Repurchase Agreement Template (Convertible note + Installments)

A customizable repurchase agreement template that sets out the terms under which a company agrees to buy back outstanding notes or securities.

Free cash flow conversion is a financial performance metric that assesses the efficiency with which a company converts its net income into free cash flow. This clause in contracts may detail expectations or targets for cash flow conversion, serving as an indicator of a company's ability to generate cash from its operations relative to its reported earnings.

In response to the Staff's comment, in future filings the Company will present net cash from operating activities and net cash from operating activities as a percentage of net income (“Operating Cash Flow Conversion”), which we consider to be the most directly comparable GAAP measures, with equal or greater prominence to the non-GAAP measures of Free Cash Flow and Free Cash Flow Conversion, respectively. Please see the updated applicable language and non-GAAP reconciliation table below using our Form 8-K filed on February 6, 2020 as a representation of how we plan on displaying this information.

Full-year operating cash flow conversion was 209%; free cash flow conversion was 124%

The reconciliation from net cash flow provided by operating activities to free cash flow, the calculation of operating cash flow conversion, the calculation of free cash flow conversion of adjusted earnings (“free cash flow conversion”) and the reconciliation of operating cash flow conversion to free cash flow conversion are shown in the table below (in millions):

Free cash flow conversion is defined as Free cash flow divided by Adjusted earnings. We compute free cash flow conversion on an annual basis only due to the seasonality of our businesses.

This release describes historical financial information that includes “Adjusted EBITDA,” and “Free cash flow conversion,” both of which are financial measures that are not calculated in accordance with GAAP and provided only as supplemental information.

The Company provides Free cash flow conversion because it is a useful measure to investors as to the ongoing liquidity of the business after required capital expenditure investments. Adjusted EBITDA and Free cash flow conversion are each a non-GAAP financial measure and should not be considered as an alternative to financial measures prepared in accordance with GAAP such as operating income or net income as measures of operating performance or cash flows or as measures of liquidity. Adjusted EBITDA and Free cash flow conversion are not necessarily calculated the same way as other companies and should not be considered a substitute for or more meaningful than GAAP results, and should be read in conjunction with the GAAP financial information provided in this release.

Adjusted EBITDA and Free Cash Flow Conversion This release uses the term “Adjusted EBITDA,” which is not a recognized measure under GAAP. The Company uses Adjusted EBITDA as a supplement to its GAAP results in evaluating certain aspects of its business, as described below. For purposes of this release, the Company defines Adjusted EBITDA as net income (loss) plus (i) depreciation and amortization, (ii) interest expense, net, (iii) provision for income taxes, net (net income (loss) plus clauses (i) through (iii) referred to collectively as “EBITDA”), (iv) foreign currency translation gain or loss and (v) gain or loss on equipment sales or retirements, adjusted to include certain add-backs permitted by the Company’s new senior credit facility dated June 11, 2018 (as amended, the “New Credit Facility”), including (i) management fees, (ii) impairment expense of goodwill and intangible assets, (iii) acquisition-related transaction expenses (including due diligence costs, legal, accounting and other advisory fees and costs, retention and severance payments, facility closure costs and financing fees and expenses), (iv) the impact of pre-acquisition revenues, earnings and EBITDA of certain recent acquisitions and certain management estimates relating thereto, (v) normalization adjustments to reflect a run-rate level of EBITDA within NRC Group’s historical financial statements, (vi) non-recurring costs and other non-operating expenses and income, (vii) the impact of certain completed cost savings initiatives at various domestic regions, (viii) the impact of a reduction in force adjustment, (ix) costs relating to the shutdown of certain international operations and (x) certain out-of-period timing adjustments and reclassification of capitalized leases not applicable under the New Credit Facility. “Adjusted EBITDA” is substantially the same as the metric called “Consolidated Adjusted EBITDA,” as defined in the New Credit Facility, which is a key component in the determination of the Company’ leverage ratios (including its ability to service debt and incur capital expenditures).

The release also uses the term “Free cash flow conversion,” which is not a recognized measure under GAAP. The Company uses Free cash flow conversion as a supplement to its GAAP results because it believes it is useful to show investors the ongoing liquidity of the business after required capital expenditure investments. For purposes of this release, the Company defines Free cash flow conversion as Adjusted EBITDA less total capex (excluding one-time waste-disposal investments) divided by Adjusted EBITDA. Free cash flow conversion is not a substitute for, or more meaningful than, its comparable GAAP measure, and there are limitations to using non-GAAP measures such as Free cash flow conversion.

Management of the Food Safety Business defines free cash flow conversion as free cash flow as a percentage of net cash provided by operating activities. A reconciliation between net cash flow provided by operating activities and free cash flow, and the calculation of free cash flow conversion, is as follows:

These non-GAAP financial measures consist of EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, free cash flow, and free cash flow conversion.

We publicly discuss free cash flow conversion on our earnings conference calls as a measure for how the company performed, as our investors view it as an important indicator of value creation for stakeholders.

In future filings, we will clarify that free cash flow over adjusted income (loss) from continuing operations is a reference to free cash flow conversion, and expand our related disclosures to include the foregoing rationale.

Free cash flow, ongoing free cash flow and free cash flow conversion are non-GAAP liquidity measures that Ashland believes provide useful information to management and investors about Ashland’s ability to convert Adjusted EBITDA to ongoing free cash flow. These liquidity measures are used regularly by Ashland’s stakeholders and industry peers to measure the efficiency at producing cash from regular business activities.

Free cash flow, ongoing free cash flow and free cash flow conversion have certain limitations, including that they do not reflect adjustments for certain non-discretionary cash flows such as mandatory debt repayments. The amount of mandatory versus discretionary expenditures can vary significantly between periods.

Free cash flow conversion and adjusted free cash flow conversion are also non-GAAP financial measures used by our management and our board of directors as supplemental information to evaluate the Company’s ability to convert earnings from our operational performance to cash. We calculate free cash flow conversion as free cash flow divided by adjusted EBITDA and adjusted free cash flow conversion as adjusted free cash flow divided by adjusted EBITDA. In evaluating EBITDA, adjusted EBITDA, adjusted EBITDA margin, adjusted net income, adjusted EPS, free cash flow, adjusted free cash flow, free cash flow conversion and adjusted free cash flow conversion, you should be aware that in the future, we will incur expenses similar to the adjustments in the reconciliation presented below, other than the Change in Control1 charges. Our presentations of EBITDA, adjusted EBITDA, adjusted EBITDA margin, adjusted net income, adjusted EPS, free cash flow, adjusted free cash flow, free cash flow conversion and adjusted free cash flow conversion should not be construed as suggesting that our future results will be unaffected by these expenses or any unusual or non‑recurring items.

Organic revenues, adjusted EBITDA, adjusted net income, adjusted earnings per diluted share, free cash flow and adjusted free cash flow conversion are not calculated in accordance with GAAP, and should be considered supplemental to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. Non-GAAP financial measures have limitations in that they do not reflect all of the revenues, costs or benefits associated with the operations of the Company's business as determined in accordance with GAAP. As a result, you should not consider these measures in isolation or as a substitute for analysis of the Company's results as reported under GAAP.

Organic revenues, adjusted EBITDA, adjusted net income, adjusted earnings per diluted share, free cash flow and adjusted free cash flow conversion are significant measures used by management for purposes of: • supplementing the financial results and forecasts reported to the Company's board of directors; • evaluating, managing and benchmarking the operating performance of the Company; • establishing internal operating budgets; • determining compensation under bonus or other incentive programs; • enhancing comparability from period to period; • comparing performance with internal forecasts and targeted business models; and • evaluating and valuing potential acquisition candidates.

Free Cash Flow Conversion is a financial metric used to measure a company’s ability to convert its earnings into free cash flow (FCF). Essentially, it measures the efficiency with which a company can turn its earnings before interest, taxes, depreciation, and amortization (EBITDA) or net income into free cash flow. Free cash flow itself is the cash generated by the company after accounting for capital expenditures necessary to maintain or expand its asset base.

The formula for calculating free cash flow conversion is:

[ \text{Free Cash Flow Conversion} = \frac{\text{Free Cash Flow}}{\text{EBITDA or Net Income}} ]

A high free cash flow conversion rate indicates that a company is effective at turning its profits into cash, which can be used for reinvestment in the business, paying down debt, or returning capital to shareholders.

You should use Free Cash Flow Conversion when assessing a company’s financial health and operational efficiency. This metric is particularly useful:

When writing about Free Cash Flow Conversion, ensure you present the concept clearly and practically. Use the following structure:

Example:

Free Cash Flow Conversion is a metric used to evaluate a company’s efficiency in converting its earnings into cash flow. It is important because it indicates how well a company can generate cash to fund its operations and growth. The conversion rate is calculated as:

[ \text{Free Cash Flow Conversion} = \frac{\text{Free Cash Flow}}{\text{EBITDA or Net Income}} ]

For instance, if a company has a free cash flow of $100 million and EBITDA of $150 million, the free cash flow conversion rate would be 66.7%.

Free Cash Flow Conversion metrics are not usually directly referenced in legal contracts. However, they may be considered in various business evaluations and agreements, such as:

In these contexts, free cash flow conversion is used indirectly as part of the financial analysis supporting the agreements.

These templates contain the clause you just read about.

A customizable repurchase agreement template that sets out the terms under which a company agrees to buy back outstanding notes or securities.

Dive deeper into the world of clauses and learn more about these other clauses that are used in real contracts.

A "full and final release" clause is a contractual provision where one party agrees to relinquish any future claims or legal actions related to a particular matter or dispute, effectively settling and concluding the issue. This clause is designed to provide certainty and closure for all involved parties, ensuring that no further obligations or liabilities can be pursued once the agreement is executed.

A full disclosure clause requires a party to reveal all relevant information that may impact the other party's understanding of the contract. This ensures transparency and allows both parties to make informed decisions based on complete and accurate data.

The "Functionality" clause in a contract outlines the specific features and capabilities that a product or service must deliver according to agreed standards. It ensures that any deviations from these stated functionalities allow for remedies, such as corrections or compensation, to uphold the contract's integrity.

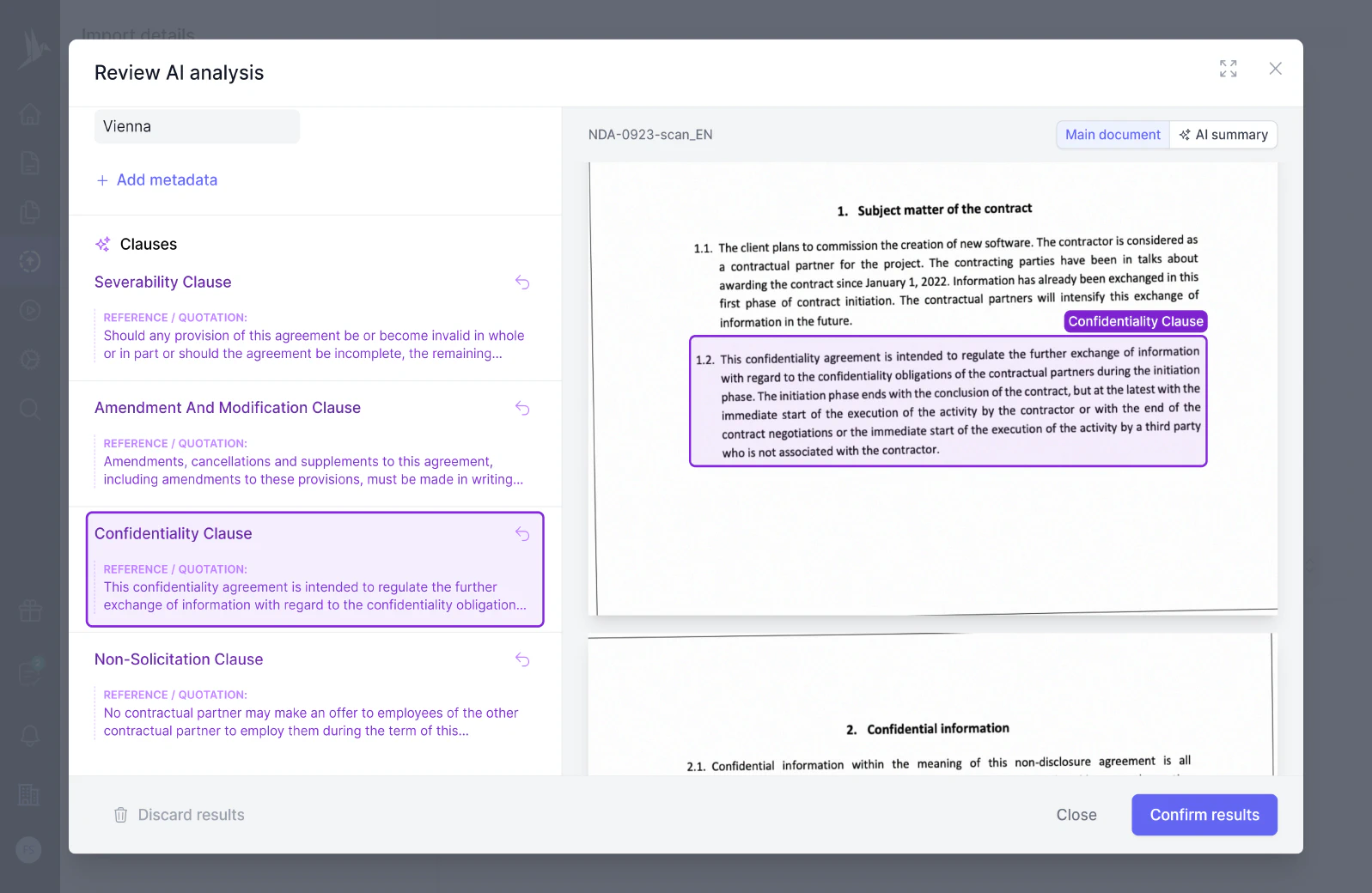

Try our AI contract analysis and extract important clauses and information from existing contracts.

< <

Fill out the form and we will get in touch with you to give you a personal, customized demo of fynk.

Greetings!

I'm Markus, co-founder of fynk. After you've submitted the form, I'll swiftly get in touch with you.

Also, right after you submit your details, you can pick a time that works best for you for our meeting.