Brokerage Agreement Template

A sound brokerage agreement template that defines broker roles, fees, confidentiality, indemnification, and termination rights for SMEs.

An independent contractor clause establishes the relationship between the parties, specifying that the contractor is not an employee and will work independently, managing their own schedule and methods of completing the work. This clause typically outlines the responsibilities of the contractor, their lack of entitlement to employee benefits, and their obligation to pay their own taxes.

The Company hereby engages the Independent Contractor, and the Independent Contractor accepts the engagement to provide the Company with such consulting services as may reasonably be requested by the Company from time to time in connection with the Company’s PRINT® Product Platform and associated tooling, materials, and prototyping (“Services”). “PRINT® Product Platform” shall mean Liquidia’s proprietary products, micro and/or nano-particles, patterned particle molding film, particle and mold film handling, and Liquidia’s instrumentation, processes, systems, know-how, intellectual property, manufacturing and technology infrastructure that produces the same. In particular, through the Independent Contractor’s services under this Agreement, its managing member, Steve Bariahtaris, shall be made available and appointed to and serve as the Company’s Interim Chief Financial Officer and the Company’s Principal Financial Officer for purposes of the Company’s periodic SEC reporting obligations (collectively, the “Interim Chief Financial Officer”).

The Independent Contractor will be reimbursed for ordinary and necessary expenses incurred by the Independent Contractor in the performance of services hereunder that have been expressly approved in advance by the Company, provided that the Independent Contractor has furnished such documentation for authorized expenses as the Company may reasonably request. The Independent Contractor shall submit written documentation and receipts where available, itemizing the dates on which expenses are incurred. The Company shall pay the Independent Contractor the amounts due pursuant to submitted reports.

The Independent Contractor represents and warrants that the Independent Contractor has the right and unrestricted ability to enter this Agreement and all its terms and conditions contained herein.

The Independent Contractor certifies to the best of the Independent Contractor’s knowledge and belief that Independent Contractor: A. Is not presently debarred or convicted for a crime for which Independent Contractor can be debarred under the Generic Drug Enforcement Act of 1992 (21USC335a)(the “Act”); B. Is not presently indicted or otherwise criminally or civilly charged by a government entity (Federal or State) with commission of the kinds of conduct for which Independent Contractor can be debarred under the Act; C. Will not knowingly employ or otherwise engage any individual who has been (i) debarred or (ii) convicted of a crime for which a person can be debarred under the Act, in any capacity in connection with the activities of developing or reporting data which may become part of an application for approval of a drug or biologic.

7. INDEPENDENT CONTRACTOR RELATIONSHIP. The Independent Contractor’s relationship with the Company is that of an independent contractor, and nothing in this Agreement is intended to, or should be construed to, create a partnership, agency, joint venture or employment relationship. The Independent Contractor shall not be entitled to any of the benefits that the Company may make available to its employees, including, but not limited to, group health or life insurance, profit sharing, or retirement benefits, except as expressly stated in this Agreement. The Independent Contractor is not authorized to make any representation, contract, or commitment on behalf of the Company unless specifically requested or authorized in writing to do so by an executive officer of the Company. The Independent Contractor is solely responsible for, and will file, on a timely basis, all tax returns and payments required to be filed with, or made to, any federal, state, or local tax authority with respect to the performance of services and receipt of fees under this Agreement. The Independent Contractor is solely responsible for, and must maintain adequate records of, expenses incurred in the course of performing services under this Agreement. The Company will not withhold for the payment of any social security, federal, state, or any other employee payroll taxes payable with respect to the Independent Contractor. The Company will, as applicable, regularly report amounts paid to the Independent Contractor by filing Form 1099-MISC with the Internal Revenue Service as required by law.

The Independent Contractor represents that he/she has the right and authority to enter into this Agreement and by doing such will not be in breach of any existing agreements. During the term of this Agreement and for a period of 1 year thereafter, the Independent Contractor will not accept work, enter into a contract, or accept an obligation from any third party in breach of the Independent Contractor’s obligations under this Agreement. The Independent Contractor agrees to indemnify the Company from any and all loss or liability incurred by reason of the alleged breach by the Independent Contractor.

Pursuant to the Defend Trade Secrets Act of 2016 (the “Act”), Independent Contractor acknowledges that Independent Contractor will not have criminal or civil liability under any Federal or State trade secret law for the disclosure of a trade secret that (a) is made (i) in confidence to a Federal, State, or local government official, either directly or indirectly, or to an attorney and (ii) solely for the purpose of reporting or investigating a suspected violation of law; or (b) is made in a complaint or other document filed in a lawsuit or other proceeding, if such filing is made under seal. In addition, if Independent Contractor files a lawsuit for retaliation by the Company for reporting a suspected violation of law, Independent Contractor may disclose the trade secret to Independent Contractor’s attorney and may use the trade secret information solely in the court proceeding if Independent Contractor (x) files any document(s) containing the trade secret under seal and (y) does not disclose the trade secret, except pursuant to court order.

The Independent Contractor may not subcontract or otherwise delegate its obligations under this Agreement without the Company’s prior written consent. This Agreement will be for the benefit of the Company’s successors and assigns, and subject to the foregoing sentence, will be binding on the Independent Contractor’s assignees.

The Independent Contractor’s obligations under this Agreement are of a unique character that gives them particular value; breach or any threatened breach of any of such obligations will result in irreparable and continuing damage to the Company for which there will be no adequate remedy at law; and, in the event of such breach, the Company will be entitled to seek injunctive relief and/or a decree for specific performance, and such other and further relief as may be proper (including monetary damages if appropriate).

The waiver by the Company of a breach of any provision of this Agreement by the Independent Contractor shall not operate or be construed as a waiver of any other or subsequent breach by the Independent Contractor.

The Independent Contractor shall not, either during the term of this Agreement or at any time after termination, impart or disclose any Confidential Information to any person, firm or entity other than the Company, or use any of such Confidential Information, directly or indirectly, for his/her own benefit or for the benefit of any person, firm or entity other than the Company. The Independent Contractor hereby acknowledges that the items included within the definition of Confidential Information are valuable assets of the Company and that the Company has a legitimate business interest in protecting such Confidential Information.

5.2 This Agreement shall enure to the benefit of and be enforceable by the Independent Contractor’s legal personal representatives, executors and administrators. If the Independent Contractor should die while any amount would still be payable to the Independent Contractor hereunder if the Independent Contractor had continued to live, all such amounts shall be paid in accordance with the terms of this Agreement to the Independent Contractor’s estate or such other person as may be properly appointed by the Independent Contractor for this purpose.

Covenants of Independent Contractor. For and in consideration of the above herein, Independent Contractor does hereby covenant, agree and promise that: (a) Independent Contractor will not actively engage, directly or indirectly, in any other business or venture that competes with the Company except at the direction or upon the written approval of the Company; (b) Independent Contractor will not engage, directly or indirectly, in the ownership, management, operation or control of, or employment by, any business of the type and character engaged in by the Company or any of its subsidiaries. Independent Contractor may make personal investments in public companies, such as those made through or recommended by a stock broker; (c) Independent Contractor will truthfully and accurately make, maintain and preserve all records and reports that the Company may from time to time reasonably request or require; (d) Independent Contractor will be loyal and faithful to the Company at all times, constantly endeavoring to improve Independent Contractor’s ability and knowledge of the business in an effort to increase the value of Independent Contractor’s services to the mutual benefit of the Parties;

Independent Contractor will make available to the Company any and all of the information of which Independent Contractor has knowledge relating to the business of the Company or any of the Company’s other subsidiaries and will make all suggestions and recommendations which Independent Contractor feels will be of benefit to the Company; (f) Independent Contractor will fully account for all money, records, goods, wares and merchandise or other property belonging to the Company of which Independent Contractor has custody, and will pay over and deliver the same promptly whenever and however he may be reasonably directed to do so;

BCO Independent Contractors. Management believes the Company has the largest fleet of truckload BCO Independent Contractors in the United States. BCO Independent Contractors provide truck capacity to the Company under exclusive lease arrangements. Each BCO Independent Contractor operates under the motor carrier operating authority issued by the U.S. Department of Transportation (“DOT”) to Landstar’s Operating Subsidiary to which such BCO Independent Contractor provides services and has leased his or her equipment. The Company’s network of BCO Independent Contractors provides marketing, operating, safety, recruiting and retention advantages to the Company.

The Company relies exclusively on independent third parties for its hauling capacity other than for trailing equipment owned or leased by the Company and utilized primarily by the BCO Independent Contractors. These third party transportation capacity providers consist of BCO Independent Contractors, Truck Brokerage Carriers, air and ocean cargo carriers and railroads. Landstar’s use of capacity provided by third parties allows it to maintain a lower level of capital investment, resulting in lower fixed costs. During fiscal year 2022, revenue generated by BCO Independent Contractors, Truck Brokerage Carriers and railroads represented approximately 35%, 54% and 2%, respectively, of the Company’s consolidated revenue. Collectively, revenue generated by air and ocean cargo carriers represented approximately 8% of the Company’s consolidated revenue during fiscal year 2022. Historically, variable contribution margin (defined as variable contribution, which is defined as revenue less variable costs of revenue, divided by revenue) generated from freight hauled by BCO Independent Contractors has been greater than that from freight hauled by other third party capacity providers. However, the Company’s insurance and claims costs, depreciation costs and other operating costs are incurred primarily in support of BCO Independent Contractor capacity. In addition, as further described in the “Corporate Services” section that follows, the Company incurs significantly higher selling, general and administrative costs in support of BCO Independent Contractor capacity as compared to the other modes of transportation. Purchased transportation costs are recognized over the freight transit period as the performance obligation to the customer is completed.

The Company’s BCO Independent Contractors are compensated primarily based on a contractually agreed-upon percentage of revenue generated by loads they haul. This percentage generally ranges from 62% to 70% where the BCO Independent Contractor provides only a tractor and 73% to 76% where the BCO Independent Contractor provides both a tractor and trailing equipment. The BCO Independent Contractor must pay substantially all of the expenses of operating his/her equipment, including driver wages and benefits, fuel, physical damage insurance, maintenance, highway use taxes and debt service, if applicable. The Company passes 100% of fuel surcharges billed to customers for freight hauled by BCO Independent Contractors to its BCO Independent Contractors. During fiscal year 2022, the Company billed customers $445 million in fuel surcharges and passed 100% of such fuel surcharges to the BCO Independent Contractors. These fuel surcharges are excluded from revenue and the cost of purchased transportation.

All employees, officers, directors and independent contractors should protect the Company’s assets and ensure their efficient use. All Company assets should be used only for legitimate business purposes. Theft, carelessness and waste have a direct impact on our profit.

Employees, officers, directors and independent contractors are prohibited from taking (or directing to a third party) a business opportunity that is discovered through the use of corporate property, information or position, unless the Company has already been offered the opportunity and turned it down. More generally, employees, officers, directors and independent contractors are prohibited from using corporate property, information or position for personal gain and from competing with the Company.

Sometimes, the line between personal and Company benefits is difficult to draw, and sometimes there are both personal and Company benefits in certain activities. Employees, officers, directors and independent contractors who intend to make use of Company property or services in a manner not solely for the benefit of the Company should consult beforehand with your manager, the Chief Executive Officer or Chief Financial Officer, or their equivalents.

In carrying out the Company’s business, employees, officers, directors and independent contractors often learn confidential or proprietary information about the Company, its customers, suppliers, or joint venture parties. Employees, officers, directors and independent contractors must maintain the confidentiality of all information so entrusted to them, except when disclosure is authorized or legally mandated. Confidential or proprietary information of our Company, and of other companies, includes any non-public information that would be harmful to the relevant company or useful or helpful to competitors if disclosed.

At December 28, 2019, 12,733 of the trailers available to the BCO Independent Contractors were owned by the Company and 290 were leased. In addition, at December 28, 2019, 4,044 trailers were provided by the BCO Independent Contractors. Approximately 31% of Landstar’s truck transportation revenue was generated on Landstar provided trailing equipment during fiscal year 2019.

BCO Independent Contractors are independent contractors who provide truck capacity to the Company under exclusive lease arrangements.

An independent contractor is a self-employed individual or business that provides goods or services to another entity under terms specified in a contract or within a verbal agreement. Unlike employees, independent contractors are not subject to the same tax withholding regulations or employee benefits. They have the freedom to operate their own business, control how their services are executed, and often work with multiple clients.

You should consider hiring an independent contractor when:

To write an independent contractor agreement, include the following key elements:

Parties Involved: Clearly identify the contracting parties, including legal names and contact information.

Scope of Work: Define the services to be provided, deliverables, timelines, and any materials or equipment needed.

Compensation: Specify the payment terms, including rates, schedules, and methods of payment.

Term and Termination: Outline the duration of the agreement and conditions under which it can be terminated by either party.

Confidentiality and Non-Disclosure: Address how confidential information will be handled during and after the contract.

Liability and Indemnification: Specify responsibility for any liabilities and mention indemnification clauses.

Intellectual Property: Define ownership of any intellectual property created during the contract period.

Legal Compliance: Ensure the agreement complies with applicable laws and regulations specific to the location and industry.

Independent contractor clause are generally used in:

These templates contain the clause you just read about.

A sound brokerage agreement template that defines broker roles, fees, confidentiality, indemnification, and termination rights for SMEs.

A ready-to-use consulting services agreement template to define scope, compensation, confidentiality, and responsibilities between consultants and companies.

A master service agreement (MSA) template that providing a framework for long-term client–service provider relationships.

A master service agreement (MSA) template that providing a framework for long-term client–service provider relationships.

A professional services agreement template that establishes terms for consulting, advisory, or transition support services.

A customizable subcontractor agreement outlining scope, responsibilities, payment terms, scheduling, insurance, and dispute resolution.

Dive deeper into the world of clauses and learn more about these other clauses that are used in real contracts.

The injunctive relief clause is a contractual provision that allows a party to seek a court-ordered injunction to prevent the other party from engaging in specific actions that could cause irreparable harm. This clause is often included to protect intellectual property, confidentiality, or other critical interests by quickly addressing potential breaches or violations through judicial intervention.

The "Inspection and Acceptance" clause outlines the buyer's right to examine and evaluate the goods or services provided by the seller before formally accepting them. This clause typically includes the process, timeline, and conditions under which the buyer can reject goods or services that do not meet specified quality or performance standards.

An insuring agreement is a fundamental component of an insurance policy that outlines the scope of coverage provided by the insurer, including the types of risks or perils that are covered, the parties involved, and the conditions under which a claim can be made. It serves as the foundation of the policy, detailing the insurer's obligation to indemnify the policyholder for losses incurred from specified events.

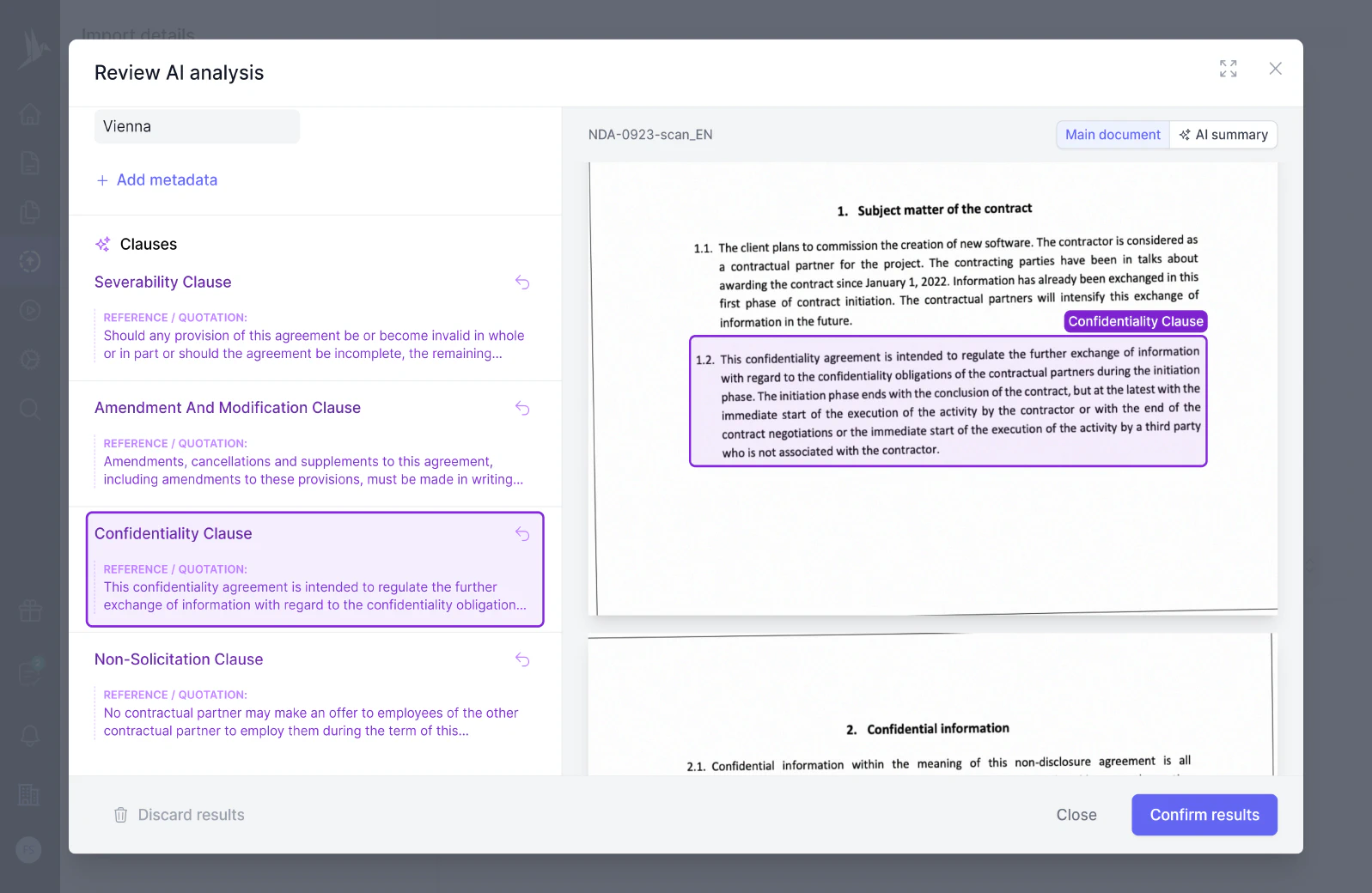

Try our AI contract analysis and extract important clauses and information from existing contracts.

< <

Fill out the form and we will get in touch with you to give you a personal, customized demo of fynk.

Greetings!

I'm Markus, co-founder of fynk. After you've submitted the form, I'll swiftly get in touch with you.

Also, right after you submit your details, you can pick a time that works best for you for our meeting.