Job Offer Letter Template

Outline role details, compensation, benefits, and employment conditions in a clear and professional job offer letter.

A signing bonus is a financial incentive offered to an employee or contractor upon agreeing to and signing a contract, often used to attract top talent or compensate for potential losses incurred by leaving a previous position. This one-time payment is typically provided in addition to other salary or compensation benefits and might be contingent on fulfilling specific terms of the contract, such as staying with the company for a predetermined period.

Signing Bonus Terms. Employee has agreed to accept an at-will employment position with Eaton. Employee will begin working at Eaton on _________, and the Signing Bonus will be paid in one lump sum in Employee’s first regularly scheduled paycheck. This payment is subject to applicable tax withholding and requires Employee to be an active employee and in good standing on the date of the payment.

Repayment of Signing Bonus. Employee agrees that the Signing Bonus is subject to the following repayment obligations: (a) If Employee works for Eaton for more than 24 months following the payment of the Singing Bonus, Employee shall have no obligation to repay the Signing Bonus. Additionally, if Eaton terminates Employee’s employment without Cause at any time, Employee has no obligation to repay the Signing Bonus. (b)If Employee voluntarily leaves Eaton or is terminated by Eaton for Cause within 24 months of the Signing Bonus payment date, Employee must repay Eaton the full amount of the Signing Bonus within fourteen (“14”) days of Employee’s final date of employment with Eaton. For the purposes of this Agreement, “Cause” shall mean: (i) your willful and continued failure to perform substantially your duties with the Company or an Affiliate (other than any such failure resulting from incapacity due to physical or mental illness), after a written demand for substantial performance is delivered to you by your manager, the Board of Directors of Eaton Corporation, plc, or the Chief Executive Officer of the Company which specifically identifies the manner in which they believe that you have not substantially performed your duties; (ii) you plead guilty or nolo contendere to, or are convicted of (a) any felony or (b) any crime involving moral turpitude, dishonesty, fraud or unethical business conduct; (iii) your material violation of the Company’s Code of Ethics or other applicable Company or an Affiliate’s policies or procedures as are in effect from time to time; (iv) your willful misconduct in the course of your continuous service, which is materially detrimental to the financial condition or business reputation of the Company or an Affiliate, whether as a result of adverse publicity or otherwise.

Signing Bonus. If you accept this employment offer, you will receive a cash signing bonus in an amount of $200,000 (the “Signing Bonus”), less applicable withholding and taxes as required by law. The Signing Bonus will be paid in one lump sum no later than 30 days from your start date in a payment separate from your salary payment of the same date. In the event that you resign or are terminated for Cause (as defined below) within 12 months of your Start Date, you will be required to repay 100% of the Signing Bonus to the Company within 30 days of your termination or resignation date; if you resign or are terminated for Cause between 12 months and 24 months after your Start Date, you will be required to repay 50% of the Signing Bonus to the Company within 30 days of your termination or resignation date. If you are terminated without Cause, you will not be required to repay any amount of the Signing Bonus.

In the event that you are unable to begin employment with the Company for a period of time after the termination of your employment with your former employer, solely due to the terms of such restrictive covenants (as determined by the Company in its sole discretion), the Company agrees to pay you an additional sign on bonus of $2,000 per week, less applicable withholding and taxes as required by law, for a maximum of twelve (12) weeks (the "Additional Signing Bonus").

Signing Bonus In addition, you will receive a signing bonus of $525,000. This will be considered taxable income and all regular payroll taxes will be withheld and other required deductions made. This bonus will be paid in one lump sum by your 60th day of employment with Ecolab. In order to receive this payment, you must (1) be employed on the payment date, and (2) sign and return the Signing Bonus Payback Agreement within 5 days. If you leave Ecolab’s employment voluntarily or are discharged for cause* at any time during the 18-month period following your date of hire, you will be required to repay the entire Signing Bonus as specified in the Signing Bonus Payback Agreement. This payment is intended to be exempt from Internal Revenue Code (IRC) Section 409A as a “short-term deferral” described in Treasury Regulation Section 1.409A-1(b)(4), but in any event, Ecolab will not have any liability for any tax or penalty imposed by reason of IRC Section 409A.

To offset the costs of your obligation, arising from your termination from your prior employer (the “Prior Employer”) and commencement of employment with the Company, to repay to the Prior Employer a signing bonus and other incurred costs that were previously paid to you by the Prior Employer (the “Prior Employer Signing Bonus”), provided that you attempt in good faith to negotiate with the Prior Employer to minimize the amount of any such repayment obligation and subject in all events to your commencing employment with the Company, the Company will pay you a one-time signing bonus (the “Signing Bonus”) in an amount equal to the lesser of (a) the amount of the Prior Employer Signing Bonus you are required (after negotiating in good faith) to repay to the Prior Employer and (b) $160,000

If you resign from Dean Foods other than for Good Reason or if the company terminates your employment for Cause, you will be responsible for reimbursing Dean Foods for the full gross amount of your paid signing bonus on a pro-rated basis, according to the number of full months worked from the assigned date and following the below schedule.

If you accept this offer of employment, you will be eligible for a one-time signing bonus, payable over time based on the length of your continuous at-will employment with the Company. The total signing bonus you will be eligible for is $350,000, subject to regular withholdings, paid in three payments as follows: 1) $116,667 paid on the first regular payroll cycle after the first day of employment; 2) $116,667 paid on the first regular payroll cycle following your 180th day of continuous, active employment; and 3) $116,666 paid on the first regular payroll cycle following the 365th day of your continuous, active employment. If you take an extended leave of absence for any reason during the first two years of your employment, the signing bonus payment dates will be extended accordingly, so that you are only eligible for the second and third signing bonus payments on your 180th and 365th days of active employment, respectively.

Signing Bonus. In addition to the bonus under Section 3 above, in connection with your commencement of employment with the Company on September 30, 2019, you became eligible to receive a one-time cash sign-on bonus in the amount of $50,000 (the “Signing Bonus”), of which $25,000 was paid to you within 30 days of the date you commenced employment with the Company (the “Start Date”) and the final $25,000 will be paid to you on the date that is 6 months from the Start Date. You must be employed by the Company at the time of payment of the Signing Bonus in order to receive the Signing Bonus or any portion thereof. The Signing Bonus shall be subject to deductions and withholdings as required by law. If, prior to the 12-month anniversary of the Start Date, you voluntarily terminate your employment or are terminated by the Company for Cause (as defined below), then you agree to repay to the Company the net amount of the initial Signing Bonus of $25,000 that you received, after deduction of state and federal withholding tax, social security, FICA, and all other employment taxes and authorized payroll deductions, within 30 days of your Date of Termination (as defined below). If, prior to the 18-month anniversary of the Start Date, you voluntarily terminate your employment or are terminated by the Company for Cause, then you agree to repay to the Company the net amount of the second installment of the Signing Bonus of $25,000 that you received, after deduction of state and federal withholding tax, social security, FICA, and all other employment taxes and authorized payroll deductions, within 30 days after your Date of Termination.

The 2024 Signing Bonus is not due or payable unless the Employee is employed by the Company on the date such bonus is paid by the Company.

Signing Bonus. Upon the commencement of Employee’s employment with the Company, Employee will receive a one-time signing bonus in the amount of $50,000 (the “Signing Bonus”), subject to applicable payroll deductions and withholdings. The Signing Bonus will be paid to Employee as an advance in a single lump sum in accordance with the Company’s standard payroll processes within 30 days after Employee’s Start Date, and is provided to Employee prior to Employee’s earning of such Signing Bonus. Employee will not earn the Signing Bonus unless Employee remains actively and continuously employed with the Company through the second anniversary of the Start Date. If Employee’s employment terminates under any circumstances other than due to a resignation for Good Reason or a termination without Cause by the Company, Employee agrees to repay to the Company, within thirty (30) days of the employment termination date: (i) 100% of the gross amount of the Signing Bonus if such termination occurs before the first anniversary of the Start Date.

Signing Bonus. The Company is pleased to offer you a cash signing bonus of $100,000. This bonus will be paid in one lump sum in a separate check on the next regularly scheduled pay date after you start employment with the Company. The signing bonus is taxable, and all regular payroll taxes will be withheld. In the event that you voluntarily leave the Company within 12 months of your Starting Date, you will be responsible for reimbursing the Company for the signing bonus, reduced by 1/12 for each month of employment.

ONE TIME SIGNING BONUS: You are eligible to receive a one-time signing bonus of $88,000, which will become payable upon completion of six (6) months of continuous service with the Company. The signing bonus will be paid on a regularly scheduled pay date following the six (6) month anniversary of your employment commencement date (subject to applicable withholdings and deductions). You agree that in the event that (i) you resign from the company before you have completed twenty-four (24) full months of service or (ii) the Company terminates your employment for any reason other than a reduction in force before you have completed twenty-four (24) full months of service, you will then, within seven (7) days of such resignation or termination, refund to the Company the gross amount of the signing bonus paid hereunder; however the repayment will be reduced by 25% for each 6 month period of service completed.

A signing bonus is a financial incentive offered by an employer to a prospective employee as an enticement for taking a specific job. It is typically a one-time payment provided to the individual upon signing a contract or agreement to join the company. Signing bonuses are often used in competitive job markets to attract high-quality candidates or to fill roles that are difficult to recruit for.

Example: A tech company offers a $10,000 signing bonus to a software engineer as an incentive to join their team over competing companies.

A signing bonus should be considered in several scenarios:

Example: A company offers a signing bonus to a candidate who has expressed that cost of relocation is a significant concern.

When including a signing bonus clause in a contract, clarity and detail are crucial. Here are some elements to consider:

Example clause: “The Employee shall receive a signing bonus of $5,000, payable upon commencement of employment. If the Employee voluntarily resigns or is terminated for cause within 12 months of the employment start date, the signing bonus must be repaid in full.”

Signing bonuses are commonly found in several types of contracts, including:

Example: A professional athlete’s contract includes a signing bonus as part of their multi-year agreement with a sports team.

These templates contain the clause you just read about.

Outline role details, compensation, benefits, and employment conditions in a clear and professional job offer letter.

Dive deeper into the world of clauses and learn more about these other clauses that are used in real contracts.

A Social Media Policy clause outlines the guidelines and expectations for employees' use of social media platforms, both on behalf of the company and in their personal capacity, to protect the company's reputation and confidential information. This clause typically addresses issues such as permissible content, privacy settings, and the consequences of non-compliance.

A software warranty clause outlines the guarantee provided by the software vendor that the product will function as described for a specified period, covering any defects or issues that might arise. It typically includes the vendor's obligations to repair, replace, or refund the software if it fails to meet the specified standards or performance criteria.

The "sole discretion" clause grants one party the exclusive authority to make decisions or take actions without needing approval or consent from the other party involved. This clause is often used to give flexibility and control over specific matters outlined in a contract, allowing the designated party to act based on their judgment and preferences.

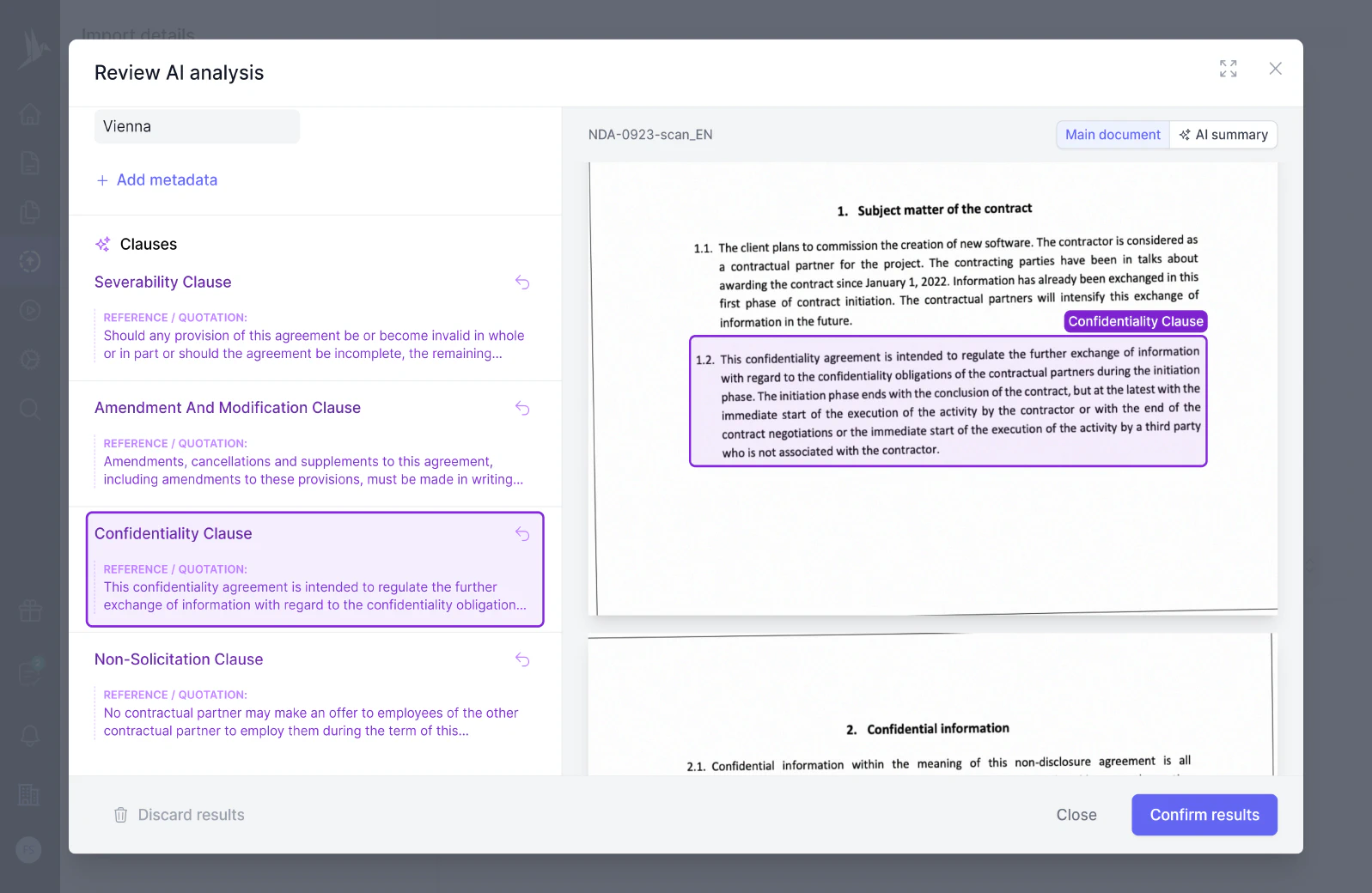

Try our AI contract analysis and extract important clauses and information from existing contracts.

< <

Fill out the form and we will get in touch with you to give you a personal, customized demo of fynk.

Greetings!

I'm Markus, co-founder of fynk. After you've submitted the form, I'll swiftly get in touch with you.

Also, right after you submit your details, you can pick a time that works best for you for our meeting.