Certificate of Trust

A Certificate of Trust is a legal document that verifies the existence of a trust and outlines essential details, allowing parties to engage with the trust without reviewing the entire trust agreement.

What is a Certificate of Trust?

A Certificate of Trust is a legal document used to verify the existence of a trust and provide key information about it without revealing the entire trust agreement. This document is often used in real estate, banking, or financial transactions to confirm a trustee’s authority without the need for disclosing private or sensitive details contained in the full trust document.

Key Information in a Certificate of Trust

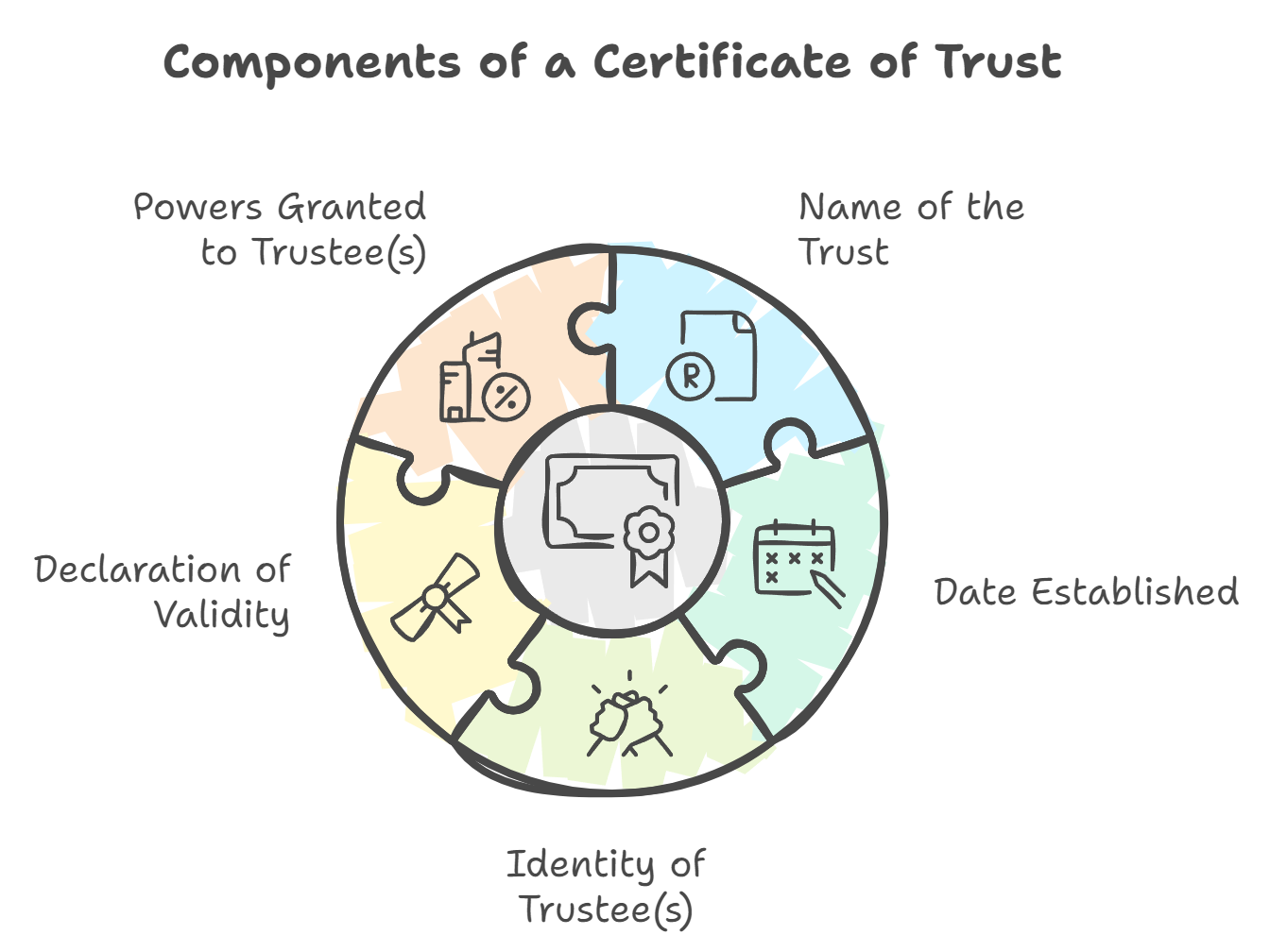

A typical Certificate of Trust includes:

- The name of the trust

- The date the trust was established

- The identity of the trustee(s)

- A declaration that the trust is valid and in effect

- A description of the powers granted to the trustee(s)

The key components of a Certificate of Trust.

Crucially, the Certificate of Trust does not disclose the trust’s assets, beneficiaries, or the terms of the trust, which helps maintain privacy.

Common Uses of a Certificate of Trust

A Certificate of Trust is often used in transactions that involve the trust, particularly:

- Real Estate Transactions: When a trust is buying or selling property, a Certificate of Trust may be required by the title company or lender to verify the trustee’s authority.

- Banking and Financial Institutions: Banks or financial firms may request a Certificate of Trust to confirm that a trustee is authorized to manage or access accounts on behalf of the trust.

- Legal Proceedings: It can also be used in legal contexts to demonstrate the trust’s existence without disclosing private information.

Benefits of Using a Certificate of Trust

- Privacy: The primary advantage of a Certificate of Trust is that it allows trust details to remain confidential. It only shares information that is essential to a transaction or legal requirement.

- Simplicity: Rather than providing the full trust document, which may be lengthy and contain sensitive information, the certificate streamlines the process, reducing the risk of unnecessary disclosure.

- Efficiency: It helps speed up transactions, as it avoids the need for detailed trust documents to be reviewed by all parties involved.

Legal Context

The use of Certificates of Trust may vary by jurisdiction, but they are widely recognized in the United States and are commonly used in estate planning and trust administration. Local laws may dictate specific requirements, such as whether the document must be notarized or the level of detail it must include.

Related Terms

- Trust Agreement: The full legal document that outlines the terms, conditions, and details of a trust.

- Trustee: The individual or entity responsible for managing the trust according to its terms.

- Settlor/Trustor: The person who creates the trust and transfers assets into it.

Contracts can be enjoyable. Get started with fynk today.

Companies using fynk's contract management software get work done faster than ever before. Ready to give valuable time back to your team?

Schedule demo