Convertible Loan Agreement Template

Convertible loans template offer startups flexible financing that can later be converted into equity.

A prepayment clause outlines the terms under which a borrower can pay off a loan or portion of it before its due date without facing penalties. This clause often specifies any conditions or fees associated with early payments, helping borrowers manage their financial obligations more flexibly.

“Initial Prepayment” means a prepayment for Crude Oil by Buyer to Seller in the amount of $50,000,000.

“Outstanding Prepayment Volume” means, as of any date of determination, the total volume of Crude Oil to be delivered to Buyer under this Agreement as determined by the Volume Model.

“Prepayment” means either the Initial Prepayment, the Additional Prepayments or both together, as the context requires.

“Prepayment Documents” means, collectively, this Agreement, the Performance Guaranty, the Mortgages, the Parent Performance Guaranty, the Commercial Contracts, and the Final Commercial Contracts.

THE PREPAYMENTS Initial Prepayment. Subject to the other terms of this Agreement, Buyer shall pay to Seller on the Effective Date, the Initial Prepayment in exchange for Seller agreeing to deliver Initial Prepayment Volumes in such amounts within such calendar months as set forth on Schedule 2.1; provided, however, that if the Initial Prepayment Market Value of the Initial Prepayment Volumes delivered to Buyer equals or exceeds $57,500,000 prior to the Final Delivery Date, then as of such date, Seller obligation to deliver any additional volumes of Crude Oil in connection with the Initial Prepayment shall terminate effective immediately (the “Initial Maximum Valuation Threshold Termination”). Seller and Buyer have agreed to and electronically exchanged a financial model, which will determine the final volumes subject to the Initial Prepayment and the Additional Prepayments, which shall include the Volume Model Computations (the “Volume Model”). Within thirty (30) days of the Effective Date with respect to the Initial Prepayment, Seller and Buyer will obtain all other information necessary in addition to the Agreed Price Deck to mutually agree upon and insert the necessary inputs into the Volume Model, which will determine the Initial Prepayment Volumes (the “Initial Prepayment Calculation”). The Initial Prepayment Calculation will be inserted into Schedule 2.1, subject to the Initial Maximum Valuation Threshold Termination.

First Additional Prepayment. On September 30, 2020, upon the satisfaction of the First Prepayment Conditions Subsequent and following delivery of a Prepayment Request from Seller, the Buyer shall pay to Seller an additional prepayment of Crude Oil up to an amount not exceeding $100,000,000 (the “First Additional Prepayment”) in exchange for Seller agreeing to deliver the First Additional Prepayment Volumes in such amounts within such calendar months as set forth on Schedule 2.2; provided, however, that if the First Additional Prepayment Market Value of the First Additional Prepayment Volumes that has been delivered to Buyer equals or exceeds the First Additional Maximum Valuation Threshold prior to the Final Delivery Date, then as of such date, Seller’s obligation to deliver any additional volumes of Crude Oil in connection with the First Additional Prepayment shall terminate effective immediately (the “First Additional Maximum Valuation Threshold Termination”).

Second Additional Prepayment. On or before March 31, 2021, upon the mutual agreement of both Buyer and Seller to enter into the Second Prepayment, satisfaction of the Second Prepayment Conditions Subsequent and following delivery of a Prepayment Request from Seller, the Buyer shall pay to Seller an additional prepayment of Crude Oil up to an amount not exceeding $50,000,000 (the “Second Additional Prepayment”) in exchange for Seller agreeing to deliver the Second Additional Prepayment Volumes in such amounts within such calendar months as set forth on Schedule 2.4; provided, however, that if the Second Additional Prepayment Market Value of the Second Additional Prepayment Volumes that has been delivered to Buyer equals or exceeds the Second Additional Maximum Valuation Threshold prior to the Final Delivery Date, then as of such date, Seller’s obligation to deliver any additional volumes of Crude Oil in connection with the Second Additional Prepayment shall terminate effective immediately (the “Second Additional Maximum Valuation Threshold Termination”).

Determination of Second Additional Prepayment Volumes. On the Second Additional Prepayment Funding Date, Seller and Buyer will obtain all other information necessary in addition to the Agreed Price Deck to mutually agree upon and insert the necessary inputs into the Volume Model, which will determine the volumes of Crude Oil that must be delivered to Buyer associated with the Second Additional Prepayment and the Second Additional Maximum Valuation Threshold (the “Second Additional Prepayment Calculation”). The volumes from the Second Additional Prepayment Calculation will then be inserted into Schedule 2.4, subject to the Second Additional Maximum Valuation Threshold. The “Second Additional Maximum Valuation Threshold” means a dollar amount equal to the Second Additional Maximum Valuation Threshold as calculated and determined by the Volume Model. The Second Additional Maximum Valuation Threshold shall be set forth on Schedule 2.4 following the Second Additional Prepayment Calculation.

First Prepayment Conditions Subsequent. The funding of the First Additional Prepayment under this Agreement is subject to the satisfaction of the following conditions by Seller, on the one hand, and Buyer, on the other (the “First Prepayment Conditions Subsequent”): 1. The Initial Prepayment shall have occurred. 2. Representations. The Repeating Representations shall be true and correct in all material respects as of the funding of the Additional Prepayment (except to the extent such representations and warranties expressly (i) relate to an earlier date, in which case such representations and warranties shall have been true and correct in all material respects as of such earlier date or (ii) contain a materiality or Material Adverse Effect qualifier, in which case such representations and warranties shall be in true and correct in all respects). 3.No Default or Event of Default. No Default or Event of Default is continuing or shall result from the First Additional Prepayment as of the date of the Prepayment Request related to the First Additional Prepayment. 4.Prepayment Request. Buyer shall have received a Prepayment Request as and when required pursuant to Section 5.1. 5. Additional Diligence. Seller shall have provided Buyer with any reasonably requested information as provided in Section 13.7.

WHEREAS, the Borrower intends to prepay on the later of April 1, 2024 and two (2) Business Days following the Closing Date (as defined in the PSA), outstanding principal amounts under the Term Loans in the amount of $175,000,000 (the “Term Loan Prepayment”);

WHEREAS, such Term Loan Prepayment constitutes a prepayment in part, and not in whole, of the outstanding principal amounts under the Term Loans and, consequently, is prohibited under Section 2.2(c) of the Loan Agreement;

16. Prepayments. (a) The Borrower may elect to prepay all or any portion of the outstanding principal amount of any Advance made under this Bond, or to prepay this Bond in its entirety, in the manner, at the price, and subject to the limitations specified in this paragraph 16 (each such election being a "Prepayment Election"). (b) For each Prepayment Election in which the Borrower elects to prepay a particular amount of the outstanding principal of an Advance, the Borrower shall deliver to RUS written notification of the respective Prepayment Election, in the form of notification attached to this Bond as Annex 2-A (each such notification being a "Prepayment Election Notice"), making reference to the Advance Identifier that FFB assigned to the respective Advance (as provided in the Bond Purchase Agreement) and specifying, among other things, the following:

For each Prepayment Election in which the Borrower elects to have a particular amount of funds applied by FFB toward the prepayment of the outstanding principal of an Advance, the Borrower shall deliver to RUS written notification of the respective Prepayment Election, in the form of notification attached to this Bond as Annex 2-B (each such notification also being a "Prepayment Election Notice"), making reference to the Advance Identifier that FFB assigned to the respective Advance (as provided in the Bond Purchase Agreement) and specifying, among other things, the following: (1) the particular date on which the Borrower intends to make the prepayment on such Advance (such date being the "Intended Prepayment Date" for such Advance), which date: (A) must be a Business Day; and (B) for any Advance for which the Borrower has selected a fixed premium prepayment/refinancing privilege that includes a 5-year No-Call Period, may not be a date that will occur before the applicable First Call Date; and (2) the particular amount of funds that the Borrower elects to be applied by FFB toward a prepayment of the outstanding principal amount of such Advance. To be effective, a Prepayment Election Notice must be approved by RUS in writing, and such Prepayment Election Notice, together with written notification of RUS's approval thereof, must be received by FFB on or before the fifth Business Day before the date specified therein as the Intended Prepayment Date for the respective Advance or Portion.

Payment of the Prepayment Price for any Advance, any Portion of any Advance, or this Bond in its entirety shall be due to FFB before 3:00 p.m. (Washington, DC, time) on the Intended Prepayment Date for such Advance or Portion or this Bond, as the case may be. Each prepayment of a Portion shall, as to the principal amount of such Portion, be subject to a minimum amount equal to $100,000.00 of principal. The Borrower may make more than one Prepayment Election with respect to an Advance, each such Prepayment Election being made with respect to a different Portion of such Advance, until such time as the entire principal amount of such Advance is repaid in full.

Prepayment refers to the settlement of a financial obligation or debt before it is due. This can occur in various forms, such as the payment of a loan, mortgage, or other forms of credit obligation ahead of the scheduled payment plan. Prepayments may be voluntary or required under certain contract terms. They can be beneficial in reducing interest liabilities or avoiding penalties associated with unpaid balances.

Prepayment should be considered in the following scenarios:

Interest Savings: Utilizing prepayment can significantly reduce the total interest paid over the life of a loan. By reducing the principal balance sooner, borrowers save on the interest that would accrue on that balance.

Debt-Free Goal: If you aim to become debt-free sooner, prepayment is a useful strategy. It accelerates the fulfillment of your obligation and can provide peace of mind.

Penalty Avoidance: If a contract specifies penalties for late payments, prepaying can help avoid these penalties, maintaining a good credit rating.

Variable Rate Loans: If you have a variable interest rate loan and expect a rise in interest rates, prepaying can minimize increased interest payments.

Writing about prepayment, particularly in a contractual or financial context, should include:

Define the Terms: Clearly outline what constitutes a prepayment, including acceptable methods and the effective date of any prepayment.

Detail the Procedure: Explain the process for making a prepayment, ensuring the inclusion of any notices or documentation required to process the prepayment.

Outline Benefits and Penalties: Specify any associated benefits such as reduced interest payments, along with any penalties or fees for prepayment, which some loans might include as a “prepayment penalty.”

Provide Examples: Use examples to illustrate how prepayment affects the financial obligation, for instance:

“A borrower with a 30-year fixed mortgage chooses to make additional payments each month. This reduces the principal balance quicker and shortens the loan term, saving thousands in interest.”

Prepayment clauses can be found in various contracts, most notably:

In each of these contracts, understanding the specific terms of prepayment is crucial, as they can significantly impact financial outcomes.

These templates contain the clause you just read about.

Convertible loans template offer startups flexible financing that can later be converted into equity.

A comprehensive and flexible master promissory note template covering repayment terms, collateral, default provisions, and key lender protections.

A customizable unsecured loan agreement template outlining loan terms, repayment conditions, interest rates, default provisions, and dispute resolution.

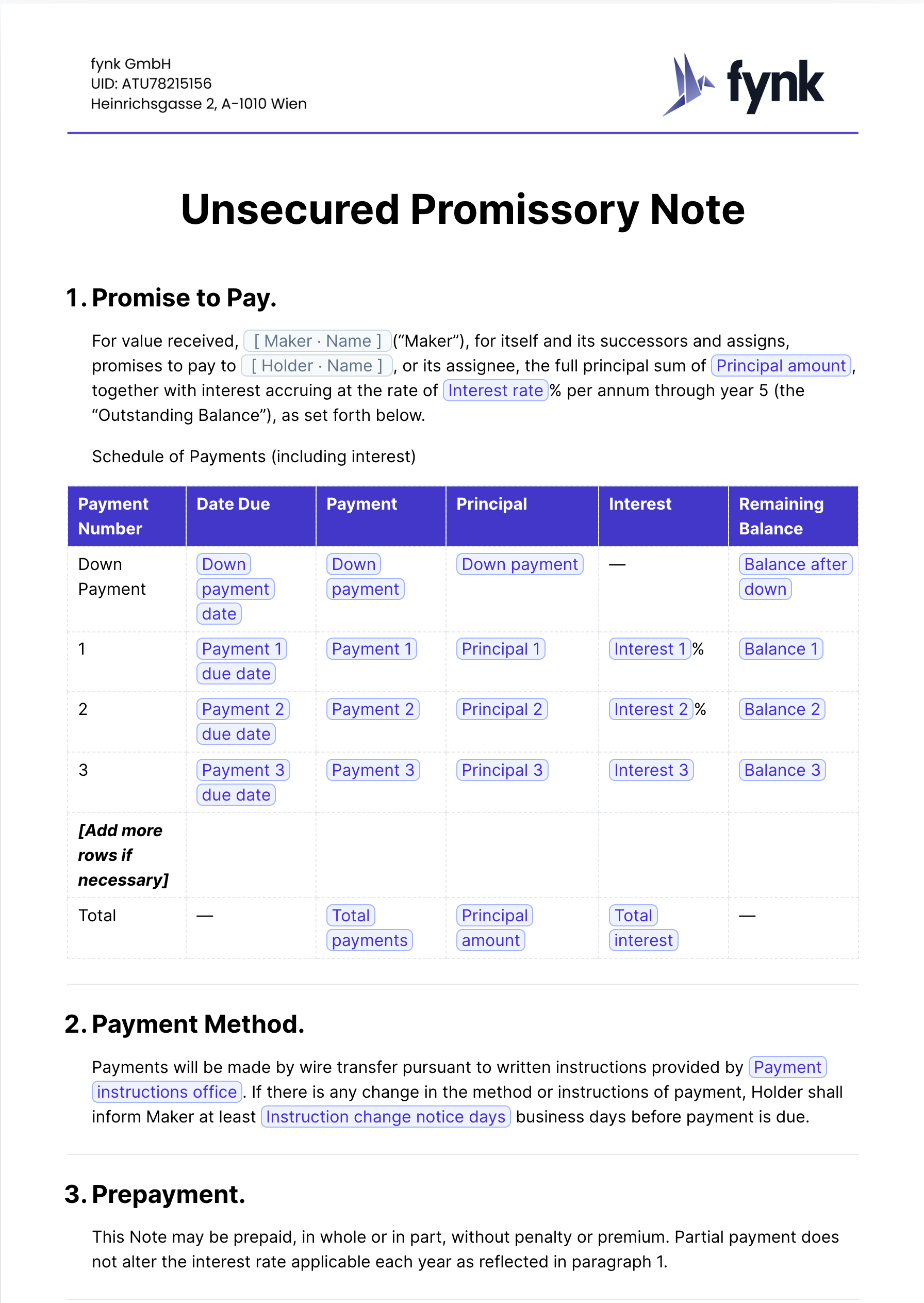

A straightforward promissory note template for documenting loans without collateral between individuals or businesses.

Dive deeper into the world of clauses and learn more about these other clauses that are used in real contracts.

The "prevailing market rate" clause refers to a contractual agreement where the payment or pricing is determined based on the current average rate for similar goods or services in the relevant market at the time of the transaction or service. This clause ensures that the pricing remains fair and competitive by aligning with existing market conditions, accommodating fluctuations over the duration of the contract.

The "prevailing parties" clause stipulates that the party who wins a legal dispute or arbitration is entitled to recover certain costs, such as attorney fees and court expenses, from the losing party. This clause incentivizes parties to consider the potential financial implications before pursuing litigation or arbitration.

The Price Changes clause specifies the conditions under which the price of goods or services in a contract may be adjusted, including factors like market fluctuations, currency exchange rates, or cost of materials. It often outlines the notice requirements and processes for implementing such changes to ensure transparency and agreement between the parties involved.

Try our AI contract analysis and extract important clauses and information from existing contracts.

< <

Fill out the form and we will get in touch with you to give you a personal, customized demo of fynk.

Greetings!

I'm Markus, co-founder of fynk. After you've submitted the form, I'll swiftly get in touch with you.

Also, right after you submit your details, you can pick a time that works best for you for our meeting.