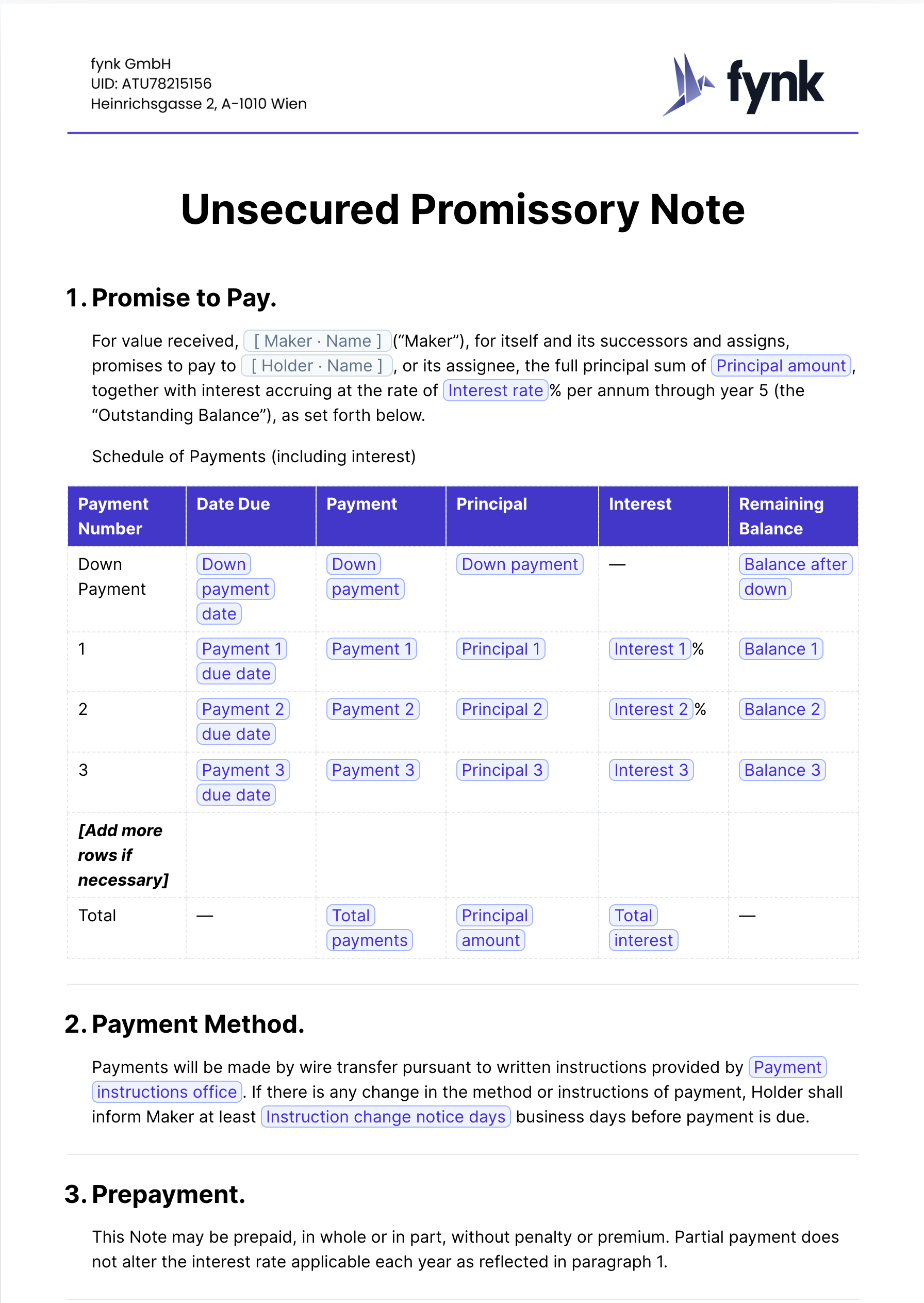

Unsecured Promissory Note Template

A straightforward promissory note template for documenting loans without collateral between individuals or businesses.

A cancellation of promissory note clause outlines the conditions under which a promissory note, which is a financial instrument detailing a borrower's obligation to repay a loan, can be canceled or deemed null and void. This clause typically specifies circumstances such as full repayment, mutual agreement, or certain legal events that would lead to the termination of the borrower's obligations under the note.

1. Cancellation of Promissory Note The Parties agree and affirm that as of the Effective Date the Balance shall be forgiven by Lender in its entirety and Borrower shall have no further obligation to Borrower with respect to the Note.

Cancellation of Promissory Note. Upon payment in full, the Payee shall promptly mark this Note as cancelled and return the original Note to the Maker, and this Note shall be of no further effect.

5. Cancellation of Promissory Note. As of the Effective Date, the promissory note in the principal amount of $1,250,000 issued by Clyra in favor of Scion, dated September 28, 2018 (“Promissory Note”), issued to Scion in connection with the transaction through which Clyra purchased from Scion the SkinDisc intellectual property (the “Transaction”), is hereby cancelled and terminated in its entirety. Neither Scion nor any Scion Member is obligated to return any payment made pursuant to the Promissory Note. Scion hereby forgives all accrued and outstanding interest due on the Promissory Note.

Sale of Property, Cancellation of Promissory Note and Entry Into Operating Lease On October 1, 2020, 1612 E. Cape Coral Parkway Holding Co., LLC (“Seller”), a subsidiary of the Company, closed on the sale of the real property and improvements located at 1612 E. Cape Coral Parkway, Cape Coral, Florida (the “Property”) for $2.5 million to Daniel Thom, as Trustee of Torstonbo Trust, a Florida revocable trust (“Buyer). A portion of the proceeds realized by the Seller from the sale of the Property were used to satisfy Seller’s obligations under a Promissory Note (“Note”) and Mortgage, Assignment of Rents, and Security Agreement (collectively, the “Loan Documents”) entered into on August 6, 2020 with Northern Equity Group, Inc., JKH Ventures, Inc., and Donald Ross, LLC pursuant to which Seller had borrowed the principal amount of $1 million. The Seller’s obligations under the Loan Documents were secured by a first mortgage on the Property. The net proceeds realized by the Seller from the sale of the Property were $1.24 million after deductions for repayment of the Note, broker commissions, and other fees, and costs. See Note 7 “Short-Term and Long-Term Debt”. The Property served as the Company’s headquarters until its sale date. On October 1, 2020, the Company relocated its headquarter to 1490 N.E. Pine Island Road, Suite 5D, Cape Coral, FL 33909 and entered into a two year operating lease for the new 1,600 square feet office and warehouse space. The new lease provides the Company an option to extend the term of the lease for a third year. The lease obligation is approximately $32 thousand plus other costs for shared services, maintenance and sales tax over the course of its life.

(b) Cancellation of Promissory Note. Each applicable Holder acknowledges and agrees that, effective as of the applicable Closing Date, the Promissory Note shall be deemed automatically canceled in full and of no further force or effect and shall thereafter represent only the right to receive the Securities.

Post-Closing Transfer of Rezolve USA and Cancellation of Promissory Note. Immediately following the Closing, the Parties will use reasonably best efforts to effect the acquisition of Rezolve Mobile Commerce Inc., a Delaware corporation and subsidiary of the Company, by the Surviving Company, in exchange for capital stock of the Surviving Company (the “Rezolve USA Consideration”), pursuant to documentation reasonably acceptable to the Parties (the “Rezolve USA Acquisition”). Immediately following the effectiveness of the Rezolve USA Acquisition, (i) the Company shall subject to compliance with and to the extent possible under applicable law distribute the Rezolve USA Consideration to Cayman NewCo and (ii) the Surviving Company will distribute the Promissory Note to Cayman NewCo, thereby extinguishing it.

Exhibit 6.2 Cancellation of Promissory Note (Incorporated by reference to Exhibit 6.2 to the Form 1-A amendment filed June 3, 2019)

As a result, the note was discharged in the current year. During the year ended August 31, 2020, the Company recognized gain on the cancellation of promissory note of $536,729. The difference is due to fluctuation in foreign exchange.

The cancellation of a promissory note refers to the formal process of nullifying a previously issued promissory note, indicating that the borrower is no longer obligated to repay the debt as originally agreed. This usually occurs when the debt has been fully settled or if both parties mutually agree to terminate the obligation. The cancellation serves as a documented acknowledgment that the debt has been satisfied and clears any legal responsibility tied to the note.

The cancellation of a promissory note should be utilized in the following situations:

Writing a cancellation of a promissory note involves clear documentation that states the extinguishing of the debt. The document should typically include the following elements:

Example:

Cancellation of Promissory Note

This document certifies that the promissory note dated [Date], in the principal amount of [Amount], originally made by [Borrower] to [Lender], is hereby cancelled and all obligations under this note are discharged as of [Date].

[Borrower’s Signature] [Lender’s Signature]

Date: [Date]

Contracts that might typically include a clause or provision for the cancellation of a promissory note include:

Understanding these contexts helps ensure proper legal and financial readiness when dealing with promissory notes and their potential cancellation.

These templates contain the clause you just read about.

A straightforward promissory note template for documenting loans without collateral between individuals or businesses.

Dive deeper into the world of clauses and learn more about these other clauses that are used in real contracts.

Capitalized terms in a contract are specific words or phrases that have been given a distinct, defined meaning within that document. This convention helps ensure clarity and consistency throughout the contract by clearly identifying terms with special significance or particular definitions.

A car allowance clause outlines the terms under which an employer provides a predetermined monetary compensation to an employee for the use or maintenance of their personal vehicle for work-related purposes. This clause typically specifies the amount, frequency of payments, and any conditions or requirements the employee must meet to qualify for the allowance.

The "CCRs or "CC&Rs" refers to Covenants, Conditions, and Restrictions, which are rules and guidelines set by a homeowners' association (HOA) or a property developer that dictate how properties within a particular community can be used and what homeowners can and cannot do with their properties. These contractual obligations are designed to maintain the aesthetic and functional harmony of the community, ensuring that all residents adhere to agreed-upon standards to preserve property values and neighborhood appeal.

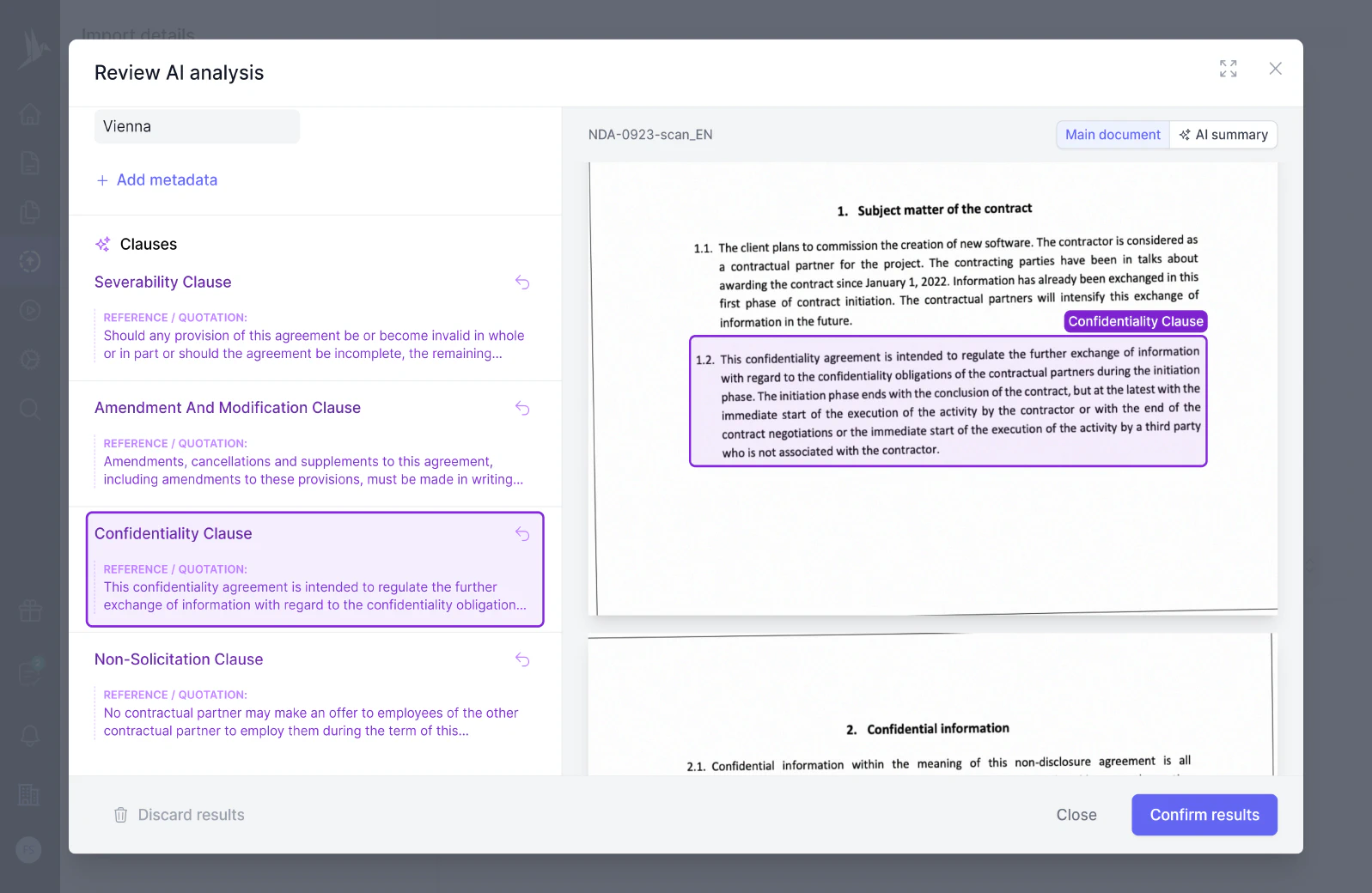

Try our AI contract analysis and extract important clauses and information from existing contracts.

< <

Fill out the form and we will get in touch with you to give you a personal, customized demo of fynk.

Greetings!

I'm Markus, co-founder of fynk. After you've submitted the form, I'll swiftly get in touch with you.

Also, right after you submit your details, you can pick a time that works best for you for our meeting.