Bonded Title

A bonded title is issued when a person cannot provide sufficient evidence of ownership for a vehicle or property. It involves purchasing a surety bond, which protects the state and any previous owners from financial loss if a legitimate claim to the property arises.

What is a Bonded Title?

A bonded title is a legal document issued by the state to establish ownership of a vehicle or property when the original title has been lost, stolen, or cannot be found. Unlike a regular title, a bonded title includes a surety bond, which provides financial protection to the state and any future claimant in case another party asserts a legitimate claim to the vehicle or property.

This type of title is typically used when an individual needs to prove ownership but lacks sufficient documentation to obtain a standard title.

How a Bonded Title Works

A bonded title involves the use of a surety bond, which is a financial guarantee purchased by the applicant. The surety bond ensures that the state and any rightful owners are compensated in case a claim is made against the ownership of the vehicle or property in question. The bond amount is usually set at 1.5 to 2 times the value of the vehicle or property.

While a bonded title provides the same functional benefits as a regular title, it differs in that it remains provisional until either the surety bond expires or the title is replaced with a standard one.

Common Scenarios for a Bonded Title

A bonded title is typically required when:

- The original title is lost, and there is no duplicate available.

- The previous owner did not transfer ownership properly, leaving a gap in the chain of title.

- The vehicle or property was purchased without a title, and the buyer has insufficient documentation to prove ownership.

Bonded titles are commonly used for vehicles, but they may also be applied to other types of property, such as real estate, depending on state regulations.

How to Obtain a Bonded Title

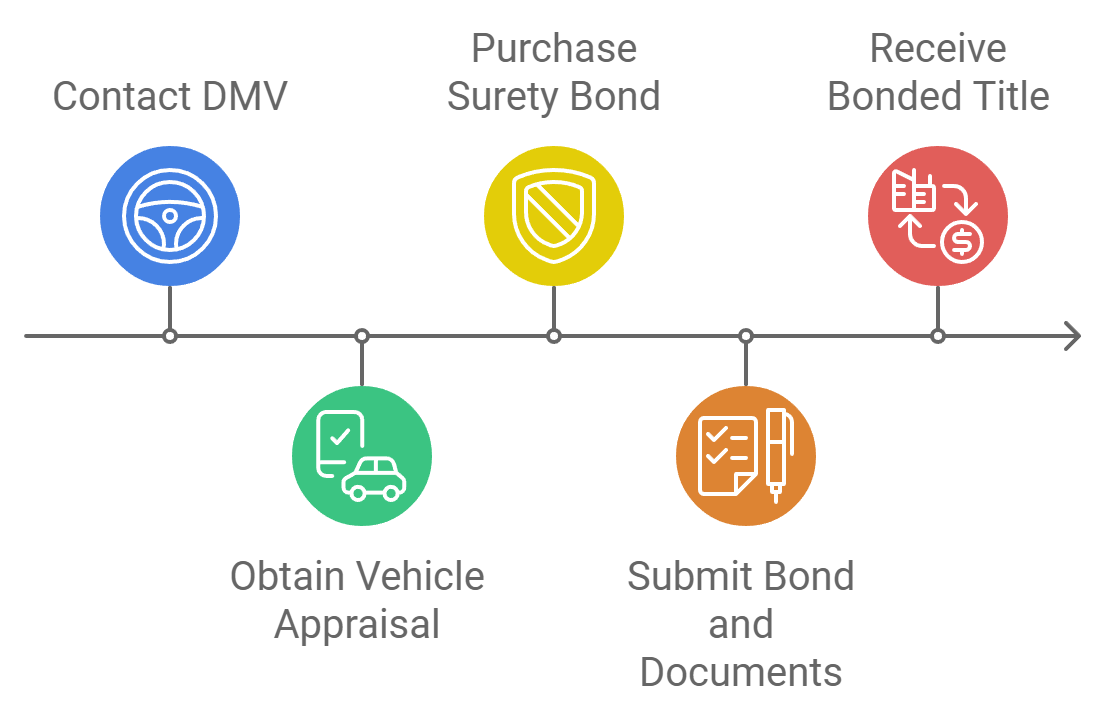

To get a bonded title, the following steps are generally required:

The process of obtaining a bonded title.

- Contact the state DMV or equivalent agency to determine eligibility for a bonded title.

- Obtain a vehicle appraisal to determine its current value.

- Purchase a surety bond from an authorized bonding company for an amount determined by the state (typically 1.5-2 times the vehicle’s value).

- Submit the bond and other necessary documents to the DMV, along with an application for a bonded title.

- Receive the bonded title, which will have the word “Bonded” printed on it, indicating the provisional status.

State requirements and processes may vary, so it’s important to check local laws before applying.

Liability and Limitations of a Bonded Title

The bonded title provides limited ownership protection for a set period, typically 3-5 years, depending on the state. During this time, the surety bond can cover claims from anyone who believes they have a legitimate right to the vehicle or property.

The applicant is financially responsible if a valid claim arises, as the bonding company will pay the claimant and seek reimbursement from the titleholder.

After the bond expires and no claims have been made, the bonded title may be converted into a standard title, at which point the “Bonded” designation is removed.

Frequently Asked Questions (FAQs)

Can I sell a vehicle with a bonded title? Yes, you can sell a vehicle with a bonded title. However, the “bonded” status will remain on the title until it expires or is converted to a standard title. Buyers should be aware of the bonded title’s conditions before completing the transaction.

How long does a bonded title last? A bonded title typically lasts between 3 and 5 years, depending on state regulations. After this period, if no claims have been made against the bond, the titleholder may apply for a regular title.

What happens if a claim is made against the bond? If someone claims ownership or a legitimate interest in the vehicle or property, the surety bond provides compensation to the claimant. The bond issuer will pay the claim and then seek reimbursement from the titleholder. This means the titleholder is financially liable for any valid claims made.

Contracts can be enjoyable. Get started with fynk today.

Companies using fynk's contract management software get work done faster than ever before. Ready to give valuable time back to your team?

Schedule demo