Aviation Catering Services Framework Agreement Template

A framework agreement defining long-term catering services, safety standards, pricing rules, and delivery requirements.

An audit clause in a contract grants a party the right to examine and verify the financial records and compliance of the other party to ensure adherence to the agreed terms. This provision helps safeguard against fraudulent activity and ensures transparency and accountability in contractual relationships.

The Audit Committee of the Board of Directors (the “Board”) of Huarui International New Material Limited (the “Corporation”) will make such examinations as are necessary to monitor the corporate financial reporting and external audits of the Corporation and its subsidiaries; to provide to the Board the results of its examinations and recommendations derived therefrom; to outline to the Board improvements made, or to be made, in internal accounting controls; to nominate independent auditor; and to provide to the Board such additional information and materials as it may deem necessary to make the Board aware of significant financial matters requiring Board attention.

The Audit Committee shall meet as often as it determines is appropriate to carry out its responsibilities under this Charter, but not less frequently than quarterly. A majority of the members of the Audit Committee shall constitute a quorum for purposes of holding a meeting and the Audit Committee may act by a vote of a majority of the members present at such meeting. In lieu of a meeting, the Audit Committee may act by unanimous written consent. The Chair of the Audit Committee, in consultation with the other committee members, may determine the frequency and length of the committee meetings and may set meeting agendas consistent with this Charter.

The Audit Committee shall review and reassess the adequacy of this Charter annually and recommend to the Board any amendments or modifications to the Charter that the Audit Committee deems appropriate.

The Audit Committee shall be directly responsible for the appointment, retention, and termination, and for determining the compensation, of the Company’s independent auditors engaged for the purpose of preparing or issuing an audit report or performing other audit, review or attest services for the Company. The Audit Committee may consult with management in fulfilling these duties but may not delegate these responsibilities to management.

The Audit Committee shall be directly responsible for oversight of the work of the independent auditors (including resolution of disagreements between management and the independent auditors regarding financial reporting) engaged for the purpose of preparing or issuing an audit report or performing other audit, review, or attest services for the Company.

The Audit Committee shall pre-approve all auditing services and the terms thereof (which may include providing comfort letters in connection with securities underwritings) and non-audit services (other than non-audit services prohibited under Section 10A(g) of the Exchange Act or the applicable rules of the SEC or the Public Company Accounting Oversight Board (the “PCAOB”)) to be provided to the Company by the independent auditors; provided, however, the pre-approval requirement is waived with respect to the provision of non-audit services for the Company if the “de minimus” provisions of Section 10A(i)(1)(B) of the Exchange Act are satisfied. This authority to pre-approve non-audit services may be delegated to one or more members of the Audit Committee, who shall present all decisions to pre-approve an activity to the full Audit Committee at its first meeting following such decision.

The Audit Committee shall: 1. request that the independent auditors provide the Audit Committee with the written disclosures and the letter required by PCAOB Rule 3526 (“Rule 3526”), 2. require that the independent auditors submit to the Audit Committee at least annually a formal written statement describing all relationships between the independent auditors or any of its affiliates and the Company or persons in financial reporting oversight roles at the Company that might reasonably be thought to bear on the independence of the independent auditors, 3. discuss with the independent auditors the potential effects of any disclosed relationships or services on the objectivity and independence of the independent auditors, 4. require that the independent auditors provide to the Audit Committee written affirmation that the independent auditor is, as of the date of the affirmation, independent in compliance with PCAOB Rule 3520 and 5. based on such disclosures, statement, discussion, and affirmation, take, or recommend that the Board take appropriate action in response to the independent auditor’s report to satisfy itself of the independent auditor’s independence. In addition, before approving the initial engagement of any independent auditor, the Audit Committee shall receive, review, and discuss with the audit firm all information required by, and otherwise take all actions necessary for compliance with the requirements of, Rule 3526. References to rules of the PCAOB shall be deemed to refer to such rules and to any substantially equivalent rules adopted to replace such rules, in each case as subsequently amended, modified, or supplemented.

The Audit Committee shall review the overall audit plan (both internal and external) with the independent auditors and the members of management who are responsible for preparing the Company’s financial statements, including the Company’s Chief Financial Officer and/or principal accounting officer or principal financial officer (the Chief Financial Officer and such other officer or officers are referred to herein collectively as the “Senior Accounting Executive”).

The Audit and Supervisory Committee Members shall prepare minutes for meetings of the Audit and Supervisory Committee, the contents of which should be the matters set out below, and each Audit and Supervisory Committee Member who is present at the meeting shall sign or affix his or her name and seal (including electronic signature) to the minutes.

The Audit and Supervisory Committee Staff who supports duties of Audit and Supervisory Committee Members shall take charge of affairs concerning the convocation of the meetings of the Audit and Supervisory Committee, preparation of the minutes and any other matters concerning operation of the Audit and Supervisory Committee.

Internal Auditors. i. The Audit Committee shall evaluate the performance, responsibilities, budget and staffing of the Company’s internal audit function and review the internal audit plan. Such evaluation may include a review of the responsibilities, budget and staffing of the Company’s internal audit function with the independent auditors. ii. If applicable, in connection with the Audit Committee’s evaluation of the Company’s internal audit function, the Audit Committee may evaluate the performance of the senior officer or officers responsible for the internal audit function.

The provisions in this Audit Committee Charter (the “Charter”) apply to each of the above-listed partnerships (each a “Fund” and collectively the “Funds”).

The Audit Committee shall have unrestricted access to each Fund’s Board of Directors (“Board”), the independent registered public accounting firm (“independent auditors”), and the executive and financial management of the Funds. The independent auditors ultimately are accountable to the Audit Committee and the Board.

“Permissible non-audit services” include any professional services, including tax services, provided to the Funds by the independent auditor, other than those provided in connection with an audit or a review of the financial statements of the Funds. Permissible non-audit services may not include: (i) bookkeeping or other services related to the accounting records or financial statements of the Funds; (ii) financial information systems design and implementation; (iii) appraisal or valuation services, fairness opinions or contribution-in-kind reports; (iv) actuarial services; (v) internal audit outsourcing services; (vi) management functions or human resources; (vii) broker or dealer, investment adviser or investment banking services; (viii) legal services and expert services unrelated to the audit; and (ix) any other service the PCAOB determines, by regulation, is impermissible.

An “audit committee financial expert” is an individual who, in the determination of the Board, has acquired the following attributes: (i) an understanding of generally accepted accounting principles and financial statements; (ii) the ability to assess the general application of such principles in connection with the accounting for estimates, accruals, and reserves; (iii) experience preparing, auditing, analyzing, or evaluating financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of issues that can reasonably be expected to be raised by the registrant’s financial statements, or experience actively supervising one or more persons engaged in such activities; (iv) an understanding of internal control procedures for financial reporting; and (v) an understanding of audit committee functions.

Authority 11. The Audit Committee shall have the resources to pay, as applicable, any fees to the independent auditors engaged for the purpose of rendering or issuing an audit report or related work or performing other audit, review or attest services to a Fund, or engagements to provide any permissible non-audit services to a Fund. 12. The Audit Committee shall have the resources and the authority to engage independent counsel and any other advisers as it deems necessary or appropriate to discharge its responsibilities. The Funds shall provide for appropriate funding, as determined by the Audit Committee, for such counsel and advisers.

Review and discuss annually reports from the independent auditors on: a.All critical accounting policies and practices to be used; b.All alternative treatments of financial information within generally accepted accounting principles that have been discussed with management, ramifications of the use of such alternative disclosures and treatments, and the treatment preferred by the independent auditor; and c.Other material written communications between the independent auditor and management, such as any management letter or schedule of unadjusted differences.

Discuss with management and the independent auditor any correspondence with regulators or governmental agencies and any published reports, which raise material issues regarding the FHLBank’s financial statements or accounting policies.

In addition, any member of the audit committee who otherwise qualifies as an “audit committee financial expert,” as defined by the Securities and Exchange Commission (SEC), shall meet the definition of “independent director” set forth in NASDAQ Exchange Rule 5605(a)(2), the other independence requirements set forth in NASDAQ Exchange Rule 5605 and Section 10A(m)(3) of the Securities Exchange Act of 1934.

An audit is an official inspection and evaluation of an organization’s accounts, financial statements, or compliance with regulations. It is conducted by an independent body—either internal (internal auditors) or external (external auditors)—to ensure accuracy, transparency, and integrity in reporting. Audits can also apply to operational processes, systems, and performance against set benchmarks.

You should use an audit in several scenarios:

Writing an audit involves several steps:

Audits are commonly referenced in several types of contracts:

These templates contain the clause you just read about.

A framework agreement defining long-term catering services, safety standards, pricing rules, and delivery requirements.

A clear energy services agreement template for engaging a service provider to manage operations, finance, and compliance.

Define roles, ownership, and profit-sharing for film partners with a clear collaboration agreement.

Define rights, payments, and obligations between producers and distributors for film releases.

Secure film funding and clarify repayment, profit-sharing, and investor rights with a clear financing agreement.

A publishing agreement is a legal contract that defines the terms and rights a creator grants to a publisher for managing and exploiting their creative works.

Dive deeper into the world of clauses and learn more about these other clauses that are used in real contracts.

An automatic renewal clause specifies that a contract will automatically renew for an additional term upon its expiration unless one party provides notice of termination within a designated period. This clause ensures continuity in the contractual relationship but requires parties to be vigilant about notification deadlines if they wish to terminate the agreement.

The automatic termination clause specifies conditions under which a contract will end automatically without any further action required by either party. It typically outlines specific events or timelines that trigger the termination, ensuring clarity and reducing the need for additional negotiation or intervention.

A balloon payment clause refers to a provision in a loan agreement that requires the borrower to make one large payment at the end of the loan term, typically after a series of smaller periodic payments. This final payment is significantly larger than the earlier installments and is used to pay off the remaining balance of the loan.

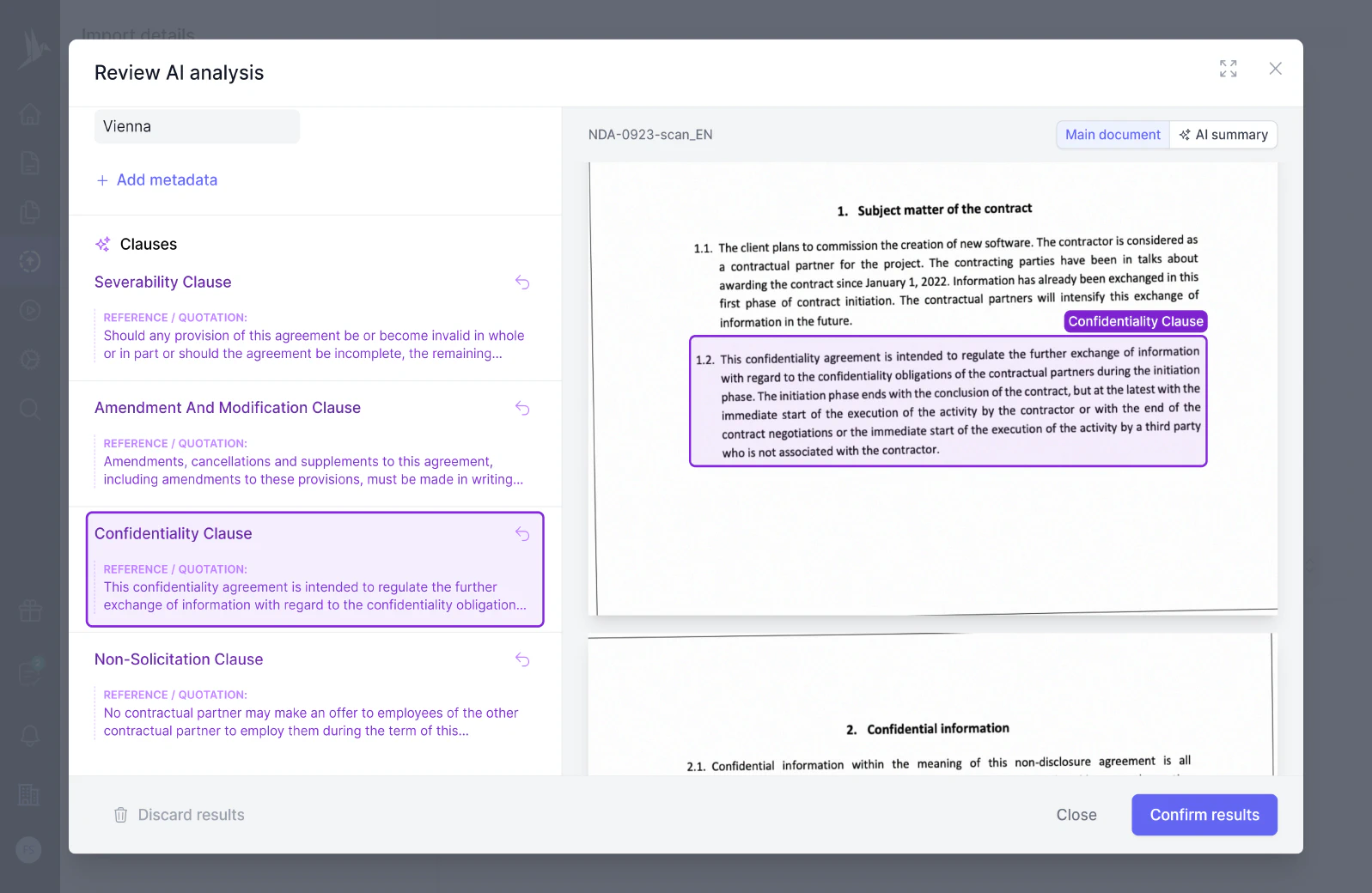

Try our AI contract analysis and extract important clauses and information from existing contracts.

< <

Fill out the form and we will get in touch with you to give you a personal, customized demo of fynk.

Greetings!

I'm Markus, co-founder of fynk. After you've submitted the form, I'll swiftly get in touch with you.

Also, right after you submit your details, you can pick a time that works best for you for our meeting.