Change of Control Agreement Template (Executive Retention)

A change of control agreement defines compensation and protections for executives when ownership or control of a company changes.

Severance pay is a financial compensation provided to an employee upon termination of employment, often based on factors such as duration of employment and salary level. It is intended to provide support during the transition period while the employee seeks new employment opportunities.

Effective as of January 1 , 2017 (the “Effective Date”), the KinderCare Education Severance Pay Plan (the “Plan”) is for the benefit of eligible employees of KinderCare Education LLC, formerly Knowledge Universe Education LLC, (the “Company”), including its subsidiaries (collectively herein, the “Employer”). The purpose of the Plan is to provide an eligible employee with severance pay and benefits for a specified period of time in the event that his or her employment is involuntarily terminated by the Employer. The Plan is an unfunded welfare benefit plan for purposes of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), a severance pay plan within the meaning of United States Department of Labor regulations section 2510 3-2(b), and an involuntary separation pay plan under Treas. Reg. Section 1 409A-1(b)(9)(iii). The Plan supersedes each prior Company severance plan, program and policy covering eligible employees, both formal and informal, including but not limited to, the severance policy set forth in the Company’s Employee Benefits Handbook. This document serves as both the Plan document and the summary Plan description for all purposes under ERISA.

SEVERANCE PAY AND BENEFITS Each participant (as defined above) shall be entitled to receive the severance pay and benefits set forth in the applicable Attachment to this document. The Plan Administrator may, in its sole discretion, provide a participant with greater severance pay or different forms of severance benefits than those set forth in the Attachments to this document.

RETURN OF PROPERTY As a condition for receiving severance pay and benefits under the Plan, an eligible employee must return to the Employer all Employer property (e.g., building keys, credit cards (including p-card), documents and records (both electronic and hard copies), identification cards, office equipment, portable computers, car/mobile phones, parking cards, computer storage drives, etc.). Any Employer property must be returned to the Employer no later than the eligible employee’s termination date.

Generally, eligible employees do not need to make a claim for benefits under the Plan to receive Plan benefits (other than completing and not revoking the Agreement to obtain severance pay and benefits). However, if an employee believes he or she is entitled to benefits, or to greater benefits than are paid under the Plan, the employee may file a claim for benefits with the Plan Administrator. The Plan Administrator will either accept or deny the claim and will notify the claimant of acceptance or denial of the claim.

RETURN OF SEVERANCE PAYMENTS Eligible employees shall be required to return to the Employer any severance pay or severance benefits, or portion thereof, made by a mistake of fact or law, or paid contrary to the terms of the Plan, and the Employer shall have all remedies available at law for the recovery of such amounts. In the event a participant who is receiving or has received severance pay or severance benefits under the Plan breaches any portion of the Agreement, or any portion of this document (i) the payment of severance pay and benefits to such participant shall cease, (ii) the Employer shall have no further obligation at any time to make available any severance pay or severance benefits under the Plan, and (iii) the participant shall be required to return to the Employer any severance pay and benefits, or portion thereof, paid to the participant, less $100, and the Employer shall have all remedies available at law for the recovery of such amounts.

REPAYMENT OF SEVERANCE PAY UPON REHIRE The Employer may require a participant to repay any part or all of the severance pay and benefits received if the participant is rehired by the Employer or any subsidiary or affiliate of the Employer. If the Employer requires the participant to repay any amount, the Employer shall determine the amount, timing, and manner of repayment on a discretionary basis with respect to each individual participant.

MAXIMUM PAYMENTS Except as otherwise provided by the Company in its sole discretion, the severance pay available under the Plan is the maximum pay available to the eligible employee in the event of termination of employment. To the extent that a federal, state or local law requires the Company to make a payment to an eligible employee because of termination of employment or in accordance with a plant closing law, including the Worker Adjustment and Retraining Notification Act (WARN), the severance pay and benefits otherwise payable under the Plan shall be coordinated with and reduced by the amount of such required payment.

SEVERANCE PAY AND BENEFITS VICE PRESIDENTS AND ABOVE ELIGIBILITY Each participant in the KinderCare Education Severance Pay Plan who is involuntarily terminated through a position elimination, reduction in force, or reorganization, and who is employed at a Vice President level or above shall be eligible for the severance pay and benefits described in this ATTACHMENT II to the KinderCare Education Severance Pay Plan document.

SEVERANCE PAY As consideration for signing and (if applicable) not revoking the Agreement, each participant entitled to severance pay and benefits under this ATTACHMENT II will receive as severance pay up to twenty-six (26) Weeks of Pay, paid on a bi-weekly basis in accordance with the Company’s regular payroll practices. Severance pay will end either at the end of the twenty-six (26) week period, or upon commencement of new regular employment, whichever occurs first. The participant must inform the Company upon obtaining new, regular employment. Failure to timely inform the Company of new, regular employment will result in the participant being responsible to reimburse the Company for all weeks of severance paid after commencing the new, regular employment. A “Week of Pay’’ for a participant who is paid on a salaried basis equals the participant’s annual base salary rate in effect at the time the employee is notified of his or her termination, divided by fifty-two (52). Notwithstanding anything to the contrary, a “Week of Pay” for purposes of this Plan excludes bonuses, commissions, overtime, and other supplemental pay or allowances provided to the participant.

Envista Holdings Corporation (the “Company”) has established this Senior Leaders Severance Pay Component, a component of the Envista Holdings Corporation & Subsidiaries Severance Plan (the “Plan”) for the benefit of eligible domestic (United States) Senior Leader employees of the Company and the Company’s domestic (United States) affiliates (individually and collectively referred to as the “Employer”) effective as of the closing of the Company’s initial public offering). The purpose of the Plan is to provide an eligible Senior Leader employee who is terminated under the conditions described herein a measure of financial security while seeking new employment.

III.Calculation Of Severance Pay A.Severance Pay The amount of the severance pay an eligible employee will receive will be based on his or her base salary at the time he or she is notified of termination. Any performance/merit reviews that are pending, in process, or “past due” will not affect the amount of the severance pay. For purposes of calculating “salary” for commission sales representatives, the base salary will be based on the employee’s total earnings (salary plus commission) for the twelve-month period preceding the commencement of any severance pay. If the terminating employee’s length of service is less than twelve months, severance pay will be based on the terminating employee’s pro rata earnings during the term of employment.

B.Amount of Severance Pay Employees are not entitled to any severance pay or benefits under the Plan unless they sign (and do not later revoke) a Separation Agreement and General Release (discussed below). Eligible employees who sign (and do not later revoke as applicable) a Separation Agreement and General Release within the allotted timeframe shall be entitled to receive severance pay under the Plan equal to a minimum amount of three months of annual base salary, plus one month of annual base salary for each year of service. An eligible employee who is a president of a U.S. operating Employer with annual revenue of at least $100 million shall be entitled to receive severance pay under the Plan equal to a minimum amount of 12 months of annual base salary. The maximum amount of severance pay an eligible employee can receive under this Plan is 12 months of annual base salary. Years of service are calculated in full years as of the date of termination based on the eligible employee’s most recent date of hire (or rehire) and the eligible employee’s most recent anniversary date, as determined by the Employer’s personnel records, unless otherwise provided in Section IV.C.

A.Method of Severance Payments - Severance payments and subsidized COBRA continuation coverage will be provided only if the Employer receives a signed Separation Agreement and General Release from the eligible employee as provided in Section IV.F. Severance payments to eligible employees shall be paid in accordance with the Employer’s customary payroll practices for the Employer’s full and partial pay periods until the total severance is paid. Severance pay is subject to any federal, state and local tax deductions and withholding.

A.No Assignment - Severance pay payable under the Plan shall not be subject to alienation, pledge, sale, transfer, assignment, attachment, execution or encumbrance or any kind and any attempt to do so shall be void, except as required by law.

VI. Amount of Severance Pay Eligible Executives will be entitled to severance pay calculated as described below. The severance package will comply with all obligations of notice, termination and severance pay under applicable legislation and any common law (Civil Code in Quebec), and entitlements to pay in lieu of reasonable notice. Subject to the minimums and maximums below, severance pay will be based on the following criteria: (a) Eligible Executives will receive six (6) weeks of "eligible pay" per year of continuous service, subject to the following: (1) The minimum severance amount will be 52 weeks of eligible pay. (2) The maximum severance amount will be 104 weeks of eligible pay. (3) Eligible Executive's with partial years of service will receive a prorated number of weeks of eligible pay for completed months of service. (b) "Eligible Pay" means annual base pay as in effect at the termination of employment date and the average of the Eligible Executive's last two (2) incentive awards paid under a regular cash incentive plan or program, including the 2010 Short-Term Incentive Plan ("Incentive Awards"). Other cash recognition, non-recurring or multi-year incentive awards are not considered Incentive Awards for the purpose of this Policy. If an Incentive Award paid under the 2010 STIP is included, such award amount will be annualized. In any case, the award amount used to determine Eligible Pay is subject to a maximum of 125% of the Executive's target incentive (expressed in dollars) for the year in which the termination occurs.

2. Eligibility for Severance Pay. 2.1 A Participant becomes eligible to receive Severance Pay (as defined below in Section 3.1) and other benefits under the Plan upon a “Qualified Termination of Employment” (as defined below in Section 2.2), provided that the Participant: (a) performs all transition and other matters required of the Participant by the Company prior to the Participant’s Qualified Termination of Employment; (b) returns to the Company any property of the Company which has come into the Participant’s possession; and (c) returns (and does not thereafter revoke), within sixty days, a signed and dated general release in a form acceptable to the Company, in its sole and absolute discretion (the “Release”), under which the Participant, among other things, releases and discharges the Company and its subsidiaries and affiliates from any and all claims and liabilities relating to the participant’s employment with the Company and the termination of the Participant’s employment, including without limitation, any and all claims under all applicable laws, whether federal, state or local, statutory or common law, that may be legally waived and released in a form required by the Company (the “Release”).

13. Severance. As an executive officer, you will be eligible for a severance arrangement that, under certain circumstances, will provide you with benefits in the event of your employment termination during specified periods preceding and following a change of control of the Company. The terms of the severance arrangement are set forth in the CIC Agreement attached to this letter as Addendum A. You will also be eligible to participate in the Company’s Severance Pay Plan for Vice Presidents and Higher (“Severance Pay Plan” attached as Addendum B) which, under certain circumstances, will provide you with benefits in connection with a termination of your employment other than for Cause, and outside the context of a change in control of the Company. Your position as Executive Vice President, Research, Development, and Medical Affairs is considered an “Executive Officer” position for purposes of the Severance Pay Plan. The terms of the CIC Agreement and Severance Pay Plan will govern the provision of these benefits, modified as follows: a. With respect to Section IV(D) of the Severance Pay Plan, the word “material” is added to the third line, so that the section now reads: “Any Severance Benefits to which you may be entitled shall immediately cease upon the determination by the Company that you violated the material terms of the separation agreement or the Proprietary Information, Inventions and Competition Agreement between you and the Company.” b. With respect to Section III(B)(2) of the Severance Pay Plan, any bonus amounts shall be paid no later than March 15 of the calendar year following the calendar year in which the Termination Date (as defined in the Severance Pay Plan) occurs.

Article III: Amount of Severance Pay Severance Pay is the greater of the Officer’s: (a) Annual base salary in effect at the time of Involuntary Termination other than for Cause plus the Officer’s Annual Incentive Program target bonus dollar amount for the calendar year in which the Officer’s Involuntary Termination other than for Cause occurs, divided by 52; or (b) Established compensation, if applicable, in effect at the time of Involuntary Termination other than for Cause plus the Officer’s Annual Incentive Program target bonus dollar amount (if any) for the calendar year in which the Officer’s Involuntary Termination other than for Cause occurs, divided by 52.

(r) Non-U.S. Benefit means, in the case of a Termination Event occurring outside of a Change in Control Period, an amount equal to the Canada Severance Pay Amount, the China Severance Pay Amount, the France Severance Pay Amount, the Hong Kong Severance Pay Amount, the Ireland Severance Pay Amount, the Israel Severance Pay Amount, the Malaysia Severance Pay Amount, the Netherlands Severance Pay Amount, the Singapore Severance Pay Amount, the Thailand Severance Pay Amount, or the U.K. Severance Pay Amount, as applicable based on the law governing Eligible Executive’s employment, in each case as specified in the applicable Benefits Schedule for a Non-U.S. Eligible Executive, plus, if applicable, the Prior Year Bonus and/or Pro Rata Bonus, or in the case of a Termination Event occurring during a Change in Control Period, an amount equal to the Canada Severance Pay Amount, the China Severance Pay Amount, the France Severance Pay Amount, the Hong Kong Severance Pay Amount, the Ireland Severance Pay Amount, the Israel Severance Pay

5. PAYMENT OF SEVERANCE PAY (a) In General. Subject to Section 6(b), if you become eligible to receive severance pay, you will receive your severance pay in the form of salary continuation during the Severance Period at the rate set forth in Section 4, beginning as soon as practicable after the execution of your Release and the expiration of any revocation periods allowable by law and provided for in the Release (the “Release Date”). If the Company offers you a job before your severance payments and benefits are paid and you accept that offer and become reemployed before your severance payments and benefits are paid, no severance payments and benefits will be payable (unless and until you have another severance from employment covered under the Plan). You will cease to be entitled to severance pay and benefits if, during the Severance Period, you become employed by the Company or an Acquirer as defined in Section 2(d).

Severance pay is a form of compensation provided by an employer to an employee who is being terminated from their job. This payment is typically offered in cases of layoffs, company restructuring, or business closures. Severance pay serves to provide financial support to the employee during the transitional period following job loss.

Severance pay is typically utilized in situations where an employment contract or company policy includes a provision for it. It is often used in the following circumstances:

Writing about severance pay, whether outlining it in a contract or policy document, involves clear communication regarding the terms of the severance. Here are some key components to include:

Example: “Employees who have completed three or more years of service are eligible for severance pay, calculated at two weeks’ pay for each year of service. Payment will be made in a lump sum within 30 days of termination, contingent upon the signing of a release agreement.”

Severance pay provisions are typically found in the following types of contracts:

These templates contain the clause you just read about.

A change of control agreement defines compensation and protections for executives when ownership or control of a company changes.

Dive deeper into the world of clauses and learn more about these other clauses that are used in real contracts.

A shareholding structure clause outlines the distribution of shares among the shareholders of a company, detailing each party's ownership percentage and the rights associated with their shares. This clause is crucial for defining voting power, profit distribution, and control within the company.

A short form lease is a simplified version of a standard lease agreement that outlines the essential terms and conditions between the landlord and tenant, often omitting detailed provisions for the sake of brevity. This type of lease typically includes fundamental details such as the identification of the parties involved, property description, lease duration, rent amount, and basic obligations, while more complex terms may be addressed in supplemental documentation.

The Sick Leave clause outlines the conditions under which an employee can take time off due to illness, including the amount of leave allowed, any documentation required for extended absences, and whether the leave is paid or unpaid. It ensures that employees have the necessary time to recover from illness without fear of job loss or penalty.

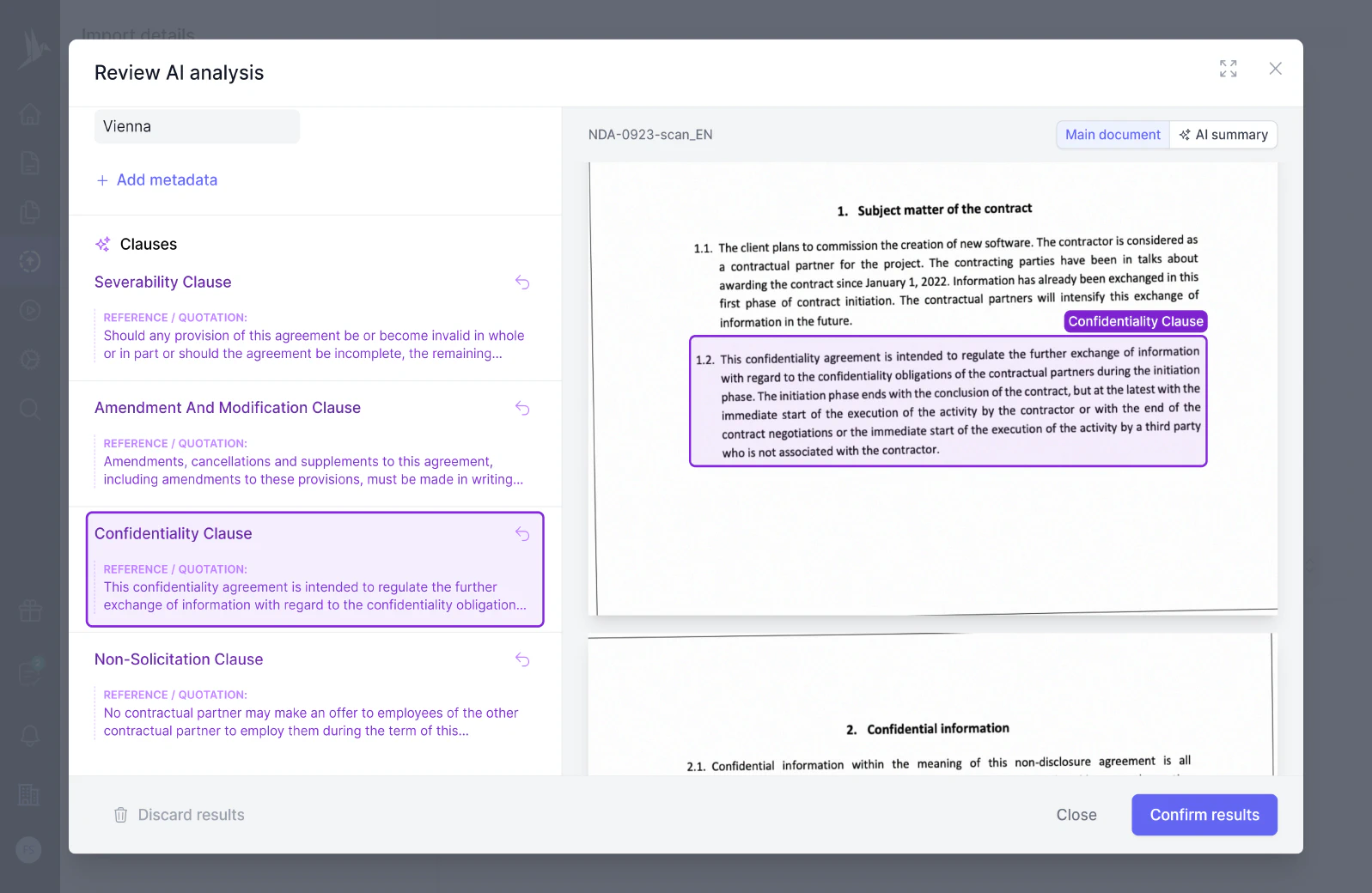

Try our AI contract analysis and extract important clauses and information from existing contracts.

< <

Fill out the form and we will get in touch with you to give you a personal, customized demo of fynk.

Greetings!

I'm Markus, co-founder of fynk. After you've submitted the form, I'll swiftly get in touch with you.

Also, right after you submit your details, you can pick a time that works best for you for our meeting.