Cleaning Services Agreement Template for B2B

Define cleaning, maintenance, and payment terms between service providers and clients for professional cleaning contracts.

Billing and payment terms outline the specific details regarding the timing, methods, and conditions for invoicing and remittance between parties in an agreement. These terms clarify when payments are due, acceptable forms of payment, any penalties for late payments, and any applicable discounts or incentives for early payments.

Section 4.2 Billing and Payment Terms. (a) Service Provider shall invoice Service Recipient monthly (such invoice to set forth a description of the Services provided) for all Services that Service Provider delivered during the preceding month, denominated in U.S. Dollars. Each such invoice shall be payable within [***] days after Service Recipient’s receipt of the invoice and payment of such invoices shall be made by Service Recipient to Service Provider in U.S. Dollars. Any Service for which the foregoing process does not apply shall be invoiced by the Service Provider Party providing such Service to Service Recipient in accordance with a mutually agreed timetable and in U.S. Dollars, and shall be paid by Service Recipient in accordance with such mutually agreed timetable and in U.S. Dollars. (b) If any undisputed invoice or undisputed line item of an invoice is not paid in full within [***] days after Service Recipient’s receipt of the invoice pursuant to Section 11.3, interest shall accrue on the unpaid amount at a rate of [***] percent [***] per month or the highest rate permitted by applicable law, whichever is less, from the date such amount is due until finally paid. Late fees are without any prejudice to, or modification of, any other remedies that Service Provider may have. (c) The Parties acknowledge that there may be a lag in the submission of charges from third parties relating to the provision of Services, and that the Service Provider Parties shall use commercially reasonable efforts to obtain such third party invoices, and to provide the same to Service Recipient, in a timely fashion.

(iii) Billing and Payment Terms. Unless otherwise specified on Exhibit A, statements of amounts due will be invoiced monthly and such invoices shall be payable within thirty (30) days. All amounts invoiced will be equally divided between Genexine and Handok.

Section 4.1. Billing and Payment Terms. The Service Provider shall invoice the Recipient for the amounts as indicated in the “Compensation Due” column (as set forth on the Schedules hereto) on the last day of each month during the Term (as defined below), in arrears, and the applicable Recipient shall remit full payment, in immediately available funds, within thirty (30) days after receipt of such invoice.

Billing and Payment Terms: IDR shall be paid upfront for the Services pursuant to the rate and other particulars set forth in the Work Order or Billing. If any invoice is not paid, and work has been performed on the behalf of the Client, it is understood, within seven (7) days of the date of such invoice, IDR may suspend its duties/ performance under the Work Order or Billing without liability or penalty at its sole discretion. Interest shall accrue on the balance of any overdue invoice at a rate equal to one- and one-half percent (1.5%) per month or eighteen percent (18%) per annum. IDR may also impose a late payment penalty equal to five percent (5%) of any overdue balance. The Client and its principals shall bear IDR’s costs of collection, including reasonable attorney’s fees, court costs and related expenses.

Billing and payment terms are the conditions under which a seller will complete a sale. The agreement usually specifies the period allowed to a customer to pay off the amount due, any cash discount that can be taken for early payment, and any special conditions applying. Simply put, these terms outline when payment is expected and the penalties for late payment.

Billing and payment terms should be used in any business transaction that involves providing goods or services in exchange for payment. These terms are essential to clearly communicate the expectations regarding payment timelines, discounts for early payments, and penalties for late payments.

When writing billing and payment terms, it’s important to be clear and precise to avoid any misunderstandings. Here is a general structure to follow:

Payment Due Date: Specify when the payment is due. For example:

Payment is due within 30 days from the date of invoice.

Early Payment Discounts: If you offer any discounts for early payments, specify them clearly. For example:

A 2% discount will be applied for payments made within 10 days.

Late Payment Penalties: Clarify any penalties or interest charges for late payments. For example:

A 1.5% interest per month will be charged on overdue accounts.

Accepted Payment Methods: Outline the methods of payment you accept. For example:

We accept payments via bank transfer, credit card, or PayPal.

Special Conditions: Include any other conditions related to the payment. For example:

Invoices disputed within 7 days of receipt will be reviewed. After 7 days, the invoice is considered accepted.

Billing and payment terms are commonly included in various types of contracts to ensure clarity and enforceability:

Service Agreements: Used by consultants, freelancers, and agencies.

Example: A web development service contract specifying payments in milestones aligned with project phases.

Sales Contracts: Used in transactions involving the sale of goods.

Example: A wholesale agreement where products are invoiced upon delivery with a net 30 payment term.

Leases and Rental Agreements: Used when renting property or equipment.

Example: An equipment rental agreement requiring monthly payments due on the first of each month.

Loan Agreements: Used in financial lending.

Example: A personal loan agreement that outlines monthly payments and interest charges for late payments.

Subscription Agreements: Used for services billed on a recurring basis.

Example: A software as a service (SaaS) agreement that bills clients on an annual basis, with penalties for overdue balances.

These templates contain the clause you just read about.

Define cleaning, maintenance, and payment terms between service providers and clients for professional cleaning contracts.

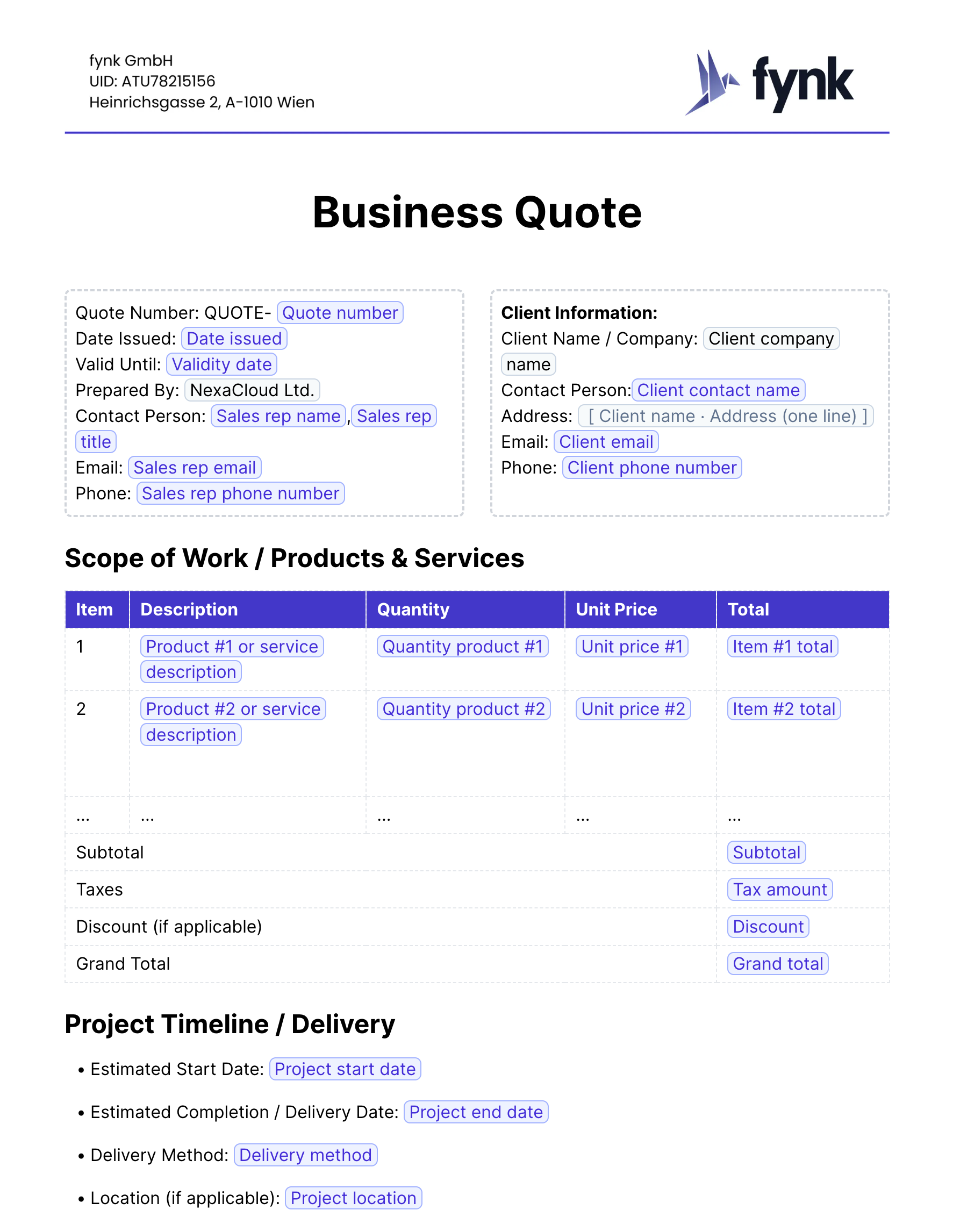

An easy-to-use, professional sales quote template designed to streamline your quotation process, clarify pricing details, and close deals faster.

Dive deeper into the world of clauses and learn more about these other clauses that are used in real contracts.

A binding arbitration clause requires parties to resolve disputes through arbitration rather than litigation, with the arbitrator's decision being final and legally enforceable. This mechanism aims to provide a more efficient and private resolution process compared to traditional court proceedings.

The "Binding Effect" clause ensures that the terms and conditions of the contract are legally enforceable and extend to the parties involved, as well as their respective heirs, successors, and assigns. This clause guarantees that all parties and their successors must uphold the obligations and rights established in the agreement.

Binding Provisions clauses establish the enforceability of a contract's terms, ensuring that all parties involved are legally obligated to adhere to the agreed-upon conditions. These clauses underscore the commitment and accountability required from each party to fulfill the contract's obligations, often delineating the consequences of non-compliance or breach.

Try our AI contract analysis and extract important clauses and information from existing contracts.

< <

Fill out the form and we will get in touch with you to give you a personal, customized demo of fynk.

Greetings!

I'm Markus, co-founder of fynk. After you've submitted the form, I'll swiftly get in touch with you.

Also, right after you submit your details, you can pick a time that works best for you for our meeting.