Convertible Loan Agreement Template

Convertible loans template offer startups flexible financing that can later be converted into equity.

A Late Payment Penalty clause stipulates that if a payment is not made by its due date, the party responsible for the payment will incur an additional fee or penalty. This clause incentivizes timely payments and compensates the payee for any inconvenience or financial impact caused by the delay.

A late payment penalty of $10,000 per day will be due if the initial $500,000 is not paid by April 13, 2020 and a late payment penalty of $5,000 per day will be due if the $1,000,000 is not paid by May 6, 2020.

8.2. Tenant is deemed breaching this agreement if tenant fails to pay the rent, deposit and other fee on time in accordance with this agreement and any other agreed supplemental clauses. Landlord reserves the right to charge late payment penalty during the overdue period. If the overdue period is less than 7 days, 1% late payment penalty per day is applied on the overdue amount; If the overdue is more than 7 days but less than 10 days, an additional 2% late payment penalty per day is applied on the overdue amount; If the overdue is more than 10 days, landlord reserves the right to seize the leased office and all properties remain in the leased office within 24 hours. If tenant fails to pay 2 days after the seizure, it is deemed as tenant voluntarily surrender all his/her rights in this agreement and the title right of all the properties remain in the leased office, which landlord reserves the right to terminate this agreement, clear the leased office, dispose all properties remain in the leased office, enter a new lease with others, and seek compensation from tenant. Tenant is responsible for his/her loss as a result of this clause.

5.2 If any part of the Loan is not repaid by the Repayment Date, the Borrower shall pay to the Lender late payment penalty at the rate of 4% per annum in addition to the Interest Rate on such Loan amount that remains outstanding from the Repayment Date until the date of actual payment of the Loan Sum and accrued interest in full (“Late Payment Penalty”). For the avoidance of doubt, the Late Payment Penalty shall be calculated based on the following: (USD500,000 + accrued interest up to Repayment Date) x 22% x (number of days after Repayment Date until the date of actual payment of the Loan and accrued interest in full / 365 days)

On April 20, 2020, the holder of the Note agreed to extend the due date for the $1,000,000 payment from May 6, 2020 to June 15, 2020. In consideration for extending the repayment date for the second amount to June 15, 2020, the Company issued to the note holder 200,000 shares of its common stock, and warrants to purchase 200,000 shares of the Company’s common stock. The warrants are exercisable at a price of $2.00 per share and expire January 1, 2025. A late payment penalty of $5,000 per day will be due if the $1,000,000 is not paid by June 15, 2020.

A late payment penalty of $5,000 per day will be due if the $1,000,000 is not paid by July 15, 2020. On July 14, 2020, the holder of the Note agreed to extend the due date for the $1,000,000 payment to August 15, 2020. In consideration for extending the repayment date for the second amount to August 15, 2020, the Company issued the note holder 100,000 shares of its common stock, and warrants to purchase 100,000 shares of the Company's common stock. The warrants are exercisable at a price of $2.00 per share and expire January 1, 2025.

9.2. Tenant is deemed breaching this agreement if tenant fails to pay the rent, deposit and other fee on time in accordance with this agreement and any other agreed supplemental clauses. Landlord reserves the right to charge late payment penalty during the overdue period. If the overdue period is less than 7 days, 1% late payment penalty per day is applied on the overdue amount; If the overdue is more than 7 days but less than 10 days, an additional 2% late payment penalty per day is applied on the overdue amount; If the overdue is more than 10 days, landlord reserves the right to seize the leased office and all properties remain in the leased office within 24 hours. If tenant fails to pay 2 days after the seizure, it is deemed as tenant voluntarily surrender all his/her rights in this agreement and the title right of all the properties remain in the leased office, which landlord reserves the right to terminate this agreement, clear the leased office, dispose all properties remain in the leased office, enter a new lease with others, and seek compensation from tenant. Tenant is responsible for his/her loss as a result of this clause.

To the extent there is a late payment penalty that is not due to the obligor’s error or omission, such late payment penalty would be paid by PGIM RELS or CoreLogic, depending on the circumstances giving rise to the late payment.

LATE PAYMENT PENALTY Payment is due within FIVE (5) days of due date, after which there will be a late payment fee of $4,400.00, 10% of the monthly payment of $44,000.00.

A late payment penalty is a fee or charge imposed on a payor for failing to make a required payment by the specified due date. This penalty serves as compensation for the inconvenience and potential financial impact caused by the delay. It also acts as a deterrent, encouraging timely payments.

You should use a late payment penalty in contracts or agreements where timely payments are critical to the financial health and stability of the business. This is especially important if delayed payments could cause significant disruptions to cash flow, incurring additional costs, or affecting service delivery.

When writing a late payment penalty, clarity and precision are key. Here’s a template you can use as a guideline:

Late Payment Penalty Clause: If any payment due to [Party Name] is not received by the due date, [Other Party Name] agrees to pay a late payment penalty of [amount or percentage] per [day/week/month] of delay. This penalty shall be in addition to and not in lieu of any other remedies available under this agreement.

Contracts that typically contain a late payment penalty include:

Including late payment penalties in these contracts helps maintain discipline and predictability in financial transactions.

These templates contain the clause you just read about.

Convertible loans template offer startups flexible financing that can later be converted into equity.

A detailed financial lease agreement template that sets out loan terms, repayment schedules, security interests, and obligations of both lender and client.

Purchase order templates streamline procurement by providing a consistent format for specifying product requirements, pricing, delivery and payment terms.

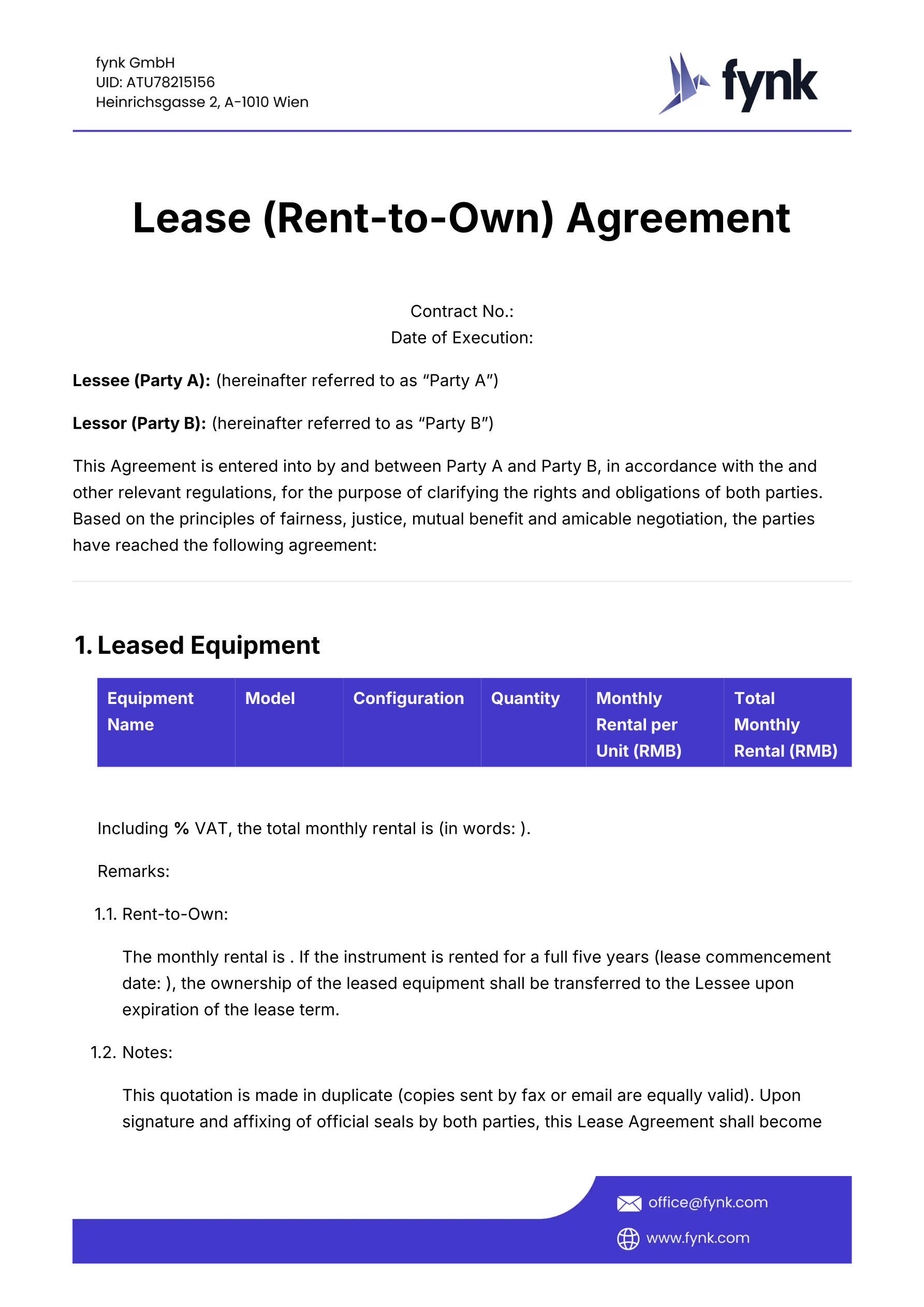

A practical rent-to-own equipment lease agreement template that defines the terms of leasing, payment schedules, maintenance, and ownership transfer.

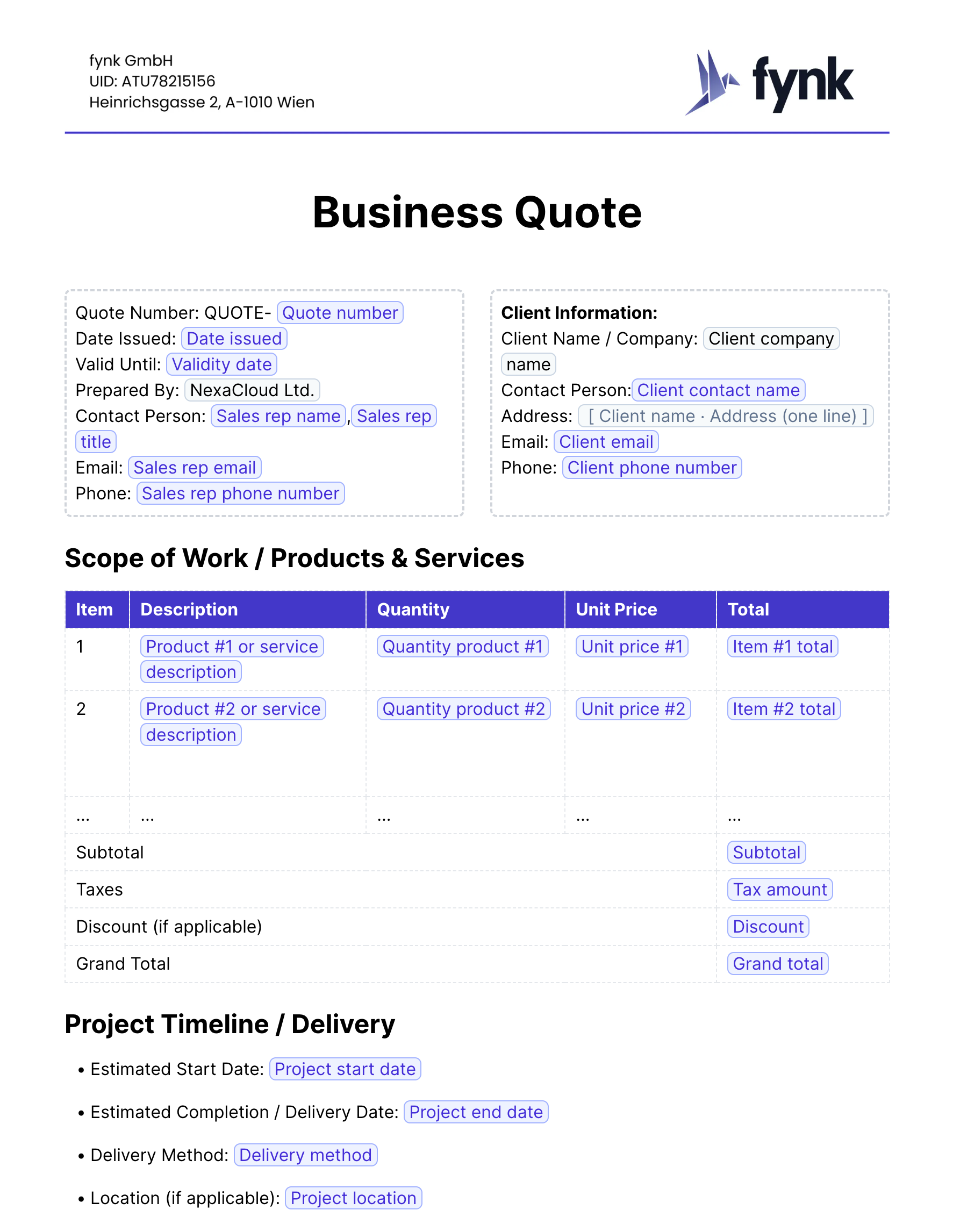

An easy-to-use, professional sales quote template designed to streamline your quotation process, clarify pricing details, and close deals faster.

A comprehensive sponsorship agreement template outlining rights, benefits, fees, and obligations between a professional sports team and a sponsor.

Dive deeper into the world of clauses and learn more about these other clauses that are used in real contracts.

The "Launch Date" clause specifies the exact date on which a product, event, or service is officially introduced to the market or public. It outlines any associated obligations or expectations for the parties involved to ensure that all necessary preparations are completed by this stipulated date.

A Lead Warning Statement is a mandatory notice included in contracts, particularly in real estate and rental agreements, stipulating that properties built before 1978 may contain lead-based paint, which poses health risks. This clause usually alerts tenants or buyers about the potential for lead exposure and outlines their rights to information and necessary precautions.

A lease renewal clause outlines the terms and procedures for extending a lease agreement beyond its original expiration date, often specifying conditions such as rental rate adjustments, renewal notice periods, and any changes to the original lease terms. This clause provides both the landlord and tenant with a framework for continuing the lease relationship under mutually agreed-upon terms.

Try our AI contract analysis and extract important clauses and information from existing contracts.

< <

Fill out the form and we will get in touch with you to give you a personal, customized demo of fynk.

Greetings!

I'm Markus, co-founder of fynk. After you've submitted the form, I'll swiftly get in touch with you.

Also, right after you submit your details, you can pick a time that works best for you for our meeting.