Employment Contract Template

An employment contract is a legally binding document that defines the working relationship between an employer and an employee.

The "Compensation and Payment" clause outlines the terms under which the party providing services or goods will be remunerated. It details the agreed payment amount, schedule, method, and any conditions for adjustments, ensuring clarity and mutual understanding between the contracting parties.

Compensation and payment terms Pinghu Street shall compensate the Company for the land resumption for a total amount of RMB29,157,170, which was determined after arm’s length negotiations between the Company and Pinghu Street with reference to the Real Estate Appraisal Report (CEA (2022) (Housing Appraisal) Zi No. 0034) jointly issued by Beijing CEA Assets Appraisal Co., Ltd and Real Estate Appraisal Co., Ltd.

COMPENSATION AND PAYMENT OF EXPENSES In consideration of the Services, the Company agrees to pay to the Consultant the following fees: · First Period (6 Months) (April 8, 2022 – October 8th, 2022) Cash: $11,500 per month Stock: $60,000 of Restricted Shares of the company, with the number of Restricted Shares of the company determined by dividing $60,000 by the closing price on the prior day to the execution of contract (issued and sent within 5 days of the execution and sent to the address in set forth below) Termination. The Agreement may be terminated at any time by either party for convenience, upon delivery of written notice to the other party. If the Agreement is terminated by the Company before the end of any period, then the Consultant shall be entitled to receive the entire compensation for the complete period. After such termination of the Agreement, Consultant shall not be entitled to any compensation for any periods that have not started following the date of termination.

COMPENSATION AND PAYMENT OF EXPENSES FORGIVEN IN EXCHANGE FOR 383,000 SHARES OF RESTRICTED 144 COMMON SHARES.

Compensation and Payment Method. The fee for technical maintenance services provided by Party B for Party A’s trading system is RMB 6000/ month. Party A shall pay Party B the service fee monthly on time from the effective date of this contract.

Compensation and Payment. (a) In consideration of the Services, Lucid Diagnostics shall pay to PAVmed a fee of $20,000 per month, plus all reasonable, out-of-pocket expenses incurred by PAVmed in connection with the performance of the Services (the “Service Fee”). The Service Fee shall be payable on a monthly basis on the first day of the month following the month in which the Services in respect thereof have been provided; provided that Lucid Diagnostics may defer payment of all or any portion of the Service Fee until such time that it has sufficient cash to pay such amount, and in such case any unpaid Service Fee shall continue to accrue so long as it remains unpaid. (b) PAVmed and Lucid Diagnostics agree to consider in good faith from time to time adjustments to the Service Fee as required to reflect changes in the Services as agreed to from time to time. The parties shall amend this Agreement to reflect any such agreed upon changes.

6. COMPENSATION AND PAYMENT OF EXPENSES (a) Issuer agrees to pay Consultant or its designee(s) the following compensation (the “Compensation”): A one-time payment of five hundred thousand (500,000) shares of Issuer's common stock, $0.005 par value, at a deemed value of $0.025 per share, issuable within five (5) business days from the Effective Date and deliverable to Consultant in accordance with Issuer's standard transfer agent protocols. (b) Issuer shall cause to be delivered the applicable share certificates or direct registered shares statement for the shares described in subsection (a) above (the “Securities”) to Consultant. Issuer represents and warrants that, when issued, the Securities will be issued free and clear of all liens, charges, and encumbrances of any kind whatsoever, subject only to the re-sale restrictions under applicable securities laws. (c) The Parties agree that the Compensation hereunder shall be inclusive of any and all fees or expenses incurred by Consultant pursuant to this Agreement, including, but not limited to, the costs of providing the Services. Consultant shall not have any right or authority to, and shall not, employ any person in any capacity, or contract for the purchase or rental of any service, article, or material, nor make any commitment, agreement, or obligation whereby Issuer shall be required to pay any monies or other consideration without Company's prior consent in each instance.

Compensation and Payment Terms. (a) Subject to your strict compliance with Section 4 (General Release and Restrictive Covenants): (i) For Services rendered, the Company will pay you at the applicable hourly rate and on the payment terms set forth on Exhibit A. (ii) Your performance of, and availability to perform, the Services during the Consulting Period will constitute continued “Service,” as defined under and for purposes of each of the Company’s 2015, 2013 and 2008 Equity Incentive Plans and your awards thereunder (collectively, the “Plans”). As a result, (A) your equity awards that are unvested as of the Retirement Date will continue to vest in accordance with their terms until the end of the Consulting Period, and (B) all of your vested stock options will remain exercisable in accordance with their terms through the earlier of (1) the forty fifth (45th) day after the end of the Consulting Period or (2) August 5, 2023, which is the date on which your stock options expire in accordance with their terms. Also, in the event that a Change of Control (as defined under the Plans) is consummated prior to the end of the Consulting Period, any expiration or nonrenewal of this Agreement thereafter will be deemed to be a termination of “Service” without “Cause” (as defined under the Plans) for purposes of those Plans, in which case, vesting of certain equity awards will be accelerated in accordance with their respective terms. (b) The Parties acknowledge and agree that this compensation, which was negotiated at arms’ length, represents the fair market value of the Services to be provided by you to the Company.

Compensation and Payment. (a) Consultant will be compensated in cash at the rate of $18,025.00 per month for performance of the Consulting Services. Company shall reimburse Consultant for reasonable and necessary expenses, related to all travel or otherwise, which shall include but is not limited to airline, hotel, transportation, and meals. The Company shall pay Consultant monthly by no later than the 1st of each month, which shall be paid in advance of the month worked. (b) As additional compensation for the Consulting Services, on January 2, 2024, and on each subsequent anniversary of January 1, 2024, so long as this Agreement has not been terminated, Company shall grant Clifford 2,200 stock options exercisable at an exercise price equal to the then-current stock price. Twenty-five percent (25%) of the options shall be vested immediately as of the date of grant; the remaining options shall vest in three equal increments on April 1, July 1 and October 1 during the first nine months following the date of grant. The exercise period and other terms shall otherwise be substantially the same as the terms of the options granted by the Company to its outside directors.

Compensation and Payment of Expenses. The Company agrees to pay Consultant Six Thousand Two Hundred and Fifty Dollars ($6,250.00) and 90,000 shares of Renavotio common stock restricted under Rule 144 as total and complete consideration for the services to be provided by the Consultant to the Company. If for any reason, the Company determines that it shall not proceed to utilize the services of Consultant, the fee shall continue to be deemed earned by Consultant and remain nonrefundable. Company shall have no other obligation to Consultant for payment. Company agrees to pay for all costs and expenses incurred associated with its employees’ working with the Consultant and its representatives, including lodging, meals, and travel as necessary. All other expenses for the fulfillment of this Agreement shall be borne by the Consultant, and by third parties engaged by it in connection with the performance of the financial and public relations services provided for herein.

Compensation and Payment Terms: The Company shall pay you $100,000, divided evenly over five months beginning on the Effective Date. In addition, upon approval of the Board of Directors, the Company will grant you 100,000 shares of Emerald Health Pharmaceuticals common stock, par value $0.0001 per share, in accordance with the Subscription Agreement to be executed between the Company and Consultant.

2. Compensation and Payment. 2.1 Retainer. The Company will pay Advisor an annual cash retainer of $75,000 (the “Retainer”), paid quarterly in arrears, in consideration for Advisor’s performance of the Services. 2.2 Reimbursable Expenses. The Company will reimburse Advisor for reasonable travel and other out-of-pocket expenses incurred by Advisor in providing the Services, which expenses have been approved in advance by the Company. In accordance with the Company’s reimbursement policies, Advisor will provide to the Company an itemized expense voucher, together with receipts or other reasonable evidence or substantiation of expenses. 2.3 Invoices and Payment. Advisor will promptly submit invoices for amounts payable under Section 2.1 and for reimbursable expenses under Section 2.2. The Company will pay the amount properly due and payable under each of Advisor’s invoices within thirty (30) days after the Company’s receipt and validation of a properly submitted and correct invoice.

Compensation and Payment. Company shall pay to Consultant for Services rendered under this Agreement as follows: (a)Consulting Fee. During the Consulting Period, the Company shall pay Consultant a hourly rate of $230.77 for Consulting Services to be performed by Consultant (the ‘Consulting Fee’). Fee to be billed in advance at 100 hours per advance. All unused hours paid but not used to be reimbursed by Consultant. Company agrees to pay Consultant within seven (7) days after receipt of an approved invoice. (b)Expenses. Consultant will be entitled to reimbursement from Company for reasonable, actual, out-of-pocket expenses incurred on behalf of and for the benefit of Company and with the prior written approval of Company, in the performance of the Consulting Services. Company shall reimburse Consultant for all reasonable business expenses paid or incurred by Consultant directly in connection with the performance of the Services. Such expenses shall be reimbursed within seven (7) days after receipt of an invoice and any supporting documentation as may be reasonably requested by Company, provided that the invoice is submitted to Company no later than thirty (30) days after the expense was incurred. (c)Invoicing. Consultant shall submit invoices to Company in accordance with this Section using the form of invoice (or substantially similar form) attached to this Agreement. All such invoices shall be sent to Company, addressed as follows [***]

COMPENSATION AND PAYMENT TERMS: Consultant shall be paid $60,000 per year, which shall be paid at the end of every month, the first payment being due on September 30 th for the month ending September 2021..

Compensation and Payment refer to the remuneration provided to individuals or entities in exchange for goods, services, or employment. Compensation typically encompasses all forms of payment received, including wages, salaries, bonuses, and benefits, whereas payment tends to refer to specific transactions for goods or services rendered.

The concept of compensation is crucial in employment and business transactions as it acts as a motivating factor for individuals to engage in economic activity and ensures fairness and legality in transactions.

You should use Compensation and Payment in a variety of contexts, including:

When writing about Compensation and Payment, clarity and specificity are key. Ensure that:

Example:

“The Employee shall receive an annual salary of $60,000, payable in bi-weekly installments, subject to standard withholding taxes. In addition, the Employee will be eligible for a performance-based bonus of up to 10% of the annual salary, based on the successful achievement of predetermined goals.”

Compensation and Payment clauses typically appear in the following contracts:

Each contract type requires a tailored approach to compensation and payment terms to align with the nature of the agreement and industry standards.

These templates contain the clause you just read about.

An employment contract is a legally binding document that defines the working relationship between an employer and an employee.

A clear retainer agreement defining scope, hours, pay, confidentiality, non-solicitation, and contractor status for post-employment consulting.

A performance consent and release form template that grants rights to record, broadcast, and promote live performances.

A clear revenue sharing agreement template that defines terms, percentages, and payment structures between two parties.

A template defining how a person's name, likeness, and identity may be used commercially with clear permissions and safeguards.

A customizable unsecured loan agreement template outlining loan terms, repayment conditions, interest rates, default provisions, and dispute resolution.

Dive deeper into the world of clauses and learn more about these other clauses that are used in real contracts.

The "Compensation for Damages" clause outlines the obligations of a party to financially reimburse the other party for losses or harm caused due to a breach of contract or negligent actions. This clause establishes the specific conditions under which compensation is applicable, including the types and extent of damages covered.

The compensation clause outlines the payment terms agreed upon between the parties involved in a contract, specifying the amount, schedule, and method of payment for services rendered or work completed. It ensures transparency and sets expectations regarding financial responsibilities and obligations.

A "Competitor" clause in a contract typically restricts one or both parties from engaging in activities or partnerships with specified competitors of the other party for the duration of the agreement, and possibly beyond. This clause is intended to protect a party's market position or sensitive information by limiting competitive conflicts of interest.

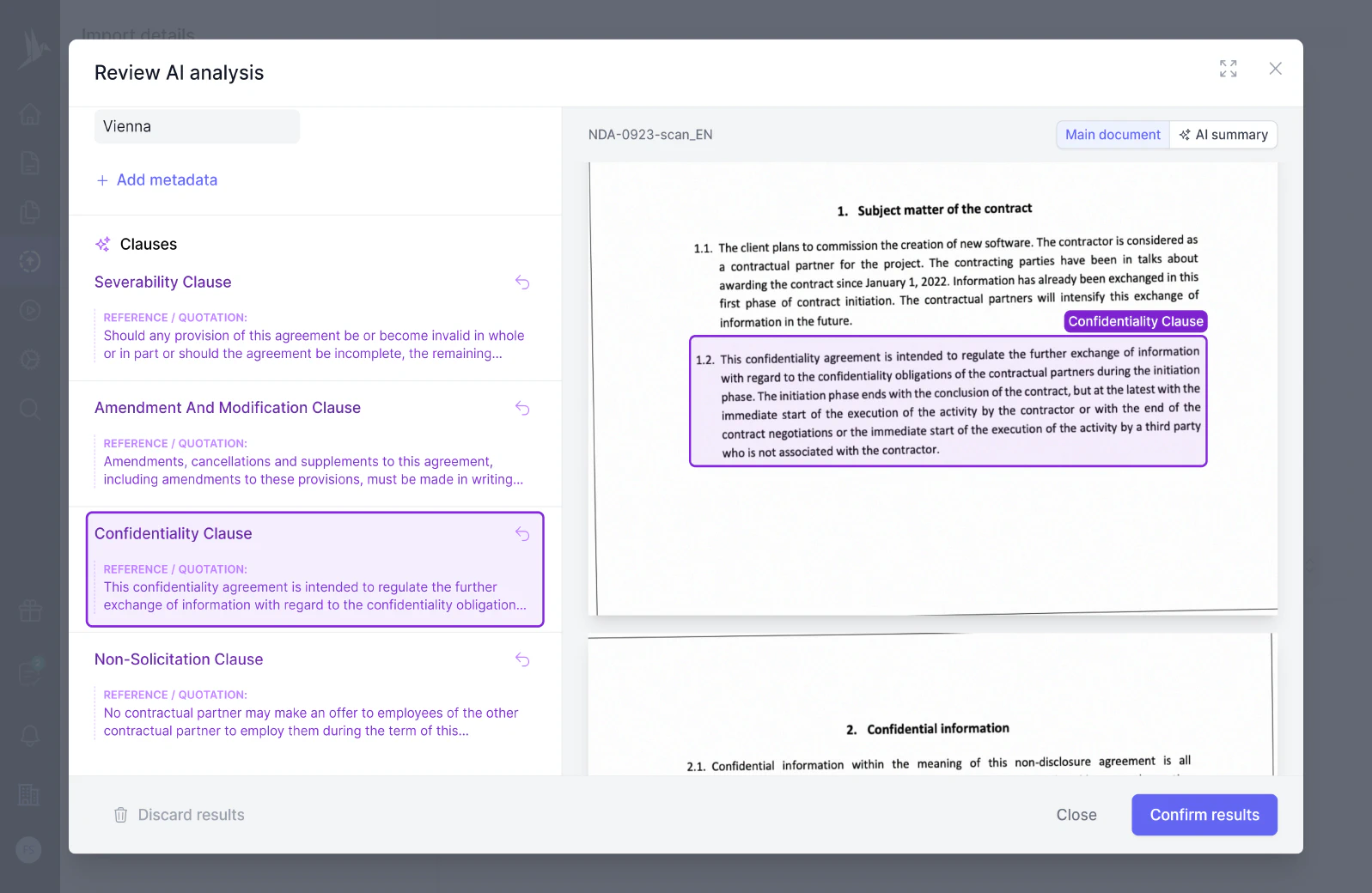

Try our AI contract analysis and extract important clauses and information from existing contracts.

< <

Fill out the form and we will get in touch with you to give you a personal, customized demo of fynk.

Greetings!

I'm Markus, co-founder of fynk. After you've submitted the form, I'll swiftly get in touch with you.

Also, right after you submit your details, you can pick a time that works best for you for our meeting.