Confidentiality and Exclusivity Agreement (M&A) Template

A purpose-built NDA and exclusivity template for life sciences transactions, covering evaluation material, non-disclosure, standstill, and return-or-destroy

A standstill provision is a contractual clause that restricts one party from making certain actions, such as purchasing additional shares or launching takeover bids, for a specified period. This clause is often used in merger and acquisition agreements to maintain the status quo while negotiations or due diligence are ongoing.

On March 29, 2023 the Company and Dragoneer Adviser entered into a non-disclosure agreement (the “Non-Disclosure Agreement”) pursuant to which Dragoneer Adviser agreed to keep confidential any non-public information that may be received by Dragoneer Adviser or its affiliates in connection with the non-binding going private proposal reported in the Form 6-K filed by the Company with the Securities and Exchange Commission on January 26, 2023 (such information, the “Non-Public Information”). The Non-Disclosure Agreement will terminate on the earlier of the two year anniversary of the Non-Disclosure Agreement or the consummation of a transaction by the parties or their affiliates. The Non-Disclosure Agreement includes a standstill provision (the “Standstill Provision”) that lasts for 230 days from the date of the Non-Disclosure Agreement (the “Standstill Period”). The Standstill Provision provides, among other things and subject to certain exceptions, that during the Standstill Period, unless specifically invited in writing by the Company, Dragoneer Adviser and its affiliates who receive Non-Public Information are restricted from, (i) acquiring or obtaining any economic interest in, any right to direct the voting or disposition of, or any other right with respect to, any equity securities of the Company or rights to acquire any equity securities of the Company, (ii) effecting or seeking, proposing or offering (whether publicly or otherwise and whether or not subject to conditions) to effect, or publicly announcing any intention to effect or cause or participate in (a) any unsolicited tender or exchange offer for the acquisition of all or substantially all of the assets of the Company or any of its affiliates or (b) any solicitation of proxies to vote with respect to the voting securities of the Company in the election of directors of the Company, (iii) forming or joining a “group” within the meaning of Section 13(d)(3) of the Exchange Act except with Oto Brasil de Sá Cavalcante Neto and Ari de Sá Cavalcante Neto (together with Oto Brasil de Sá Cavalcante Neto, the “Founders”) and General Atlantic L.P., (iv) seeking to change control of, or representation on, the board of directors of the Company, (v) taking any action that would require the Company to make a public announcement regarding any of the matters set forth in the Standstill Provision, or (vi) enter into any discussions, arrangements, contracts or understandings with any third party providing for any of matters restricted in the Standstill Provision with persons other than the Founders and General Atlantic L.P. In addition, during the Standstill Period, Dragoneer Adviser may not request, or solicit or induce another person to request, that Dragoneer Adviser or any of its representatives, directly or indirectly, to amend or waive the Standstill Provision if any such request, solicitation or inducement would reasonably be expected to require the Company to make a public announcement regarding any of the matters set forth in the Standstill Provision. Dragoneer Adviser is not prohibited from making a private indication of interest regarding an acquisition to the Company for consideration by the board of directors and the special committee of the Company, provided that any such indication would not reasonably be expected to require the making of a public announcement thereof and would not require public disclosure of Non-Public Information. The Standstill Provision does not restrict dispositions of securities of the Company.

On February 27, 2020, the Company and Party B executed a non-disclosure agreement that included a reciprocal “standstill” provision and a provision prohibiting either party from publicly requesting or proposing any waiver or amendment of the standstill provision. The Company subsequently opened a virtual data room populated with, among other information, selected organizational, financial and property due diligence information relating to the Company, its business and its assets. Upon gaining access to the virtual data room, representatives of Party B and its financial advisors commenced their due diligence investigation of the Company.

The standstill provision restricts Party E’s ability to request or propose that the Company amend or waive any of the terms of the standstill provision. The standstill provision did not terminate upon the Company’s execution of the merger agreement.

On May 2, 2020 GASF and the Company entered into a customary non-disclosure agreement (the “Non-Disclosure Agreement”) regarding any non-public information that may be received by GASF or its affiliates in connection with the Proposed Transaction. The Non-Disclosure Agreement includes a standstill provision (the “Standstill Provision”) that lasts for 15 months from the date of the Non-Disclosure Agreement (the “Standstill Period”). The Standstill Provision provides, among other things, that during the Standstill Period, GASF and its affiliates shall require the prior written consent of the special committee of the board of directors of the Company that has been established to review, evaluate and negotiate the terms and conditions of the Proposed Transaction (the “Special Committee”) to: (i) acquire, offer to acquire, or agree to acquire, directly or indirectly, by purchase or otherwise, any beneficial ownership, or direct or indirect rights to acquire any beneficial ownership in more than 3% of the voting securities of the Company or any of its subsidiaries; (ii) make any public announcement with respect to, or submit a proposal for or offer of (with or without conditions), any tender or exchange offer, merger, recapitalization, reorganization, business combination or other extraordinary transaction involving the Company or any of its subsidiaries; (iii) seek or propose to influence or control the management or policies of the Company, make or in any way participate, directly or indirectly, in any “solicitation” of “proxies” (as such terms are used in the rules of the Securities and Exchange Commission) to vote any voting securities of the Company or any of its subsidiaries, or seek to advise or influence any person with respect to the voting of any voting securities of the Company or any of its subsidiaries; (iv) enter into any arrangements or understandings with any third party (other than consortium members approved by the Special Committee) with respect to any of the foregoing, or otherwise form, join or in any way engage in discussions with any third party (other than consortium members approved by the Special Committee) relating to the formation of, or participate in, a “group” within the meaning of Section 13(d)(3) of the Exchange Act, in connection with any of the foregoing; (v) take any action which may require the Company to make a public announcement regarding the possibility of a business combination or merger; or (vi) publicly request the Company or any of its representatives, directly or indirectly, to amend or waive any provision of, or take any action challenging the enforceability or validity of, the Standstill Provision. The Standstill Provision becomes inoperative, and the Standstill Period ends: (A) if any person or group acquires or enters into a binding definitive agreement approved by the board of directors of the Company (or any duly constituted committee thereof composed entirely of independent directors, including the Special Committee) to acquire more than 50% of the outstanding voting securities of the Company or assets of the Company or its subsidiaries representing more than 50% of the consolidated revenue or net profit of the Company and its subsidiaries, taken as a whole or (B) if any person (other than a consortium member approved by the Special Committee) commences a tender or exchange offer which, if consummated, would result in such person acquiring beneficial ownership of more than 50% of the outstanding voting securities of the Company, and in connection therewith, the Company files with the Securities and Exchange Commission a Schedule 14D-9 (or any amendment thereto) with respect to such offer that does not recommend that the Company’s shareholders reject such offer; provided, further, that, with respect to the aforementioned clauses (A) and (B), GASF does not solicit, initiate, encourage or take any action to facilitate or assist or participate with any such other person or group in connection with any of the transactions contemplated by the aforementioned clauses (A) and (B) prior to the termination of the Standstill Provision.

On January 31, 2019, Parent and Tower entered into an amendment to the Confidentiality Agreement to extend the overall term of the Confidentiality Agreement and the term of certain provisions therein, including amending the term of the customary standstill provision for the benefit of Tower, to expire on July 31, 2020

The Confidentiality Agreement includes, among other things, a standstill provision (the “Standstill Provision”) that lasts from the date of the Confidentiality Agreement until the earlier of (i) December 31, 2021 and (ii) the date which is 10 business days prior to the director nomination deadline for the 2022 annual meeting of stockholders (the “Standstill Term”). The terms of the Standstill Provision provide, among other things, that during the Standstill Term, Atlas shall not, among other things: (a) acquire any (i) economic interest in, or voting securities of, the Issuer, (ii) direct or indirect rights, warrants or options to acquire, or securities convertible into or exchangeable for, any voting securities of the Issuer; (iii) swaps, hedges or other derivative agreements with respect to voting securities of the Issuer; or (iv) any material assets or properties of the Issuer; (b) make or become a “participant” in any “solicitation” of “proxies” (as such terms are used in the proxy rules under Section 14 of the Act) or consents to vote securities of the Issuer; (c) form, join or in any way participate in a “group” within the meaning of Section 13(d)(3) of the Act; (d) make any public announcement with respect to, or solicit or submit a proposal for any extraordinary transaction involving the Issuer (including any merger, business combination, tender or exchange offer, or recapitalization), (e) seek the removal of any member of the Board, nominate any person as a director who is not nominated by the then-incumbent directors, convene a meeting of the stockholders of the Issuer or propose any matter to be voted upon by the stockholders of the Issuer, (f) propose to amend, waive or terminate the Standstill Provision, contest the validity or enforceability of the Confidentiality Agreement or seek a release from the restrictions therein, in each case which would reasonably be expected to result in a public announcement; or (g) announce or enter into any arrangement to do any of the actions restricted or prohibited by the Standstill Provision.

GHC and the Issuer are party to a Confidentiality Agreement regarding any non-public information that may be received by GHC in connection with GHC evaluating a possible business transaction involving the Issuer. The Confidentiality Agreement includes, among other things, a standstill provision (the “Standstill Provision”) that lasts from the date of the Confidentiality Agreement until the 36-month anniversary of the date of the Confidentiality Agreement (the “Standstill Term”). The terms of the Standstill Provision provide, among other things, that during the Standstill Term, GHC will not, among other things, unless approved in advance by the Issuer: (a) acquire any equity securities of the Issuer, or rights or options to acquire interests in any of the Issuer’s equity securities, except that GHC is permitted to acquire equity securities of the Issuer provided that GHC and its affiliates do not in the aggregate beneficially own twenty percent (20%) or more of the Common Stock, as determined pursuant to Rule 13d-3 promulgated under the Act, and provided that any required regulatory consent is obtained with respect thereto (and for any equity securities of the Issuer held by GHC that exceed ten percent (10%) of such beneficial ownership of the Common Stock (“Excess Securities”), GHC and its affiliates will, at any annual or special meeting of the Issuer, vote any such Excess Securities in such manner as the Issuer, in its sole discretion, will deem proper); (b) make any proposal to the Issuer, or make any public announcement regarding, or otherwise solicit, seek or offer to effect, any business combination, merger, tender offer, acquisition of substantially all of the assets of, or other similar transaction (including any restructuring or recapitalization) involving the Issuer; (c) make any proposal to seek representation on the Board of the Issuer; or (d) take any action that would reasonably be expected to require the Issuer or its affiliates to make a public announcement of any of the actions set forth above. The Standstill Term automatically terminates upon (i) the commencement of a bona fide tender offer by a third party or group to acquire fifty percent (50%) or more of the outstanding voting securities of the Issuer, or (ii) if the Issuer or any of its affiliates enters into a definitive agreement with a third party for a transaction involving the acquisition by such third party of more than fifty percent (50%) of the outstanding voting securities of the Issuer or of all or substantially all of the consolidated assets of the Issuer (or the Issuer publicly announces that it plans to enter into any such transaction). The foregoing description of the Confidentiality Agreement does not purport to be complete and is qualified in its entirety by reference to the Confidentiality Agreement, which is filed as Exhibit 99.3 hereto and is incorporated by reference herein.

A standstill provision is a contractual clause that restricts one party, typically in a merger or acquisition context, from taking specific actions such as increasing their stake in a company or launching a hostile takeover. This type of provision is often included to ensure a period of stability and to protect the interests of the company being targeted during sensitive negotiations.

You should consider using a standstill provision in scenarios where maintaining control and stability is crucial. Common situations include:

When drafting a standstill provision, clarity and specificity are critical. Here are some steps to follow:

Standstill Period: During the Standstill Period, the Investor agrees not to acquire additional shares of the Company, engage in any tender offer or proxy contest without prior written consent of the Board of Directors. The Standstill Period shall commence on the effective date of this Agreement and continue for a period of two (2) years thereafter. Breaching this provision will result in legal actions and possible forfeiture of existing shares.

Standstill provisions are common in several types of contracts, particularly in situations involving sensitive corporate transactions. Typical contracts that may contain standstill provisions include:

These templates contain the clause you just read about.

A purpose-built NDA and exclusivity template for life sciences transactions, covering evaluation material, non-disclosure, standstill, and return-or-destroy

A comprehensive and customizable joint venture agreement template designed to clearly define roles, contributions, management, and operational terms.

Dive deeper into the world of clauses and learn more about these other clauses that are used in real contracts.

A "Statement of Services" or (SoS) clause outlines the specific services that a contractor or service provider agrees to deliver under a contract, serving as a detailed description of the work scope and expectations. It helps both parties have clarity on deliverables, timelines, and service obligations, reducing the potential for disputes.

The statutory compliance clause requires all parties to adhere to applicable laws, regulations, and legal standards relevant to the contract's execution and subject matter. It aims to ensure that all actions, obligations, and deliverables under the contract comply with current legal requirements, mitigating legal risks and potential liabilities.

A statutory deductions clause specifies that any required deductions, such as taxes or social security contributions, will be withheld from payments made under the contract in compliance with applicable laws. This ensures that both parties fulfill their legal obligations for deductions mandated by governmental authorities.

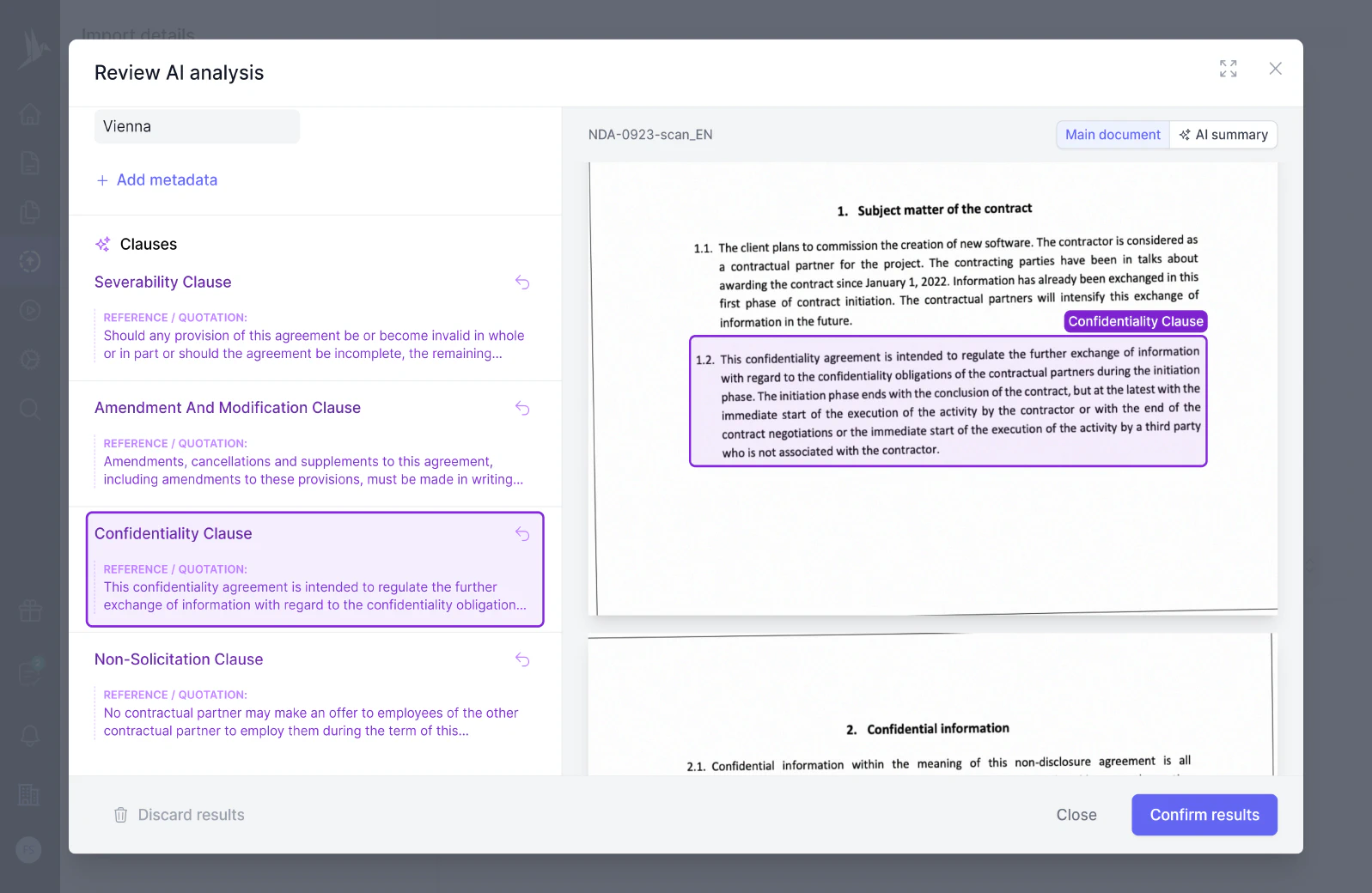

Try our AI contract analysis and extract important clauses and information from existing contracts.

< <

Fill out the form and we will get in touch with you to give you a personal, customized demo of fynk.

Greetings!

I'm Markus, co-founder of fynk. After you've submitted the form, I'll swiftly get in touch with you.

Also, right after you submit your details, you can pick a time that works best for you for our meeting.