Booking Agreement Template for professional Wrestling

Define performer rights, payments, IP, and exclusivity with a customizable booking agreement for artists, athletes, or influencers.

An independent contractor relationship clause defines the working relationship between parties, specifying that the contractor operates autonomously and is not an employee of the hiring party. This clause clarifies that the contractor is responsible for their own taxes, insurance, and adherence to laws, and it delineates the absence of benefits typically associated with employment.

Further, the agreement that you entered into with an individual to provide services does not create an employee relationship, but an independent contractor relationship with no obligation to provide services.

Materials Created During Consultant’s Independent Contractor Relationship with the Company. Consultant hereby expressly represents and agrees that all Materials created, conceived, originated, developed, adopted, improved or reduced to practice by Consultant in the course and scope of Consultant’s independent contractor relationship with the Company pursuant to this Agreement, whether solely or in collaboration with others during such relationship, are forever solely and exclusively the property and/or intellectual property of Life Time. Consultant hereby assigns to the Company all rights to such Materials. If any Materials are not considered a works made for hire owned by Company by operation of law, Consultant assigns the ownership of copyrights in such works to Company.

Independent Contractor Relationship. This Agreement is intended to create an independent contractor relationship between Consultant and Company.

Independent Contractor Relationship. This Agreement is intended to create an independent contractor relationship between Consultant and Company, which is described in Section 3508 of the Internal Revenue Service Code, and shall be interpreted to effectuate such intent between the parties.

Independent Contractor Relationship. (a)An independent contractor relationship shall exist between the Company and Consultant. Consultant is neither an agent nor an employee of the Company. Consultant has the authority to control and direct the performance of the details of the Consulting Services, as governed by Consultant’s own independent judgment and discretion. In a manner that meets the business needs of the Company, Consultant shall: (i) work with the Company to determine how the Consulting Services are performed, in a manner mutually agreeable to both parties; (ii) be responsible for hiring, training, assigning work to, compensating, and supervising Consultant’s own employees or agents; (iii) work with the Company to determine the order or sequence in which tasks are performed related to the Consulting Services; (iv) at Consultant’s expense, provide Consultant’s own labor, materials, equipment, tools, supplies, and other items necessary for performing the Consulting Services; and (v) maintain Consultant’s own work facility, except, for purposes of Company data security and privacy protocols, the Company may provide Consultant a laptop solely for the use of services provided to the Company under this agreement.

Independent Contractor Relationship. It is specifically agreed that the relationship of the parties hereto shall be that of a company and an independent contractor, and not that of an employer-employee. Therefore, the parties specifically agree that Company shall have the right of control only to the extent of determining the results to be accomplished by Contractor, but not as to the details and means by which those results shall be accomplished. Contractor is not an employee of Company. Contractor shall be solely responsible for unemployment compensation contributions, all benefits and any other payroll tax matters as they relate to Contractor.

Independent Contractor Relationship. Nothing contained in this Agreement will be deemed to constitute Consultant an employee of Agios, it being the intent of the parties to establish an independent contractor relationship, nor will Consultant have authority to bind Agios in any manner whatsoever by reason of this Agreement. Consultant will at all times while on Agios premises observe all security and safety policies of Agios. Consultant will bear sole responsibility for paying and reporting its own applicable federal and state income taxes, social security taxes, unemployment insurance, workers’ compensation, and health or disability insurance, retirement benefits, and other welfare or pension benefits.

Independent Contractor Relationship. This Agreement is intended to create an independent contractor relationship between Consultant and Company.

Independent Contractor Relationship. (a) Advisor’s relationship with Company is that of an independent contractor, and nothing in this Agreement is intended to, or shall be construed to, create a partnership, agency, joint venture, employment or similar relationship. Advisor will not be entitled to any of the benefits that Company may make available to its employees, including, but not limited to, group health or life insurance, profit-sharing or retirement benefits, vacation days, sick days, or holidays. Advisor is not authorized to make any representation, contract or commitment on behalf of Company unless specifically requested or authorized in writing to do so by a Company manager. Advisor is solely responsible for, and will file, on a timely basis, all tax returns and payments required to be filed with, or made to, any federal, state or local tax authority with respect to the performance of services and receipt of fees under this Agreement. Advisor is solely responsible for, and must maintain adequate records of, expenses incurred in the course of performing services under this Agreement. No part of Advisor’s compensation will be subject to withholding by Company for the payment of any social security, federal, state or any other employee payroll taxes. Advisor is solely responsible for and assumes full responsibility for (as applicable) the payment of FICA, FUTA and income taxes and compliance with any other international, federal, state, or local laws, rules and regulations. Company will regularly report amounts paid to Advisor by filing Form 1099-MISC with the Internal Revenue Service as required by law. (b) Company understands and agrees that Advisor shall render services in whatever manner deemed appropriate by Advisor. During the term of this Agreement, Advisor agrees to perform the services on a professional best-efforts basis, in accordance with all applicable laws and regulations and in accordance with the highest applicable industry standards. (c) Company shall not control or direct, nor shall the Company have any right to control or direct, the result of or the details, methods, manner or means by which Advisor performs his or her business or services, except that Advisor shall coordinate services with the Company, shall provide services in accordance with generally accepted industry standards and in compliance with all international, federal, state, and local laws. (d) Advisor has and will at all times retain the exclusive right to control and direct the method, details, and means of performing the services under this Agreement. Company shall not specify the amount of time required to perform individual aspects of the services. Advisor’s services are not exclusive to the Company, and Advisor may render services for other business entities.

Independent Contractor Relationship. Nothing contained in this Agreement shall be deemed to constitute Consultant an employee of Company, it being the intent of the parties to establish an independent contractor relationship, nor shall Consultant have authority to bind Company in any manner whatsoever by reason of this Agreement. Consultant shall at all times while on Company premises observe all security and safety policies of Company. Consultant shall bear sole responsibility for paying and reporting its own applicable federal and state income taxes, social security taxes, unemployment insurance, workers’ compensation, and health or disability insurance, retirement benefits, and other welfare or pension benefits, if any, and shall indemnify and hold Company harmless from and against any liability with respect thereto. Consultant shall provide all required tax information, including without limitation, where applicable, the IRS Form W-9 “Request for Taxpayer Identification Number and Certification.” Failure to provide such information may result in withholding of payments to Consultant.

An Independent Contractor Relationship is a business agreement where a person or entity (the independent contractor) is engaged to perform specific tasks or services for another party (the client) while retaining control over how the work is executed. Unlike employees, independent contractors operate under their own business structure, manage their own taxes, and do not receive benefits such as health insurance from the hiring party.

Common characteristics of an independent contractor include:

Example: A freelance graphic designer hired by a company to create website graphics is an independent contractor, not an employee.

An Independent Contractor Relationship should be used when:

Example: A tech startup might hire a software developer as an independent contractor to build a specific app feature rather than hiring a full-time developer.

To write an effective Independent Contractor Agreement, include the following elements:

Example:

This Independent Contractor Agreement (“Agreement”) is made and entered into by and between [Client Name], located at [Client Address], and [Contractor Name], located at [Contractor Address].

Contracts that typically establish an Independent Contractor Relationship include:

Example: A marketing firm might enter into a service agreement with a content creator to produce social media content on a project basis.

These templates contain the clause you just read about.

Define performer rights, payments, IP, and exclusivity with a customizable booking agreement for artists, athletes, or influencers.

Define rights, payments, and image use terms for athlete, celebrity, or influencer endorsements with this customizable contract.

A clear retainer agreement defining scope, hours, pay, confidentiality, non-solicitation, and contractor status for post-employment consulting.

Dive deeper into the world of clauses and learn more about these other clauses that are used in real contracts.

An independent contractor clause establishes the relationship between the parties, specifying that the contractor is not an employee and will work independently, managing their own schedule and methods of completing the work. This clause typically outlines the responsibilities of the contractor, their lack of entitlement to employee benefits, and their obligation to pay their own taxes.

The injunctive relief clause is a contractual provision that allows a party to seek a court-ordered injunction to prevent the other party from engaging in specific actions that could cause irreparable harm. This clause is often included to protect intellectual property, confidentiality, or other critical interests by quickly addressing potential breaches or violations through judicial intervention.

The "Inspection and Acceptance" clause outlines the buyer's right to examine and evaluate the goods or services provided by the seller before formally accepting them. This clause typically includes the process, timeline, and conditions under which the buyer can reject goods or services that do not meet specified quality or performance standards.

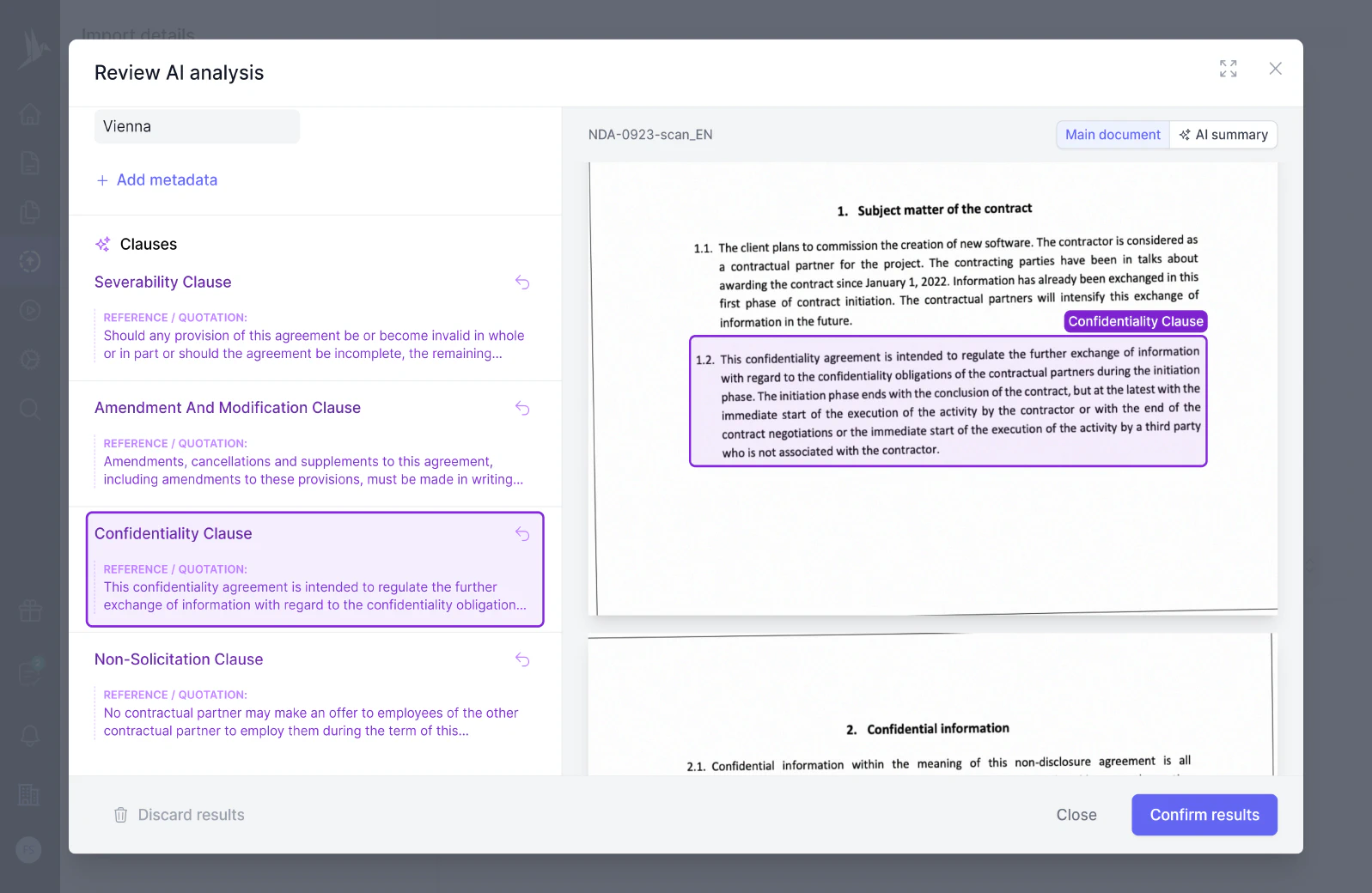

Try our AI contract analysis and extract important clauses and information from existing contracts.

< <

Fill out the form and we will get in touch with you to give you a personal, customized demo of fynk.

Greetings!

I'm Markus, co-founder of fynk. After you've submitted the form, I'll swiftly get in touch with you.

Also, right after you submit your details, you can pick a time that works best for you for our meeting.