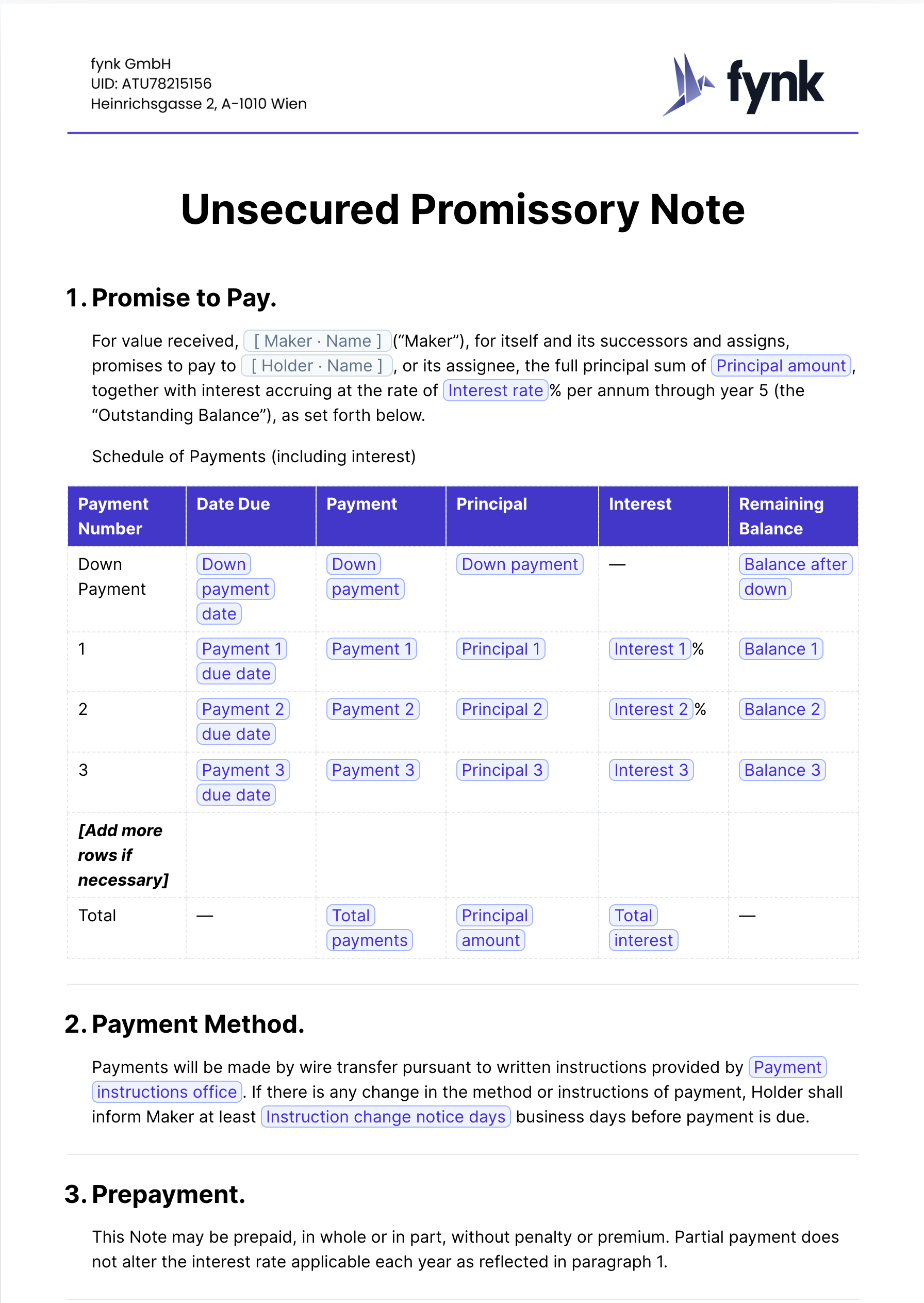

Unsecured Promissory Note Template

A straightforward promissory note template for documenting loans without collateral between individuals or businesses.

A "Promise to Pay" clause is a contractual agreement where one party commits to making a specified payment to another party under outlined conditions. This clause serves as a legal assurance of payment, detailing the amount, payment method, and deadline to ensure clarity and accountability between the parties involved.

On 1/15/2017 borrower made a promise to pay in the amount of $1,623.95.

PROMISE TO PAY. For value received, I promise to pay you or your order, at your address, or at such other location as you may designate, amounts advanced from time to time under the terms of the Loan up to the maximum outstanding principal balance of $500,000.00 (Principal), plus interest from the date of disbursement, on the unpaid outstanding Principal balance until the Loan is paid in full and you have no further obligations to make advances to me under the Loan.

“PROMISE TO PAY. IMAC Holdings, Inc. (“Borrower”) promises to pay to Edward S. Bredniak (“Lender”), or his order, in lawful money of the United States of America, the amount of One Million Seven Hundred Fifty Thousand & 00/100 Dollars ($1,750,000.00) or so much as may be outstanding, together with interest on the unpaid outstanding principal balance of each advance. Interest shall be calculated from the date of each advance until repayment of each advance.”

You promise to pay to us interest on any amount which you must pay under this document (including interest) which is unpaid and which is not otherwise incurring interest. That interest will be calculated as from the day that amount falls due and on the daily balance of the amount unpaid. This applies even if we have a judgment for the amount.

You promise to pay all stamp duty and other government duties and charges on this document and any security for this document and payments and receipts under them. If we pay any of those amounts, you must reimburse us.

Taxes If you are required to deduct any tax from any payment then: - you promise to pay that amount to the appropriate authority and promptly give to us evidence of payment; and - the amount payable to us is increased so that (after deducting tax and paying any taxes on the increased amount) we receive the same amount we would have received had no deduction been made.

You promise to pay any goods and services tax or other tax payable on any amount which you have to pay to us. Where you have to indemnify us against an amount or reimburse us for any amount, that amount will be inclusive of any goods and services tax or other tax payable by us.

The Borrowers jointly and severally promise to pay all costs and expenses, including reasonable attorneys’ fees, all as provided in the Credit Agreement, incurred in the collection and enforcement of this Note. Time is of the essence with respect to the terms of this Note.

The undersigned hereby agreed to extend the maturity dates and term of the loans to: Promise to Pay: January 1, 2023. Replacing: Promise to Pay: On the earliest of January 1 or within 1 month from from the date that the Borrower will go public (the SEC declares the Com2000 S-1 registration statement effective).

The Borrowers hereby promise to pay interest at the Default Rate, on demand, on the Loan and other Obligations as provided in the Credit Agreement.

The undersigned further jointly and severally promise to pay interest on the unpaid principal amount of each Advance under the Term Loan (2022) from the date of such loan until the Term Loan (2022) is paid in full, payable at the rate(s) and at the time(s) set forth in the Credit Agreement. Payments of both principal and interest are to be made in lawful money of the United States and in immediately available funds.

Borrower made a promise to pay $1141.36 via cashiers check.

Because fixed-income investments generally represent a promise to pay principal and interest by an issuer, and not an ownership interest, and may involve complex structures, ESG-related investment considerations may have a more limited impact on risk and return (or may have an impact over a different investment time horizon) relative to other asset classes, and this may be particularly true for shorter-term investments.

Promise to Pay. The Obligors hereby jointly and severally promise to pay to the order of Payee $1,250,000 (the “Principal Amount”), in lawful money of the United States of America (the “Loan”), as hereinafter provided in this Note.

PROMISE TO PAY. LF3 Cedar Rapids, LLC; and LF3 Cedar Rapids TRS, LLC ("Borrower") jointly and severally promise to pay to Western State Bank ("Lender"), or order, in lawful money of the United States of America, the principal amount of Five Million Eight Hundred Fifty-eight Thousand One Hundred Thirty-four & 26/100 Dollars ($5,858,134.26) or so much as may be outstanding, together with interest on the unpaid outstanding principal balance of each advance. Interest shall be calculated from the date of each advance until repayment of each advance.

PROMISE TO PAY. U.S. WELL SERVICES, INC., U.S. WELL SERVICES, LLC, and USWS HOLDINGS LLC ( collectively “Borrower” and each individually a “Borrower”) promise to pay to the order of Greater Nevada Credit Union (“Lender”), in lawful money of the United States of America the sum of Dollars (U.S. $ ), or such other or lesser amounts as may be reflected from time to time on Lender’s books and records as evidencing the aggregate unpaid principal balance of loan advances made to Borrower on a multiple advance basis as provided herein, together with simple interest at the rate or rates provided herein in the “PAYMENT” paragraph, with interest being assessed on the unpaid principal balance of this Note as outstanding from time to time, commencing on November 12, 2020, and continuing until this Note is paid in full.

The undersigned further promise to pay, jointly and severally, interest on the unpaid principal amount of each Loan from the date of such Loan until such Loan is Paid in Full, payable at the rate(s) and at the time(s) set forth in the Credit Agreement. Payments of both principal and interest are to be made in lawful money of the United States of America.

A “Promise to Pay” is a written declaration by a borrower or an entity indicating their commitment to repay a specified sum of money to a lender or another party at a future date. This document serves as evidence of the debt and the borrower’s intention to pay back the amount. It is often referred to as a promissory note and is legally binding, providing a formal acknowledgment of the obligation to repay.

You should use a “Promise to Pay” in situations where one party lends money or extends credit to another party. This document is beneficial in the following scenarios:

Writing a “Promise to Pay” involves including specific elements to ensure the document is clear, thorough, and legally enforceable. The essential components include:

Example of a simple “Promise to Pay”:

PROMISE TO PAY

Date: [Insert Date]

I, [Borrower’s Name], residing at [Borrower’s Address], hereby promise to pay [Lender’s Name], residing at [Lender’s Address], the sum of $[Amount] with an interest rate of [Interest Rate]% per annum. Payments will be made in monthly installments of $[Installment Amount], starting on [Start Date] and to be paid by [Due Date] each month, until the total amount is paid in full.

Signed,

[Borrower’s Signature]

[Lender’s Signature]

A “Promise to Pay” is commonly embedded within several types of contracts including:

These templates contain the clause you just read about.

A straightforward promissory note template for documenting loans without collateral between individuals or businesses.

Dive deeper into the world of clauses and learn more about these other clauses that are used in real contracts.

The "proper cause" clause specifies that any action or decision by a party, such as termination of a contract, must be based on a legitimate and justifiable reason that is aligned with the terms agreed upon in the contract. This clause is intended to prevent arbitrary or unfair actions and ensure that both parties adhere to agreed standards and expectations.

The "Proprietary Information and Confidentiality" clause ensures that any proprietary or confidential information shared between parties remains protected and is not disclosed to unauthorized individuals or entities. It restricts the use of such information solely for the purposes defined in the contract, safeguarding the interests of the party that owns the information.

A Proprietary Information clause establishes that any confidential or sensitive information shared between parties during the course of their relationship may not be disclosed to third parties without authorization. It ensures that proprietary data, such as trade secrets or business strategies, is protected from unauthorized use or distribution.

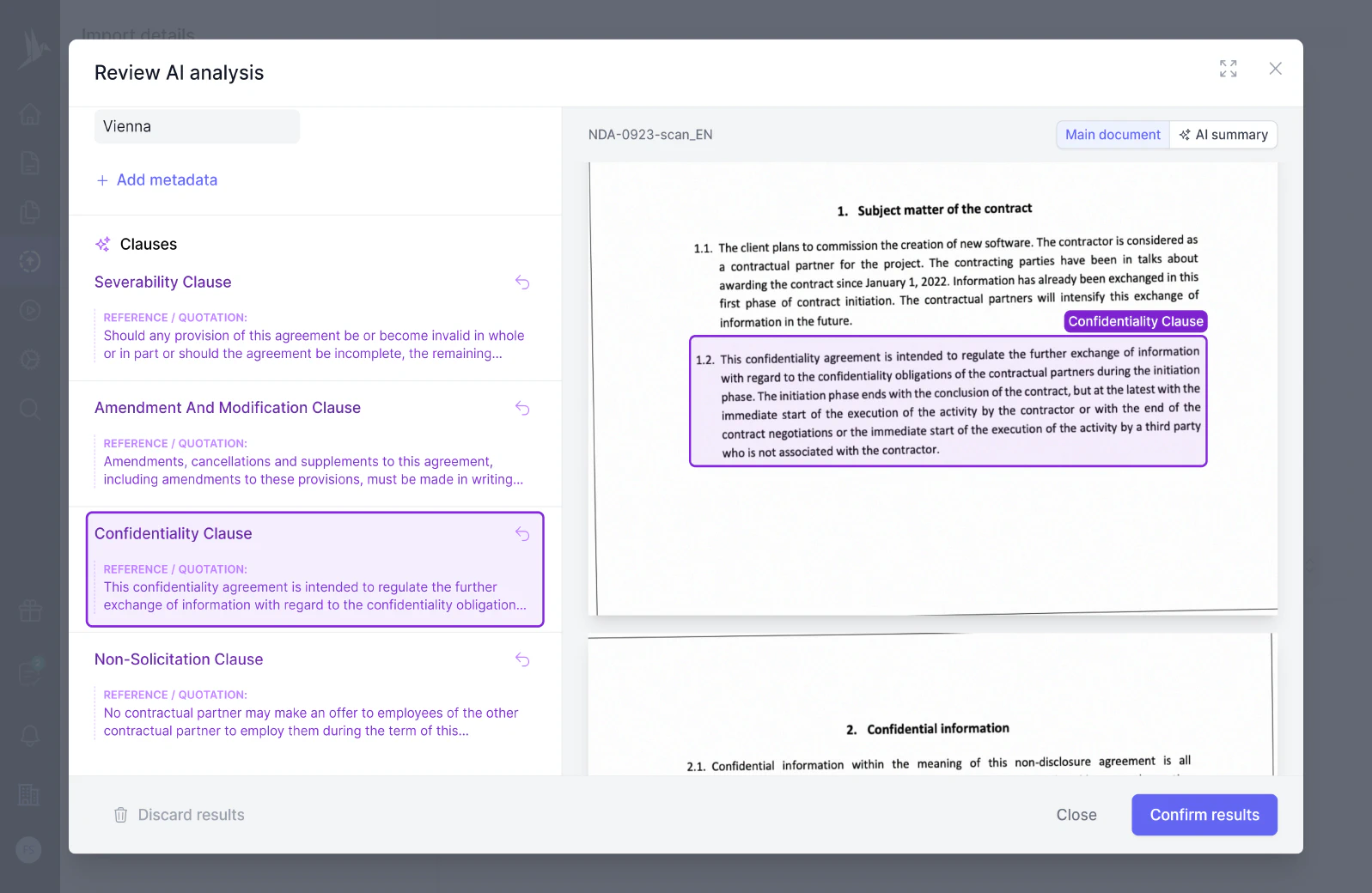

Try our AI contract analysis and extract important clauses and information from existing contracts.

< <

Fill out the form and we will get in touch with you to give you a personal, customized demo of fynk.

Greetings!

I'm Markus, co-founder of fynk. After you've submitted the form, I'll swiftly get in touch with you.

Also, right after you submit your details, you can pick a time that works best for you for our meeting.