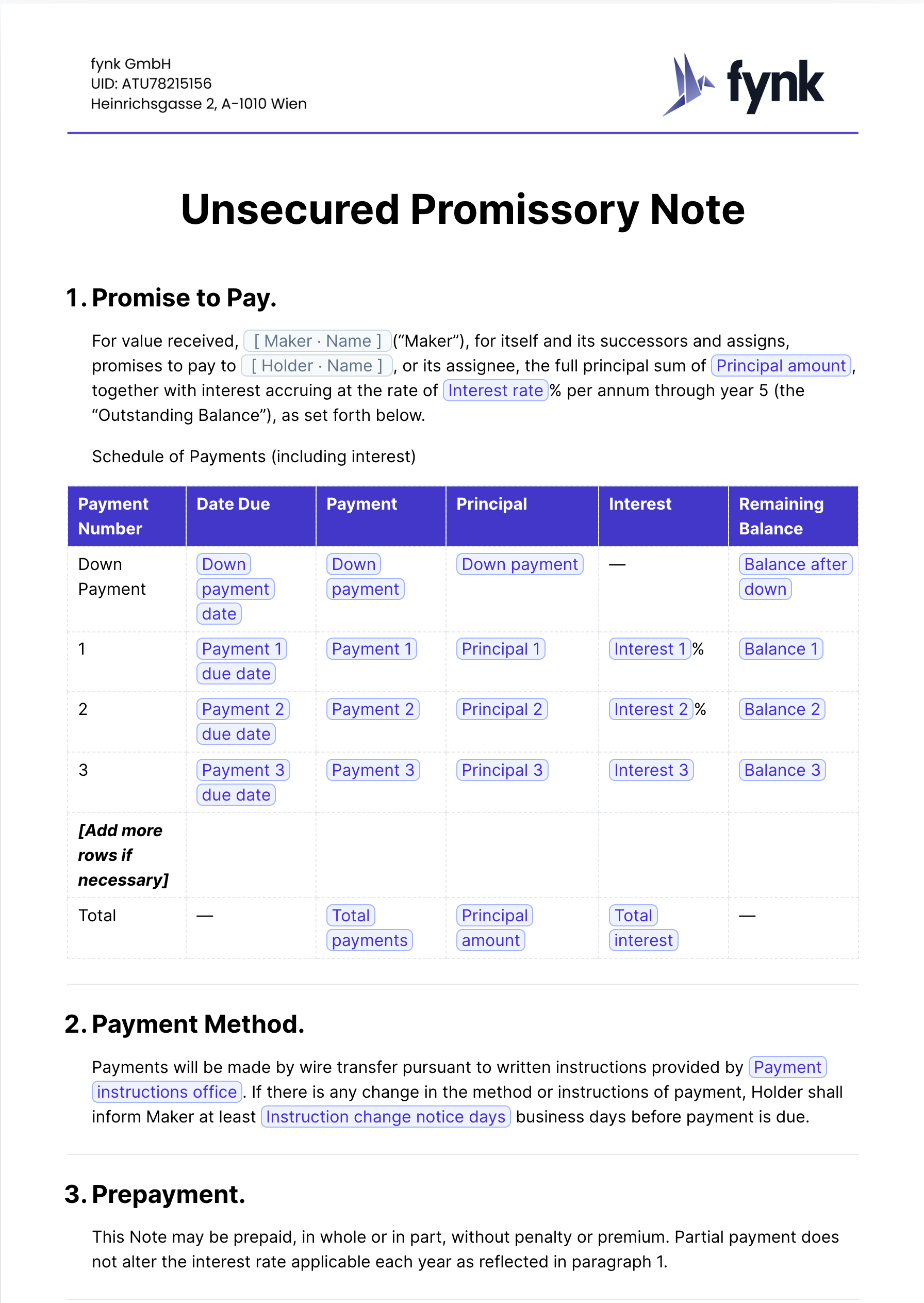

Unsecured Promissory Note Template

A straightforward promissory note template for documenting loans without collateral between individuals or businesses.

An amendment to a promissory note refers to a formal modification or alteration to the original terms of the promissory note, often addressing changes in payment schedules, interest rates, or other relevant conditions. This amendment requires the mutual agreement of all parties involved and is documented to ensure clarity and enforceability.

This Eighth Amendment to Promissory Note (the “Eighth Amendment”) is made by and between the parties High Sierra Technologies, Inc., a Nevada Corporation (“HSTI”) and Larry Mamey (“Mamey”) to be effective as of this 5th day of September, 2021.

Amendment to Promissory Note. Maker and Holder agree that Section 1 of the Promissory Note is hereby deleted in its entirety and replaced with the following:

On December 5, 2019, GCEL advanced $566,287.53 to LACQ pursuant to the Expense Advancement Agreement, on the terms set forth in the Promissory Note, which terms were subsequently amended by the Amendment to Promissory Note on January 31, 2021. Also on January 31, 2021, pursuant to the Notice of Conversion, 566,288 Conversion Warrants (as defined in the Amendment to Promissory Note) were issued, in full satisfaction of the Promissory Note (as amended by the Amendment to Promissory Note).

Maker executed that certain Promissory Note dated February 12, 2021 in the principal sum of up to Three Hundred Thousand dollars ($300,000), as amended by that certain First Amendment to Promissory Note dated June 23, 2021 (collectively, the “Note”).

THIS SECOND AMENDMENT TO PROMISSORY NOTE (“Amendment”) dated as of January 29, 2021, is to become affixed to, modify and become a part of that certain 6% Secured Convertible Promissory Note in the original principal sum of $1,500,000 dated as of September 18, 2020 (“Original Issue Date”), and amended on September 22, 2020 (as amended, the “Note”), which Note was made and executed by Torchlight Energy Resources, Inc., a Nevada corporation (the “Debtor”), and payable to the order of McCabe Petroleum Corporation (the “Holder”), which Note is due and payable on May 10, 2021 (“Maturity Date”).

D. Borrower and Lender subsequently agreed to extend the Maturity Date of the Note a third time pursuant to that certain Third Amendment to Promissory Note dated February 25, 2021 (the “Third Amendment”, and together with the First Amendment and the Second Amendment, the “Prior Amendments”).

WHEREAS, the Maker and the Payee now wish to enter into this Second Amendment to Promissory Note (this “Amendment”) to increase the maximum principal amount.

The undersigned have executed this Amendment to Promissory Note as of the date set forth above.

The Company and CoBank are parties to a Promissory Note and Supplement (Revolving Term Loan Supplement) dated as of March 19, 2009, and number RX0024T6, as amended by a First Amendment to Promissory Note and Supplement dated as of August 31, 2011, a Second Amendment to Promissory Note and Supplement dated as of October 15, 2014 and a Third Amendment to Promissory Note and Supplement dated as of March 7, 2017 (collectively, the “Supplement”). The parties now desire to amend the Supplement.

AMENDMENT TO PROMISSORY NOTE July 11, 2022 This Amendment to the Promissory Note dated November 30, 2021 (the “Agreement”), between Bengochea SPAC Sponsors I LLC (the “Payee”) and Iron Horse Acquisitions Corp. (the “Maker”) is made as of the date set forth above. The parties to the Agreement are entering into this Amendment in order to amend the Agreement in the manner set forth below. 1. Section 1 of the Agreement is hereby amended and restated in its entirety as follows:

IN WITNESS WHEREOF, the Maker and Payee, intending to be legally bound hereby, have caused this First Amendment to Promissory Note to be duly executed the day and year first above written.

An Amendment to Promissory Note is a legal document that modifies the terms of an existing promissory note. A promissory note itself is a financial instrument that contains a written promise by one party to pay another party a definite sum of money, either on demand or at a specified future date. An amendment alters the original note’s terms, which could include changes in interest rates, payment schedules, or maturity date.

You should use an Amendment to Promissory Note when the borrower and lender have mutually agreed to modify the terms of the original promissory note. Situations that may require an amendment include:

When writing an Amendment to Promissory Note, the document should contain specific elements to ensure clarity and enforceability:

Example:

Amendment to Promissory Note

This Amendment (“Amendment”) is made and entered into effective as of [Date], and amends the Promissory Note dated [Original Date] (the “Note”) by and between [Lender’s Full Name] (“Lender”) and [Borrower’s Full Name] (“Borrower”).

[Details of Amendment]

In Witness Whereof, the parties hereto have executed this Amendment as of the date first above written.

Contracts that typically contain an Amendment to Promissory Note include:

These templates contain the clause you just read about.

A straightforward promissory note template for documenting loans without collateral between individuals or businesses.

Dive deeper into the world of clauses and learn more about these other clauses that are used in real contracts.

An amendment clause outlines the procedures and requirements for making changes or modifications to an existing contract. It specifies how amendments can be proposed, agreed upon, and documented by the parties involved to ensure that all modifications are legally binding and enforceable.

The "Amicable Resolution" clause encourages parties in a contract to resolve disputes through negotiation or mediation before resorting to formal legal proceedings. This approach aims to foster open communication and cooperation to find a mutually agreeable solution, potentially saving time and resources.

Amortization in contract clauses refers to the process of gradually reducing a debt or an asset's book value over a specified period, typically through regular payments or expense allocations. This clause outlines how financial obligations or asset costs are spread out over time, providing clarity on payment schedules and tax implications.

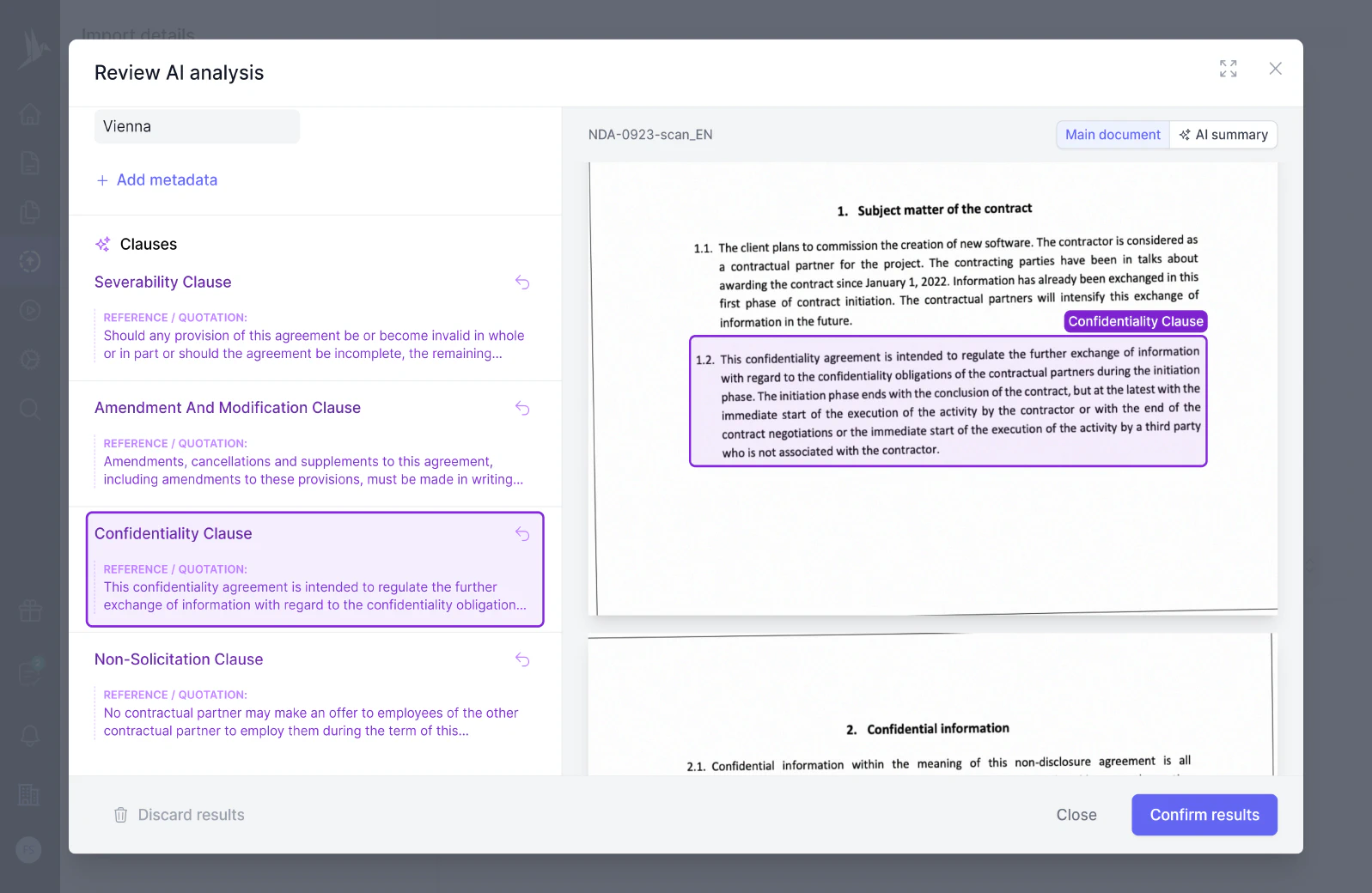

Try our AI contract analysis and extract important clauses and information from existing contracts.

< <

Fill out the form and we will get in touch with you to give you a personal, customized demo of fynk.

Greetings!

I'm Markus, co-founder of fynk. After you've submitted the form, I'll swiftly get in touch with you.

Also, right after you submit your details, you can pick a time that works best for you for our meeting.