Unsecured Promissory Note

Promise to Pay.

For value received, (“Maker”), for itself and its successors and assigns, promises to pay to , or its assignee, the full principal sum of , together with interest accruing at the rate of % per annum through year 5 (the “Outstanding Balance”), as set forth below.

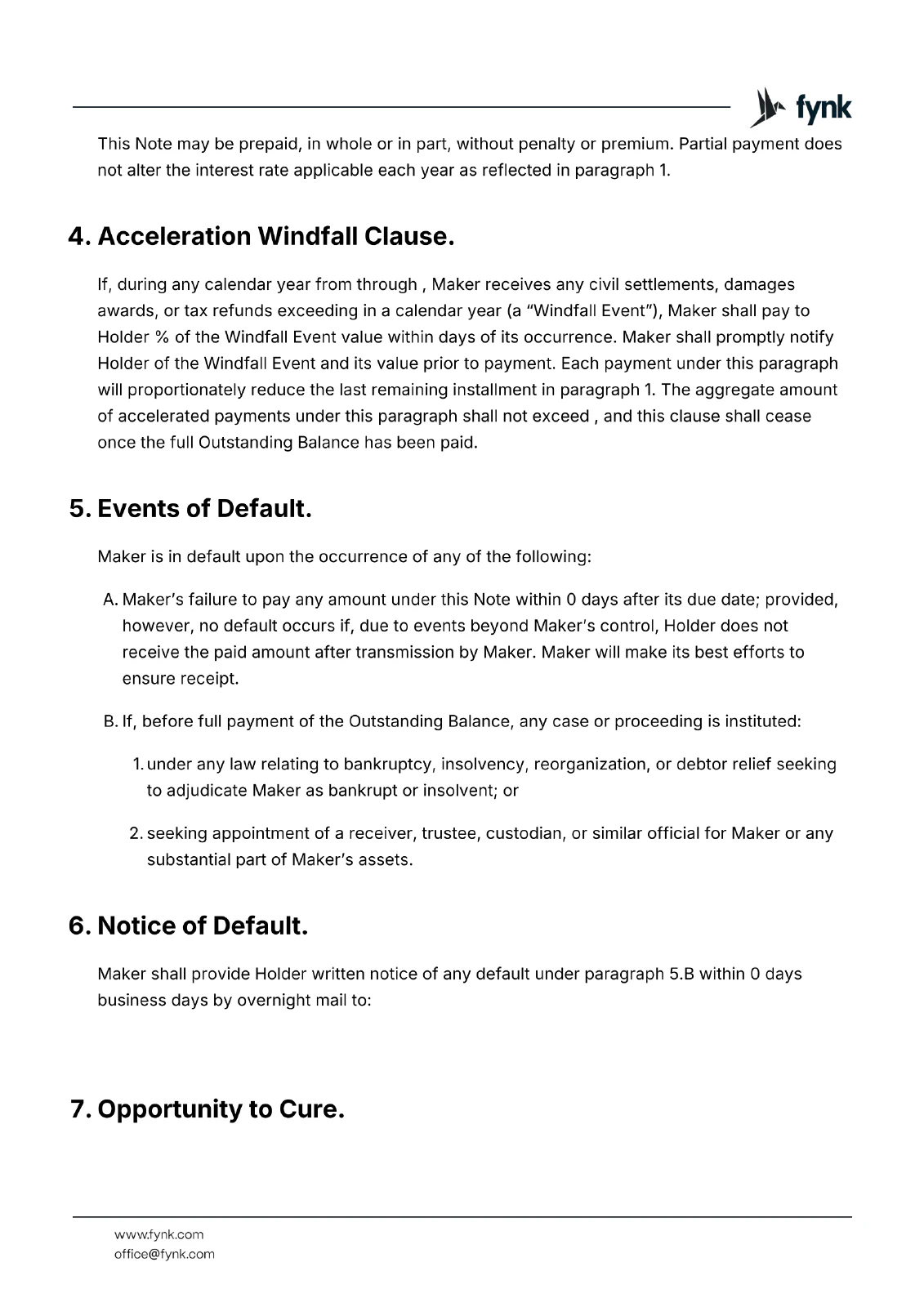

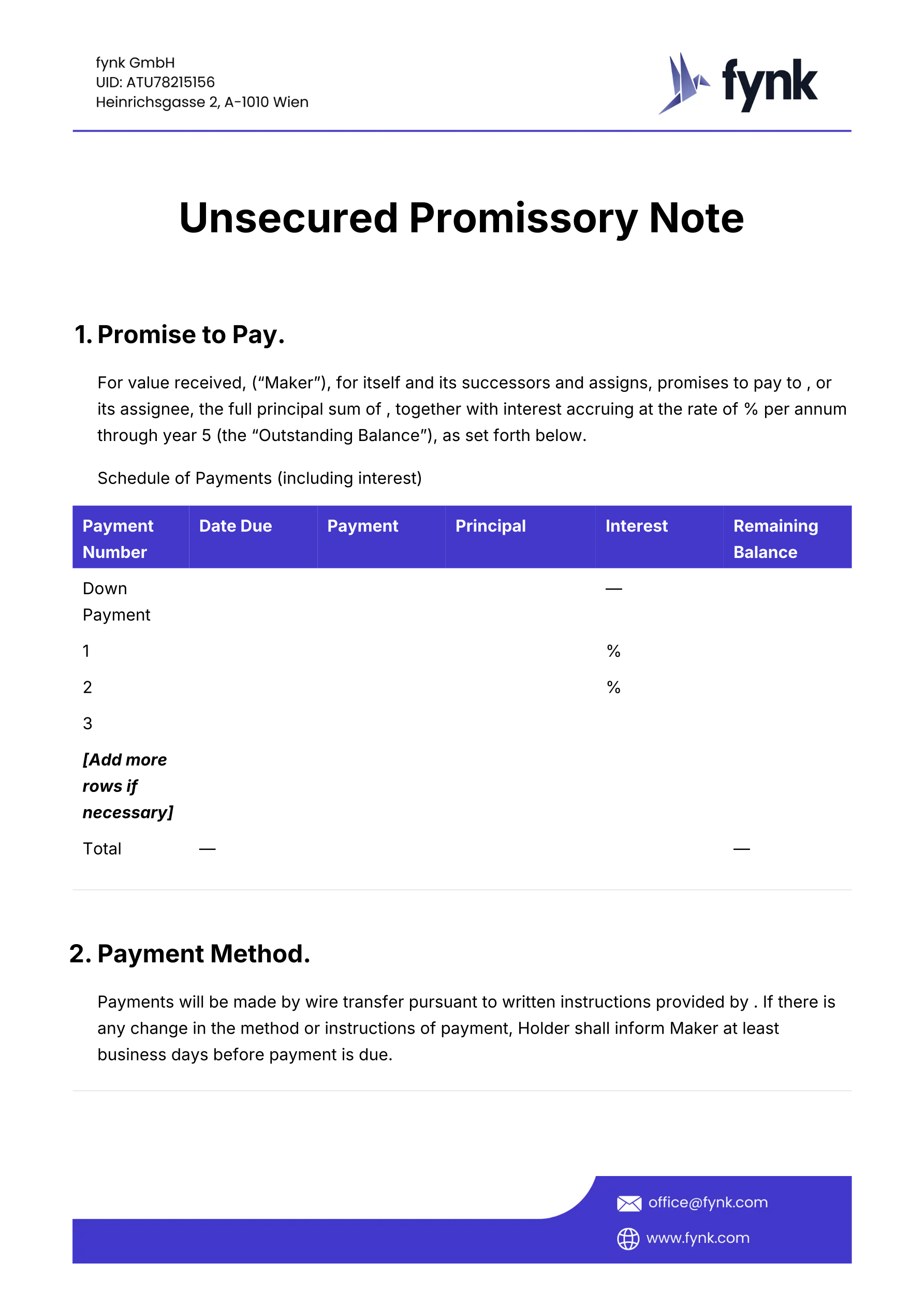

Schedule of Payments (including interest)

Payment Number | Date Due | Payment | Principal | Interest | Remaining Balance |

|---|---|---|---|---|---|

Down Payment | — | ||||

1 | % | ||||

2 | % | ||||

3 | |||||

[Add more rows if necessary] | |||||

Total | — | — |

Payment Method.

Payments will be made by wire transfer pursuant to written instructions provided by . If there is any change in the method or instructions of payment, Holder shall inform Maker at least business days before payment is due.

Prepayment.

This Note may be prepaid, in whole or in part, without penalty or premium. Partial payment does not alter the interest rate applicable each year as reflected in paragraph 1.

Acceleration Windfall Clause.

If, during any calendar year from through , Maker receives any civil settlements, damages awards, or tax refunds exceeding in a calendar year (a “Windfall Event”), Maker shall pay to Holder % of the Windfall Event value within days of its occurrence. Maker shall promptly notify Holder of the Windfall Event and its value prior to payment. Each payment under this paragraph will proportionately reduce the last remaining installment in paragraph 1. The aggregate amount of accelerated payments under this paragraph shall not exceed , and this clause shall cease once the full Outstanding Balance has been paid.

Events of Default.

Maker is in default upon the occurrence of any of the following:

Maker’s failure to pay any amount under this Note within 0 days after its due date; provided, however, no default occurs if, due to events beyond Maker’s control, Holder does not receive the paid amount after transmission by Maker. Maker will make its best efforts to ensure receipt.

If, before full payment of the Outstanding Balance, any case or proceeding is instituted:

under any law relating to bankruptcy, insolvency, reorganization, or debtor relief seeking to adjudicate Maker as bankrupt or insolvent; or

seeking appointment of a receiver, trustee, custodian, or similar official for Maker or any substantial part of Maker’s assets.

Notice of Default.

Maker shall provide Holder written notice of any default under paragraph 5.B within 0 days business days by overnight mail to:

Opportunity to Cure.

For a default under paragraph 5.A, Holder shall give Maker written notice. Maker then has calendar days from notice delivery to cure. If not cured within calendar days after mailing of the notice (“Uncured Event of Default”), interest shall accrue on the remaining unpaid principal at % per annum, compounded daily, beginning calendar days after notice mailing.

Remedies Upon Default.

Upon any Event of Default under paragraph 5.B or an Uncured Event of Default under paragraphs 5.A and 7, without further notice or demand:

The Outstanding Balance shall become immediately due and payable (“Default Amount”), and interest on the Default Amount shall accrue at % per annum, compounded daily from the date of default.

Holder may exercise any rights and remedies available at law or in equity to collect the Outstanding Balance.

Holder retains all other rights and remedies under law or equity and may exercise them.

No delay or failure by Holder to exercise any right or remedy shall operate as a waiver of that right or remedy.

Maker will pay all reasonable costs of collection, including attorneys’ fees and expenses.

Waivers; No Waiver.

Maker and any endorser waive presentment, demand for payment, notice of dishonor, and protest. Waiver by Holder of any default will not constitute a waiver of any subsequent default. Failure by Holder to exercise any right does not preclude later exercise of that right.

Governing Law.

This Note shall be governed by and construed under the laws of .

Voluntary Acknowledgment.

Maker acknowledges entering into this Note freely, voluntarily, and without compulsion.

Notices.

Any notice under this Note shall be in writing and delivered by hand, courier, or email with confirmation, addressed as follows (or to such other address as a party designates):

To Maker:

To Holder:

IN WITNESS WHEREOF, Maker has executed this Note as of .