Purchase Order (PO) Template for Products

Purchase order templates streamline procurement by providing a consistent format for specifying product requirements, pricing, delivery and payment terms.

A "No Prepayment Penalty" clause allows borrowers to repay a loan ahead of schedule without incurring any additional fees or penalties. This provides flexibility for borrowers to save on interest costs by paying off their debt early.

The Company shall have the right to prepay the balance due hereunder in full or in part, at any time, with no prepayment penalty.

Pre-Payment Terms: No prepayment penalty.

The Company has right to accelerate payments or prepay in full at any time with no prepayment penalty. This DL Note shall not be secured by any collateral or any assets of the Company.

There is no prepayment penalty under either Note.

While Spire has sufficient liquidity to cover its purchased gas costs it is taking steps to ensure that its financial flexibility is maintained. As a result, Spire Missouri has entered into a loan agreement (the “Loan Agreement”) with U.S. Bank, as administrative agent, and the lenders party thereto. The Loan Agreement provides a $250 million, 364-day unsecured term loan, maturing on March 22, 2022, with an interest rate based on LIBOR plus 65 basis points, which carries no prepayment penalty, and has the same covenants as our Revolving Credit Facility dated October 31, 2018 as amended. The foregoing summary of the Loan Agreement is not complete and is qualified in its entirety by reference to the full text of the Loan Agreement, which is attached hereto as Exhibit 10.1 and incorporated herein by reference.

As a result, no prepayment penalty was incurred in connection with this prepayment.

Additionally, the remaining PPP Loan balance will carry a two year maturity date. There is no prepayment penalty on the PPP Loan.

The Note may be prepaid at any time before April 29, 2022 with no prepayment penalty.

There is no prepayment penalty. Under the terms of the PPP, all or a portion of the principal may be forgiven if the Loan proceeds are used for qualifying expenses as described in the CARES Act, such as payroll costs, benefits, rent, and utilities. No assurance is provided that the Company will obtain forgiveness of the Loan in whole or in part. With respect to any portion of the SBA Loan that is not forgiven, the SBA Loan will be subject to customary provisions for a loan of this type, including customary events of default relating to, among other things, payment defaults and breaches of the provisions of the Promissory Note.

The outstanding principal balance, plus accrued interest, is due and payable in a single balloon payment upon the Maturity Date. There is no prepayment penalty.

A “No prepayment penalty” refers to a clause in a loan agreement that allows the borrower to pay off some, or all, of their loan balance before it is due without incurring any additional fees. Lenders sometimes charge prepayment penalties to safeguard expected interest revenue when a borrower pays off a loan ahead of the agreed-upon schedule. This type of clause benefits borrowers who wish to reduce their debt faster without extra costs.

You should look for loans with “No prepayment penalty” clauses when:

When drafting a loan agreement with a “No prepayment penalty” clause, clear and concise language is essential. Here is an example:

No Prepayment Penalty: Borrower may pay, at any time or from time to time, without penalty or premium, all or any portion of the principal balance owing under this Loan. Any such prepayments will reduce the principal balance of the Loan and will not incur any additional fees or charges.

Contracts that might include a “No prepayment penalty” clause often pertain to:

These templates contain the clause you just read about.

Purchase order templates streamline procurement by providing a consistent format for specifying product requirements, pricing, delivery and payment terms.

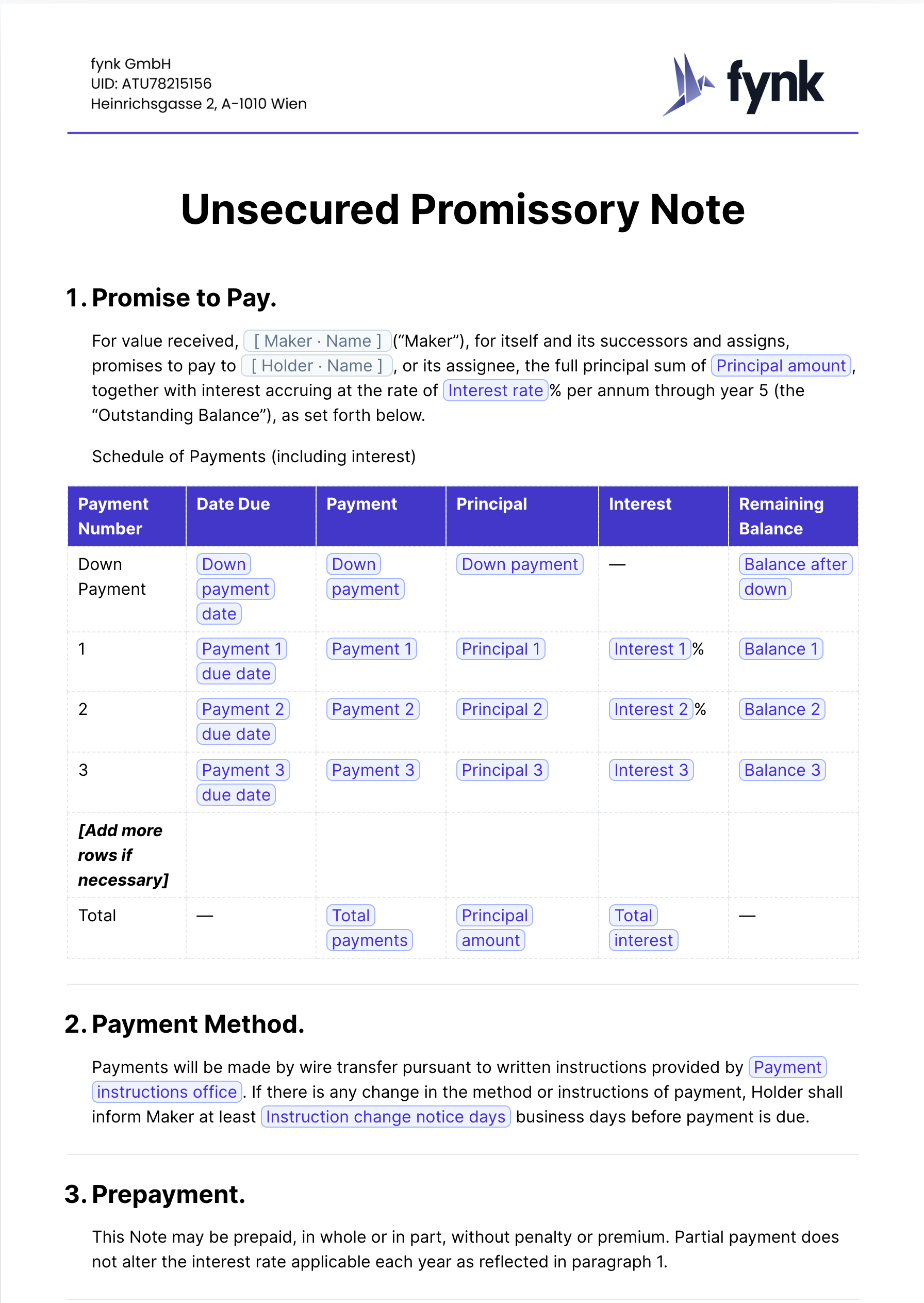

A straightforward promissory note template for documenting loans without collateral between individuals or businesses.

Dive deeper into the world of clauses and learn more about these other clauses that are used in real contracts.

The "No Refunds" clause stipulates that once a purchase or transaction is completed, the buyer is not entitled to a refund under any circumstances. This provision ensures that the seller is not obligated to return the buyer's money, regardless of dissatisfaction or change of mind.

The "No Reverse Engineering" clause prohibits any attempts to deconstruct, disassemble, or otherwise analyze a product, software, or system to obtain underlying trade secrets or proprietary information. This clause is designed to protect intellectual property by preventing unauthorized access to the technology's source code or structural makeup.

A "No Smoking" clause prohibits individuals from smoking within certain designated areas or premises, aiming to maintain a smoke-free environment for health and safety reasons. This clause may apply to all forms of smoking, including cigarettes, cigars, and electronic vaping devices, and often outlines potential penalties for violations.

Try our AI contract analysis and extract important clauses and information from existing contracts.

< <

Fill out the form and we will get in touch with you to give you a personal, customized demo of fynk.

Greetings!

I'm Markus, co-founder of fynk. After you've submitted the form, I'll swiftly get in touch with you.

Also, right after you submit your details, you can pick a time that works best for you for our meeting.