Employee Retention Agreement Template

Define retention bonuses, eligibility, termination outcomes, and clawback rules to retain key employees during critical transitions.

Clawback provisions are contractual clauses that allow an employer or company to reclaim previously paid compensation, typically bonuses or incentives, from an employee under specific circumstances, such as financial misstatements or misconduct. These provisions aim to protect the organization’s interests by holding individuals accountable for actions that negatively impact the company’s financial health or reputation.

Compromise and Release of Clawback Provision. In recognition of a good faith dispute as to the meaning, intent and administration of the Clawback Provision, you and the Company agree that your agreement to the Revised Separation Date and consequent forfeiture of the November Vestings shall constitute full satisfaction of the Parties’ rights and obligations with respect to the Clawback Provision. As further consideration for this Compromise and Release, you further agree: (i) on or within twenty-one (21) days of your receipt of this Agreement, you sign it and allow the releases contained herein to become effective; and (ii) you will fully comply with your obligations hereunder during the Transition Period and thereafter. In the event the Company believes you have not fully complied with your obligations, the Company must provide you written notice of such event and provide you three (3) days to cure such event, until which time you will be deemed to have fully complied.

Clawback: If the Committee considers that there is a significant downward restatement of our financial results it may, in its discretion, within two years of your performance-related remuneration (which, for the avoidance of doubt) includes vested awards under the GSIP and MCIP) vesting or being paid: require you to repay to Unilever (or as Unilever directs) an amount equal to the after-tax value of some or all of any cash bonus you were paid (as determined by the Committee); and/or require you to transfer to Unilever (or as Unilever directs) for nil consideration, some or all of the after-tax number of Unilever shares which have previously vested, or pay to Unilever (or as Unilever directs) an amount equal to the value of those shares (as determined by the Committee); and/or require Unilever to withhold from, or offset against, any other remuneration to which you may be or become entitled in connection with your employment such an amount as the Committee considers appropriate. Where you are notified that you must transfer shares or pay an amount in accordance with this clawback provision, any such shares or cash must be transferred or paid (as directed by Unilever) within 30 days of the notification. To avoid doubt, in exercising its powers under these malus and clawback provisions, the Committee may, in its discretion, apply different treatments to: (i) different employees and/or (ii) different remuneration, and may apply such different treatment in combination. These provisions can apply even if you are not responsible for the event in question, or if it happened before the vesting or grant of your performance-related remuneration.

Clawback Provision: The Amended Equity Plan includes a mandatory clawback provision consistent with the requirements of Rule 10D-1 under the Securities Exchange Act of 1934, related listing standards of the New York Stock Exchange, and the Company's clawback policy. Under the Amended Equity Plan, and consistent with the Company's clawback policy, the executive is required to repay or return erroneously awarded compensation in the event of an accounting restatement of previously-reported financial results.

Strengthened Clawback Provision. The Plan provides that all compensation awarded under the Plan and prior incentive plans is subject to recovery or other penalties pursuant to any clawback provision set forth in an applicable award agreement. It further provides that, if the Company is required to prepare an accounting restatement due to material noncompliance with any financial reporting requirement under the securities laws, the Committee may terminate any awards granted under the Plan or prior incentive plans and/or require any participant to reimburse the Company the amount of any payment or benefit received with respect to any awards granted under the Plan and prior incentive plans to the extent such awards would not have been earned or accrued after giving effect to the accounting restatement.

CLAWBACK: Associate acknowledges and agrees that, to the extent permitted by governing law, Section 2.11 of the ARG applies to any bonus under this Agreement. Associate acknowledges and agrees that in addition to all other requirements in this Agreement to earn a bonus, Associate’s eligibility to earn a bonus is directly related to, and dependent on, compliance with the sections in this Agreement relating to confidential information, disparaging statements, and non-solicitation (all collectively, “Restrictions”). In the event the Company reasonably believes that Associate has violated any of the Restrictions at any time the applicable Restriction applied to Associate, the Company shall be entitled to seek all injunctive relief and recover all damages available to it under any legal theory; and Associate will forfeit, and if previously paid, repay any bonus previously paid by the Company to Associate. In accordance with applicable law, Associate authorizes the Company to directly deduct any sums claimed by the Company under this clawback provision from any wages owed to Associate by the Company.

4. Clawback Provisions 4.01. Notwithstanding any provisions in this Agreement to the contrary, any Grant Shares issued hereunder shall be subject to recoupment and recapture as provided in this Section 4 or to the extent necessary to comply with the requirements of any Company-adopted policy, any laws or regulations, listing policy of any exchange or market. 4.02. By accepting these Grant Shares, Grantee agrees and acknowledges that he or she is obligated to cooperate with, and provide any and all assistance necessary to, the Company to recover, recoup or recapture the Grant Shares (or monies received upon the sale of such shares) pursuant to such law, government regulation, stock exchange or market listing requirement or the terms herein. Such cooperation and assistance shall include, but is not limited to, executing, completing and submitting any documentation necessary to recover, recoup or recapture any such Grant Shares. 4.03. Absent any formal clawback policy of the Company, Grantee agrees that he/she shall forfeit and pay back to the Company all of such Grant Shares (or monies received upon the sale of such shares) if a majority of the members of the Board determine that the Grantee had committed a Cause Event during the period from the Grant Date to and including September 30, 2022. 4.04. Subject however to the provisions Subsection 4.03 above, if Grantee’s Continuous Business Relationship with the Company is terminated due to Grantee’s resignation or Disability (“Termination Event”) occurring in the Second or Third Periods, then in such event, the number of Grant Shares (or monies received upon the sale of such shares) subject to the clawback provision and shall be as follows: A. If the Termination Event occurs during the Second Period, then the Grantee shall forfeit and return 2/3rds of the Grant Shares (or monies received upon the sale of such shares) to the Company, and B. If the Termination Event occurs during the Third Period, then the Grantee shall forfeit and return 1/3rd of the Grant Shares (or monies received upon the sale of such shares) to the Company.

5.5 Clawback. (a) If, due to a restatement of CMS Energy’s or an affiliate’s publicly disclosed financial statements or otherwise, an Officer is subject to an obligation to make a repayment or return of benefits to CMS Energy or an affiliate pursuant to a clawback provision contained in this Plan, a supplemental executive retirement plan, the Performance Incentive Stock Plan, or any other benefit plan (a “benefit plan clawback provision”) of the Company, the Committee may determine that it shall be a precondition to the payment of any award under this Plan, that the Officer fully repay or return to the Company any amounts owing under such benefit plan clawback provision (taking into account the requirements of Code Section 409A, to extent applicable). Any and all awards under this Plan are further subject to any provision of law, which may require the Officer to forfeit or return any benefits provided hereunder, in the event of a restatement of the Company’s publicly disclosed accounting statements or other illegal act, whether required by Section 304 of the Sarbanes-Oxley Act of 2002, Section 954 of the Dodd-Frank Wall Street Reform and Consumer Protection Act, federal securities law (including any rule or regulation promulgated by the Securities and Exchange Commission), any state law, or any rule or regulation promulgated by the applicable listing exchange or system on which the Company lists its traded shares. (b) To the degree any benefits hereunder are not otherwise forfeitable pursuant to the preceding sentences of this Section 5.5, the Board or a Committee delegated authority by the Board (“delegated Committee”), may require the Officer to return to the Company or forfeit any amounts granted under this Plan, if: 1. the grant of such compensation was predicated upon achieving certain financial results which were subsequently the subject of a substantial accounting restatement of the Company’s financial statements filed under the securities laws (a “financial restatement”), 2. a lower payout or Annual Award (“reduced financial results”), would have occurred based upon the financial restatement, and 3. in the reasonable opinion of the Board or the delegated Committee, the circumstances of the financial restatement justify such a modification of the Annual Award. Such circumstances may include, but are not limited to, whether the financial restatement was caused by misconduct, whether the financial restatement affected more than one period and the reduced financial results in one period were offset by increased financial results in another period, the timing of the financial restatement or any required repayment, and other relevant factors. Unless otherwise required by law, the provisions of this Subsection (b) relating to the return of previously paid Plan benefits shall not apply unless a claim is made therefore by the Company within three years of the payment of such benefits. (c) The Board or delegated Committee shall also have the discretion to require a clawback in the event of a mistake or accounting error in the calculation of a benefit or an award that results in a benefit to an eligible individual to which he/she was not otherwise entitled. The rights set forth in this Plan concerning the right of the Company to a clawback are in addition to any other rights to recovery or damages available at law or equity and are not a limitation of such rights.

Clawback. The Agreement contains a clawback provision under which all performance-based cash bonuses and equity incentive awards issued under the Agreement will be subject to clawback (i) in the event the Company restates its financial statements and the Compensation Committee determines that the award paid or issued to Mr. Allison would not have been paid or vested had actual performance been based on the restated results; (ii) if the Committee determines that a performance measure was satisfied based on peer comparison data that does not include fourth quarter data and ultimately it is determined that the such measure was not satisfied once fourth quarter data is received; (iii) if the Committee determines in its reasonable discretion that an award would not have been made or vested had the Committee known of an action or omission of Mr. Allison; and (iv) under any Company clawback policy as may be in effect from time to time which may require the awards to be repaid or forfeited to the Company after they have been paid or issued.

13. Clawback or Recoupment Policy. In consideration for the grant of the Award, Grantee agrees to be subject to (i) any compensation, clawback, recoupment or similar policies of the Company or its Affiliates that may be in effect from time to time, whether adopted before or after the Grant Date, and (ii) to such other clawbacks as may be required by applicable law, regulation or exchange listing standard ((i) and (ii) together, the “Clawback Provisions”). Grantee understands that the Clawback Provisions are not limited in their application to the Award, or to equity or cash received in connection with the Award. To the extent that any Clawback Provision is now or in the future applicable to Grantee, Grantee agrees that Grantee is hereby bound by such Clawback Provision in its entirety. For the avoidance of doubt, this Section 13 is in addition to, and not in lieu of, Section 15.7 of the Plan.

Section 3. NYSE Clawback Provisions. 3.1. Recoupment of Erroneously Awarded Compensation from Executive Officers. In the event that the Company is required to prepare an Accounting Restatement, (i) the Committee shall determine the amount of any Erroneously Awarded Compensation for each applicable current or former Executive Officer (whether or not such individual is serving as an Executive Officer at such time) (the “Applicable Executives”) in connection with such Accounting Restatement, and (ii) the Company will reasonably promptly require the recoupment of the amount of such Erroneously Awarded Compensation from any such Applicable Executive, and any such Applicable Executive shall surrender such Erroneously Awarded Compensation to the Company, at such time(s), and via such method(s), as determined by the Committee in accordance with the terms of this Policy. 3.2 Impracticability Exceptions. Notwithstanding anything herein to the contrary, the Company shall not be required to recover Erroneously Awarded Compensation from any Applicable Executive pursuant to the terms of this Policy if (1) the Committee determines that such recovery would be impracticable, and (2) any of the following conditions is met: (a) the direct expenses paid to a third party to assist in enforcing the Policy would exceed the amount to be recovered, provided that, before concluding that it would be impracticable to recover any amount of Erroneously Awarded Compensation based on expense of enforcement pursuant to this clause (a), the Company has (x) made a reasonable attempt to recover such Erroneously Awarded Compensation, (y) documented such reasonable attempt(s) to recover, and (z) provided such documentation to the NYSE; (b) recovery would violate home country law where that law was adopted prior to November 28, 2022, provided that, before determining that it would be impracticable to recover any amount of Erroneously Awarded Compensation based on violation of home country law, the Company has obtained an opinion of home country counsel, acceptable to the NYSE, that recovery would result in such a violation, has provided copy of the opinion is provided to the NYSE; or (c) recovery would likely cause an otherwise tax-qualified retirement plan, under which benefits are broadly available to employees of the Company Group, to fail to meet the requirements of 26 U.S.C. 401(a)(13) or 26 U.S.C. 411(a) and regulations thereunder. 3.3 Acknowledgment. Each Executive Officer shall be required to sign and return to the Company the form of acknowledgment to this Policy in the form attached hereto as Exhibit A pursuant to which such Executive Officer will agree to be bound by the terms and comply with this Policy.

Clawback Provision. Anything in this Award Agreement to the contrary notwithstanding, the Employee hereby acknowledges and agrees that any compensation payable under this Agreement is subject to the Company’s rights and remedies under any Company clawback or recoupment policy, as may be in place from time to time, including the Del Taco Restaurants, Inc. Incentive Compensation Recoupment Policy.

“Clawback Period” shall mean, with respect to any Accounting Restatement, the three completed fiscal years of the Company immediately preceding the Restatement Date and any transition period (that results from a change in the Company’s fiscal year) of less than nine months within or immediately following those three completed fiscal years.

“Discretionary Clawback Participant” means (i) any employee of the Company Group receiving equity awards from the Company pursuant to (x) the Community Health Systems, Inc. 2009 Stock Option and Award Plan, as amended and restated or otherwise amended from time to time, or (y) any other equity incentive plan of the Company adopted following the Adoption Date, (ii) any employee of the Company Group receiving any short-term cash incentive award from the Company pursuant to (a) the Community Health Systems, Inc. 2019 Employee Performance Incentive Plan, as amended from time to time (the “2019 Plan”), or (b) any other short-term cash incentive plan of the Company adopted following the Adoption Date, and (iii) any other employee of the Company Group hereafter designated as a “Discretionary Clawback Participant” by the Committee.

“NYSE Clawback Eligible Incentive Compensation” shall mean all Incentive-Based Compensation Received by any current or former Executive Officer on or after the Effective Date, provided that: (i) such Incentive-Based Compensation is Received after such individual began serving as an Executive Officer; (ii)such individual served as an Executive Officer at any time during the performance period for such Incentive-Based Compensation; (iii)such Incentive-Based Compensation is Received while the Company has a class of securities listed on the NYSE; and (iv)such Incentive-Based Compensation is Received during the applicable Clawback Period.

CLAWBACK POLICY ACKNOWLEDGEMENT AND ACCEPTANCE FORM. The Board of Directors of BioRestorative Therapies, Inc. has adopted a Clawback Policy which is applicable to the Company’s Covered Individuals. I, the undersigned, acknowledge that I have received a copy of the Clawback Policy, as it may be amended, restated, supplemented or modified from time to time, and that I have read it, understand it, and acknowledge that I am fully bound by, and subject to, all of the terms and conditions thereof.

CLAWBACK POLICY. Purpose. The Board of Directors (the “Board”) of BioRestorative Therapies, Inc. (the “Company”) has adopted this clawback policy, as amended (the “Clawback Policy”), which describes the circumstances in which Covered Individuals will be required to repay or return Erroneously Awarded Compensation to the Company in the event of an Accounting Restatement in accordance with Clawback Rules issued by the United States Securities and Exchange Commission (the “SEC”) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the Nasdaq Stock Market LLC (the “Exchange”). Capitalized terms used and not otherwise defined herein shall have the meanings given in Section 2 or 4 below.

“Clawback Period” shall mean, with respect to any Accounting Restatement, the three completed fiscal years of the Company immediately preceding the Restatement Date and any transition period (that results from a change in the Company’s fiscal year) of less than nine months within or immediately following those three completed fiscal years.

“Clawback Rules” shall mean Section 10D of the Exchange Act and any applicable rules or standards adopted by the SEC thereunder (including Rule 10D-1 under the Exchange Act) or the Exchange pursuant to Rule 10D-1 under the Exchange Act (including Nasdaq Stock Market Listing Rule 5608), in each case as may be in effect from time to time.

The Board of Directors (the “Board”) of International Seaways, Inc. (together with its direct and indirect subsidiaries as the Board determines is applicable, the “Company”) has determined that it is in the best interest of the Company and its shareholders to implement and effect as of October 2, 2023 (the “Effective Date”), this Incentive Compensation Recoupment Policy (as may be amended and/or restated from time to time, this “Two-Part Clawback Policy”), comprised of Part A (Dodd-Frank Act Restatement Clawback Policy) and Part B (Supplemental Clawback Policy).

As of the Effective Date, Part B (Supplemental Clawback Policy) of this Two-Part Clawback Policy amends and restates the Incentive Compensation Recoupment Policy for Executive Officers (the “Prior Policy”), which was initially adopted by Overseas Shipholding Group, Inc. (“OSG”) on December 9, 2009 and was subsequently adopted by the Company in conjunction with the spin-off of the Company from OSG effective as of November 30, 2016. For the avoidance of doubt, the rights of recoupment that may be available to the Company prior to the Effective Date shall remain outstanding to the extent permitted pursuant to the Prior Policy and be governed by the terms and conditions of the Prior Policy.

Purpose. The purpose of the Dodd-Frank Act Restatement Clawback Policy (this “Dodd-Frank Act Restatement Clawback Policy”) is to describe the circumstances in which Executive Officers will be required to repay or return Erroneously Awarded Compensation to the Company in accordance with the Clawback Rules.

CLAWBACK POLICY 1.Name and Purpose. This Clawback Policy is intended to satisfy the obligations of Silgan Holdings Inc. (the “Company”) pursuant to Section 10D of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), Rule 10D-1 of the Exchange Act, and other applicable rules of the Securities and Exchange Commission (the “SEC”) and the New York Stock Exchange (the “NYSE”). 2.Authority; Administration. This Clawback Policy shall be administered by the Compensation Committee of the Board of Directors of the Company, except as otherwise set forth herein. In furtherance of this authority, the Compensation Committee is authorized to make all determinations for the administration of this Clawback Policy. Any interpretations, determinations and decisions made by the Compensation Committee with regard to this Clawback Policy shall be final and binding on the Company and all affected individuals and need not be consistent or uniform with respect to individuals subject to this Clawback Policy.

Subject Individuals. This Clawback Policy applies to Executive Officers of the Company. 5.Clawback Requirement. The Company will recover reasonably promptly the amount of Erroneously Awarded Compensation in the event that the Company is required to prepare a Restatement (the “Clawback Requirement”) in accordance with the terms of this Clawback Policy.

Clawback Period. With respect to any Accounting Restatement, the three completed fiscal years immediately preceding the date that Elbit Systems is required to prepare an Accounting Restatement pursuant to Section 5 of this Clawback Policy and any transition period (that results from a change in Elbit Systems' fiscal year) of less than nine months within or immediately following those three completed fiscal years.

Clawback Policy. This Policy Regarding the Recovery of Erroneously Awarded Compensation, as the same may be amended and/or restated from time to time.

Clawback Rules. Section 10D of the Exchange Act and any applicable rules or standards adopted by the SEC thereunder (including Rule 10D-1 under the Exchange Act) or the Nasdaq pursuant to Rule 10D-1 under the Exchange Act (including Nasdaq Listing Rule 5608).

CERAGON NETWORKS LTD POLICY FOR RECOVERY OF ERRONEOUSLY AWARDED COMPENSATION Ceragon Networks Ltd (the “Company”) has adopted this Policy for Recovery of Erroneously Awarded Compensation (the “Clawback Policy”), effective as of October 2, 2023 (the “Effective Date”). Capitalized terms used in this Clawback Policy but not otherwise defined herein are defined in Section 12. This Clawback Policy is intended to comply with the requirements of the Applicable Rules (as defined below). 1. Persons Subject to Clawback Policy This Clawback Policy shall apply to and be binding and enforceable on current and former Officers. In addition, the Committee and the Board may apply this Clawback Policy to persons who are not Officers (in such cases, with references herein to “Officers” deemed to include such persons), and such application shall apply in the manner determined by the Committee and the Board in their sole discretion.

Compensation Subject to Clawback Policy. This Clawback Policy shall apply to Incentive-Based Compensation received on or after the Effective Date. For purposes of this Clawback Policy, Incentive-Based Compensation will be deemed to be “received” in the Company’s fiscal period during which the relevant Financial Reporting Measure is attained or satisfied, without regard to whether the grant, vesting or payment of the Incentive-Based Compensation occurs after the end of that period.

Policy Purpose. The purpose of this incentive-based compensation recovery, or clawback, policy (the “Clawback Policy”) adopted by iPower Inc. (the “Company”) is to enable the Company to recover Erroneously Awarded Compensation in the event that the Company is required to prepare an Accounting Restatement. This Clawback Policy is intended to comply with the requirements set forth in The Nasdaq Stock Market Listing Rule 5608 of the corporate governance rules (the “Listing Rule”) and shall be construed and interpreted in accordance with such intent. Unless otherwise defined in this Clawback Policy, capitalized terms shall have the meaning ascribed to such terms in Section 7. This Clawback Policy shall become effective on December 1, 2023. Where the context requires, reference to the Company shall include the Company’s subsidiaries and affiliates (as determined by the Committee in its discretion).

Section 1. Overview. The purpose of this Amended and Restated Clawback Policy of the Company (as amended from time to time, the “Policy”), dated as of September 13, 2023 (the “Adoption Date”) is to set forth (i) recoupment terms applicable to current and former Executive Officers (as defined below) pursuant to Section 954 of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, as codified by Section 10D of the Exchange Act, and the rules and requirements of the NYSE (including Section 303A.14 of the NYSE Listed Company Manual) (such legal requirements, and rules and requirements of the NYSE, collectively, the “SEC/NYSE Clawback Rules”), as provided in Section 3 of this Policy and the other applicable provisions set forth herein (such recoupment terms, the “NYSE Clawback Provisions”), and (ii) recoupment terms applicable to Discretionary Clawback Participants as provided in Section 4 of this Policy and the other applicable provisions set forth herein (such recoupment terms, the “Discretionary Clawback Provisions”).

Section 3. NYSE Clawback Provisions. 3.1. Recoupment of Erroneously Awarded Compensation from Executive Officers. In the event that the Company is required to prepare an Accounting Restatement, (i) the Committee shall determine the amount of any Erroneously Awarded Compensation for each applicable current or former Executive Officer (whether or not such individual is serving as an Executive Officer at such time) (the “Applicable Executives”) in connection with such Accounting Restatement, and (ii) the Company will reasonably promptly require the recoupment of the amount of such Erroneously Awarded Compensation from any such Applicable Executive, and any such Applicable Executive shall surrender such Erroneously Awarded Compensation to the Company, at such time(s), and via such method(s), as determined by the Committee in accordance with the terms of this Policy.

5.3 Method of Recovery. In the event that (i) recoupment is required pursuant to the NYSE Clawback Provisions, and/or (ii) the Committee has elected to require recoupment pursuant to the Discretionary Clawback Provisions, the Committee shall determine, in its sole discretion, the method(s) for recouping any Erroneously Awarded Compensation from any Clawback Policy Individual subject to such recoupment, which may include:

Without limiting the mandatory clawback provisions applicable to any Covered Officer, in the event of a Financial Statement Restatement Event or upon a determination by the Board (or an authorized committee of the Board) that a Covered Employee has engaged in Misconduct, the Board may, to the extent permitted by law and to the extent it determines that it is in the Company’s best interests to do so, in addition to all other remedies available to the Company, recover from the Covered Employee all or a portion of any erroneously awarded Incentive-Based Compensation received by such Covered Employee (including by requiring cancellation or reimbursement or payment of such Incentive-Based Compensation).

In the case of a Financial Statement Restatement Event, Incentive-Based Compensation shall be considered “erroneously awarded” to a Covered Employee in the same manner as set forth above in the mandatory clawback provisions of this policy. In the case of any Misconduct by a Covered Employee, Incentive-Based Compensation shall be considered “erroneously awarded” to a Covered Employee to the extent such Incentive-Based Compensation (1) is received with respect to any performance period for the relevant Incentive-Based Compensation during which such individual shall be determined to have engaged in Misconduct, and (2) the Board (or an authorized committee of the Board) determines that such individual should not have been entitled to the amount of such received Incentive-Based Compensation as a result of such employee’s Misconduct.

This policy supplements (1) application of the clawback provisions found in Sarbanes-Oxley Section 404 and any other applicable laws and regulatory rules, (2) clawback provisions in company governing documents applicable to breaches of restrictive covenants, and (3) any clawback provisions that exist in any particular employment agreement.

a.The Board or the Committee will administer the Dodd-Frank Act Clawback Provisions of this Policy in accordance with the Final Guidance, and will have full and exclusive authority and discretion (including to engage experts, consultants and/or other advisors for opinions, advice and/or guidance regarding this Policy and its operation) to supplement, amend, repeal, interpret, operate, terminate, construe, modify, replace and/or enforce (in whole or in part) the Dodd-Frank Act Clawback Provisions of this Policy, including the authority to correct any defect, supply any omission or reconcile any ambiguity, inconsistency or conflict in the Policy, subject to the Final Guidance. Otherwise, the Board or the Committee has the exclusive power and authority to reasonably administer this Policy, including to supplement, amend, repeal, interpret, operate, terminate, construe, modify replace and/or enforce (in whole or in part) the other portions of this Policy, and all reasonable actions, interpretations and determinations taken or made by the Board or the Committee thereby will be final, conclusive and binding.

(h)Clawback/Recovery. All Awards and payouts under the Plan will be subject to recoupment in accordance with the following provisions, as applicable and subject to applicable law (the “Clawback Provisions”): (i) any clawback policy that the Company (x) is required to adopt pursuant to applicable law (including without limitation pursuant to the listing standards of any national securities exchange or association on which the Company’s securities may become listed or as may be required by the Dodd-Frank Wall Street Reform and Consumer Protection Act in the event the Company’s securities become publicly traded and subject thereto) and (y) otherwise voluntarily adopts, to the extent applicable and permissible under applicable law; and (ii) such other clawback, recovery or recoupment provisions set forth in an individual written agreement between the Company or an affiliate and the Participant. No recovery of compensation under such a Clawback Provision will be an event giving rise to a right to resign for “good reason” or “constructive termination” (or similar term) under any agreement with the Company.

(i)Recovery of Mistaken Payments and Payments Subject to the Clawback Provisions. On occasion, the Company or an affiliate may mistakenly overpay or make incorrect payments of Awards or may need to make deductions for any overpaid amounts under the Clawback Provisions. For these situations, to the extent permitted by applicable law, the Company or an affiliate reserves the right to offset or recover such payment amounts from any future payments of compensation to the Participant. By participating in the Plan, the Participant authorizes the Company or an affiliate to reduce from any amounts owed to the Participant by the Company or an affiliate (including without limitation Base Salary, expense reimbursements, other bonuses or accrued vacation pay, notice pay) such mistaken payment amounts and, to the extent the payment amounts are not repaid to the Company or affiliate from such reduction, then the unpaid balance becomes a debt the Participant owes to the Company or affiliate.

8.4 No Duplicative Recovery. To the extent that recovery of Erroneously Awarded Compensation is achieved under the NYSE Clawback Provisions of this Policy (or otherwise under the Final Requirements), then the Committee will credit the amount an applicable Executive Officer has already reimbursed the Company against the amount subject to recovery under the remainder of this Policy. Also, to the extent that recovery of compensation or other amounts is achieved under 15 U.S.C. 7243 (Section 304 of the Sarbanes-Oxley Act of 2002), then the Committee will credit the amount an applicable Covered Officer has already reimbursed the Company against the amount subject to recovery under Section 4 of this Policy.

8.2 Relationship of this Policy to Prior Clawback Policy. The clawback provisions under Section 4 of this Policy represent an amendment, restatement and continuation of the Company’s clawback policies and provisions in effect prior to the Effective Date and applicable under certain circumstances described therein (the “Prior Clawback Policy”). This Policy continues, uninterrupted, but as modified hereby, the Prior Clawback Policy. For purposes of clarification, to the extent any compensation or other amounts or Executive Officers are covered by or subject to the NYSE Clawback Provisions by this Policy’s terms, Section 4 of this Policy will operate only after, and as a supplement to (as opposed to superseding and/or replacing), the NYSE Clawback Provisions regarding such compensation or other amounts or Executive Officers.

Following, and subject to, the Plan Administrator’s determination of actual Awards for a performance period, the Plan Administrator will approve the payment of Awards for such performance period, subject to satisfaction of any continued services or additional conditions established by the Plan Administrator to receive the Award. Payment of Awards under the Plan will be made as soon as practicable after such approval or satisfaction of such conditions, as applicable. However, Awards are not earned until no longer subject to recovery pursuant to the Clawback Provisions described in Section 6(h) below, as applicable. As a result, to the extent the Clawback Provisions described in Section 6(h) below apply, the Company pays Awards in advance of the Participant’s earning of the Award, and such advances are subject to recovery pursuant to the Clawback Provisions described in Section 6(h) below.

We will replace any RSU and/ or MIP awards that you forfeit with Prudential awards of the same value. These replacement awards will be released in line with the vesting timeframe attached to your original awards and will be subject to malus and clawback provisions. Where your current awards have performance conditions, Prudential conditions will be attached to your replacement awards.

To avoid doubt, in exercising its powers under these malus and clawback provisions, the Committee may, in its discretion, apply different treatments to: (i) different employees and/or (ii) different remuneration, and may apply such different treatment in combination. These provisions can apply even if you are not responsible for the event in question, or if it happened before the vesting or grant of your performance-related remuneration.

A clawback provision is a contractual clause that allows an employer or company to reclaim previously distributed compensation under certain circumstances. These provisions are typically included in employment contracts, executive compensation agreements, and other financial or legal contracts. The primary aim is to mitigate risks and ensure fairness by allowing the retrieval of bonuses or other incentive compensation if certain conditions are breached, such as financial restatements or misconduct.

Clawback provisions should be used when there is a need to safeguard financial interests and ensure ethical behavior among employees, particularly in situations involving:

These provisions can also be useful tools during mergers and acquisitions or when setting terms for high-risk investment ventures.

Writing a clawback provision involves several key steps to ensure clarity and enforceability:

Define the triggering events: Specify the exact conditions under which the clawback will be enacted, such as financial restatements, misconduct, bankruptcy, etc.

Detail the compensation subject to clawback: Clearly outline which types of compensation (e.g., bonuses, stock options, severance packages) can be reclaimed.

Specify the timeframe: Determine the period after which the clawback provision can no longer be enforced.

Outline the repayment process: Describe how and when the paid compensation must be returned to the company.

Include legal and procedural language: Ensure the provision complies with applicable laws and suits company policies.

Example:

“The Company reserves the right to reclaim any or all bonuses and equity awards paid to the Employee within a two-year period following the publication of a financial restatement due to material noncompliance with any financial reporting requirement under the securities laws, resulting in the Employee’s gross negligence or intentional misconduct.”

Clawback provisions are commonly found in the following types of contracts:

By incorporating clawback provisions, entities can protect themselves against financial losses and uphold ethical standards.

These templates contain the clause you just read about.

Define retention bonuses, eligibility, termination outcomes, and clawback rules to retain key employees during critical transitions.

Dive deeper into the world of clauses and learn more about these other clauses that are used in real contracts.

Closing costs are the various fees and expenses incurred during the finalization of a real estate transaction, often including charges such as loan origination fees, appraisal fees, title insurance, and escrow deposits. These costs can be negotiated between the buyer and seller, with each party potentially responsible for certain expenses as outlined in the purchase agreement.

A commencement letter is a formal document issued to officially notify the start date of a contract or project, ensuring all involved parties acknowledge and agree on when obligations and responsibilities are to begin. It typically confirms the acceptance of terms outlined in the contract and may include additional details pertinent to the initiation of services or work.

The "Company Rules and Regulations" clause typically outlines the expected standards of behavior, procedures, and guidelines that employees must adhere to while working for the company. It serves to ensure consistency, safety, and compliance within the organization and can include aspects such as attendance, dress code, and conduct.

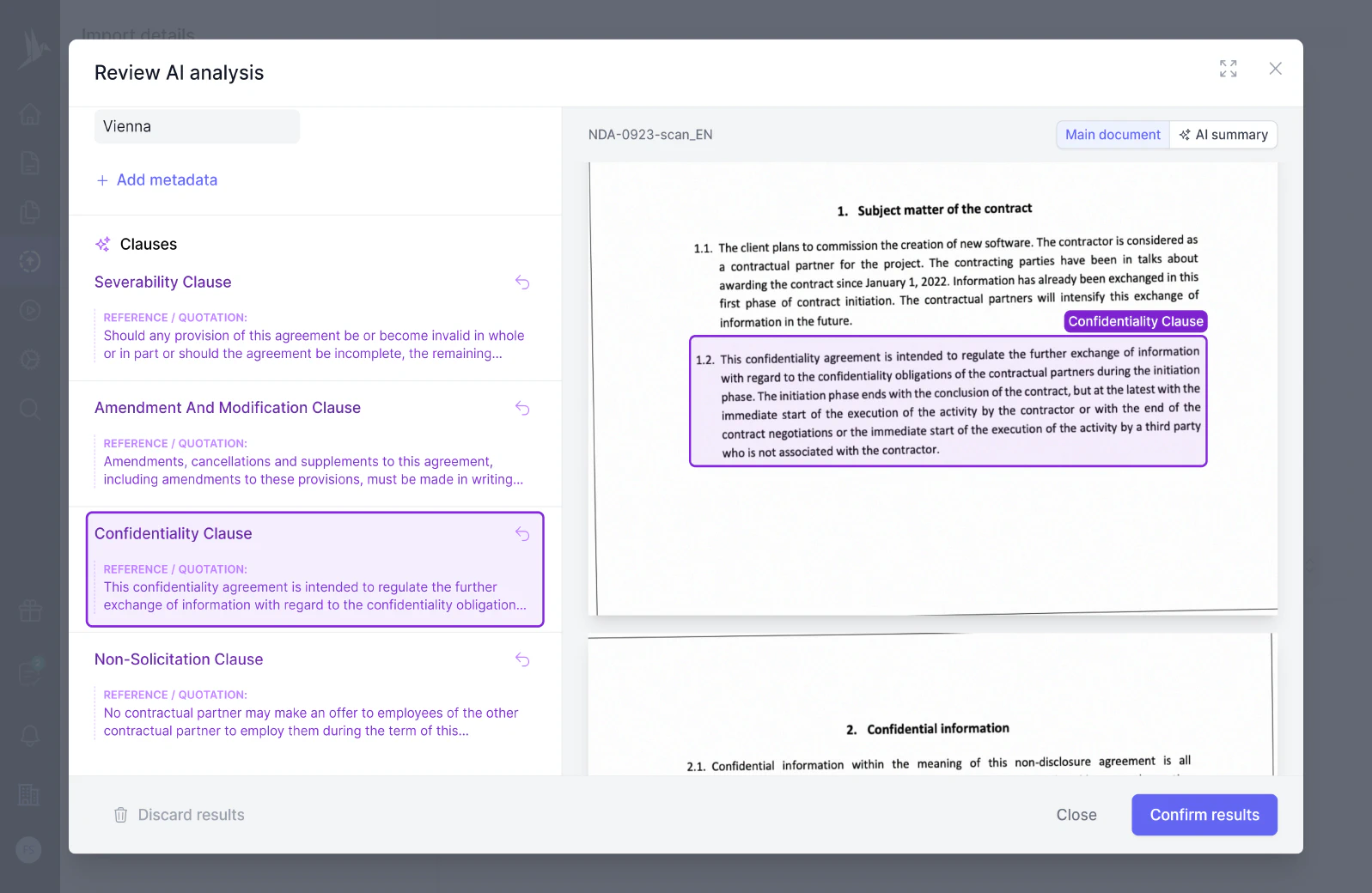

Try our AI contract analysis and extract important clauses and information from existing contracts.

< <

Fill out the form and we will get in touch with you to give you a personal, customized demo of fynk.

Greetings!

I'm Markus, co-founder of fynk. After you've submitted the form, I'll swiftly get in touch with you.

Also, right after you submit your details, you can pick a time that works best for you for our meeting.