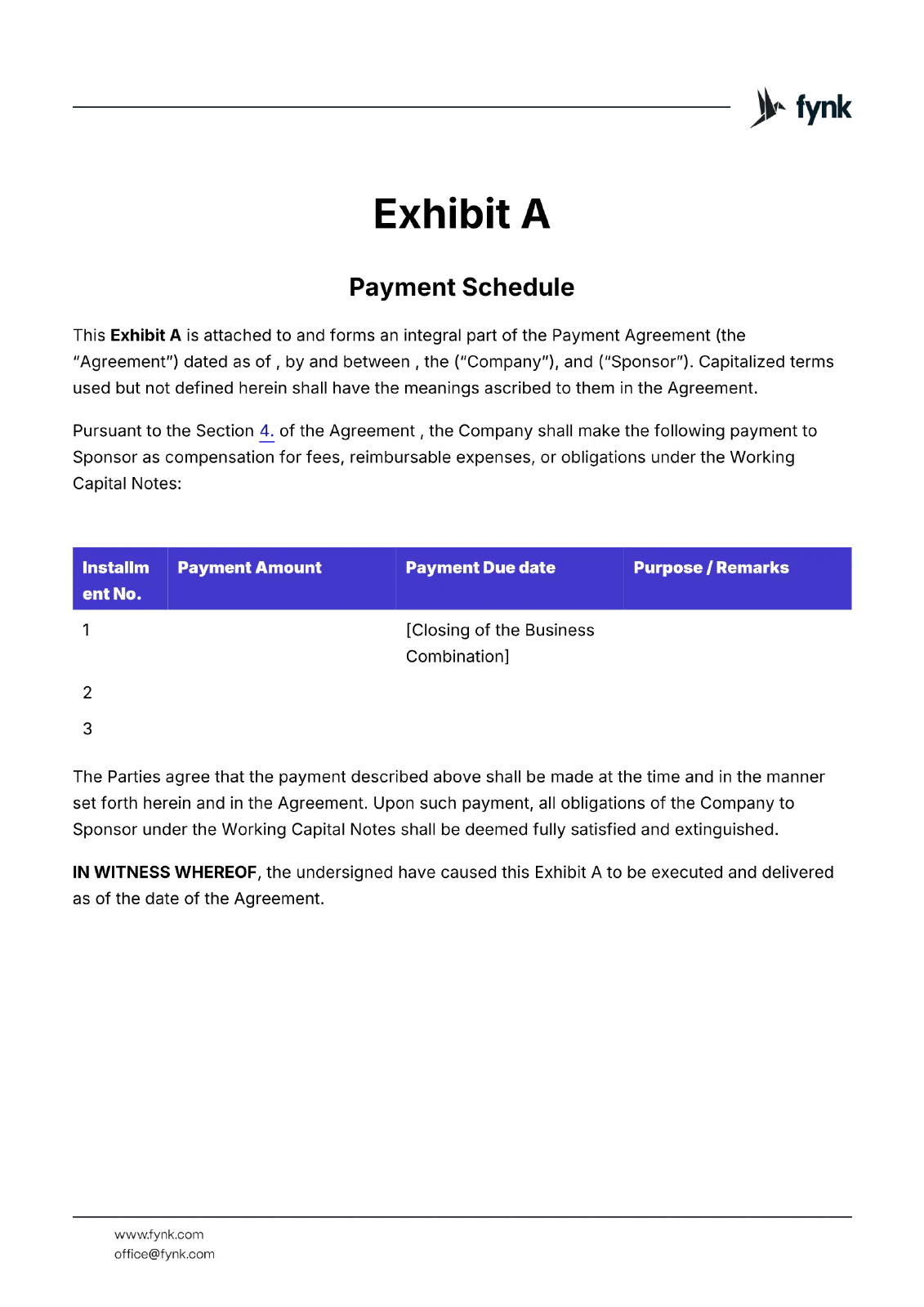

Exhibit A

Payment Schedule

This Exhibit A is attached to and forms an integral part of the Payment Agreement (the “Agreement”) dated as of , by and between , the (“Company”), and (“Sponsor”). Capitalized terms used but not defined herein shall have the meanings ascribed to them in the Agreement.

Pursuant to the Section 4. of the Agreement , the Company shall make the following payment to Sponsor as compensation for fees, reimbursable expenses, or obligations under the Working Capital Notes:

Installment No. | Payment Amount | Payment Due date | Purpose / Remarks |

|---|---|---|---|

1 | [Closing of the Business Combination] | ||

2 | |||

3 |

The Parties agree that the payment described above shall be made at the time and in the manner set forth herein and in the Agreement. Upon such payment, all obligations of the Company to Sponsor under the Working Capital Notes shall be deemed fully satisfied and extinguished.

IN WITNESS WHEREOF, the undersigned have caused this Exhibit A to be executed and delivered as of the date of the Agreement.