Employment Contract Template

An employment contract is a legally binding document that defines the working relationship between an employer and an employee.

A performance bonus clause outlines the conditions under which an employee or contractor is eligible for additional compensation based on exceeding predefined performance metrics or achieving specific targets. This incentive is designed to motivate individuals to enhance productivity and align their efforts with the organization's strategic objectives.

Emergence Performance Bonuses. Subject to the provisions of the Plan and any Participation Agreement, each Participant will earn an Emergence Performance Bonus as of the Emergence Date, depending upon the extent to which the Emergence Performance Goals have been achieved.

Quarterly Performance Bonus. Subject to the provisions of this Plan, each Participant shall be eligible to earn a Quarterly Performance Bonus as of the end of each Quarter. Subject to the provisions of this Section 6, the actual amount payable with respect to a given Quarter (the “Quarterly Performance Bonus”) is equal to the Quarterly Performance Bonus Amount as calculated pursuant to the chart below and adjusted, upwards or downwards, by the amount of a True-Up or True-Down, as defined and described below. Calculation of Quarterly Performance Bonus Amount. The Quarterly Performance Bonus Amount, if any, is calculated as the sum of the amounts determined payable for each Performance Metric for the applicable Quarter, based on the level of achievement of the applicable Performance Metric in such Quarter as assessed against Quarterly Performance Goals.

Adjustment of Quarterly Performance Bonus Amount. Once the Quarterly Performance Bonus Amount is determined, the actual Quarterly Performance Bonus payable is calculated by applying the applicable adjustment, if any, described below. In order to determine whether an adjustment will apply, performance with respect to each Performance Metric for the period commencing on January 1, 2019 and expiring on the last day of the applicable Quarter (for each Quarter, the applicable “YTD Performance Period”) will be assessed and determined in a manner consistent with the calculation of the Quarterly Performance Bonus Amount. If the Quarterly Performance Bonus Amount as determined pursuant to the achievement of the Quarterly Performance Goals is less than the amount that would be payable for a Quarter based on the achievement of the YTD Performance Goals through such date, the Quarterly Performance Bonus will be increased to a level equal to the amount payable with respect to the achievement of the YTD Performance Goals for such Quarter (the “True-Up”); provided, that, no additional True-Up addition will be provided for performance in excess of the Quarterly Maximum Performance Goal. Conversely, if the Quarterly Performance Bonus Amount as determined pursuant to the achievement of the Quarterly Performance Goals is greater than the amount that would be payable for a Quarter based on the achievement of the YTD Performance Goals through such date, the Quarterly Performance Bonus will be decreased to a level equal to the amount payable with respect to the achievement of the YTD Performance Goals for such Quarter (the “True-Down”); provided, that, no additional True-Down reduction will be provided for performance below the Quarterly Threshold Performance Goal. For the avoidance of doubt, if the calculations for the Quarterly Performance Bonus Amount and with respect to the achievement of YTD Performance Goals for any Quarter result in the same number, no such adjustment will be made.

Limitation on Adjustment of Quarterly Performance Bonus Amount. Notwithstanding the foregoing, in the event that the level of achievement of a Performance Metric in a Quarter is determined to be below the Quarterly Threshold Performance Goal, then no portion of the Quarterly Performance Bonus shall be payable with respect to such Performance Metric in the applicable Quarter. Moreover, in the event the level of achievement of a Performance Metric in a Quarter is equal to or in excess of the Quarterly Threshold Performance Goal, but less than or equal to the Quarterly Target Performance Goal, the portion of the Quarterly Performance Bonus payable with respect to such Performance Metric shall not be less than the portion of the Quarterly Performance Bonus determined to be payable with respect to such Performance Metric based on the achievement level of the Quarterly Performance Goal. In addition, in the event that the level of achievement of a Performance Metric in a Quarter is in excess of the Quarterly Target Performance Goal, the portion of the Quarterly Performance Bonus payable with respect to such Performance Metric shall not be less than the portion of the Quarterly Performance Bonus determined to be payable with respect to such Performance Metric based on the achievement of the Quarterly Target Performance Goal.

Quarterly Performance Bonus. Your Quarterly Target Bonus amount in respect of each Quarter is $___________.

Performance Bonus Performance Measure. Your Quarterly Performance Bonus, if any, is calculated in accordance with the terms of the Plan and based on the achievement of Quarterly and YTD Performance Goals, as applicable and as set forth on Schedule A of the Plan, and subject to adjustment or possible recovery as described in the Plan.

2020 and 2021 Performance Bonus Opportunity. For the fiscal years commencing on January 1, 2020 and January 1, 2021, Executive shall be eligible to receive a performance-based bonus award (the “Performance Bonus”) in a range between Twenty-Five percent (25%) and One Hundred Twenty-Five percent (125%) of the Base Salary, based upon the level of EBITDA (defined below) achieved by the Company for such fiscal year prior to deduction of bonus expenses and one-time non-recurring costs for initiatives approved by the Board (each an “EBITDA Target Amount”), as determined by the Compensation Committee, and subject to the terms and conditions set forth herein (the Performance Bonus for fiscal year 2020 is referred to as the “2020 Performance Bonus and the Performance Bonus for fiscal year 2021 is referred to as the “2021 Performance Bonus”.)

The Company shall pay any 2020 Performance Bonus due Executive hereunder for the fiscal year commencing January 1, 2020 in cash, subject to any required tax withholding, in 2021, not later than twenty-one (21) business days following the date on which the Auditors’ final report on the Company’s financial statements for fiscal year 2020 is issued and delivered to the Company and in any event not later than April 30, 2021 (the “2020 Performance Bonus Award Date”). Except as otherwise provided herein, Executive must be employed on the 2020 Performance Bonus Award Date to be eligible to receive the 2020 Performance Bonus, or any portion thereof, for such fiscal year.

Performance Bonus Award. The total cash payment available for each Participant in the ERB-Plan during the Performance Period amounts to 75% of the total ERB-Value established for each Participant in the ERB-Plan. As the Performance Period includes four (4) separate six-month performance periods, the value of the Performance Bonus Award available for each Participant in a given six-month performance period is one quarter (1/4) of the total Performance Bonus Award cash payment available for each Participant in the ERB-Plan during the corresponding six-month performance period of the Performance Period.

Performance Bonus Award Determination. After the end of a given six-month performance period, the Committee shall approve the extent to which the Performance Targets relative to the Performance Measures used during such given six-month performance period were achieved by the Participants to the ERB-Plan. The Performance Bonus Award for such given six-month performance period for each Participant shall be determined according to the level of actual performance. The Committee, at its sole discretion, may eliminate, reduce, or increase the Performance Bonus Award payable to any Participant below or above that which otherwise would be payable.

Performance Bonus Award Timing. The Company shall pay a Performance Bonus Award to a Participant, less applicable withholdings and deductions, as soon as is administratively practicable following the determination and written certification by the Committee to the degree that the Performance Targets, relative to the Performance Measures, were achieved during a given six-month performance period, but in no event later than sixty (60) days following the end of the applicable portion of the Performance Period.

A performance bonus is a form of additional compensation awarded to employees based on their performance and contribution to the company’s success. It is often used as an incentive to encourage and reward employees who exceed set targets or demonstrate exceptional work. Performance bonuses can be distributed annually, quarterly, or even monthly, depending on the company’s policy and the nature of the work.

A performance bonus should be used when:

Writing a performance bonus involves clearly articulating the criteria, structure, and expectations associated with the bonus. Key elements to consider include:

Define Clear Objectives: Establish specific, measurable, attainable, relevant, and time-bound (SMART) goals that trigger the bonus.

Example:

Employees will be eligible for a performance bonus if they exceed the quarterly sales target by 20%.

Determine Bonus Structure: Decide if the bonus will be a fixed amount, a percentage of salary, or a percentage of profits.

Specify Eligibility Criteria: Mention who qualifies for the bonus, i.e., all departments, specific roles, or individual performers.

Communicate Processes: Explain how the performance will be evaluated and who will conduct the assessment.

Example:

Performance evaluations will be conducted by department heads at the end of each quarter based on key performance indicators (KPIs).

Outline Payment Schedule: Provide information regarding when the bonuses will be paid, e.g., quarterly, annually, etc.

Include Terms and Conditions: List any terms and conditions, such as clauses about underperformance, company-wide financial health, or changes in employment status.

Performance bonuses are typically included in the following types of contracts:

These bonuses are outlined in detail within the contract to ensure clarity and mutual understanding between the employer and the employee.

These templates contain the clause you just read about.

An employment contract is a legally binding document that defines the working relationship between an employer and an employee.

Dive deeper into the world of clauses and learn more about these other clauses that are used in real contracts.

A performance guarantee is a contractual clause that ensures one party fulfills their obligations as specified, often by providing financial assurance or a form of security. It serves to protect the other party against losses or damages if the obligations are not met satisfactorily.

A performance warranty clause is a contractual provision where the seller or service provider guarantees that their goods, services, or work will meet specified performance standards or criteria. If these standards are not met, the clause typically outlines the remedies or corrective actions that the buyer can pursue.

The "Period of Duration" clause in a contract specifies the length of time the agreement will remain in effect, detailing the start and end dates, and any conditions under which the duration may be extended or shortened. This clause is crucial for establishing the temporal boundaries and can also include provisions for automatic renewal or termination based on certain criteria.

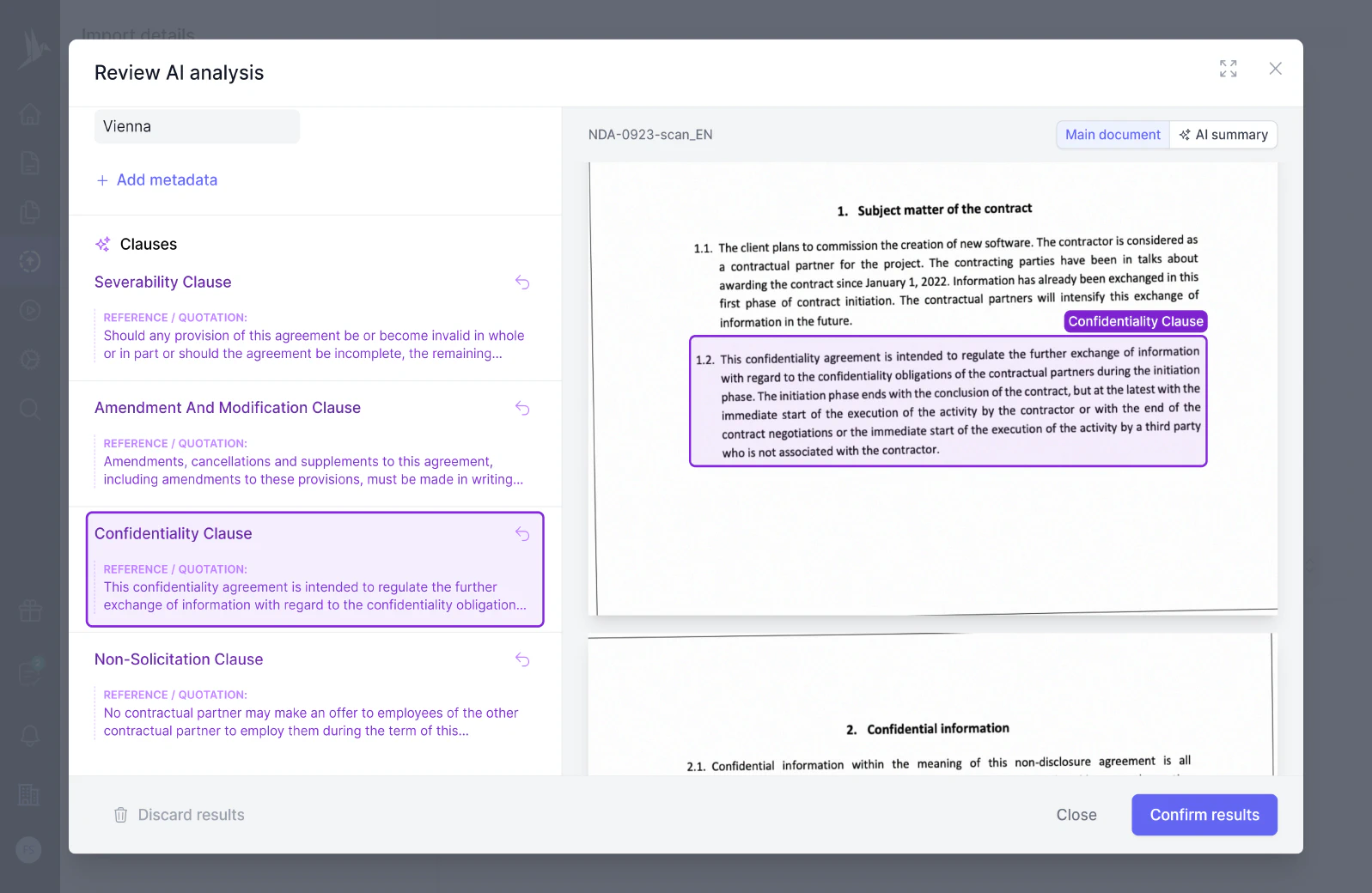

Try our AI contract analysis and extract important clauses and information from existing contracts.

< <

Fill out the form and we will get in touch with you to give you a personal, customized demo of fynk.

Greetings!

I'm Markus, co-founder of fynk. After you've submitted the form, I'll swiftly get in touch with you.

Also, right after you submit your details, you can pick a time that works best for you for our meeting.