Asset Purchase Agreement (APA) Template

A detailed guide on Asset Purchase Agreements (APAs), their benefits, key clauses, and a customizable APA template for software and other assets.

The Assumption of Liability clause specifies that one party agrees to take on certain risks and responsibilities for losses or damages that might arise during the execution of a contract. This clause is often used to delineate which party will be held financially accountable for specific incidents, thereby providing clarity and reducing potential disputes.

The terms of the PSA and the ancillary agreements also include Buyer’s assumption of liability for all responsibility for the TMI-2 site, including full decommissioning and ongoing management of core debris material not previously transferred to the DOE, as well as various forms of performance assurances for the obligations of Buyer to complete the required decommissioning, including, but not limited to, a payment and performance guaranty by EnergySolutions and the delivery of a letter of credit to backstop Buyer’s key decommissioning obligations.

Vendor in respect to any of Purchaser's representations and warranties set forth in Clause 5.4 being untrue or incorrect or a breach by Purchaser of any of its covenants in this Agreement that are to be performed prior to or on the Closing Date shall be Purchaser's assumption of liability and indemnity provided in Clause 6.2 and Vendor hereby releases and waives any and all other Claims or any other remedy or relief that it has or hereafter may have in this regard, whether arising at law, in equity or otherwise.

"Permitted Assumptions of Liability" means (a)Assumptions of liability under the financing documents (including any maximum amount guarantees issued) as well as those that exist at the time the contract is concluded and are listed in Annex 11 (Existing grants of credit and assumptions of liability), (b)Assumption of liability by a group company for an obligated party, (c)Assumption of liability by one non-obligor for another non-obligor obligated, (d)Assumptions of liability by an Obligor for a Non- Obligor up to an aggregated total value of EUR 10,000,000 or the equivalent in other currencies at any time during the term of the Credit Agreement (existing assumptions of liability for Non- Obligors at the conclusion of this Credit Agreement are excluded from the amount limit, already Permitted Assumptions of Liability under paragraph (a) of this Definition), (e)Assumptions of liability that constitute a Permitted Financial Liability, (f)Assumption of liability in the ordinary course of business for third parties, and (g)other assumptions of liability up to a total aggregate value of Permitted Loans pursuant to paragraph (g) of the definition "Permitted Loans" of EUR 5,000,000 or the equivalent in other currencies at any time during the term of the Loan Agreement.

No Assumption of Liability. The Parties agree that Slide will have no liability with respect to claims with a date of loss prior to February 1, 2023. Similarly, Slide shall not assume any other liabilities with respect to UPC, other than the Policy-related claims with a date of loss of February 1, 2023 or later.

Notice of assumption of liability. The company expressly acknowledges that the indemnification contained in this agreement requires assumption of liability predicated on the negligence, gross negligence, or conduct resulting in strict liability of indemnitee, and the company acknowledges that this section 18 complies with any requirement to expressly state liability for negligence, gross negligence, or conduct resulting in strict liability is conspicuous and affords fair and adequate notice.

No Assumption of Liability. The Issuer and the Prior Trustee acknowledge and agree that nothing contained herein or otherwise shall constitute an assumption by the Successor Trustee of any liability of the Prior Trustee arising out of any breach by the Prior Trustee in the performance or non-performance of the Prior Trustee’s duties as Trustee under the Indentures. The Issuer and the Successor Trustee acknowledge and agree that nothing contained herein or otherwise shall constitute an assumption by the Prior Trustee of any liability of the Successor Trustee arising out of any breach by the Successor Trustee in the performance or non-performance of the Successor Trustee’s duties as Trustee under the Indentures.

Assumption of liability for breach of contract by the Client and calculation method: (1) Liability for breach of contract if the commencement notice fails to be issued within 7 days prior to the scheduled commencement date due to reasons attributable to the Client: Article 16.1 of the General Conditions of Contract. (2) Liability for breach of contract if the Client fails to pay the contract price as agreed herein due to reasons attributable to the Client: Article 16.1 of the General Conditions of Contract. (3) Liability for breach of contract if the Client carries out the cancelled work on its own or transfers it to others for implementation, which is in violation of the provisions in (2) of 10.1 [Scope of Change]: Article 16.1 of the General Conditions of Contract. (4) Liability for breach of contract if the specification, quantity or quality of the materials and construction equipment provided by the Client does not conform to the contract, or if the delivery date is delayed or the delivery place is changed due to the Client: Article 16.1 of the General Conditions of Contract. (5) Liability for breach of contract if the construction is suspended caused by the Client’s violation of the contract: Article 16.1 of the General Conditions of Contract. (6) Liability for breach of contract if the Client fails to issue instructions for resumption of work within the agreed period without good reasons, resulting in the Contractor’s inability to resume work: Article 16.1 of the General Conditions of Contract.

This Insuring Clause does not cover loss resulting directly or indirectly from the assumption of liability by the INSURED by contract unless the liability arises from a loss covered by the Telefacsimile Transfer Fraud Insuring Clause and would be imposed on the INSURED regardless of the existence of the contract.

The Wire Transfer Fraud Insuring Agreement does not cover loss resulting directly or indirectly from the assumption of liability by the Insured by contract unless the liability arises from a loss covered by the Wire Transfer Fraud Insuring Agreement and would be imposed on the Insured regardless of the existence of the contract.

Assumption of Liability. As additional consideration for this Agreement and the covenants and releases set forth herein, Unrivaled agrees to assume (1) certain payroll tax liability of Silverstreak in an amount equal to $527,089.99 (the “Tax Liability”); and (2) the tax liabilities referenced in the letter (the Indemnification Notice Letter"), attached as Exhibit 2 hereto, regarding the indemnification claims pursuant to the SPA. The tax liabilities include (a) Taxes owed to the California Department of Tax and Fee Administration in the amount of $145,367.80, (b) Taxes owed to the Internal Revenue Service in the amount of $1,718,842.00, (c) Taxes owed to the California Franchise Tax Board in the amount of $165,676.51, and (d) Taxes owed to the California Employee Development Department in the amount of $252,833.26, all relating to periods prior to the closing date of the SPA.

Assumption of Liability. Licensee hereby assumes full liability for any and all lawsuits, claims, demands, judgments, costs, fees (including attorney’s fees), expenses, injuries, or losses arising from or relating to the Licensed Products, Licensed Services, or any APL IP licensed under Section 2.1 provided, however, Licensee shall not be responsible for any Liabilities to the extent that such Liabilities are finally determined to have resulted from the gross negligence or willful misconduct of APL.

No Assumption of Liability. The security interest hereunder of any Grantor is granted as security only and shall not subject the Administrative Agent or any other Secured Creditor to, or in any way alter or modify, any obligation or liability of such Grantor with respect to or arising out of any of the Collateral.

Solely for the purpose of the coverage provided by this Insuring Agreement, this Insuring Agreement does not cover loss resulting directly or indirectly from the assumption of liability by the Insured by contract unless the liability arises from a loss covered by this Insuring Agreement and would be imposed on the Insured regardless of the existence of the contract.

Non-Assumption of Liability. It is understood and agreed that the Buyer is not assuming in any way whatsoever any liability of Company of any kind whatsoever except those liabilities expressly assumed in Schedule 5(h) – Assumed Liabilities.

Assumption of liability refers to a situation where an individual or organization agrees to take on the legal responsibilities and risks associated with a certain action, transaction, or contract. This means that if any legal claims or damages arise from that particular context, the individual or organization agrees to address and manage those liabilities. It can be a formal agreement where one party agrees to indemnify the other party against specified liabilities.

You should consider using an assumption of liability clause or agreement in the following scenarios:

Business Transactions: When acquiring a company or assets, where it becomes necessary to define which liabilities the buyer is willing to assume.

Lease Agreements: When a tenant agrees to assume the liability for property-related damages or injuries that might occur on the premises.

Contractual Agreements: When entering into partnerships or collaborations where one party agrees to take responsibility for certain risks to protect the other party.

Service Agreements: When offering services that might inherently carry risk, and the provider accepts potential claims arising from the deliverance of these services.

Writing an assumption of liability involves clearly stating the responsibilities and liabilities that one party agrees to assume. Here’s a basic structure:

Introduction: Clearly identify the parties involved and the context in which the assumption of liability is being made.

Liability Clauses:

Duties and Responsibilities: Describe the specific duties and responsibilities that the accepting party will manage.

Indemnification Clause: Specify indemnification terms, outlining how one party will compensate the other in case of certain specified events.

Signature and Date: Include sections for all relevant parties to sign and date the document, to signify agreement.

Example:

“Party A agrees to assume all liabilities arising from the operation of the equipment, including but not limited to damages, maintenance, or any legal claims resulting from its use.”

Contracts that frequently include an assumption of liability clause cover a wide range of industries and contexts. Common types include:

Mergers and Acquisitions: Agreements where a company takes over another and the liabilities tied to the acquired entity.

Lease Agreements: Especially where the tenant assumes responsibility for maintaining the property or addressing incidents on site.

Service Contracts: Where providers clarify the scope of services and related liabilities they are willing to handle.

Construction Contracts: Often require assumptions of liability concerning workplace safety and project-related damages.

Identifying and including well-defined assumption of liability terms in contracts is essential for clear responsibility delineation and protection against undesired legal exposure.

These templates contain the clause you just read about.

A detailed guide on Asset Purchase Agreements (APAs), their benefits, key clauses, and a customizable APA template for software and other assets.

A detailed and customizable equipment lease agreement template covering maintenance, insurance, return conditions, and financial safeguards.

A performance consent and release form template that grants rights to record, broadcast, and promote live performances.

A comprehensive operating agreement template defining LLC formation, management structure, member rights, and financial arrangements.

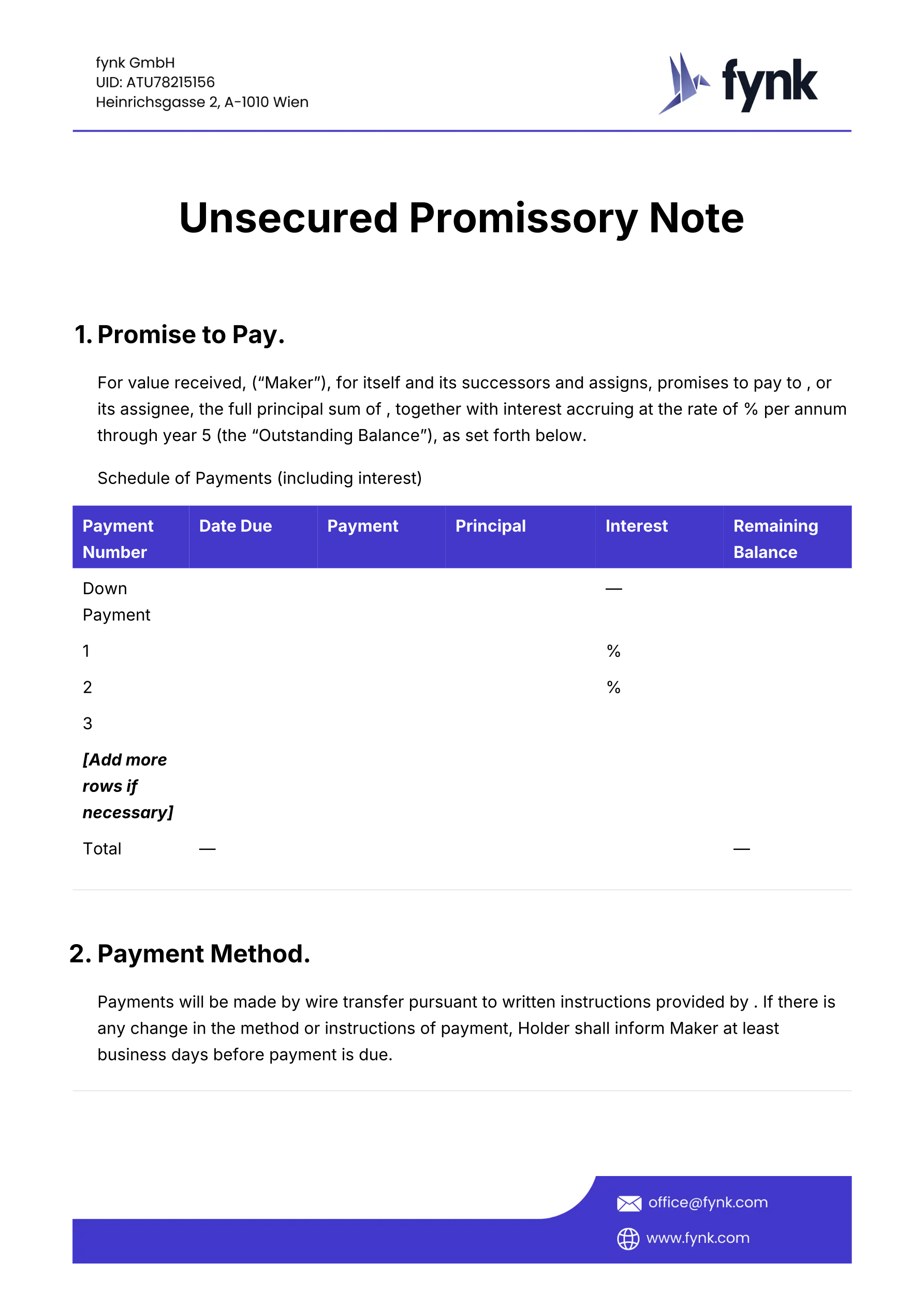

A customizable promissory note zero interest template that documents no-interest loans with clear repayment terms.

A comprehensive sponsorship agreement template outlining rights, benefits, fees, and obligations between a professional sports team and a sponsor.

Dive deeper into the world of clauses and learn more about these other clauses that are used in real contracts.

At-will employment is a type of employment arrangement in which either the employer or the employee can terminate the employment relationship at any time and for any reason, as long as it is not illegal or in violation of a specific contract. This clause provides flexibility for both parties but also means that job security is not guaranteed unless otherwise specified in a separate agreement.

Attornment is a legal agreement in which a tenant accepts the new owner of a property as their landlord following a change in ownership. It ensures that existing lease agreements remain in force despite any changes in property ownership.

An audit clause in a contract grants a party the right to examine and verify the financial records and compliance of the other party to ensure adherence to the agreed terms. This provision helps safeguard against fraudulent activity and ensures transparency and accountability in contractual relationships.

Try our AI contract analysis and extract important clauses and information from existing contracts.

< <

Fill out the form and we will get in touch with you to give you a personal, customized demo of fynk.

Greetings!

I'm Markus, co-founder of fynk. After you've submitted the form, I'll swiftly get in touch with you.

Also, right after you submit your details, you can pick a time that works best for you for our meeting.